Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Bookkeepers Supervisor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

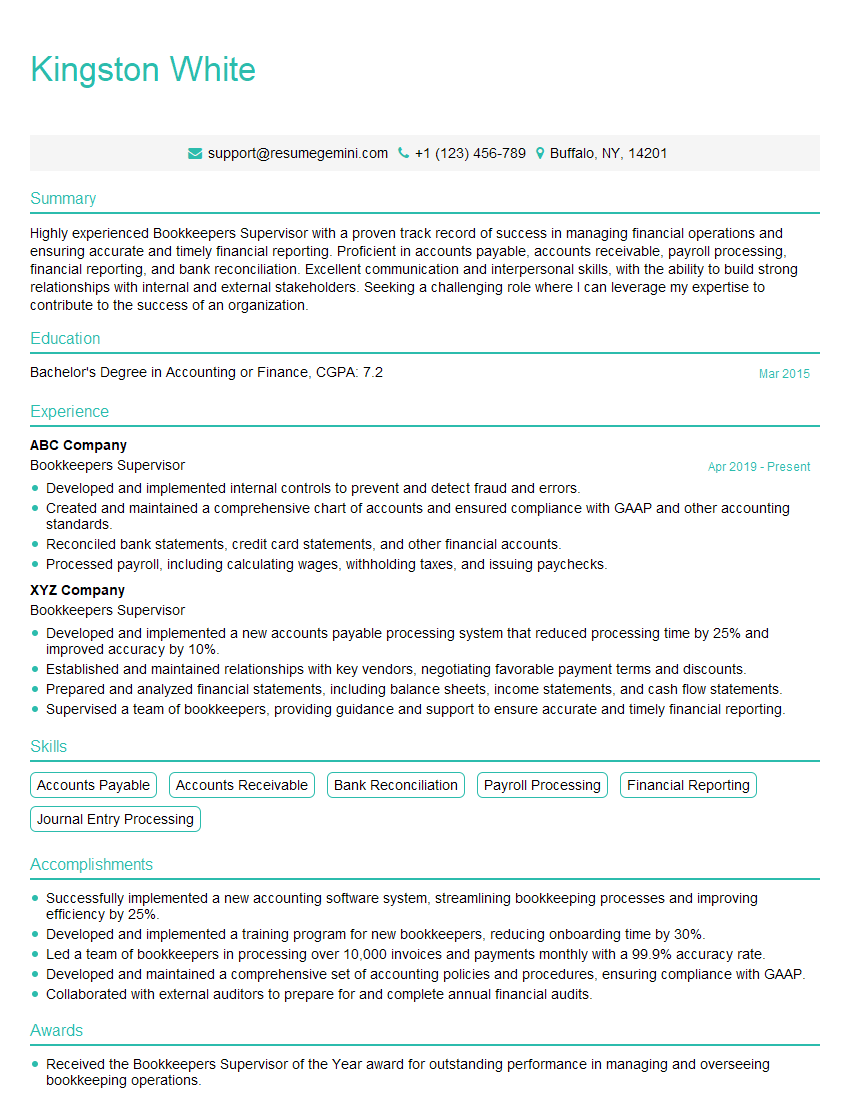

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bookkeepers Supervisor

1. How do you ensure the accuracy of financial data and the timeliness of financial reporting?

To ensure the accuracy of financial data, I implement robust internal controls, including regular reconciliations, data validation checks, and periodic audits. These measures help identify and correct any errors or inconsistencies in the data.

As for timeliness, I prioritize task delegation, streamline workflows, and utilize technology to automate processes. By optimizing the workflow and leveraging automation, my team can complete financial reporting tasks efficiently and meet deadlines consistently.

2. Describe your experience in supervising and developing bookkeepers.

Training and Development

- Conduct regular training sessions to enhance their technical skills and knowledge of accounting principles.

- Provide ongoing feedback, coaching, and mentorship to support their professional growth.

Performance Management

- Establish clear performance goals and expectations.

- Conduct regular performance reviews to assess progress and provide guidance.

- Recognize and reward exceptional performance.

Team Management

- Foster a positive and collaborative work environment.

- Delegate tasks effectively and empower bookkeepers to take ownership of their responsibilities.

- Communicate openly and regularly to ensure alignment and address any challenges.

3. How do you maintain compliance with accounting standards and regulations?

Maintaining compliance with accounting standards and regulations is paramount. I stay up-to-date with the latest industry developments, including changes in GAAP or IFRS. I regularly attend conferences, webinars, and training sessions to enhance my knowledge.

Within the team, I emphasize the importance of adherence to established accounting policies and procedures. I ensure that our processes align with regulatory requirements and that we have a system of internal controls in place to mitigate risks and maintain the integrity of our financial reporting.

4. What are the key challenges you have faced in bookkeeping supervision and how did you overcome them?

One significant challenge I faced was ensuring the accuracy and consistency of financial data across multiple teams. To address this, I implemented a centralized data validation process and standardized reporting templates. This streamlined data management and improved the reliability of our financial information.

Another challenge was motivating and engaging bookkeepers in a fast-paced environment. I introduced regular recognition programs, provided opportunities for professional development, and fostered a culture of continuous improvement. This helped boost morale and enhance overall team performance.

5. How do you leverage technology to improve bookkeeping processes?

I am a strong advocate for leveraging technology to enhance bookkeeping processes. I have implemented cloud-based accounting software that offers real-time access to financial data, automated data entry, and robust reporting capabilities.

Additionally, I have explored the use of artificial intelligence (AI) for tasks such as invoice processing and fraud detection. AI can streamline repetitive tasks, improve accuracy, and free up our team to focus on more complex and value-added activities.

6. What is your approach to fraud prevention and detection?

Fraud prevention and detection are crucial aspects of my role. I have implemented a comprehensive system of internal controls, including segregation of duties, regular audits, and mandatory vacation policies.

Additionally, I conduct regular fraud risk assessments and train my team to recognize and report any suspicious activities. By staying vigilant and adopting a proactive approach, we can minimize the risk of fraud and protect the integrity of our financial records.

7. How do you handle conflicts or disagreements within the bookkeeping team?

Conflict resolution is an essential aspect of team management. When conflicts arise, I approach them with empathy and professionalism. I actively listen to all perspectives, facilitate open dialogue, and seek to find common ground.

I encourage my team to express their concerns and ideas respectfully and to focus on finding solutions that benefit the team and the organization as a whole. By fostering a collaborative and supportive environment, I can effectively resolve conflicts and maintain a positive and productive work atmosphere.

8. How do you measure and track the performance of the bookkeeping team?

Measuring and tracking team performance is essential for continuous improvement. I have established a set of key performance indicators (KPIs) that align with the organization’s overall goals. These KPIs include accuracy rates, timeliness of reporting, and customer satisfaction.

I regularly monitor these KPIs and provide feedback to my team. By tracking progress and identifying areas for improvement, I can ensure that our bookkeeping operations are operating at an optimal level and that we are meeting the needs of the business.

9. How do you stay up-to-date with the latest trends and best practices in bookkeeping?

Continuing professional development is essential for any Bookkeepers Supervisor. I make it a priority to stay informed about industry trends and best practices. I attend industry conferences, webinars, and training programs.

Additionally, I am an active member of professional organizations such as the American Institute of Professional Bookkeepers (AIPB) and the Institute of Certified Bookkeepers (ICB). These organizations offer valuable resources, networking opportunities, and access to the latest research and developments in the field.

10. How would you approach implementing a new accounting system within the organization?

Implementing a new accounting system requires careful planning and execution. I would approach this task by:

- Conducting a thorough needs assessment to identify the organization’s specific requirements.

- Researching and evaluating potential accounting systems to find the best fit.

- Creating a detailed implementation plan that includes timelines, resources, and training.

- Communicating the plan clearly to all stakeholders and obtaining buy-in.

- Working closely with the vendor to ensure a smooth implementation.

- Providing comprehensive training to all users.

- Monitoring the system’s performance and making adjustments as needed.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bookkeepers Supervisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bookkeepers Supervisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Bookkeepers Supervisor is responsible for managing and supervising a team of bookkeepers, ensuring that financial records are accurate, complete, and in compliance with GAAP and other accounting standards.

1. Supervise and Manage Team

Oversee the day-to-day operations of the bookkeeping department, including assigning tasks, monitoring progress, and providing guidance and support to team members.

2. Review and Approve Financial Transactions

Review and approve all financial transactions, including invoices, purchase orders, and payments, to ensure accuracy and compliance with company policies.

3. Prepare Financial Reports

Prepare monthly and quarterly financial reports, including balance sheets, income statements, and cash flow statements, for management and external stakeholders.

4. Implement and Maintain Accounting Systems

Implement and maintain accounting systems and procedures, including establishing chart of accounts, setting up accounting software, and developing internal controls.

Interview Tips

Preparing for an interview for a Bookkeepers Supervisor position requires a comprehensive approach that encompasses research, practice, and a clear understanding of the key responsibilities and qualifications. Here are some tips to help you ace the interview:

1. Research the Company and Position

Thoroughly research the company’s background, industry, and financial performance, as well as the specific responsibilities of the Bookkeepers Supervisor position. This will demonstrate your interest and engagement with the opportunity.

2. Practice Answering Common Interview Questions

Anticipate common interview questions related to your experience, skills, and qualifications. Practice answering these questions concisely and confidently, emphasizing your relevant abilities and accomplishments.

3. Prepare Questions for the Interviewer

Asking thoughtful questions during the interview shows that you are engaged and interested in the role. Prepare questions that demonstrate your knowledge of the industry and the company, and that seek to clarify the expectations and responsibilities of the position.

4. Dress Professionally and Arrive Punctually

First impressions matter. Dress professionally and arrive at the interview on time to show respect for the interviewer and the company. Your appearance and punctuality will reflect your attention to detail and professionalism.

Example Interview Questions and Answers

To further aid your preparation, consider the following interview questions and sample answers:

Question: Tell me about your experience in supervising a team of bookkeepers. Answer: In my previous role, I supervised a team of five bookkeepers. I was responsible for assigning tasks, reviewing their work, and providing guidance and support. I also implemented a new accounting system that streamlined our processes and improved efficiency.

Question: What are your strengths and weaknesses as a Bookkeepers Supervisor? Answer: My strengths include my strong technical accounting skills, my ability to manage and motivate a team, and my attention to detail. I am also a quick learner and I am always willing to take on new challenges. My weakness is that I can sometimes be a bit too detail-oriented, but I am working on improving this.

Question: What are your salary expectations? Answer: My salary expectations are in line with the market rate for Bookkeepers Supervisors with my experience and qualifications. I am confident that I can add value to your company and I am willing to negotiate a salary that is fair for both parties.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Bookkeepers Supervisor, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Bookkeepers Supervisor positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.