Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Bookkeeping Clerks Supervisor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

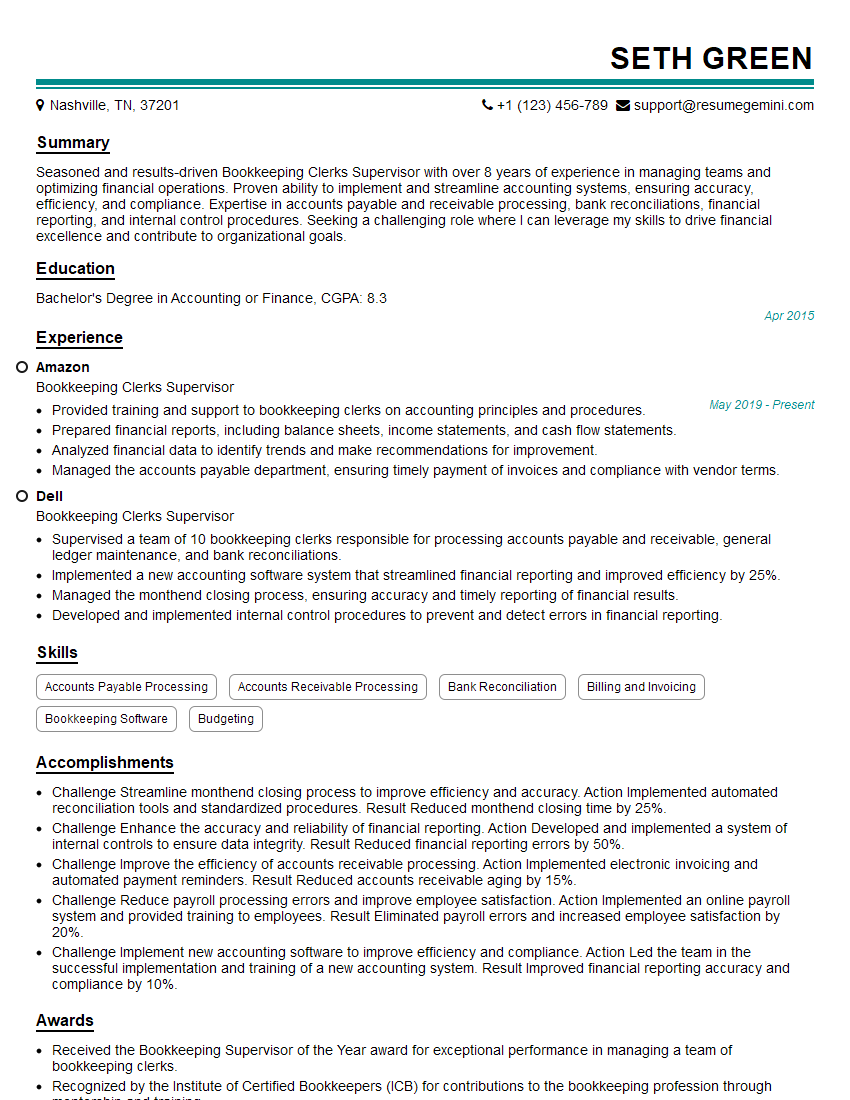

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bookkeeping Clerks Supervisor

1. What is the difference between a general journal and a subsidiary ledger?

Answer:

- A general journal is used to record all financial transactions in chronological order.

- A subsidiary ledger is used to record transactions related to a specific account, such as accounts receivable or accounts payable.

- The general journal provides a summary of all transactions, while the subsidiary ledger provides detailed information about each account.

2. What are the key steps involved in posting transactions from a subsidiary ledger to a general ledger?

Reconciling the subsidiary ledger to the general ledger

- The first step is to reconcile the subsidiary ledger to the general ledger.

- This involves ensuring that the total of the balances in the subsidiary ledger matches the balance of the corresponding account in the general ledger.

Posting the transactions

- Once the subsidiary ledger has been reconciled to the general ledger, the transactions can be posted.

- This involves copying the transactions from the subsidiary ledger to the general ledger.

3. What are some of the common errors that can occur when posting transactions from a subsidiary ledger to a general ledger?

Answer:

- Posting the transactions to the wrong account.

- Posting the transactions in the wrong amount.

- Omitting a transaction from the posting.

- Posting the transactions to the wrong period.

4. How do you ensure that the transactions posted from the subsidiary ledgers to the general ledger are accurate?

Answer:

- By reconciling the subsidiary ledgers to the general ledger on a regular basis.

- By reviewing the transactions posted from the subsidiary ledgers to the general ledger for accuracy.

- By using a software program to automate the posting of transactions from the subsidiary ledgers to the general ledger.

5. What are some of the benefits of using a subsidiary ledger?

Answer:

- Increased accuracy of the general ledger.

- Improved efficiency in the accounting process.

- Reduces the risk of fraud.

6. What are some of the challenges of using a subsidiary ledger?

Answer:

- Increased complexity of the accounting process.

- Increased risk of errors.

- Increased cost of maintaining the subsidiary ledgers.

7. What are some of the key qualities of a successful Bookkeeping Clerks Supervisor?

Answer:

- Strong knowledge of accounting principles and practices.

- Excellent organizational and time management skills.

- Strong leadership and communication skills.

- Ability to work independently and as part of a team.

- Attention to detail and accuracy.

8. What are some of the challenges facing Bookkeeping Clerks Supervisors today?

Answer:

- The increasing complexity of accounting regulations.

- The need to keep up with new technologies.

- The increasing pressure to reduce costs.

9. What are some of the opportunities for Bookkeeping Clerks Supervisors in the future?

Answer:

- Growth in the use of accounting software.

- Increased demand for financial reporting and analysis.

- Opportunities for career advancement in accounting and finance.

10. What is your favorite accounting software program? Why?

Answer:

- My favorite accounting software is [name of software].

- I like this software because it is [user-friendly, efficient, powerful].

- I have used this software for [number of years] and have found it to be a valuable tool in my work.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bookkeeping Clerks Supervisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bookkeeping Clerks Supervisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Supervising bookkeeping clerks is crucial for maintaining accurate financial records and ensuring compliance within an organization. The key job responsibilities of a Bookkeeping Clerks Supervisor encompass a wide range of tasks:

1. Supervising and Managing Team

Providing guidance and support to bookkeeping clerks, ensuring they understand and follow established procedures.

- Assigning and delegating tasks, monitoring progress, and providing feedback to enhance performance.

- Ensuring that the team meets deadlines and maintains high levels of accuracy and efficiency.

2. Monitoring Financial Transactions

Overseeing all bookkeeping processes, including recording and processing financial transactions.

- Reviewing invoices, receipts, and other financial documents for accuracy and completeness.

- Reconciling bank statements and identifying discrepancies.

3. Maintaining Financial Records

Organizing and maintaining financial records, including ledgers, journals, and reports.

- Ensuring that records are up-to-date, accurate, and accessible.

- Preparing financial statements and reports for management and external stakeholders.

4. Compliance and Internal Controls

Ensuring compliance with relevant accounting standards and regulations.

- Implementing and monitoring internal controls to prevent errors and fraud.

- Reviewing audit reports and addressing any identified issues.

Interview Tips

Preparation is key to acing an interview for a Bookkeeping Clerks Supervisor position. Here are some crucial tips:

1. Research the Company and Role

Thoroughly research the company, its industry, and the specific responsibilities of the Bookkeeping Clerks Supervisor role. This will help you understand the company’s needs and tailor your answers accordingly.

- Review the company website, LinkedIn profile, and recent news articles to gain insights.

- Carefully read the job description and identify the key skills and experience required.

2. Highlight Relevant Experience

Emphasize your relevant experience in supervising bookkeeping or accounting teams. Quantify your accomplishments and provide specific examples that demonstrate your skills.

- Describe instances where you successfully managed teams and improved efficiency.

- Quantify your results by stating the percentage of accuracy achieved or time saved.

3. Demonstrate Accounting Expertise

Showcase your strong understanding of accounting principles, bookkeeping procedures, and financial reporting standards.

- Discuss your experience in recording and reconciling financial transactions.

- Highlight your knowledge of GAAP, IFRS, or other relevant accounting standards.

4. Emphasize Communication and Interpersonal Skills

Effective communication is vital for a Bookkeeping Clerks Supervisor. Express your ability to communicate clearly and effectively, both verbally and in writing.

- Describe how you build relationships with team members and stakeholders.

- Provide examples of how you resolve conflicts or provide constructive feedback.

5. Prepare for Common Interview Questions

Anticipate common interview questions and prepare thoughtful answers that highlight your qualifications. Here are some examples:

- Tell me about your experience in supervising bookkeeping teams.

- How do you ensure the accuracy and completeness of financial records?

- What accounting software are you proficient in?

- How do you stay up-to-date with accounting standards and regulations?

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Bookkeeping Clerks Supervisor role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.