Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Book Keeper position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

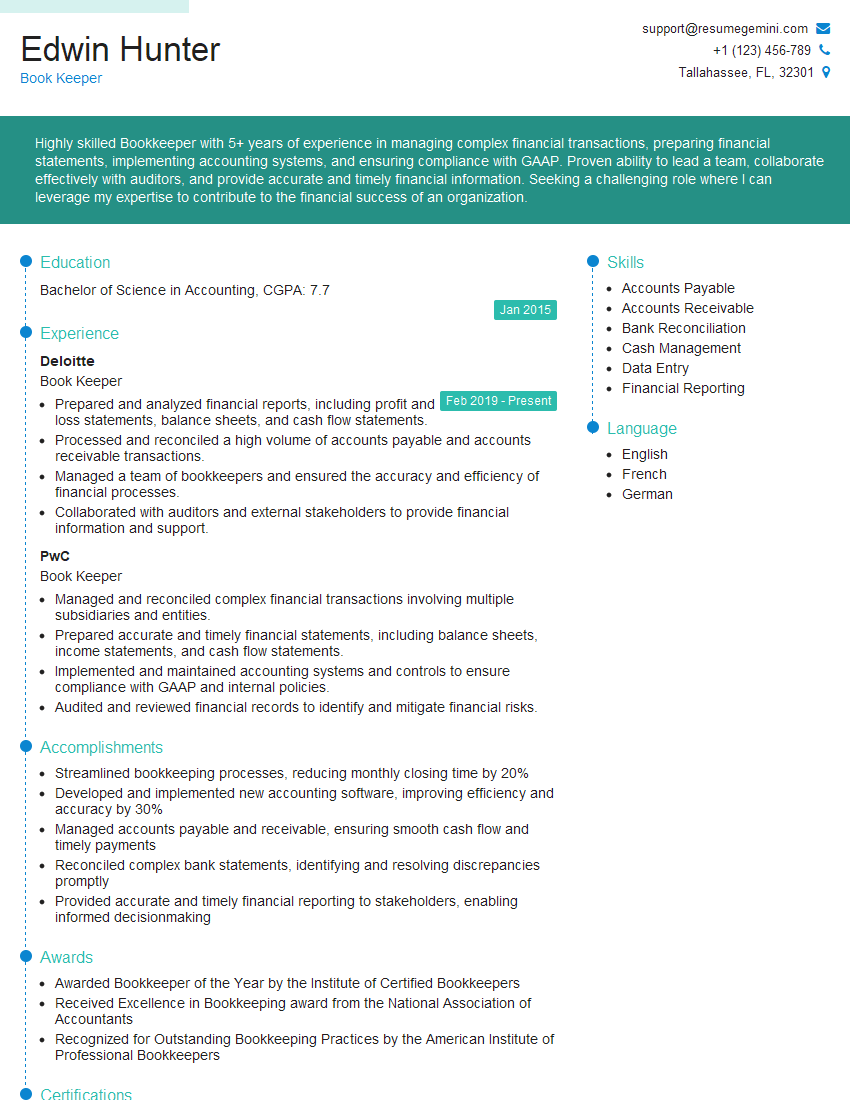

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Book Keeper

1. Walk me through the process of reconciling a bank statement.

- Gather necessary materials: bank statement, general ledger, and check register.

- Compare the beginning balance on the bank statement to the ending balance in the general ledger.

- Review all transactions on the bank statement and identify any that have not been recorded in the general ledger.

- Record any missing transactions in the general ledger.

- Review all transactions in the general ledger and identify any that have not been reconciled with the bank statement.

- Reconcile any outstanding transactions by investigating and resolving any differences.

- Determine the adjusted balance and ensure it matches the ending balance on the bank statement.

2. What are some common mistakes that bookkeepers make, and how can they be avoided?

Avoidance of Mistakes

- Posting errors: Ensure accuracy by double-checking entries and using accounting software with error-checking features.

- Classification errors: Understand the chart of accounts and consistently categorize transactions for proper financial reporting.

- Omission errors: Maintain complete records by recording all transactions, including small or unusual ones.

- Calculation errors: Use calculators or accounting software to minimize errors and verify results.

- Bank reconciliation errors: Reconcile bank statements promptly and thoroughly to identify and resolve any discrepancies.

Common Mistakes

- Posting amounts to the wrong accounts

- Misclassifying transactions

- Omitting to record transactions

- Making calculation errors

- Failing to reconcile bank statements

3. How do you handle transactions that are not clear or complete?

- Contact the person who initiated the transaction for clarification.

- Review supporting documentation, such as invoices or receipts.

- Consult with a supervisor or accountant for guidance.

- Temporarily record the transaction in a suspense account until more information is available.

- Document the steps taken and the reasons for any assumptions made.

4. What are your strengths and weaknesses as a bookkeeper?

Strengths

- Strong attention to detail and accuracy

- Proficient in accounting software (e.g., QuickBooks, Xero)

- Excellent communication and interpersonal skills

- Ability to work independently and as part of a team

- Understanding of accounting principles and financial reporting

Weaknesses

- Limited experience in advanced accounting topics (e.g., consolidations, investments)

- Still developing knowledge in tax accounting

5. Tell me about a time when you had to deal with a difficult client or colleague.

Describe a specific situation where you encountered a challenging client or colleague. Explain how you handled the situation, including the communication strategies and problem-solving techniques you employed. Highlight your ability to maintain professionalism, resolve conflicts, and find mutually acceptable solutions.

6. What are your career goals and how does this role fit into them?

Express your interest in the bookkeeper role and how it aligns with your career aspirations. Discuss your long-term career goals and explain how the responsibilities and experience gained in this position will contribute to your professional development.

7. What is your understanding of double-entry accounting?

Explain the concept of double-entry accounting, highlighting the recording of transactions in both debit and credit columns. Describe how this system ensures the accounting equation (Assets = Liabilities + Owner’s Equity) remains in balance.

8. How do you ensure the accuracy of your work?

- Regularly review and reconcile financial records

- Use accounting software with built-in error-checking features

- Double-check calculations and entries

- Seek feedback and review from supervisors or colleagues

9. Describe your experience with financial reporting.

Explain your involvement in preparing financial statements, such as balance sheets, income statements, and cash flow statements. Discuss your understanding of financial reporting standards and regulations.

10. What is your availability to work overtime or on weekends?

Clearly state your availability and flexibility to work additional hours if necessary. Explain that you understand the importance of meeting deadlines and accommodating the company’s needs.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Book Keeper.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Book Keeper‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Bookkeepers are responsible for maintaining and updating the financial records of a company. They must ensure that all transactions are properly accounted for, and that all financial reports are accurate and up-to-date.

1. Data Entry

Enter data from invoices, receipts, and other financial documents.

- Maintain accuracy of all data entered.

- Identify and correct any errors in data.

2. Account Reconciliation

Reconcile bank statements, credit card statements, and other financial documents to ensure that all transactions have been correctly recorded.

- Identify and resolve any discrepancies between accounts.

- Prepare and send out reconciliation reports.

3. Financial Reporting

Prepare financial reports, such as balance sheets, income statements, and cash flow statements.

- Ensure that all financial reports are accurate and complete.

- Provide financial reports to management and other stakeholders.

4. Accounts Payable and Receivable

Manage accounts payable and receivable, including processing invoices, making payments, and collecting payments.

- Maintain accurate records of all accounts payable and receivable.

- Prepare and send out invoices and statements.

Interview Tips

Preparing for a bookkeeping interview can be daunting, but with the right tips and tricks, you can ace it and land your dream job.

1. Research the Company

Before the interview, take some time to research the company you’re applying to. This will help you understand their business, their culture, and their financial needs.

- Visit the company’s website.

- Read articles about the company in the news.

- Talk to people you know who work at the company.

2. Practice Your Skills

Bookkeeping is a skill-based job, so it’s important to practice your skills before the interview. This will help you refresh your memory and demonstrate your proficiency to the interviewer.

- Take practice tests.

- Work on practice problems.

- Review your accounting textbooks.

3. Prepare Your Questions

At the end of the interview, the interviewer will likely ask you if you have any questions. This is your opportunity to learn more about the company and the position, and to show the interviewer that you’re interested and engaged.

- Ask about the company’s culture.

- Ask about the specific responsibilities of the position.

- Ask about the company’s financial goals.

4. Dress Professionally

First impressions matter, so make sure you dress professionally for your interview. This means wearing a suit or business casual attire.

- Choose clothes that are clean, pressed, and fit well.

- Avoid wearing revealing or distracting clothing.

- Make sure your shoes are polished.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Book Keeper role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.