Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Branch Credit Counselor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

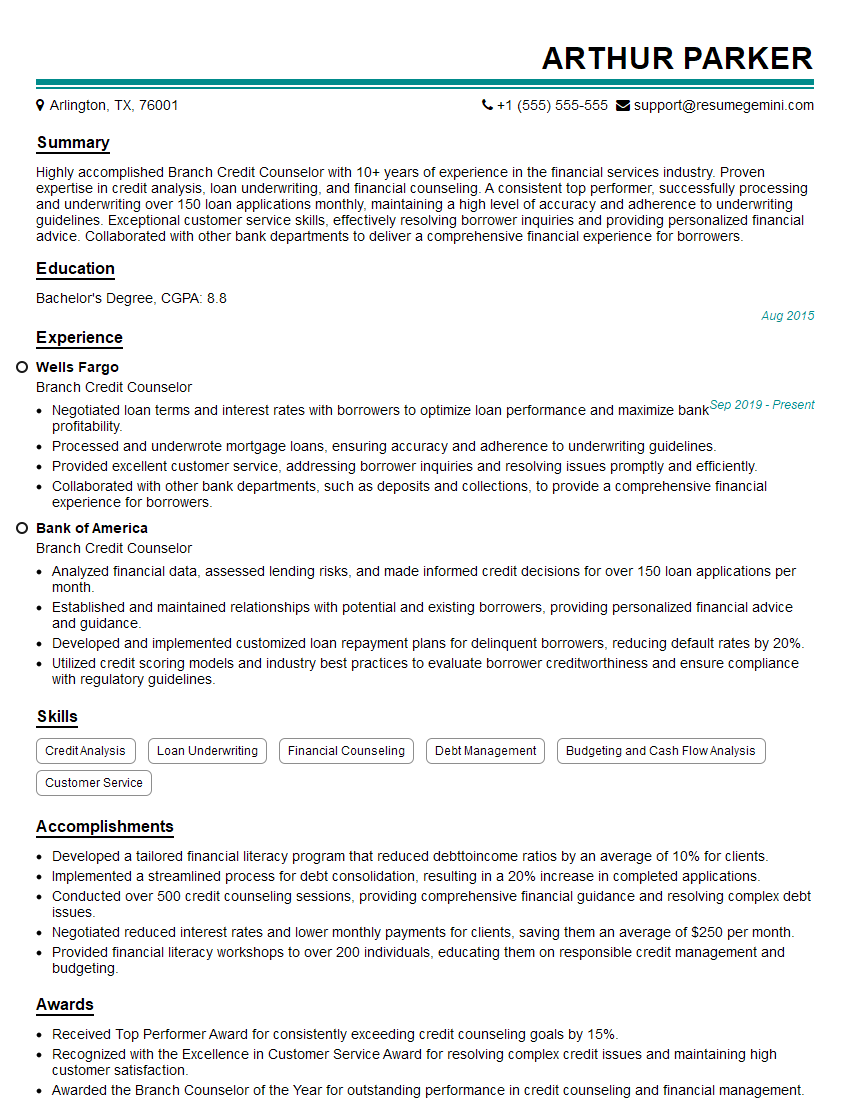

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Branch Credit Counselor

1. How would you assist a customer who is struggling to make ends meet and is considering debt consolidation?

- Assess the customer’s financial situation and gather relevant information.

- Explore debt consolidation options available to the customer, such as credit counseling, debt consolidation loans, and balance transfer cards.

- Calculate debt consolidation proposal and estimate potential savings and repayment period.

- Explain the pros and cons of each option and help the customer make an informed decision.

- If debt consolidation is suitable, assist the customer with the application process and monitor the progress.

2. Describe your process for evaluating a customer’s creditworthiness.

Credit Bureau Report:

- Review credit history, payment patterns, and outstanding balances.

- Identify any potential red flags, such as late payments or collections.

Income and Employment Verification:

- Confirm the customer’s income and employment status.

- Assess the stability and reliability of their income source.

Debt-to-Income Ratio Analysis:

- Calculate the customer’s debt-to-income ratio.

- Determine if the customer’s debt burden is within acceptable limits.

3. Explain how you would handle a customer who is disputing a credit report.

- Obtain a copy of the customer’s credit report and identify the disputed item(s).

- Review the credit report for accuracy and completeness.

- Contact the credit reporting agency to initiate a dispute and provide supporting documentation.

- Monitor the dispute resolution process and follow up with the credit reporting agency regularly.

- Inform the customer about the outcome of the dispute and provide any updated credit report.

4. How do you stay up-to-date on changes in the credit industry and financial regulations?

- Attend industry conferences and webinars.

- Read trade publications and newsletters.

- Participate in online forums and discussion groups.

- Review regulatory updates and guidelines from government agencies.

- Seek continuing education opportunities and certifications.

5. What is your experience in providing financial literacy education?

- Developed and delivered educational workshops on budgeting, credit management, and debt reduction.

- Created and distributed educational materials, such as brochures and handouts.

- Collaborated with community organizations and schools to provide financial literacy programs.

- Utilized engaging and interactive methods to make learning accessible and effective.

6. How do you prioritize and manage your workload in a fast-paced environment?

- Establish clear priorities and set deadlines for each task.

- Use a task management system to organize and monitor progress.

- Delegate tasks to colleagues as appropriate.

- Communicate regularly with team members to ensure coordination and avoid overlaps.

- Stay organized and minimize distractions to maintain efficiency.

7. Describe your approach to building and maintaining strong customer relationships.

- Provide excellent customer service by being responsive, empathetic, and professional.

- Listen attentively to customer concerns and needs.

- Communicate clearly and effectively to build trust and rapport.

- Go the extra mile to exceed customer expectations.

- Seek feedback and use it to improve service quality.

8. What ethical considerations guide your work as a Branch Credit Counselor?

- Maintain confidentiality of customer information.

- Provide objective and unbiased advice.

- Avoid conflicts of interest.

- Adhere to all applicable laws and regulations.

- Act in the best interests of the customer while considering the financial institution’s objectives.

9. How do you handle challenging or difficult customers?

- Remain calm and professional, even in stressful situations.

- Listen actively and try to understand the customer’s perspective.

- Identify the root cause of the issue and work towards a resolution.

- Offer alternative solutions and be willing to compromise.

- Document interactions and escalate matters to a supervisor when necessary.

10. What are your strengths and weaknesses as a Branch Credit Counselor?

Strengths:

- Strong technical knowledge of credit and financial management.

- Excellent communication and interpersonal skills.

- Ability to analyze financial situations and provide tailored solutions.

- Passion for helping customers improve their financial well-being.

Weaknesses:

- Limited experience in complex financial planning.

- Need to improve time management skills in high-volume environments.

- I am always open to feedback and actively seeking opportunities for professional development.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Branch Credit Counselor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Branch Credit Counselor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Branch Credit Counselors play a vital role in the financial well-being of individuals and families by providing guidance and assistance with credit-related matters. Here are the key job responsibilities of a Branch Credit Counselor:1. Credit Counseling and Education

Providing confidential and personalized credit counseling to individuals and families who are experiencing financial difficulties or seeking to improve their financial health.

- Reviewing credit reports, analyzing financial situations, and identifying areas for improvement.

- Developing and implementing personalized credit management plans.

- Educating clients on credit concepts, budgeting, debt management, and financial literacy.

2. Debt Management and Negotiation

Working with clients to negotiate and settle debts with creditors.

- Contacting creditors to discuss payment options and negotiate favorable terms.

- Developing realistic repayment plans and assisting clients with sticking to them.

- Monitoring client progress and providing ongoing support.

3. Budgeting and Financial Planning

Helping clients create and implement practical budgets to manage their finances effectively.

- Analyzing spending patterns and identifying areas for savings.

- Developing personalized budgeting plans that align with client goals.

- Providing guidance on debt consolidation, budgeting apps, and other financial planning tools.

4. Customer Service and Outreach

Providing excellent customer service and building relationships with clients.

- Maintaining regular communication with clients to track progress and provide support.

- Conducting community outreach programs and participating in financial literacy events.

- Collaborating with other professionals, such as social workers and attorneys, to provide comprehensive support.

Interview Tips

To ace your interview for a Branch Credit Counselor position, consider these tips:Before your interview, take time to thoroughly research the organization and the specific role. This will demonstrate your interest and enthusiasm.

1. Research the Organization and Role

- Review the company’s website, social media pages, and any available job descriptions.

- Identify the organization’s mission, values, and target audience.

- Analyze the key responsibilities and qualifications for the Branch Credit Counselor role.

2. Practice Your Answers

Prepare thoughtful answers to common interview questions, such as:

- Tell me about yourself and why you’re interested in this role?

- What are your strengths and weaknesses as a credit counselor?

- How do you handle difficult or emotional clients?

- What are your goals for this position and how do they align with the organization’s mission?

3. Showcase Your Skills and Experience

Highlight your relevant skills and experience, especially in credit counseling, budgeting, and financial planning. Use specific examples to demonstrate your abilities.

- Describe a time when you successfully negotiated a debt settlement for a client.

- Explain how you helped a client create a realistic budget and stick to it.

- Share your experience in providing financial education and outreach programs.

4. Prepare Questions for the Interviewer

Asking thoughtful questions shows your engagement and interest in the role. Prepare a few questions about the organization, the team, or specific aspects of the role.

- What is the typical caseload for Branch Credit Counselors?

- How does the organization measure the success of its credit counseling programs?

- What opportunities are there for professional development and advancement?

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Branch Credit Counselor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!