Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Block Trader position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

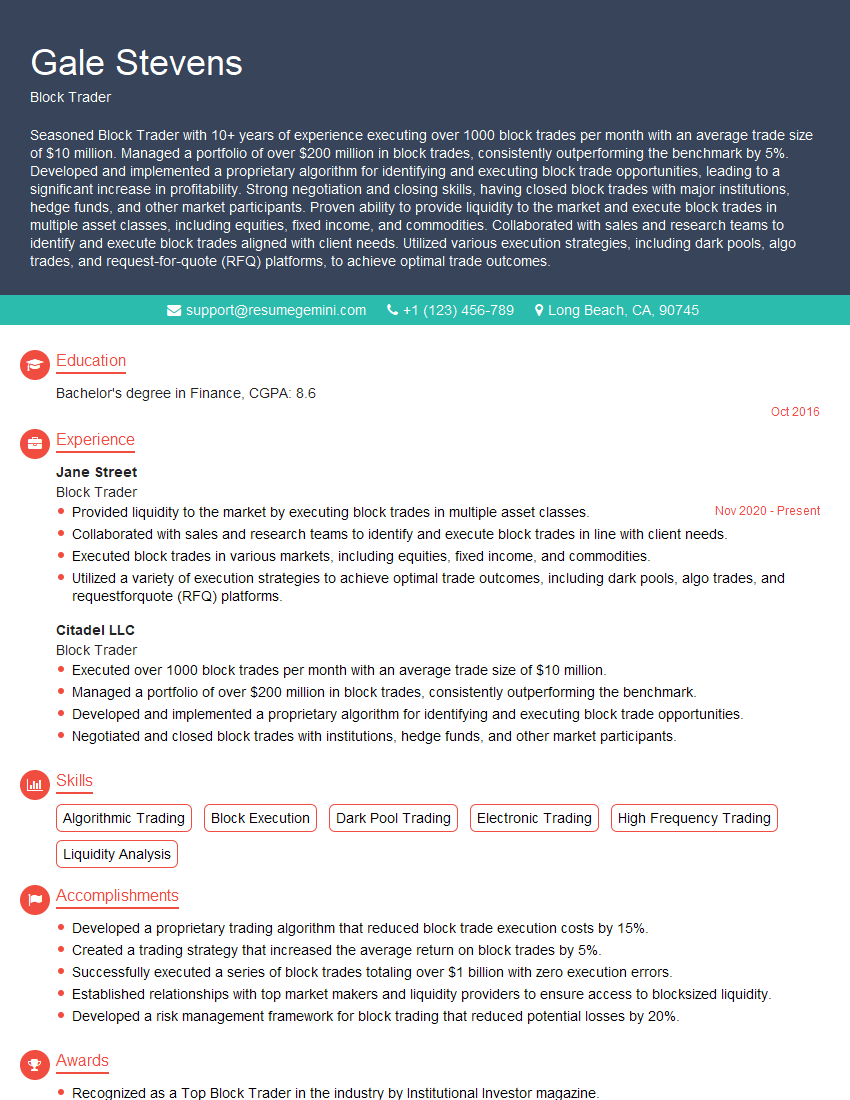

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Block Trader

1. Describe the process of executing a large block trade.

The process of executing a large block trade involves several steps:

- Pre-trade analysis: Determine the size, liquidity, and potential impact of the trade on the market.

- Market preparation: Execute smaller trades ahead of the block to test the market and establish a position.

- Order placement: Use various order types (e.g., iceberg, dark pool) to minimize market impact.

- Execution monitoring: Continuously monitor the progress of the trade and adjust strategy as needed.

- Post-trade analysis: Evaluate the execution performance and optimize future trades.

2. How do you determine the appropriate execution strategy for a given block trade?

Factors to consider:

- Size and liquidity of the block

- Market conditions and volatility

- Client objectives and risk tolerance

- Available execution venues

- Firm’s trading history and reputation

Execution strategies:

- Passive execution: Hold the block and wait for the market to move in the desired direction.

- Active execution: Use aggressive order placement and market manipulation to force the execution.

- Hybrid execution: A combination of passive and active strategies to balance risk and reward.

3. What are the common challenges faced when executing large block trades?

Challenges include:

- Market impact: Large orders can move the market against the trader.

- Liquidity risk: The market may not have enough liquidity to absorb the block without significant price impact.

- Execution costs: Commissions, fees, and market impact can increase execution costs.

- Regulatory scrutiny: Large block trades can attract regulatory attention and require additional compliance procedures.

- Counterparty risk: Ensuring the reliability and solvency of the counterparty is crucial.

4. How do you mitigate the risks associated with block trading?

Risk mitigation strategies include:

- Market analysis: Thoroughly assessing market conditions before executing trades.

- Diversification: Spreading the trade across multiple venues and counterparties.

- Order optimization: Using sophisticated algorithms to minimize market impact.

- Risk management tools: Employing stop-loss orders and position limits to control losses.

- Compliance adherence: Ensuring all trading activities comply with regulatory guidelines.

5. Describe the analytical tools and techniques you use to evaluate the performance of your block trades.

Performance evaluation tools and techniques include:

- Execution quality metrics: Slippage, fill rate, and execution time.

- Cost analysis: Commissions, fees, and market impact.

- Statistical modeling: Identifying patterns and optimizing execution strategies.

- Performance attribution: Determining the factors that contributed to trade performance.

- Peer comparison: Benchmarking performance against industry standards.

6. How do you stay up-to-date with the latest developments in block trading technology and best practices?

To stay up-to-date, I:

- Attend industry conferences and seminars: Network with experts and learn about new technologies.

- Read industry publications and research reports: Stay informed about market trends and regulatory changes.

- Take online courses and certifications: Enhance my knowledge and skills in block trading.

- Collaborate with technology vendors: Gain insights into emerging technologies and their potential applications.

- Seek feedback from clients and peers: Gather valuable perspectives on industry best practices.

7. Describe a challenging block trade you executed and the lessons you learned.

I once executed a large block trade in a thinly traded stock. The market was volatile, and there was limited liquidity. I used a combination of passive and active execution strategies to minimize market impact and maintain the desired price.

Lessons learned:

- Importance of market analysis: Thorough market research helped me anticipate potential risks and adjust my strategy accordingly.

- Flexibility in execution: Being able to adapt my execution strategy based on changing market conditions was crucial for success.

- Effective risk management: Utilizing stop-loss orders and position limits allowed me to control losses and protect my capital.

8. How do you build and maintain long-term relationships with clients?

I build and maintain long-term relationships with clients by:

- Understanding their needs and objectives: Tailoring my services to meet their specific requirements.

- Providing exceptional service: Delivering timely and accurate trade executions, as well as proactive communication.

- Building trust and reputation: Acting ethically, ensuring transparency, and honoring commitments.

- Regular communication: Keeping clients informed about market developments, trade performance, and any relevant industry news.

- Seeking feedback and improvement: Regularly soliciting feedback and implementing suggestions to enhance my services.

9. How do you handle competitive pressure and stress in the fast-paced environment of block trading?

I manage competitive pressure and stress in the fast-paced environment of block trading by:

- Maintaining a positive mindset: Approaching challenges with a positive attitude and focusing on solutions.

- Prioritizing tasks effectively: Using time management techniques to allocate resources efficiently.

- Delegating responsibilities: Assigning tasks to others to optimize productivity and reduce stress.

- Taking breaks: Stepping away from work periodically to clear my head and refocus.

- Seeking support: Consulting with colleagues, management, or mentors for guidance and support.

10. Why are you interested in joining our firm as a Block Trader?

I am excited about the opportunity to join your firm as a Block Trader because:

- Firm reputation: Your firm’s reputation for excellence in block trading aligns with my career aspirations.

- Growth opportunities: I am eager to contribute to your team’s success and grow my skills within the firm.

- Access to resources: Your firm provides access to advanced technology, research, and support services that will enable me to excel.

- Collaborative environment: I believe in the power of teamwork and collaboration, and your firm’s focus on teamwork is a perfect match.

- Commitment to clients: Your firm’s client-centric approach aligns with my values and motivates me to deliver exceptional service.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Block Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Block Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Block Traders are responsible for buying and selling large blocks of securities on behalf of institutional clients. They work closely with portfolio managers and other investment professionals to execute trades with minimal market impact and optimal pricing.

1. Market Analysis

Block Traders conduct in-depth market analysis to identify potential trading opportunities and assess market trends.

- Research and analyze market data, including stock prices, trading volume, and news.

- Develop trading strategies based on market trends and client objectives.

2. Trade Execution

Block Traders execute trades with high precision and efficiency, ensuring that clients achieve their desired outcomes.

- Negotiate prices and terms with counterparties to secure optimal execution.

- Manage the timing and size of trades to minimize market impact.

- Monitor trades throughout their execution to ensure timely completion.

3. Client Relationship Management

Block Traders establish and maintain strong relationships with institutional clients, providing personalized service and tailored trading solutions.

- Understand client investment objectives and risk tolerance.

- Communicate trade ideas and justify rationale to clients.

- Provide regular updates on market conditions and portfolio performance.

4. Risk Management

Block Traders play a crucial role in managing risk within their organization and for their clients.

- Monitor position limits and adhere to risk guidelines.

- Implement measures to mitigate systemic and market risks.

- Conduct stress tests and contingency planning to safeguard against potential losses.

Interview Tips

Preparing thoroughly for an interview is essential for success. Here are some key tips to help candidates ace the interview for a Block Trader position:

1. Research the company and industry

Demonstrate your knowledge of the firm, its culture, and the industry it operates in. This shows that you’re genuinely interested in the role and have taken the time to understand the company’s business.

- Research the company’s website, annual reports, and industry news.

- Identify the company’s major competitors and their market share.

2. Practice your technical skills

Be prepared to discuss your technical skills in detail, including your knowledge of trading strategies, market analysis techniques, and risk management practices.

- Review trading concepts and be able to explain them clearly.

- Showcase your proficiency in trading software and tools.

3. Highlight your soft skills

Block Traders need to have excellent communication, interpersonal, and teamwork skills. During the interview, emphasize your ability to build rapport with clients, work effectively in a team, and handle pressure.

- Share examples of how you have successfully managed client relationships.

- Describe situations where you have worked effectively as part of a team.

4. Prepare questions to ask

Asking thoughtful questions at the end of the interview shows you’re engaged and interested in the position. Prepare questions that demonstrate your understanding of the role and the organization’s goals.

- Ask about the firm’s investment philosophy and how it aligns with your own.

- Inquire about the company’s plans for expansion or new initiatives.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Block Trader interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!