Are you gearing up for a career in Blood Bank Credit Clerk? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Blood Bank Credit Clerk and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

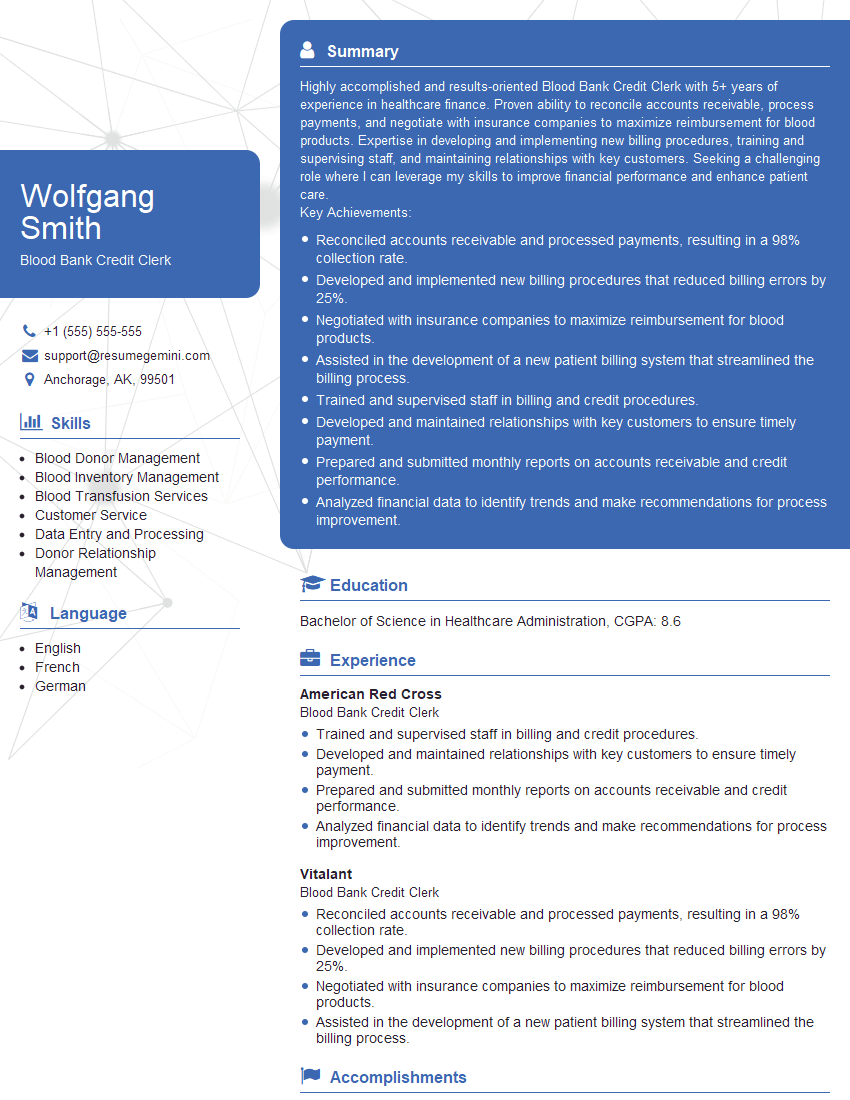

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Blood Bank Credit Clerk

1. Describe the key responsibilities of a Blood Bank Credit Clerk.

As a Blood Bank Credit Clerk, I am responsible for the following key tasks:

- Processing patient accounts and managing insurance billing

- Collecting payment and managing accounts receivable

- Resolving discrepancies and investigating insurance claims

- Maintaining patient confidentiality and adhering to HIPAA regulations

- Assisting with audits and compliance-related activities

2. What are the essential skills and qualifications required for this role?

Technical skills:

- Proficient in blood bank software and medical billing systems

- Knowledge of medical billing codes and insurance regulations

- Strong understanding of accounting principles and cash flow management

- Excellent communication and interpersonal skills

- Ability to work independently and as part of a team

Qualifications:

- Associates degree in healthcare administration, billing and coding, or related field

- Certification in medical billing and coding

- 2+ years of experience in a blood bank or healthcare setting

3. How do you ensure accurate billing and payment processing?

To ensure accurate billing and payment processing, I follow a meticulous process:

- Verifying patient information and insurance coverage

- Using correct medical billing codes and modifiers

- Checking for potential duplicate billing

- Regularly reviewing and reconciling accounts

- Collaborating with insurance companies and patients to resolve discrepancies promptly

4. How would you handle a situation where a patient has difficulty paying their bill?

When a patient experiences financial difficulty, I approach the situation with empathy and a willingness to help. My process includes:

- Discussing the patient’s financial situation and exploring payment options

- Offering payment plans or discounts if necessary

- Providing information about financial assistance programs

- Connecting the patient with social services or community resources

- Documenting all interactions and following up regularly

5. What measures do you take to protect patient confidentiality and comply with HIPAA regulations?

Protecting patient confidentiality is paramount. I adhere to the following measures:

- Restricting access to patient records to authorized personnel only

- Using secure encryption methods for electronic data

- Properly disposing of protected health information (PHI)

- Training on HIPAA regulations and privacy policies

- Regularly reviewing and updating security protocols

6. How do you stay updated with changes in medical billing and insurance regulations?

To stay abreast of changes, I actively engage in the following practices:

- Attending industry conferences and workshops

- Subscribing to professional publications and newsletters

- Consulting with insurance carriers and regulatory agencies

- Participating in online forums and discussion groups

- Seeking continuing education opportunities

7. Describe a situation where you successfully resolved a billing dispute with an insurance carrier.

In one instance, I encountered a discrepancy in a claim denial from an insurance carrier. I took the following steps to resolve the issue:

- Reviewed the claim and identified the error in the carrier’s processing

- Contacted the carrier’s claims department and presented my findings

- Provided supporting documentation to substantiate my claim

- Negotiated with the carrier to reprocess the claim accurately

- Successfully recovered the payment for the patient

8. How do you manage your workload and prioritize tasks effectively?

I prioritize tasks based on urgency, deadlines, and patient needs. I utilize the following strategies:

- Creating daily to-do lists and breaking down large tasks into smaller ones

- Using a project management system to track progress and set reminders

- Delegating tasks to colleagues when appropriate

- Seeking assistance from supervisors or co-workers when necessary

- Taking regular breaks to maintain focus and productivity

9. What is your understanding of the importance of customer service in your role?

Customer service is integral to my role. I believe in:

- Providing clear and accurate information to patients and insurance companies

- Responding promptly to inquiries and resolving issues efficiently

- Maintaining a positive and professional demeanor

- Going the extra mile to ensure patient satisfaction

- Seeking feedback to continuously improve customer service

10. Why are you interested in this particular Blood Bank Credit Clerk position?

I am drawn to this position at your blood bank for several reasons:

- My passion for healthcare administration and commitment to patient care

- My strong technical skills and experience in blood bank billing

- The opportunity to contribute to the efficient operation of your blood bank

- The reputation of your organization as a leader in blood services

- The chance to make a meaningful difference in the lives of patients and the community

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Blood Bank Credit Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Blood Bank Credit Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Blood Bank Credit Clerk is responsible for managing revenue and expense transactions for the blood bank. Key job responsibilities include:

1. Billing and Collections

Process and maintain accurate billing for blood products and services

- Generate invoices and statements

- Follow up on overdue accounts

2. Payment Processing

Receive and process payments from customers

- Maintain accurate financial records

- Reconcile bank statements

3. Customer Service

Respond to customer inquiries and resolve billing issues

- Provide excellent customer service

- Maintain relationships with key clients

4. Reporting and Analysis

Generate reports and conduct analyses to support decision-making

- Monitor financial performance

- Identify opportunities for improvement

Interview Tips

To prepare for an interview for a Blood Bank Credit Clerk position, consider the following tips:

1. Research the Blood Bank

Familiarize yourself with the blood bank’s mission, services, and financial standing. This will demonstrate your interest and knowledge of the organization.

- Visit the blood bank’s website

- Read news articles and industry reports

2. Practice Your Skills

Review your billing, collections, and customer service skills. Practice answering common interview questions related to these topics.

- Role-play scenarios with a friend or family member

- Complete online practice tests

3. Highlight Your Experience

Emphasize your experience in the healthcare or financial industry. Showcase your ability to manage large volumes of transactions and provide excellent customer service.

- Use the STAR method to provide specific examples of your accomplishments

- Quantify your results whenever possible

4. Dress Professionally

First impressions matter. Dress professionally and arrive on time for your interview. This will convey your respect for the interviewer and the organization.

- Choose classic colors and avoid flashy jewelry or accessories

- Make sure your clothes are clean and pressed

5. Be Confident

Believe in yourself and your abilities. Confident candidates are more likely to make a positive impression and secure the job.

- Practice your answers to interview questions

- Visualize yourself succeeding in the interview

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Blood Bank Credit Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!