Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Bodily Injury Adjuster position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

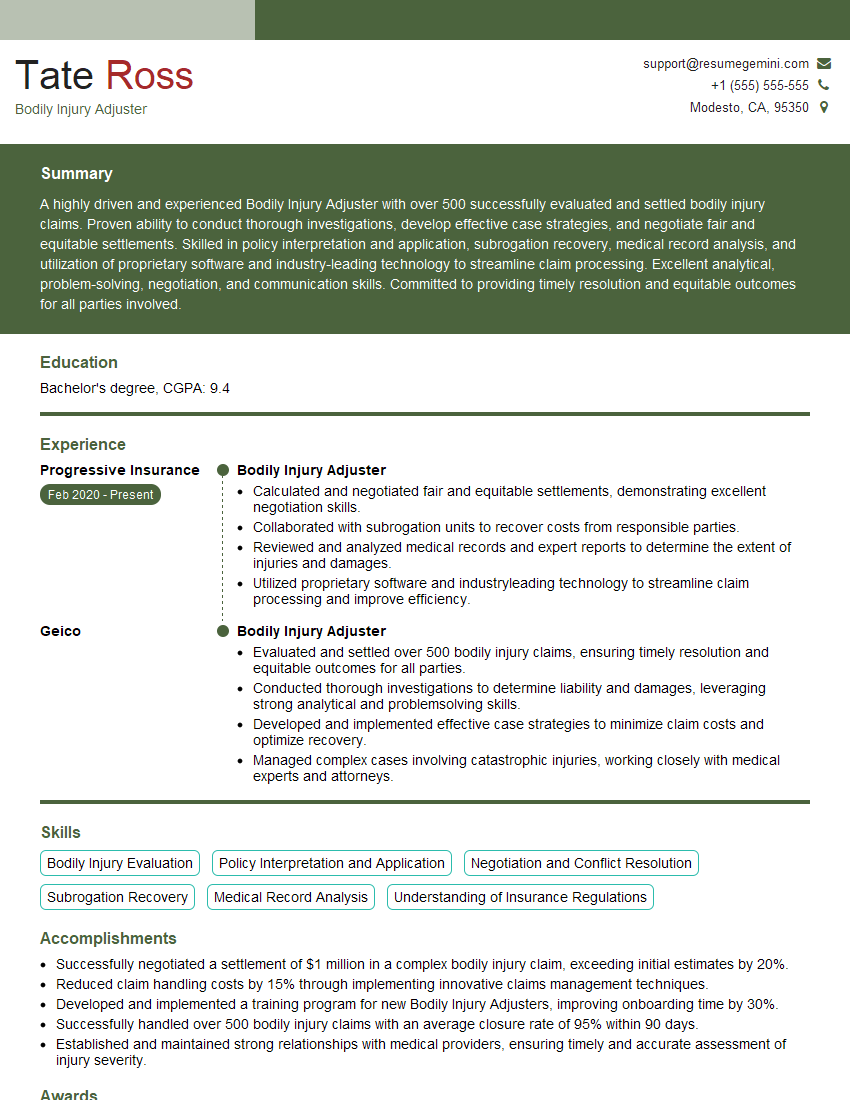

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bodily Injury Adjuster

1. What are the main principles of bodily injury liability?

- The insured is legally liable to another party for bodily injury.

- The injury is caused by an accident.

- The injury occurs during the policy period.

- The bodily injury is not covered by another policy.

2. What are the different types of bodily injury claims?

First-party claims

- Claims made by the insured against their own policy.

- Example: The insured is injured in a car accident and files a claim with their own auto insurance policy.

Third-party claims

- Claims made by someone other than the insured against the policyholder.

- Example: The insured’s dog bites a neighbor and the neighbor files a claim with the insured’s homeowner’s insurance policy.

3. What are the steps involved in investigating a bodily injury claim?

- Gather information about the accident.

- Interview the claimant and other witnesses.

- Review medical records.

- Determine liability.

- Calculate damages.

- Negotiate a settlement.

4. What are some of the challenges involved in investigating a bodily injury claim?

- The claimant may be injured and unable to provide a clear account of the accident.

- There may be conflicting witness statements.

- Medical records may be incomplete or difficult to interpret.

- The claimant may be represented by an attorney who is trying to maximize the settlement.

5. What are some of the factors that affect the value of a bodily injury claim?

- The severity of the injuries.

- The length of time the claimant is unable to work.

- The claimant’s pain and suffering.

- The claimant’s future medical expenses.

- The claimant’s earning capacity.

6. How do you negotiate a settlement in a bodily injury claim?

- Gather information about the claimant’s injuries and damages.

- Determine the policy limits.

- Make an opening offer.

- Be prepared to negotiate.

- Get the settlement agreement in writing.

7. What are some of the ethical considerations involved in adjusting bodily injury claims?

- The adjuster must treat the claimant fairly and respectfully.

- The adjuster must avoid conflicts of interest.

- The adjuster must maintain confidentiality.

- The adjuster must not misrepresent the facts.

8. What are some of the resources available to bodily injury adjusters?

- Insurance company manuals.

- Legal counsel.

- Medical experts.

- Investigative services.

9. What are some of the trends in the bodily injury claims industry?

- The increasing cost of medical care.

- The rise of social media and its impact on claims.

- The use of technology to investigate and adjust claims.

- The growing number of lawsuits filed against insurance companies.

10. What are some of the challenges facing bodily injury adjusters?

- The complexity of bodily injury claims.

- The need to balance the interests of the claimant and the insurance company.

- The pressure to settle claims quickly and cheaply.

- The emotional toll of dealing with injured claimants.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bodily Injury Adjuster.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bodily Injury Adjuster‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Bodily Injury Adjusters are responsible for investigating and assessing bodily injury claims, determining liability, and negotiating settlements. Their key job responsibilities include:

1. Investigate and assess claims

Interview policyholders, claimants, and witnesses

- Review medical records and other relevant documentation

- Conduct site inspections and take photographs

2. Determine liability

Analyze the facts of the case and applicable laws

- Determine the degree of fault of each party involved

- Issue a liability report

3. Negotiate settlements

Represent the insurance company in settlement negotiations

- Evaluate the value of the claim and make settlement offers

- Negotiate with claimants and their attorneys

4. Other duties

Maintain accurate claim files

- Prepare reports and correspondence

- Testify in court, if necessary

Interview Tips

Preparing for a Bodily Injury Adjuster interview requires a combination of understanding the role, practicing common interview questions, and presenting yourself professionally. Here are a few tips to help you ace the interview:

1. Research the company and position

Thoroughly research the insurance company and the specific Bodily Injury Adjuster position. This will help you understand the company’s culture, values, and the specific requirements of the role. You can find this information on the company’s website, LinkedIn page, or through industry publications.

- Tailor your resume and cover letter to the specific position and company.

- Prepare questions to ask the interviewer that demonstrate your interest and knowledge of the company.

2. Practice common interview questions

There are a number of common interview questions that you are likely to be asked, such as “Tell me about yourself,” “Why are you interested in this position?” and “What are your strengths and weaknesses?” Practice answering these questions in a clear and concise manner, and be prepared to provide specific examples from your experience.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Quantify your accomplishments whenever possible.

- Be prepared to discuss your experience in investigating and assessing claims, determining liability, and negotiating settlements.

3. Dress professionally and arrive on time

First impressions matter, so make sure to dress professionally and arrive on time for your interview. This shows the interviewer that you are respectful of their time and that you take the interview seriously.

- Wear a suit or business casual attire.

- Be well-groomed and make sure your shoes are polished.

- Arrive at the interview location 10-15 minutes early.

4. Be confident and enthusiastic

Confidence is key in any interview, but it is especially important in an interview for a Bodily Injury Adjuster position. This is a demanding role that requires a high level of professionalism and expertise. Show the interviewer that you are confident in your abilities and that you are enthusiastic about the position.

- Maintain eye contact with the interviewer.

- Speak clearly and confidently.

- Be prepared to answer questions about your experience and qualifications.

5. Follow up after the interview

After the interview, send a thank-you note to the interviewer. This is a simple way to show your appreciation for their time and to reiterate your interest in the position. You can also use this opportunity to address any questions or concerns that you may have.

- Send your thank-you note within 24 hours of the interview.

- Personalize your note and mention something specific from the interview.

- Reiterate your interest in the position and thank the interviewer for their consideration.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Bodily Injury Adjuster, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Bodily Injury Adjuster positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.