Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Bond Broker position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

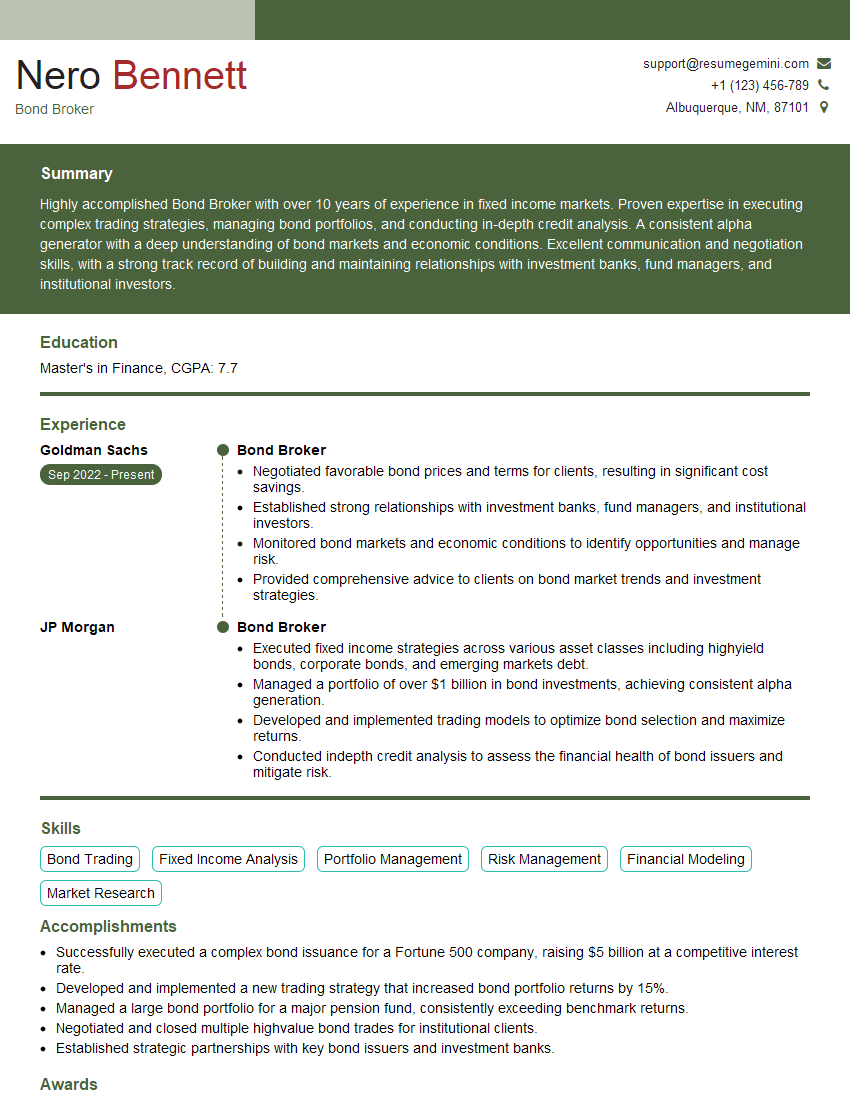

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bond Broker

1. Explain the concept of bond pricing and how it is determined?

Bond pricing is the process of determining the fair value of a bond. It is influenced by several factors, including:

- The bond’s face value

- The bond’s coupon rate

- The bond’s maturity date

- The prevailing interest rates

- The creditworthiness of the bond issuer

2. Describe the different types of bonds and their characteristics?

Corporate Bonds

- Issued by companies to raise capital

- Vary in terms of maturity, coupon rate, and credit rating

Government Bonds

- Issued by governments to fund their operations

- Generally considered safe investments with low risk

Municipal Bonds

- Issued by state and local governments for infrastructure projects

- Often offer tax-free income

3. Explain the relationship between bond prices and interest rates?

Bond prices and interest rates have an inverse relationship. When interest rates rise, bond prices tend to fall. This is because investors can now purchase new bonds with higher coupon rates, making existing bonds less attractive.

4. What are the key factors to consider when evaluating a bond’s credit risk?

- The issuer’s financial strength

- The issuer’s industry and competitive landscape

- The issuer’s management team

- The bond’s structural features, such as covenants and collateral

- The market conditions and economic outlook

5. Explain the concept of bond yield and how it is calculated?

Bond yield is the annualized rate of return an investor can expect to earn from a bond. It is calculated as the coupon rate divided by the bond’s current market price.

6. What are the different methods used to trade bonds?

- Over-the-counter (OTC) market

- Bond exchanges, such as the New York Stock Exchange

- Electronic trading platforms

7. How do you stay up-to-date on the bond market and economic trends?

- Regularly read industry publications and news articles

- Attend industry conferences and webinars

- Network with other bond professionals

- Use online resources, such as Bloomberg and Reuters

8. Describe your experience in bond portfolio management?

In my previous role, I was responsible for managing a portfolio of corporate and government bonds. I conducted thorough credit analysis, developed investment strategies, and made investment decisions. I also monitored the portfolio’s performance and made adjustments as needed.

9. How do you assess the liquidity of a bond?

- Examine the bond’s trading volume

- Consider the size and depth of the market for the bond

- Evaluate the bond’s credit rating and the issuer’s financial strength

10. Explain the ethical considerations involved in bond trading?

- Adhere to all applicable laws and regulations

- Avoid conflicts of interest

- Provide accurate and timely information to clients

- Maintain confidentiality of client information

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bond Broker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bond Broker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Bond brokers facilitate the trading of bonds, which are debt instruments issued by governments and corporations. Their primary responsibilities include:

1. Client Relationship Management

Bond brokers cultivate and maintain relationships with clients, both institutional and individual investors, to understand their investment objectives and provide tailored advice.

- Identify potential clients and establish business contacts.

- Conduct due diligence on clients to assess their financial situation and risk tolerance.

2. Market Analysis and Bond Selection

Bond brokers conduct thorough market research to identify investment opportunities and select suitable bonds for clients. They analyze market trends, economic indicators, and issuer-specific factors.

- Monitor bond market conditions and identify potential opportunities.

- Evaluate bond offerings and provide recommendations based on credit analysis and yield calculations.

- Monitor portfolio performance and make adjustments as needed.

3. Bond Trading and Execution

Bond brokers execute bond transactions on behalf of their clients, ensuring timely and efficient execution. They negotiate prices and terms with counterparties in the bond market.

- Negotiate and execute bond trades with market participants.

- Manage trade settlements and ensure timely delivery of bonds.

- Monitor and report on transaction status and performance.

4. Regulatory Compliance

Bond brokers must adhere to industry regulations and ethical guidelines. They are responsible for maintaining accurate records, conducting appropriate due diligence, and avoiding conflicts of interest.

- Comply with all applicable securities laws and regulations.

- Maintain confidentiality and protect sensitive client information.

Interview Tips

Interview preparation is crucial for success in a bond broker interview. Here are some tips to help candidates ace the interview:

1. Research the Industry and Company

Thoroughly research the bond market, recent trends, and the reputation of the financial institution you are interviewing with. This demonstrates your enthusiasm and knowledge of the industry.

- Read industry publications and news articles to stay informed about market dynamics.

- Visit the company’s website to learn about their services, offerings, and corporate culture.

2. Prepare for Technical Questions

Bond broker interviews often involve technical questions related to bond valuation, market analysis, and trading strategies. Prepare for these questions by reviewing relevant concepts and practicing solving bond-related problems.

- Study bond valuation techniques, including methods for calculating yield to maturity and yield to call.

- Practice interpreting financial statements and analyzing credit risk.

- Review common bond trading strategies and be prepared to discuss their advantages and disadvantages.

3. Showcase Soft Skills

In addition to technical skills, bond brokers must possess excellent soft skills. Highlight your communication, negotiation, and client relationship management abilities during the interview.

- Provide examples of how you have successfully built and maintained strong client relationships.

- Discuss your experience in effectively negotiating with counterparties to achieve favorable outcomes.

4. Ask Meaningful Questions

Asking thoughtful questions during the interview demonstrates your interest in the role and the company. Prepare a list of questions to ask the interviewer, focusing on the company’s business strategy, growth plans, and market outlook.

- Inquire about the team structure and opportunities for professional development.

- Ask about the company’s approach to innovation and risk management.

Next Step:

Now that you’re armed with the knowledge of Bond Broker interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Bond Broker positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini