Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Bond Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

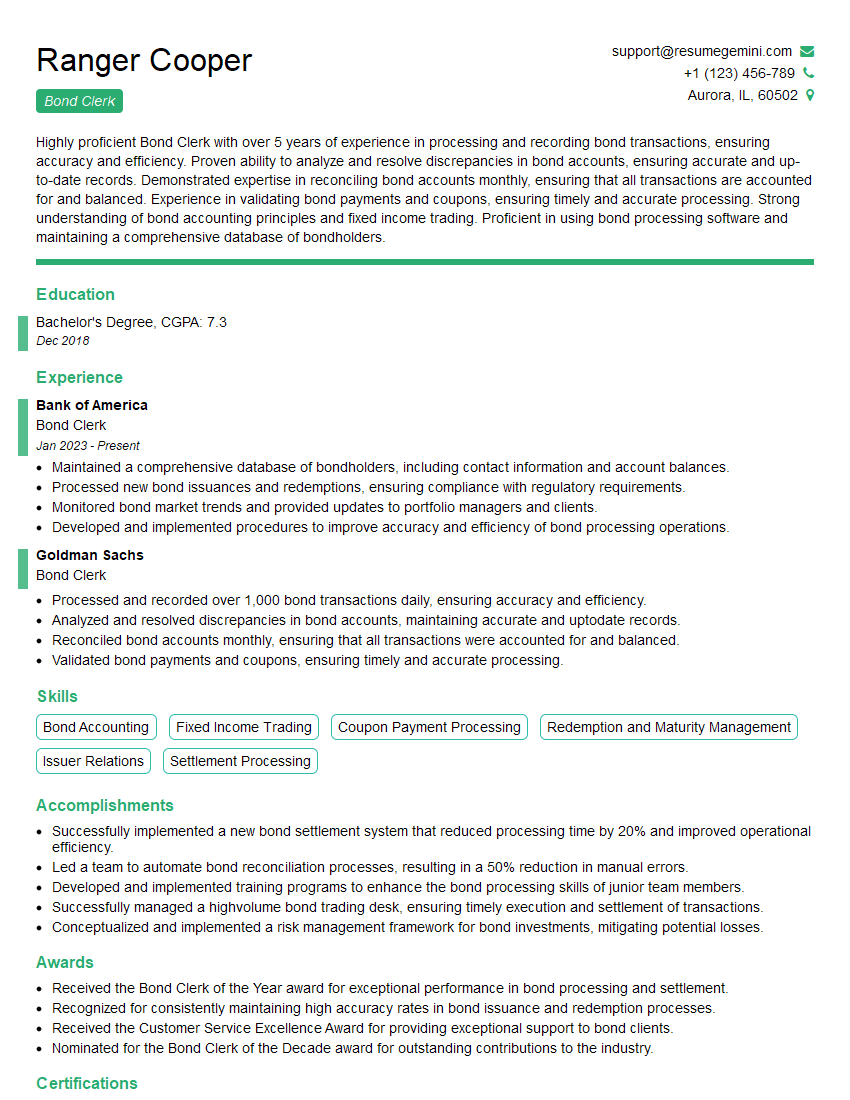

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bond Clerk

1. Explain the process of issuing bonds?

The process of issuing bonds involves several key steps:

- Authorization: The bond issuance must be authorized by the company’s board of directors and/or shareholders.

- Prospectus preparation: A detailed prospectus outlining the terms and conditions of the bond is prepared.

- Registration: The prospectus is registered with the relevant regulatory authorities, such as the Securities and Exchange Commission (SEC).

- Underwriting: Investment banks act as underwriters to purchase the bonds from the issuer and sell them to investors.

- Pricing: The underwriters determine the price and interest rate of the bonds based on market conditions and investor demand.

- Offering: The bonds are offered to investors through various channels, such as brokerages and online platforms.

- Settlement: Once the bonds are sold, the funds are transferred to the issuer, and the investors receive their bonds.

2. What are the different types of bonds available in the market?

Corporate Bonds

- Investment-grade bonds

- High-yield bonds

- Convertible bonds

- Callable bonds

Government Bonds

- Treasury bills

- Treasury notes

- Treasury bonds

- Municipal bonds

3. How do you calculate the yield on a bond?

The yield on a bond is the annual return that an investor expects to receive from the bond. It is calculated using the following formula:

- Yield = (Annual coupon payment + (Face value – Current price)) / ((Face value + Current price) / 2)) * 100

4. What are the key factors that affect the price of bonds?

- Interest rates

- Economic conditions

- Company’s financial performance

- Bond’s credit rating

- Supply and demand

5. What is the role of a Bond Clerk?

A Bond Clerk is responsible for various tasks related to the issuance, administration, and redemption of bonds. Key responsibilities may include:

- Processing bond transactions

- Maintaining bondholder records

- Calculating and distributing interest payments

- Preparing reports and statements related to bond activities

- Providing customer service to bondholders

6. What are the essential skills and qualifications required for a successful Bond Clerk?

- Strong understanding of bond markets and financial instruments

- Excellent mathematical and analytical skills

- Attention to detail and accuracy

- Ability to work independently and as part of a team

- Excellent communication and interpersonal skills

- Proficiency in Microsoft Office Suite and specialized bond processing software

7. Describe the typical workflow for processing a bond transaction.

The typical workflow for processing a bond transaction involves the following steps:

- Receive the trade confirmation from the broker.

- Verify the trade details and ensure compliance with regulations.

- Update the bondholder records.

- Calculate and record the interest accrual.

- Prepare the settlement instructions.

- Execute the settlement and transfer the bonds to the buyer’s account.

- Send confirmation of the transaction to all parties involved.

8. How do you ensure the accuracy and completeness of bondholder records?

- Use a reliable and up-to-date database to maintain bondholder records.

- Regularly reconcile bondholder records with other sources, such as the company’s shareholder register.

- Implement controls to prevent unauthorized access and modification of records.

9. Explain the process of calculating and distributing interest payments to bondholders.

The process of calculating and distributing interest payments to bondholders involves the following steps:

- Calculate the interest due for each bondholder based on the coupon rate and the number of days since the last interest payment date.

- Prepare interest payment advices and send them to bondholders.

- Transfer the interest payments to bondholders’ accounts.

10. What are some common challenges that Bond Clerks face in their work?

- Processing complex and high-volume bond transactions

- Ensuring compliance with regulatory and legal requirements

- Responding effectively to inquiries and resolving disputes

- Keeping abreast of changes in the bond market and financial industry

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bond Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bond Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Bond Clerk, you will be responsible for the efficient and accurate processing of bond transactions. This role is critical in ensuring the smooth functioning of the financial operations of the company.

1. Bond Issuance

Play a vital role in the issuance of new bonds by preparing and reviewing bond documents, calculating interest payments, and managing bondholder records.

- Prepare and review bond offering documents, ensuring compliance with legal and regulatory requirements.

- Calculate interest payments due to bondholders and record these transactions accurately.

- Maintain bondholder registers and provide updates on bond status and payments.

2. Bond Trading

Facilitate the trading of bonds in the secondary market by executing buy and sell orders, settling trades, and managing trade records.

- Execute bond trades efficiently and accurately, ensuring timely settlement of transactions.

- Maintain accurate trade records and provide trade confirmations to clients.

- Monitor market conditions and provide insights on bond prices and trends.

3. Bond Redemption

Process the redemption of bonds at maturity or upon the issuer’s call, ensuring timely payment of principal and interest to bondholders.

- Verify redemption requests and calculate redemption payments accurately.

- Process redemption payments and distribute proceeds to bondholders.

- Maintain records of redeemed bonds and provide updates to the issuer.

4. Compliance and Reporting

Adhere to all applicable laws and regulations governing bond issuance and trading, and provide accurate and timely reporting of bond-related activities.

- Ensure compliance with SEC and other regulatory requirements related to bond issuance and trading.

- Prepare and submit regular reports on bond issuance, trading, and redemption activities.

- Respond to inquiries from regulators and external auditors.

Interview Tips

To ace your interview for the Bond Clerk position, consider the following tips:

1. Research the Company and Role

Before the interview, take the time to research the company, its financial operations, and the specific responsibilities of the Bond Clerk role.

- Visit the company’s website and LinkedIn page to learn about their business, values, and recent news.

- Read industry reports and articles to stay up-to-date on the bond market and regulatory landscape.

- Prepare questions about the company’s bond issuance and trading practices.

2. Highlight Your Skills and Experience

Emphasize your technical skills in bond processing, trading, and compliance. Quantify your accomplishments whenever possible to demonstrate your impact.

- Showcase your knowledge of bond markets, including different types of bonds, pricing, and trading strategies.

- Highlight your experience in using bond processing software and databases.

- Provide examples of successful bond issuances or trades that you have managed.

3. Demonstrate Attention to Detail and Accuracy

As a Bond Clerk, attention to detail and accuracy are crucial. Provide examples that demonstrate your meticulousness and adherence to procedures.

- Describe a time when you identified and corrected an error in a bond transaction, preventing potential losses.

- Explain your process for verifying and reconciling bond-related data.

- Showcasing your ability to work independently and meet tight deadlines.

4. Emphasize Compliance and Ethics

Stress your understanding of the ethical and regulatory obligations of a Bond Clerk. Describe your commitment to adhering to all applicable laws and regulations.

- Explain your familiarity with SEC regulations and other industry standards governing bond issuance and trading.

- Provide examples of how you have ensured compliance with these regulations in your previous roles.

- Discuss your ethical principles and how they align with the company’s values.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Bond Clerk, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Bond Clerk positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.