Are you gearing up for an interview for a Branch Account Manager position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Branch Account Manager and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

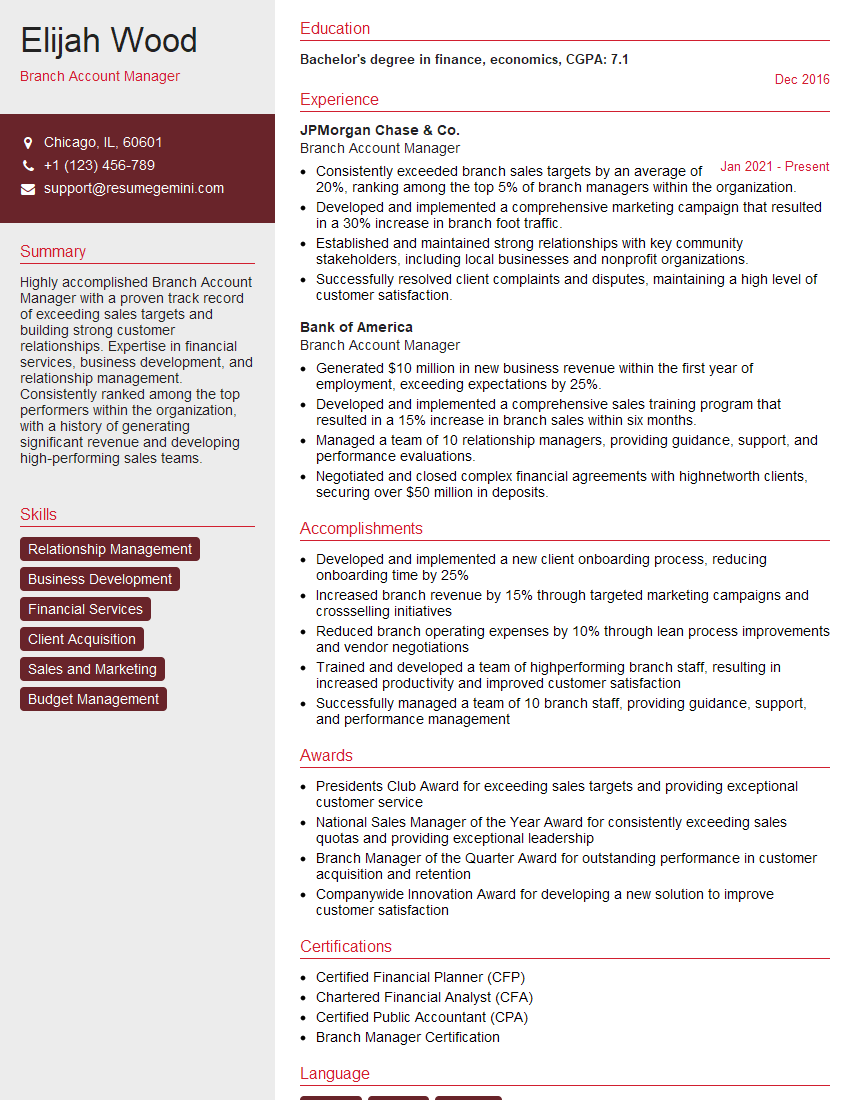

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Branch Account Manager

1. How would you assess the financial health of a business?

To assess a business’s financial health, I would start by reviewing their financial statements, including the balance sheet, income statement, and cash flow statement. These statements provide a snapshot of the company’s financial position and performance over a period of time.

- By analyzing these statements, I can get a sense of the company’s liquidity, profitability, and solvency.

- I would also look at the company’s financial ratios, which can provide insights into specific aspects of its financial performance.

2. What are some of the key challenges facing Branch Account Managers today?

Compliance and Regulation

- Staying up-to-date with the latest compliance and regulatory requirements.

- Ensuring that the branch is operating in a compliant manner.

Technology

- Keeping pace with the latest technological advancements.

- Leveraging technology to improve efficiency and customer service.

Competition

- Facing competition from other banks and financial institutions.

- Developing strategies to attract and retain customers.

3. How would you go about developing a marketing plan for your branch?

To develop a marketing plan for my branch, I would start by conducting a market analysis to identify my target audience and their needs. I would then develop a marketing strategy that outlines my goals, objectives, and target market.

- My marketing plan would include a mix of traditional and digital marketing tactics, such as print advertising, online advertising, and social media marketing.

- I would also develop a budget for my marketing plan and track my results to measure the effectiveness of my campaigns.

4. What are some of the key qualities of a successful Branch Account Manager?

Some of the key qualities of a successful Branch Account Manager include:

- Strong leadership and management skills.

- Excellent communication and interpersonal skills.

- A deep understanding of financial products and services.

- The ability to build relationships with customers and colleagues.

- A commitment to providing exceptional customer service.

5. How would you handle a difficult customer?

When handling a difficult customer, I would first try to remain calm and empathetic. I would listen to the customer’s concerns and try to understand their point of view.

- I would then work to resolve the issue to the customer’s satisfaction.

- If the issue cannot be resolved immediately, I would provide the customer with a timeline for resolution and keep them updated on the progress.

6. What are some of the ethical considerations that Branch Account Managers should be aware of?

Branch Account Managers should be aware of a number of ethical considerations, including:

- The importance of confidentiality.

- The need to avoid conflicts of interest.

- The obligation to provide customers with accurate and unbiased information.

- The responsibility to comply with all applicable laws and regulations.

7. How would you stay up-to-date on the latest industry trends and developments?

To stay up-to-date on the latest industry trends and developments, I would read industry publications, attend industry conferences, and network with other professionals in the field.

- I would also take advantage of online resources, such as webinars and podcasts, to learn about the latest trends and developments.

8. What are some of the key challenges facing the banking industry today?

Some of the key challenges facing the banking industry today include:

- Increased competition from non-traditional financial institutions.

- The need to comply with increasingly complex regulations.

- The rising cost of technology.

- The changing needs of customers.

- The need to innovate to stay ahead of the competition.

9. What are your thoughts on the future of the banking industry?

I believe that the banking industry is facing a number of challenges, but I am also optimistic about the future of the industry. I believe that banks that are able to adapt to the changing needs of customers and innovate will be successful in the future.

- I also believe that banks will play an important role in the development of new financial technologies.

10. Why are you interested in working for our bank?

I am interested in working for your bank because I am impressed by your commitment to customer service and your innovative approach to banking. I believe that my skills and experience would be a valuable asset to your team, and I am confident that I can make a significant contribution to your bank.

- I am also excited about the opportunity to work in a dynamic and challenging environment.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Branch Account Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Branch Account Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Branch Account Managers are responsible for managing all aspects of a bank branch, including sales, operations, and customer service. They are responsible for developing and implementing business plans, managing staff, and ensuring that the branch meets its financial targets. They also work closely with customers to provide financial advice and services.

1. Sales and Marketing

Branch Account Managers are responsible for generating new business and increasing revenue for their branch. They do this by developing and implementing marketing plans, identifying potential customers, and building relationships with key clients.

- Develop and implement marketing plans

- Identify potential customers

- Build relationships with key clients

2. Operations

Branch Account Managers are responsible for ensuring that their branch operates smoothly and efficiently. They do this by managing staff, setting performance goals, and ensuring that all regulatory requirements are met.

- Manage staff

- Set performance goals

- Ensure that all regulatory requirements are met

3. Customer Service

Branch Account Managers are responsible for providing excellent customer service. They do this by resolving customer issues, handling complaints, and providing financial advice and guidance.

- Resolve customer issues

- Handle complaints

- Provide financial advice and guidance

4. Financial Management

Branch Account Managers are responsible for managing the financial performance of their branch. They do this by setting financial goals, monitoring expenses, and ensuring that the branch meets its profitability targets.

- Set financial goals

- Monitor expenses

- Ensure that the branch meets its profitability targets

Interview Tips

Preparing for an interview can be daunting, but there are a few things you can do to increase your chances of success. Here are a few tips to help you ace your interview for a Branch Account Manager position:

1. Research the company and the position

The more you know about the company and the position, the better prepared you’ll be to answer questions and demonstrate your interest. Take some time to research the company’s website, read news articles, and talk to people who work there. This will give you a good understanding of the company’s culture, values, and goals.

- Research the company’s website

- Read news articles

- Talk to people who work there

2. Practice answering common interview questions

There are a few common interview questions that you’re likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?”. Take some time to practice answering these questions so that you can deliver your answers confidently and concisely.

- Practice answering common interview questions

- Deliver your answers confidently and concisely

3. Be prepared to talk about your experience and skills

The interviewer will want to know about your experience and skills, so be prepared to talk about your accomplishments in detail. Focus on your most relevant experience and skills, and be sure to highlight any results you’ve achieved.

- Be prepared to talk about your experience and skills

- Focus on your most relevant experience and skills

- Highlight any results you’ve achieved

4. Dress professionally and arrive on time

First impressions matter, so make sure you dress professionally and arrive on time for your interview. This will show the interviewer that you’re serious about the position and that you respect their time.

- Dress professionally

- Arrive on time

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Branch Account Manager interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!