Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Bookkeeper position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

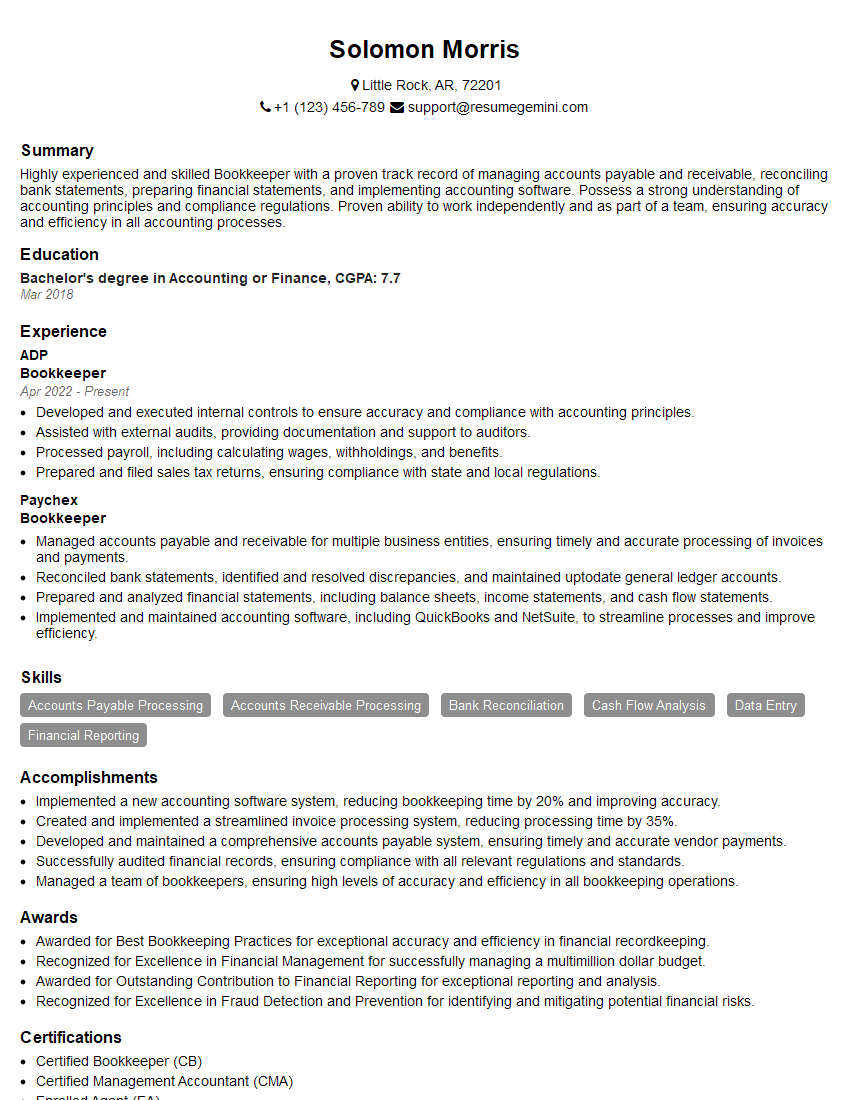

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bookkeeper

1. What is the primary responsibility of a Bookkeeper?

- Maintain accurate and up-to-date financial records.

- Process financial transactions, including recording income and expenses.

- Prepare financial reports and statements.

- Assist with audits and tax preparation.

2. Describe the different types of accounting systems you have worked with.

manual systems

- Manually recording transactions in ledgers or journals.

- Posting entries to general ledger accounts.

- Preparing trial balances and financial statements.

computerized systems

- Using accounting software to record transactions.

- Generating reports and financial statements.

- Managing accounts receivable and accounts payable.

3. What are your strengths and weaknesses as a Bookkeeper?

- Strengths: attention to detail, accuracy, strong accounting knowledge.

- Weaknesses: limited experience with certain accounting software, eagerness to learn and improve.

4. Explain the process of reconciling a bank statement.

- Matching deposits and withdrawals recorded in the accounting system with those on the bank statement.

- Identifying and correcting any discrepancies.

- Adjusting the accounting records to reflect the reconciled balance.

5. What are the different types of financial reports that you can prepare?

- Balance sheet: shows the company’s financial position at a specific point in time.

- Income statement: shows the company’s financial performance over a period of time.

- Cash flow statement: shows the company’s cash inflows and outflows over a period of time.

6. What is the role of a Bookkeeper in the audit process?

- Preparing financial records and reports for the auditors.

- Answering auditors’ questions about the company’s financial activities.

- Assisting the auditors in testing the accuracy and completeness of the financial records.

7. What are the key principles of double-entry accounting?

- Every transaction affects at least two accounts.

- The sum of the debits must equal the sum of the credits.

- The accounting equation (Assets = Liabilities + Equity) must always be in balance.

8. What are the different types of journal entries?

- General journal entries: used to record transactions that do not fit into a specific category.

- Cash receipts journal entries: used to record the receipt of cash.

- Cash disbursements journal entries: used to record the disbursement of cash.

- Sales journal entries: used to record sales of goods or services.

- Purchase journal entries: used to record purchases of goods or services.

9. What are the different types of accounts used in accounting?

- Asset accounts: represent the company’s resources.

- Liability accounts: represent the company’s obligations.

- Equity accounts: represent the owner’s investment in the company.

- Revenue accounts: represent the company’s income.

- Expense accounts: represent the company’s costs.

10. What are the different types of financial ratios that can be used to analyze a company’s financial performance?

- Liquidity ratios: measure the company’s ability to meet its short-term obligations.

- Solvency ratios: measure the company’s ability to meet its long-term obligations.

- Profitability ratios: measure the company’s ability to generate profits.

- Efficiency ratios: measure the company’s ability to use its resources effectively.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bookkeeper.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bookkeeper‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Bookkeeper is responsible for maintaining the financial health of an organization by handling day-to-day transactions, recording financial data, and preparing financial statements. Key responsibilities include:

1. Recording Financial Transactions

Documenting all financial transactions, including income, expenses, and cash flow.

- Entering data into accounting software or spreadsheets.

- Preparing and processing invoices, bills, and other financial documents.

2. Maintaining Accounting Records

Organizing and maintaining accounting records, including general ledger, cash receipts, and cash disbursements.

- Reconciling bank statements and other financial accounts.

- Filing and safeguarding financial documents.

3. Preparing Financial Reports

Preparing financial reports, such as balance sheets, income statements, and cash flow statements.

- Summarizing and analyzing financial data.

- Identifying trends and anomalies in financial activity.

4. Payroll Processing

Processing payroll, including calculating wages, withholding taxes, and distributing payments.

- Preparing and filing payroll tax returns.

- Maintaining employee records related to payroll.

Interview Tips

To ace the Bookkeeper interview, consider the following tips:

1. Research the Company and Position

Familiarize yourself with the company’s industry, size, and financial performance. Review the job description thoroughly to understand the specific requirements.

- Visit the company website and LinkedIn page.

- Read industry news and articles related to bookkeeping.

2. Highlight Relevant Skills and Experience

Emphasize your strong bookkeeping skills, including proficiency in accounting software, understanding of accounting principles, and attention to detail.

- Quantify your accomplishments with specific examples of financial improvements or process enhancements.

- Showcase your ability to handle confidential financial information.

3. Practice Common Interview Questions

Anticipate common interview questions and prepare your answers in advance. Some common questions include:

- “Tell me about your experience in bookkeeping.”

- “How do you handle reconciling financial accounts?”

- “What accounting software are you proficient in?”

4. Be Professional and Well-Prepared

Arrive on time for your interview, dress professionally, and bring copies of your resume and any supporting documents.

- Maintain eye contact, speak clearly, and demonstrate a positive attitude.

- Ask thoughtful questions to show your engagement and interest in the position.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Bookkeeper interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.