Are you gearing up for a career in Bonding Supervisor? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Bonding Supervisor and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

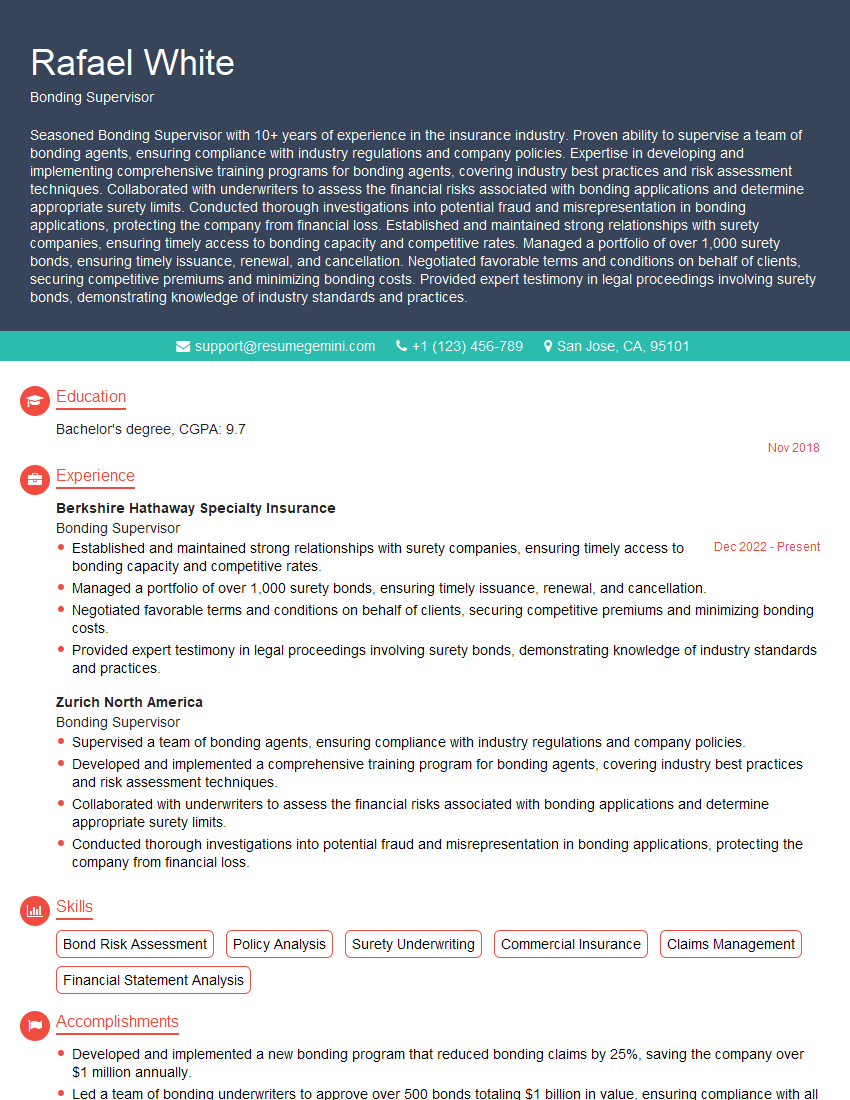

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bonding Supervisor

1. What are the different types of surety bonds and how do they differ?

Surety bonds can be classified into three main types:

- Contract Bonds: These bonds ensure that contractors complete their projects as per the agreed-upon terms and conditions, protecting the project owner from financial losses in case of default.

- Commercial Bonds: These bonds provide financial protection to businesses against risks such as employee dishonesty, theft, and fraud.

- Fidelity Bonds: These bonds protect employers against financial losses resulting from dishonest acts committed by employees, such as embezzlement or forgery.

2. What are the key steps involved in the bonding process?

Underwriting

- Assess the financial strength and reputation of the principal (the party seeking the bond).

- Review the project details and risk factors.

- Determine the bond amount and premium.

Issuance

- Issue the bond once all underwriting requirements are met.

- Provide the bond to the obligee (the party requiring the bond).

Claims

- Investigate and assess claims made against the bond.

- Determine the validity of the claim and the amount payable.

- Settle the claim and reimburse the obligee for losses covered by the bond.

3. How do you evaluate the financial strength of a principal?

I assess a principal’s financial strength by reviewing:

- Financial statements and credit reports

- Industry experience and reputation

- References from previous projects

- Collateral or other assets to support the bond

4. What are the common reasons for a bonding claim?

Bonding claims typically arise due to:

- Principal’s failure to complete the project as agreed upon

- Breach of contract

- Defective workmanship

- Employee dishonesty or fraud

- Theft or damage to property

5. How do you handle a bonding claim?

Upon receiving a bonding claim, I typically follow these steps:

- Investigate the claim and gather evidence

- Assess the validity of the claim and determine the potential liability

- Negotiate with the obligee to reach a fair settlement

- Document the claim process and outcome

6. What is the role of a bonding agent in the bonding process?

The bonding agent serves as an intermediary between the principal and the surety company. Their responsibilities include:

- Marketing and selling surety bonds

- Assessing the principal’s risk and submitting applications to surety companies

- Providing guidance and support to principals throughout the bonding process

- Maintaining relationships with surety companies and principals

7. How do you stay up-to-date with changes in the bonding industry?

I make it a priority to stay informed about industry trends and best practices through:

- Attending industry conferences and webinars

- Reading trade publications and articles

- Networking with other bonding professionals

- Participating in industry associations

8. How do you assess the risk associated with a bonding application?

To assess risk, I consider factors such as:

- Financial strength of the principal

- Nature of the project and potential risks involved

- Industry experience and track record

- Contractual terms and conditions

9. What are some best practices for managing a bonding portfolio?

Effective portfolio management involves:

- Regularly monitoring bond performance

- Identifying and mitigating potential risks

- Maintaining strong relationships with principals and bonding agents

- Staying informed about industry trends and regulatory changes

10. How do you handle disputes or disagreements with principals or obligees?

When disputes arise, I prioritize open and effective communication. I:

- Review the relevant documents and contracts

- Facilitate discussions between the parties involved

- Explore and propose mutually acceptable solutions

- Document the resolution process and outcome

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bonding Supervisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bonding Supervisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Bonding Supervisor plays a crucial role in managing and overseeing the bonding process. Their key responsibilities include:

1. Bond Management

Supervising the issuance and maintenance of surety bonds, ensuring compliance with legal and regulatory requirements.

- Reviewing and approving bond applications.

- Establishing bond limits and underwriting criteria.

2. Underwriting Analysis

Analyzing financial statements, credit reports, and other relevant data to assess the risk of potential bondholders.

- Making underwriting decisions based on risk analysis.

- Negotiating and securing appropriate collateral.

3. Claims Management

Handling and resolving bond claims, ensuring timely and fair settlements.

- Investigating claims and determining liability.

- Negotiating settlement terms and coordinating payments.

4. Risk Management

Monitoring and assessing risks associated with bonding activities, implementing risk mitigation strategies.

- Conducting regular risk assessments.

- Developing and implementing risk management policies and procedures.

5. Team Management

Leading and managing a team of bonding specialists or underwriters.

- Providing guidance, training, and support to the team.

- Evaluating team performance and implementing improvement plans.

Interview Tips

Preparing thoroughly for a Bonding Supervisor interview is essential for success. Here are some tips to help you ace the interview:

1. Research the Company and Role

Familiarize yourself with the company’s business, industry, and specific role you’re applying for. This will help you understand the company’s needs and tailor your answers accordingly.

- Visit the company website and read about their mission, products/services, and recent news.

- Review the job description carefully and identify the key responsibilities and qualifications required.

2. Practice Your Answers

Anticipate common interview questions and prepare your answers beforehand. Practice speaking clearly and concisely, using specific examples to support your points.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Seek feedback from friends, family, or a career counselor on your answers.

3. Showcase Your Industry Knowledge

Demonstrate your understanding of the bonding industry, including relevant laws, regulations, and market trends. This will show the interviewer your expertise and passion for the field.

- Read industry publications and attend industry events to stay updated on current trends.

- Share examples of how your knowledge has helped you succeed in previous roles.

4. Highlight Your Soft Skills

In addition to technical abilities, soft skills such as communication, teamwork, and problem-solving are crucial for Bonding Supervisors. Emphasize these skills in your interview.

- Provide examples of how you have successfully communicated with clients, colleagues, and stakeholders.

- Describe situations where you collaborated effectively with others to achieve a common goal.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Bonding Supervisor, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Bonding Supervisor positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.