Are you gearing up for an interview for a Bond Runner position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Bond Runner and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

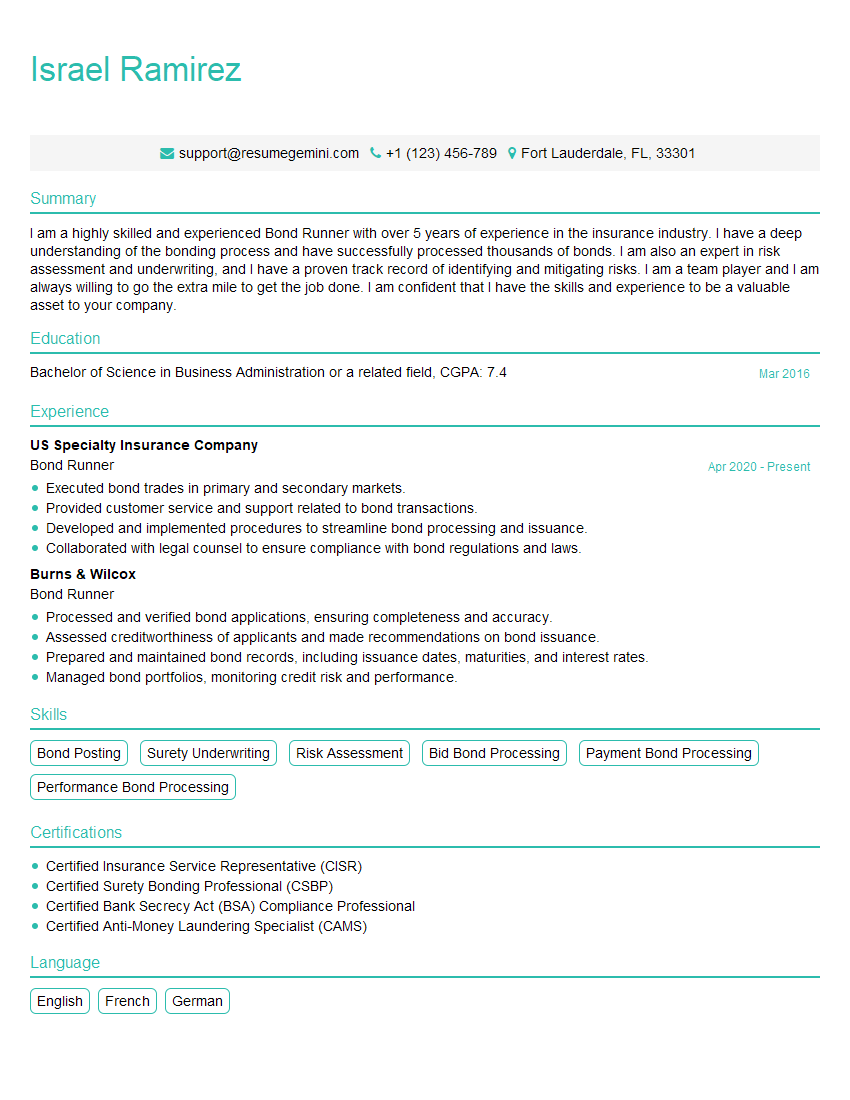

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bond Runner

1. Tell me about your experience in bond trading?

I have been working as a Bond Runner for the past 5 years. In this role, I have been responsible for trading various types of bonds, including corporate bonds, government bonds, and municipal bonds. I have a strong understanding of the bond market and I am able to effectively manage risk and generate profits for my clients.

2. What are the different types of bond trading strategies?

Fundamental Analysis

- Analyze economic data and company fundamentals to identify undervalued bonds.

- Focus on long-term investments.

Technical Analysis

- Study price charts and patterns to predict future price movements.

- Can be used for both short-term and long-term trading.

Quantitative Analysis

- Use mathematical models and algorithms to identify trading opportunities.

- Often used by high-frequency traders.

3. How do you manage risk in bond trading?

- Diversification

- Hedging

- Stress testing

- Risk limits

4. What are the different types of bond issuance?

- Public offerings

- Private placements

- Shelf registrations

- Convertible bonds

5. What are the key factors that affect bond prices?

- Interest rates

- Inflation

- Economic growth

- Credit risk

- Liquidity

6. What are the different types of bond markets?

- Primary market

- Secondary market

- Over-the-counter market

- Exchange-traded market

7. What are the challenges of bond trading?

- Interest rate risk

- Credit risk

- Liquidity risk

- Volatility

- Regulation

8. What are the rewards of bond trading?

- Potential for high returns

- Intellectual challenge

- Exposure to different markets

- Opportunity to make a real impact on the economy

9. What is your investment philosophy?

My investment philosophy is based on the following principles:

- Invest for the long term.

- Diversify your portfolio.

- Control your risk.

- Stay informed about the markets.

10. What are your strengths and weaknesses as a bond trader?

Strengths

- Strong understanding of the bond market

- Excellent risk management skills

- Ability to identify and execute trading opportunities

- Team player

Weaknesses

- Limited experience in trading emerging market bonds

- Can be impatient at times

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bond Runner.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bond Runner‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Bond Runner, also known as a Delivery Broker, plays a crucial role within the transportation industry. They act as intermediaries between shippers and carriers, facilitating the transportation of goods through efficient and cost-effective coordination.

1. Client Relationship Management

Bond Runners establish and maintain strong relationships with both shippers and carriers. They understand the unique requirements of their clients and tailor solutions that meet their specific needs.

- Consult with shippers to determine their transportation needs

- Negotiate and secure competitive rates from carriers

- Foster open communication and resolve any issues

2. Carrier Management

Bond Runners manage a network of reliable carriers to ensure the timely and cost-effective transportation of goods. They evaluate carrier performance, maintain compliance, and negotiate favorable rates.

- Qualify and onboard carriers

- Monitor carrier performance and ensure compliance

- Negotiate competitive rates and terms

3. Load Planning and Execution

Bond Runners coordinate the movement of goods from origin to destination. They plan optimal routes, schedule pickups and deliveries, and track the progress of shipments.

- Plan and optimize transportation routes

- Schedule pickups and deliveries with shippers and carriers

- Monitor shipment progress and provide updates to clients

4. Compliance and Risk Management

Bond Runners ensure compliance with all applicable regulations and industry standards. They manage insurance policies, conduct due diligence on carriers, and mitigate potential risks.

- Maintain insurance policies and proof of compliance

- Conduct due diligence on carriers to ensure reliability

- Mitigate potential risks and develop contingency plans

Interview Tips

Preparing for an interview can help you put your best foot forward and increase your chances of success. Here are some tips to help you ace your Bond Runner interview:

1. Research the Company and Industry

Take the time to learn about the company you’re applying to, as well as the industry in which they operate. This will help you understand their business needs and align your skills and experience with the role.

2. Practice Your Answers

Anticipate common interview questions and prepare your answers in advance. Consider using the STAR method (Situation, Task, Action, Result) to structure your responses and provide specific examples.

3. Showcase Your Skills and Experience

Highlight your relevant skills and experience that align with the key job responsibilities of a Bond Runner. Emphasize your abilities in client relationship management, carrier management, load planning, and compliance.

4. Ask Thoughtful Questions

Asking thoughtful questions at the end of the interview demonstrates your engagement and interest in the role. This is an opportunity to gather additional insights about the company and the position.

5. Follow Up Professionally

After the interview, send a personalized thank-you note to the interviewer. This is a chance to reiterate your interest in the role and express your appreciation for their time.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Bond Runner role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.