Are you gearing up for a career in Bookkeeping Teacher? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Bookkeeping Teacher and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

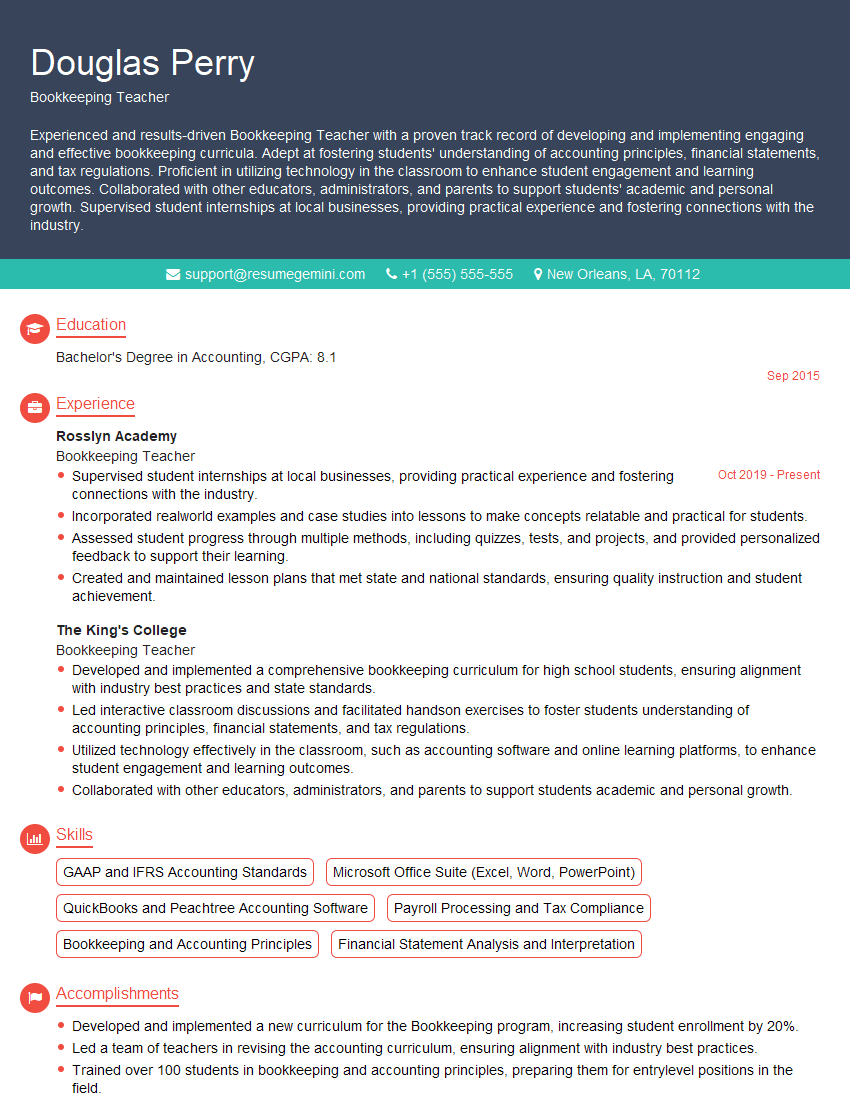

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bookkeeping Teacher

1. How would you explain the concept of double-entry bookkeeping to a student with no prior accounting knowledge?

I would explain double-entry bookkeeping as a system of recording financial transactions where each transaction is recorded in at least two accounts. I would emphasize the principle that every debit has a corresponding credit, and vice versa. I would use simple examples to illustrate how double-entry bookkeeping helps to ensure the accuracy and completeness of financial records.

2. What are the key principles of accrual accounting, and how do they differ from the principles of cash basis accounting?

Accrual Accounting Principles

- Revenues are recognized when earned, regardless of when cash is received.

- Expenses are recognized when incurred, regardless of when cash is paid.

- Assets and liabilities are recorded on the balance sheet at the end of the accounting period, even if they have not yet been collected or paid.

Cash Basis Accounting Principles

- Revenues are recognized when cash is received.

- Expenses are recognized when cash is paid.

- Assets and liabilities are not recorded on the balance sheet until cash has been collected or paid.

3. What is the difference between a debit and a credit, and how are they used to record transactions in a general ledger?

A debit is an entry that increases an asset account or decreases a liability or equity account. A credit is an entry that decreases an asset account or increases a liability or equity account. In a general ledger, debits are always recorded on the left side of an account, and credits are always recorded on the right side.

4. What are the different types of financial statements, and what information do they provide?

- Balance Sheet: Shows the company’s financial position at a specific point in time.

- Income Statement: Shows the company’s financial performance over a period of time.

- Cash Flow Statement: Shows the company’s cash inflows and outflows over a period of time.

5. What are the ethical responsibilities of a bookkeeper?

- Maintain confidentiality of financial information.

- Be accurate and thorough in their work.

- Adhere to all applicable laws and regulations.

- Avoid conflicts of interest.

- Report any suspected fraud or wrongdoing.

6. What are the common challenges that bookkeepers face, and how do you overcome them?

- Inaccurate or incomplete data: I overcome this by carefully reviewing all source documents and asking clarifying questions to ensure that I have all of the necessary information.

- Tight deadlines: I overcome this by prioritizing my work and working efficiently. I also stay organized and am always looking for ways to improve my workflow.

- Complex transactions: I overcome this by breaking down the transaction into smaller steps and researching any unfamiliar topics. I also consult with my colleagues or supervisors if necessary.

7. What software do you use for bookkeeping, and what are the advantages and disadvantages of each?

- QuickBooks: Advantages include ease of use, affordability, and a wide range of features. Disadvantages include limited customization options and potential for errors if not used correctly.

- NetSuite: Advantages include scalability, powerful reporting features, and integration with other business applications. Disadvantages include higher cost and complexity.

- Xero: Advantages include cloud-based access, user-friendly interface, and automated features. Disadvantages include limited customization options and fewer features than some other software.

8. What are the latest trends in bookkeeping, and how do you stay up-to-date with these trends?

- Cloud-based bookkeeping: Allows bookkeepers to access their work from anywhere with an internet connection.

- Automated bookkeeping: Uses software to automate tasks such as data entry and reconciliation.

- Blockchain technology: A secure and transparent way to record and track financial transactions.

- I stay up-to-date with these trends by reading industry publications, attending webinars, and taking continuing education courses.

9. How do you handle discrepancies in financial data, and what steps do you take to resolve them?

- Identify the source of the discrepancy: I carefully review all source documents and compare them to the financial records. I also look for any unusual patterns or trends.

- Correct the error: Once I have identified the source of the discrepancy, I correct the error and make any necessary adjustments to the financial records.

- Document the error and the steps taken to resolve it: I keep a record of all errors and the steps taken to resolve them. This helps me to identify any patterns or trends and to improve my accuracy in the future.

10. How do you stay organized and manage your time effectively as a bookkeeper?

- I use a to-do list to track my tasks and priorities.

- I break down large tasks into smaller, more manageable tasks.

- I set deadlines for myself and stick to them.

- I take regular breaks to avoid burnout.

- I ask for help from my colleagues or supervisors when needed.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bookkeeping Teacher.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bookkeeping Teacher‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Bookkeeping Teacher is responsible for educating students on the fundamentals and principles of bookkeeping and accounting practices. They play a crucial role in equipping students with the skills and knowledge necessary for managing financial transactions and records.

1. Curriculum Development and Delivery

Develop and implement engaging lesson plans and course materials that align with curriculum standards for bookkeeping education.

- Plan and deliver lectures, seminars, and workshops on various aspects of bookkeeping, including accounting principles, financial reporting, and record-keeping.

- Utilize a variety of teaching methodologies, including lectures, discussions, simulations, and hands-on activities, to cater to diverse learning styles.

2. Student Assessment and Evaluation

Assess student understanding and progress through various methods to provide feedback and track learning outcomes.

- Conduct regular quizzes, exams, and assignments to evaluate students’ knowledge and skills in bookkeeping.

- Provide constructive feedback to students on their performance, identifying areas for improvement and offering guidance.

3. Classroom Management and Student Support

Create a positive and supportive learning environment for students to foster their growth and development.

- Establish and maintain clear classroom rules and expectations, promoting a conducive learning atmosphere.

- Provide individualized support and guidance to students outside of class hours, addressing their queries and concerns.

4. Professional Development and Collaboration

Stay abreast of advancements in bookkeeping practices and educational methodologies to enhance teaching effectiveness.

- Engage in ongoing professional development activities, such as workshops, conferences, and self-directed learning, to update knowledge and skills.

- Collaborate with colleagues and other professionals in the field to share best practices and exchange ideas.

Interview Tips

1. Research and Preparation

Thoroughly research the school or institution you are applying to, including their mission, curriculum, and teaching philosophy.

- Familiarize yourself with the specific job requirements and qualifications outlined in the posting.

- Prepare examples of your teaching experiences, lesson plans, and assessment methods that highlight your skills and abilities.

2. Practice and Confidence

Practice answering common interview questions related to bookkeeping education and teaching methods.

- Seek feedback from a trusted colleague or mentor to refine your answers and build confidence.

- Dress professionally and maintain a positive and enthusiastic attitude during your interview.

3. Communication and Interpersonal Skills

Showcase your ability to communicate effectively, engage with students, and build rapport in a classroom setting.

- Demonstrate your passion for teaching and your commitment to student success.

- Highlight your ability to handle diverse student needs and create an inclusive learning environment.

4. Technological Proficiency

Emphasize your proficiency in bookkeeping software and other relevant technologies used in teaching or industry.

- Provide examples of how you have integrated technology into your teaching to enhance student learning.

- Discuss your willingness to adopt and learn new technologies to stay current with industry practices.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Bookkeeping Teacher, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Bookkeeping Teacher positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.