Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Bond Analyst position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

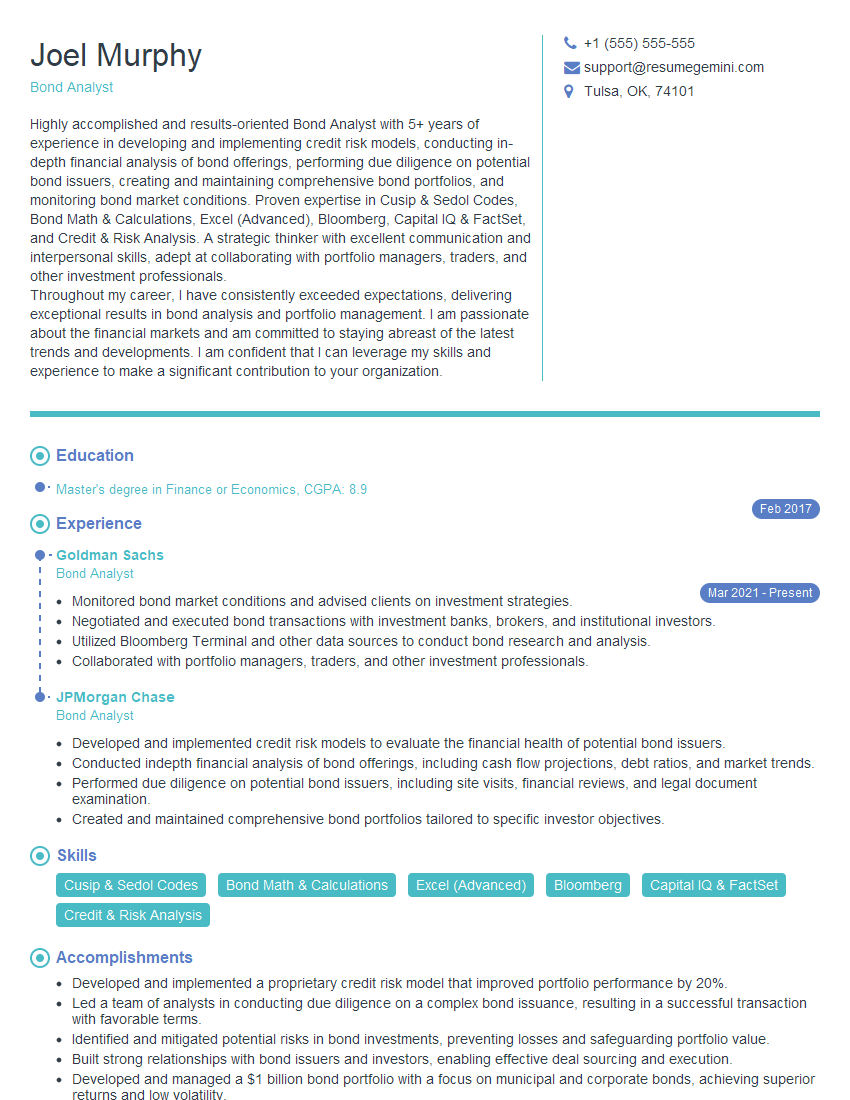

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bond Analyst

1. What are the key factors you consider when evaluating a bond’s creditworthiness?

- Issuer’s financial health and stability

- Issuer’s industry and competitive landscape

- Macroeconomic factors and market conditions

- Structural features of the bond (e.g., seniority, security)

- Legal and regulatory factors

2. Explain the concept of duration and how it influences bond prices.

Measuring Interest Rate Sensitivity

- Duration measures the weighted average time until a bond’s cash flows are received.

- Higher duration bonds are more sensitive to changes in interest rates.

Impact on Bond Prices

- When interest rates rise, bond prices of higher duration bonds tend to fall more than shorter duration bonds.

- When interest rates fall, bond prices of higher duration bonds tend to rise more than shorter duration bonds.

3. Describe the process of analyzing a bond’s yield curve.

- Obtain yield data for bonds with different maturities but similar credit risk.

- Plot the yields on a graph against their corresponding maturities.

- Identify the shape of the yield curve (e.g., upward sloping, downward sloping, humped).

- Interpret the shape of the curve for insights into market expectations and economic conditions.

4. What are the different types of bond risk premiums and how do they affect bond yields?

- Credit Risk Premium: Compensates investors for the risk of default.

- Liquidity Premium: Compensates investors for the difficulty in buying or selling the bond.

- Inflation Risk Premium: Compensates investors for the risk of inflation eroding the real value of bond payments.

- Interest Rate Risk Premium: Compensates investors for the risk of interest rates rising, which would reduce the bond’s value.

5. Explain the advantages and disadvantages of investing in corporate bonds as opposed to government bonds.

Advantages of Corporate Bonds:

- Potentially higher returns

- Diversification benefits

- Access to specific industries or sectors

Disadvantages of Corporate Bonds:

- Higher credit risk

- Lower liquidity

- Potential for default

6. Describe how you would use financial ratios to assess a bond issuer’s financial health.

- Debt-to-Equity Ratio: Measures the issuer’s reliance on debt financing.

- Interest Coverage Ratio: Measures the issuer’s ability to meet interest payments.

- EBITDA Margin: Measures the issuer’s profitability relative to revenue.

- Return on Equity (ROE): Measures the issuer’s profitability relative to shareholder investment.

7. What are the key factors to consider when building a bond portfolio?

- Diversification: Spread risk across different issuers, industries, and maturities.

- Credit Quality: Determine an appropriate balance between risk and return.

- Interest Rate Sensitivity: Manage exposure to potential interest rate fluctuations.

- Maturity Ladder: Spread maturities to reduce maturity risk and enhance return potential.

- Liquidity: Ensure adequate liquidity to meet investment objectives.

8. Explain the concept of embedded options in bonds.

- Embedded options are provisions in a bond that give the issuer or investor the right (but not the obligation) to take certain actions.

- Common embedded options include:

- Call options (issuer’s right to redeem the bond before maturity)

- Put options (investor’s right to sell the bond back to the issuer)

- Conversion options (investor’s right to convert the bond into equity)

- Embedded options can affect the bond’s value and return potential.

9. Describe the process of valuing a bond.

- Estimate future cash flows (principal and interest payments).

- Discount cash flows back to present value using a discount rate (yield to maturity).

- Consider embedded options and other factors that may affect the bond’s value.

- Use appropriate valuation models, such as the Black-Scholes model for bonds with embedded options.

10. How do you stay abreast of the latest developments in the bond market and economic conditions?

- Monitor financial news and industry publications.

- Attend industry conferences and webinars.

- Stay connected with industry professionals.

- Conduct ongoing research and analysis.

- Use data analytics and financial models to identify trends and opportunities.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bond Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bond Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Bond Analyst is responsible for evaluating the risk and return of fixed income investments, such as bonds. They provide investment advice to clients and make recommendations on which bonds to buy or sell.

1. Bond Analysis

Conduct thorough financial analysis of bonds, including credit analysis, industry analysis, and economic analysis.

- Assess the creditworthiness of bond issuers.

- Evaluate the impact of industry trends and economic conditions on bond performance.

2. Investment Recommendations

Provide investment recommendations to clients based on bond analysis.

- Recommend bonds that meet clients’ investment objectives and risk tolerance.

- Develop and maintain investment portfolios for clients.

3. Market Monitoring

Monitor financial markets and stay abreast of economic news that may impact bond prices.

- Track interest rate changes and their impact on bond valuations.

- Analyze economic data to identify potential risks and opportunities in the bond market.

4. Client Communication

Communicate with clients regularly to provide updates on bond performance and market outlook.

- Explain bond investment strategies to clients.

- Address client inquiries and provide investment advice.

Interview Tips

Preparing for a Bond Analyst interview requires a combination of technical knowledge, analytical skills, and communication abilities. Here are some tips to help you ace the interview:

1. Research the Role and Company

Thoroughly research the role of Bond Analyst and the specific company you are interviewing with. This will help you understand the company’s investment philosophy, target clients, and areas of expertise.

- Visit the company’s website and review their investment products and services.

- Read industry publications and news articles to stay up-to-date with bond market trends.

2. Practice Financial Analysis

Bond Analysts are expected to have strong financial analysis skills. Practice analyzing financial statements, conducting credit analysis, and evaluating bond valuations.

- Solve practice problems and case studies to demonstrate your analytical abilities.

- Be prepared to discuss your investment philosophy and how you would approach bond analysis.

3. Prepare Example Recommendations

In a Bond Analyst interview, you may be asked to provide investment recommendations. Prepare examples of bonds you have analyzed and provide your rationale for buying or selling them.

- Discuss the investment objectives of your clients and how you tailored your recommendations accordingly.

- Quantify your investment performance if possible to demonstrate your track record.

4. Highlight Communication Skills

Effective communication is crucial for Bond Analysts. Practice explaining complex financial concepts to non-financial audiences, such as clients or potential investors.

- Provide examples of how you have communicated investment strategies and recommendations to clients in the past.

- Be comfortable speaking about your investment views and market insights.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Bond Analyst role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.