Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Bond Trader interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Bond Trader so you can tailor your answers to impress potential employers.

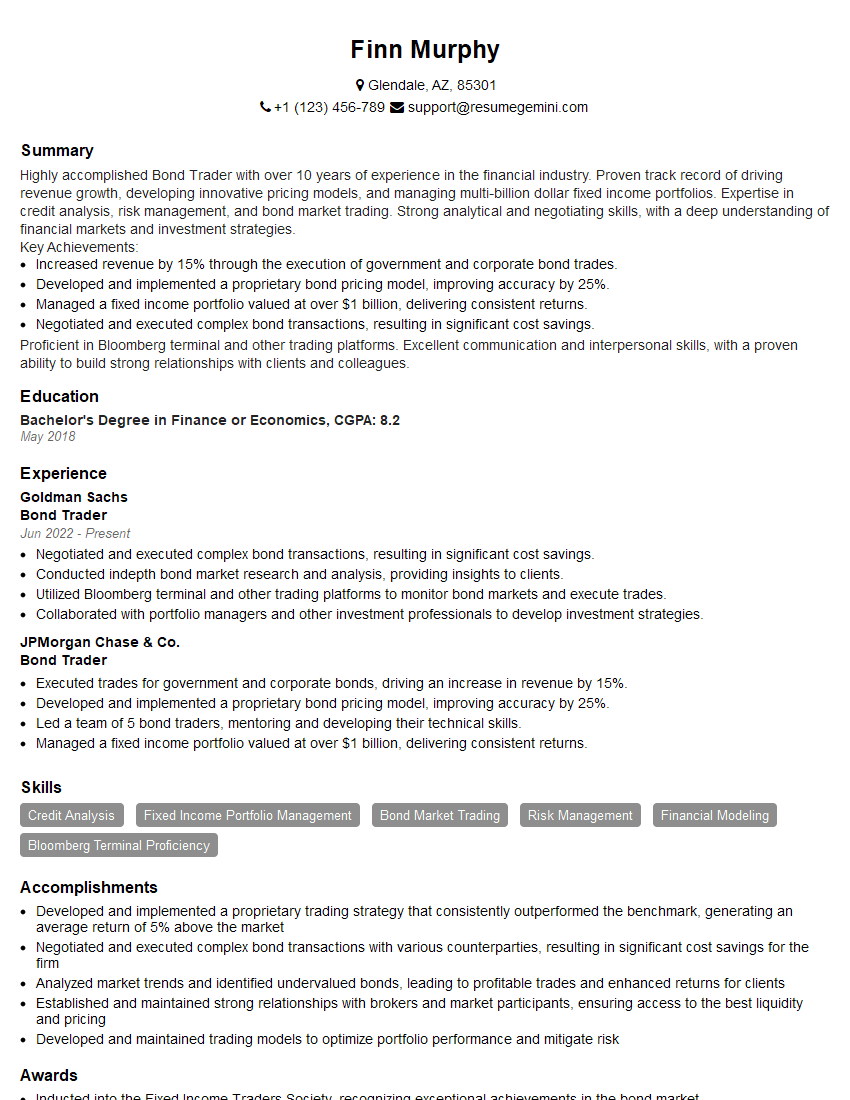

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bond Trader

1. How would you calculate the yield-to-maturity (YTM) of a bond?

- I would use the following formula: YTM = (C + (FV – PV) / N) / ((FV + PV) / 2), where:

- C is the annual coupon payment

- FV is the face value of the bond

- PV is the present value of the bond

- N is the number of years to maturity

2. What are the key factors that affect the price of a bond?

Interest rates:

- When interest rates rise, bond prices fall, and vice versa.

- This is because investors can earn a higher return on new bonds with higher interest rates, so they are less willing to pay a premium for existing bonds with lower interest rates.

Credit risk:

- The credit risk of a bond is the risk that the issuer will default on its obligations.

- Bonds with higher credit risk have lower prices because investors demand a higher return for taking on more risk.

Maturity:

- The maturity of a bond is the date on which the issuer must repay the principal.

- Bonds with longer maturities have higher prices because investors demand a higher return for tying up their money for a longer period of time.

Liquidity:

- The liquidity of a bond is the ease with which it can be bought and sold.

- Bonds with higher liquidity have higher prices because investors are willing to pay a premium for the ability to sell their bonds quickly and easily.

3. How would you hedge a portfolio of bonds against interest rate risk?

- I would use a variety of techniques to hedge a portfolio of bonds against interest rate risk, including:

- Buying bonds with different maturities.

- Buying bonds with different credit ratings.

- Buying bonds with different durations.

- Using derivatives, such as interest rate swaps or futures.

4. What is the difference between a call option and a put option?

- A call option gives the buyer the right, but not the obligation, to buy an underlying asset at a specified price on or before a specified date.

- A put option gives the buyer the right, but not the obligation, to sell an underlying asset at a specified price on or before a specified date.

5. How would you value a bond option?

- I would use a variety of techniques to value a bond option, including:

- The Black-Scholes model.

- The binomial tree model.

- The Monte Carlo simulation.

6. What are the key risks associated with bond trading?

- Interest rate risk:

- The risk that interest rates will change, which can affect the price of bonds.

- Credit risk:

- The risk that the issuer of a bond will default on its obligations.

- Liquidity risk:

- The risk that a bond cannot be bought or sold quickly and easily.

- Operational risk:

- The risk of losses due to errors or disruptions in trading systems or processes.

7. How would you manage the risk of a bond portfolio?

- I would use a variety of techniques to manage the risk of a bond portfolio, including:

- Asset allocation:

- Diversifying the portfolio across different types of bonds, such as government bonds, corporate bonds, and high-yield bonds.

- Duration management:

- Managing the average duration of the portfolio to reduce interest rate risk.

- Credit risk management:

- Investing in bonds with different credit ratings to reduce credit risk.

8. What are the ethical considerations that bond traders should be aware of?

- Bond traders should be aware of the following ethical considerations:

- Conflicts of interest:

- Traders should avoid situations where their personal interests conflict with the interests of their clients.

- Insider trading:

- Traders should not trade on inside information.

- Market manipulation:

- Traders should not engage in activities that manipulate the market.

- Client confidentiality:

- Traders should keep client information confidential.

9. What are the latest trends in bond trading?

- The following are some of the latest trends in bond trading:

- The use of electronic trading platforms.

- The growth of fixed income exchange-traded funds (ETFs).

- The increasing use of derivatives to hedge risk and speculate on interest rates.

- The development of new bond indices and benchmarks.

10. What are your career goals?

- My career goal is to become a portfolio manager.

- I believe that my skills and experience in bond trading would be valuable in this role.

- I am confident that I can make a significant contribution to your firm as a portfolio manager.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bond Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bond Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Bond Traders are professionals who play a crucial role in financial markets by facilitating the buying and selling of bonds.

1. Trading Bonds

Execute buy and sell orders for a wide range of fixed-income securities, including government bonds, corporate bonds, and municipal bonds.

- Analyze market conditions, bond yields, and economic indicators to identify trading opportunities.

- Negotiate and finalize bond transactions with clients, brokers, and other traders.

2. Managing Risk

Monitor and assess risk exposures associated with bond trading activities.

- Identify and mitigate potential risks, such as interest rate fluctuations, credit events, and market volatility.

- Develop and implement risk management strategies to protect the firm’s capital.

3. Market Analysis and Research

Conduct in-depth analysis of bond markets, economic trends, and geopolitical events to inform trading decisions.

- Stay abreast of market developments and evaluate the impact on bond prices and yields.

- Utilize financial models and analytical tools to forecast market behavior and identify trading opportunities.

4. Relationship Management

Build and maintain relationships with clients, brokers, and other market participants.

- Provide clients with tailored advice and trading recommendations.

- Communicate market insights and analysis to clients and stakeholders.

Interview Tips and Preparation

Preparing thoroughly for a Bond Trader interview will significantly enhance your chances of success.

1. Research the Company and Industry

Thoroughly research the firm you’re interviewing with and the broader bond trading industry.

- Understand the firm’s trading strategies, target markets, and recent performance.

- Stay updated on industry trends, regulations, and economic factors impacting bond trading.

2. Practice Technical Skills

Bond Traders must possess strong technical skills in financial analysis and trading.

- Review concepts such as bond valuation, yield calculations, and risk management techniques.

- Practice solving financial problems and analyzing bond market data.

3. Quantify Your Experience

When highlighting your experience, use specific metrics and data to quantify your achievements.

- For example, instead of simply stating “traded bonds,” provide details like the average volume, profitability, or risk-reward ratio.

- Showcase your ability to contribute to the firm’s bottom line and overall success.

4. Prepare for Common Interview Questions

Anticipate and prepare answers to commonly asked interview questions.

- These may include questions about your trading experience, risk management approach, and market outlook.

- Consider using the STAR method (Situation, Task, Action, Result) to structure your responses.

Next Step:

Now that you’re armed with the knowledge of Bond Trader interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Bond Trader positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini