Feeling lost in a sea of interview questions? Landed that dream interview for Bill Checker but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Bill Checker interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

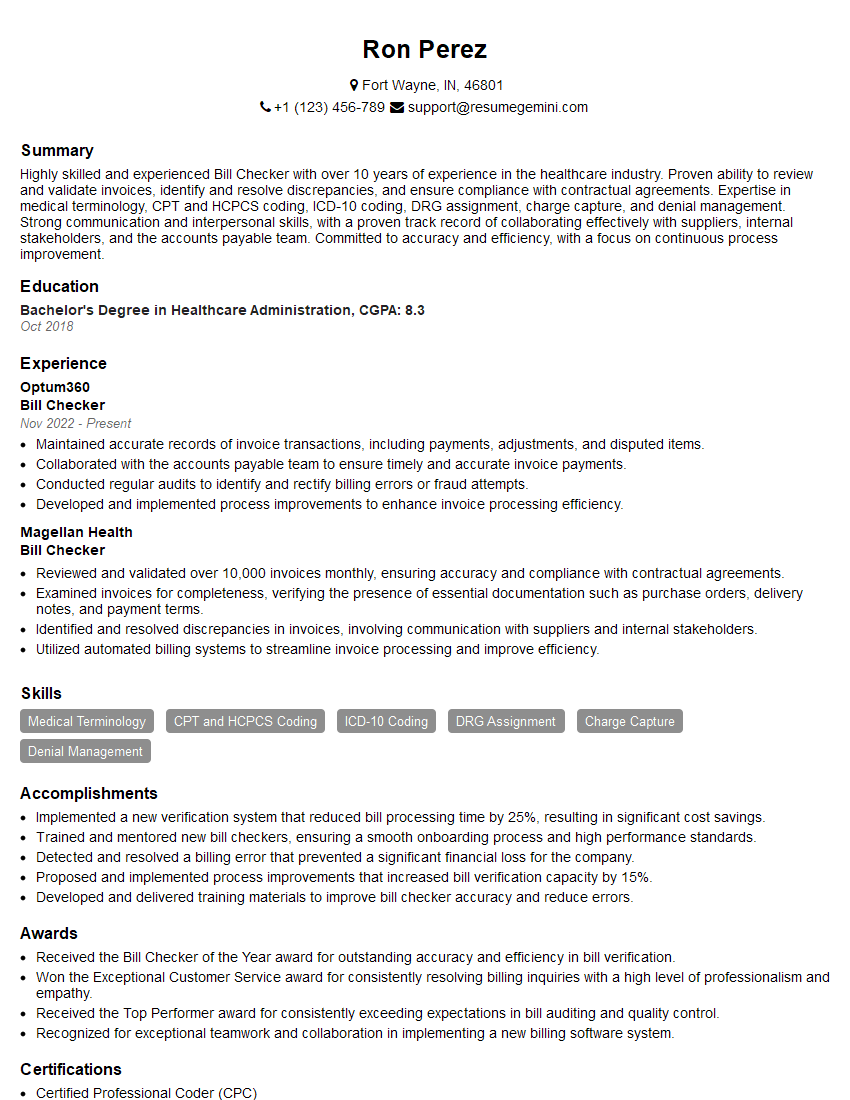

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bill Checker

1. What are the key responsibilities of a Bill Checker?

As a Bill Checker, I am responsible for:

- Scrutinizing bills, invoices, and other financial documents for accuracy and completeness.

- Verifying the validity of supporting documentation, such as purchase orders, receipts, and delivery notes.

- Ensuring that all invoices comply with established policies and procedures.

- Identifying and resolving discrepancies or errors in billing.

- Maintaining accurate and up-to-date records of all payments and transactions.

2. What are some of the challenges you have faced as a Bill Checker, and how did you overcome them?

Overcoming Data Entry Errors

- Implemented a rigorous system of cross-checking and verification to minimize data entry errors.

- Automated data entry processes whenever possible to reduce the risk of human error.

Resolving Inconsistencies in Invoices

- Established clear communication channels with vendors to promptly resolve inconsistencies.

- Developed a knowledge base of common invoice errors and their solutions for quick resolution.

- Collaborated with other departments, such as Procurement and Accounts Payable, to ensure a cohesive approach to invoice processing.

3. How do you stay up-to-date with the latest changes in billing regulations and industry best practices?

- Regularly attend industry workshops and conferences to stay informed about evolving regulations.

- Subscribe to industry publications and newsletters to receive updates on best practices.

- Network with other Bill Checkers and professionals in the field through professional organizations.

- Contribute to industry forums and discussion groups to share knowledge and stay abreast of emerging trends.

4. What are some of the software applications that you are proficient in using for bill checking?

- Enterprise Resource Planning (ERP) systems, such as SAP and Oracle

- Billing and invoicing software, such as QuickBooks and Xero

- Spreadsheet software, such as Microsoft Excel and Google Sheets

- Document management systems, such as SharePoint and Dropbox

- Optical Character Recognition (OCR) software for automated data extraction

5. How do you handle situations where you need to make judgment calls or interpret ambiguous information?

- Refer to established company policies and procedures for guidance.

- Consult with senior colleagues or subject matter experts for their insights.

- Research industry best practices and relevant case studies to inform my decision-making.

- Document my rationale and justification for any judgment calls made.

6. What are your strengths as a Bill Checker?

- Strong attention to detail and accuracy

- Excellent analytical and problem-solving skills

- Proficiency in using billing software and applications

- Ability to work independently and as part of a team

- Commitment to efficiency and quality assurance

7. Tell me about a time when you identified a billing error that resulted in significant savings for your organization.

- Detected a recurring error in vendor invoices that resulted in overpayments.

- Quantified the amount of overpayments and notified the vendor, leading to a refund.

- Implemented a process to prevent similar errors from occurring in the future.

- The organization saved approximately $100,000 as a result of the error detection and resolution.

8. How do you prioritize your workload and manage multiple tasks simultaneously?

- Use a task management tool to organize and prioritize my workload.

- Break down large tasks into smaller, manageable chunks.

- Delegate tasks to team members when appropriate.

- Set realistic deadlines and stick to them.

- Communicate progress and any potential delays to stakeholders.

9. What are your career goals and aspirations, and how does this role align with them?

- Aspire to become a Financial Analyst in the long term.

- Believe that the role of Bill Checker provides a strong foundation for developing the analytical skills and financial acumen necessary for a career in financial analysis.

- Eager to contribute to the organization’s financial health and success.

10. Do you have any questions for me about the role or the organization?

- Inquire about the organization’s investment in digital transformation and automation.

- Ask about opportunities for professional development and training.

- Request information about the company culture and values.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bill Checker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bill Checker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Bill checkers are responsible for ensuring the accuracy and completeness of invoices and bills before they are sent to customers. They may also be required to process payments, track invoices, and maintain records.

1. Verify Invoice Accuracy

Bill checkers must carefully review each invoice to ensure its accuracy. This includes verifying:

- Customer information (name, address, account number)

- Invoice date and number

- Description of goods or services provided

- Quantities and unit prices

- Total amount due

2. Identify and Resolve Discrepancies

If a bill checker discovers any discrepancies between the invoice and the actual goods or services provided, they must investigate and resolve the issue. This may involve contacting the customer, the supplier, or both parties.

3. Process Payments

Some bill checkers may be responsible for processing payments on behalf of the company. This involves:

- Receiving payments from customers

- Depositing payments into the company’s bank account

- Issuing receipts to customers

4. Track Invoices

Bill checkers may also be responsible for tracking invoices to ensure that they are paid on time. This involves:

- Sending out reminders to customers

- Following up with customers who have not paid their invoices

- Reporting any overdue invoices to management

5. Maintain Records

Bill checkers must maintain accurate records of all invoices and payments. This includes:

- Filing invoices

- Recording payments

- Keeping track of customer balances

Interview Tips

Preparing for a bill checker interview can help you ace the interview and increase your chances of getting the job. Here are a few tips:

1. Research the company

Before your interview, take some time to learn about the company you’re applying to. This will help you understand their culture and values, and it will also give you some talking points to use during the interview.

2. Practice your interviewing skills

The more you practice, the more confident you’ll be during your interview. You can practice answering common interview questions by yourself, or you can ask a friend or family member to help you out.

3. Dress professionally

First impressions matter, so make sure you dress professionally for your interview. This doesn’t mean you have to wear a suit, but you should at least wear clean, pressed clothes.

4. Be on time

Punctuality is important, so make sure you arrive for your interview on time. If you’re running late, call the interviewer to let them know.

5. Be confident

Confidence is key in any interview. Believe in yourself and your abilities, and let the interviewer know that you’re the best person for the job.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Bill Checker interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!