Are you gearing up for an interview for a Bookkeeping Assistant position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Bookkeeping Assistant and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

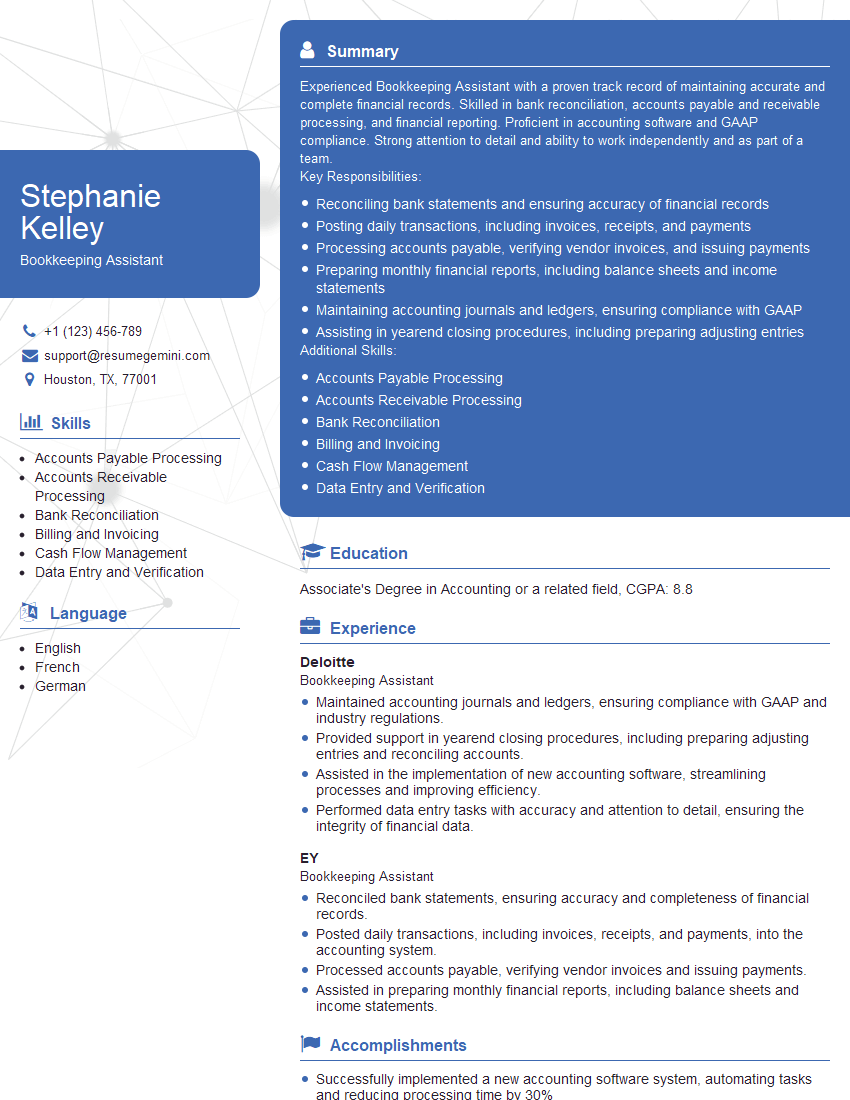

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bookkeeping Assistant

1. How do you create a new chart of accounts?

To create a new chart of accounts, I would:

- Open the accounting software and navigate to the “Chart of Accounts” section.

- Click on the “New” or “Add” button to create a new account.

- Enter the account name, number, and type (e.g., asset, liability, equity, revenue, expense).

- Set up any necessary sub-accounts or sub-ledgers.

- Assign the account to an appropriate account group or category.

- Configure any default values or preferences for the account.

- Save and publish the new chart of accounts.

2. Explain the difference between a debit and a credit in accounting.

In accounting, debits and credits are used to record financial transactions. A debit increases an asset account or expense account, while it decreases a liability account, equity account, or revenue account. On the other hand, a credit decreases an asset account or expense account, while it increases a liability account, equity account, or revenue account. The total debits in a transaction must always equal the total credits.

of the answer

Here’s a table summarizing the effects of debits and credits on different account types:

| Account Type | Debit | Credit |

|---|---|---|

| Asset | Increase | Decrease |

| Liability | Decrease | Increase |

| Equity | Decrease | Increase |

| Revenue | Decrease | Increase |

| Expense | Increase | Decrease |

3. What are the steps involved in reconciling a bank statement?

To reconcile a bank statement, I would:

- Gather the bank statement and a copy of the company’s books and records.

- Compare the bank statement balance to the book balance.

- Identify and record any outstanding deposits or withdrawals that are not yet reflected in the books.

- Identify and record any bank errors or adjustments.

- Identify and investigate any discrepancies between the bank statement and the books.

- Make any necessary adjustments to the books to bring them into agreement with the bank statement.

- Document the reconciliation process and retain the supporting documentation.

4. How do you handle customer invoices and payments?

I would typically handle customer invoices and payments as follows:

- Upon receiving an order from a customer, I would create an invoice and send it to the customer.

- I would track the status of each invoice, including whether it has been paid or not.

- When a payment is received, I would record the payment in the accounting system and update the customer’s account.

- I would also process any necessary refunds or adjustments to customer invoices.

- I would maintain a record of all customer transactions for auditing purposes.

5. What are some of the common mistakes that you have seen in bookkeeping?

Some common mistakes that I have seen in bookkeeping include:

- Inaccurate data entry

- Missing or incomplete transactions

- Incorrect account classification

- Unreconciled bank statements

- Lack of documentation

- Failure to follow accounting standards

- Poor internal controls

6. How do you stay up-to-date on the latest accounting standards and regulations?

To stay up-to-date on the latest accounting standards and regulations, I would:

- Attend industry conferences and webinars.

- Read accounting publications and journals.

- Participate in professional development courses and workshops.

- Consult with accounting professionals and experts.

- Monitor the websites of relevant regulatory bodies.

7. What are your strengths and weaknesses as a Bookkeeping Assistant?

Strengths:

- Strong attention to detail and accuracy.

- Excellent organizational and time management skills.

- Proficient in accounting software and principles.

- Ability to work independently and as part of a team.

- Bachelor’s degree in accounting or a related field.

Weaknesses:

- Limited experience with complex accounting transactions.

- Still developing my knowledge of tax laws and regulations.

8. What are your career goals?

My career goals are to become a Certified Public Accountant (CPA) and to eventually become a Controller or CFO. I am passionate about accounting and finance, and I believe that my skills and experience would make me a valuable asset to any organization.

9. Why are you interested in working for our company?

I am interested in working for your company because I am impressed by your company’s reputation as a leader in the industry. I am also attracted to your company’s commitment to customer service and employee development. I believe that my skills and experience would be a valuable asset to your team, and I am eager to contribute to your company’s continued success.

10. Do you have any questions for me?

Yes, I have a few questions for you:

- What are the company’s expectations for this role?

- What is the company’s culture like?

- What opportunities are there for professional development?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bookkeeping Assistant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bookkeeping Assistant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Bookkeeping Assistants are responsible for maintaining accurate and up-to-date financial records for organizations. They perform a range of duties to ensure the smooth functioning of the accounting department.

1. Data Entry and Processing

• Enter accounting data into software systems, such as transactions, invoices, and payments

• Process and post journal entries to record financial activities

• Reconcile bank statements and accounts to ensure accuracy

2. Account Management

• Set up and maintain general ledger accounts

• Track and manage accounts payable and accounts receivable

• Prepare reports on account balances and activity

3. Reporting and Analysis

• Compile and analyze financial data to create reports

• Monitor financial performance and identify trends

• Prepare tax returns and other regulatory filings

4. Compliance and Internal Controls

• Adhere to accounting principles and best practices

• Implement and maintain internal controls to prevent errors and fraud

• Assist with audits and reviews

Interview Tips

Preparing for a Bookkeeping Assistant interview requires understanding the role’s responsibilities and showcasing your relevant skills. Here are some tips to ace your interview:

1. Research the Company and Role

• Visit the company website to learn about their business, industry, and company culture.

• Thoroughly review the job description to identify key responsibilities and requirements.

2. Highlight Your Skills and Experience

• Emphasize your proficiency in accounting software and bookkeeping principles.

• Quantify your accomplishments to demonstrate your impact on previous roles.

3. Practice Common Interview Questions

• Prepare for questions about your accounting knowledge, attention to detail, and ability to handle data.

• Practice describing your strengths and weaknesses in a professional and growth-oriented manner.

4. Prepare Questions for the Interviewer

• Ask well-thought-out questions that show your interest in the company and position.

• This demonstrates your enthusiasm for the role and willingness to learn more about the organization.

5. Dress Professionally and Maintain a Positive Attitude

• Show up to the interview well-dressed and groomed.

• Maintain a positive and enthusiastic demeanor throughout the interview to convey your interest in the role.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Bookkeeping Assistant, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Bookkeeping Assistant positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.