Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Branch Lending Officer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

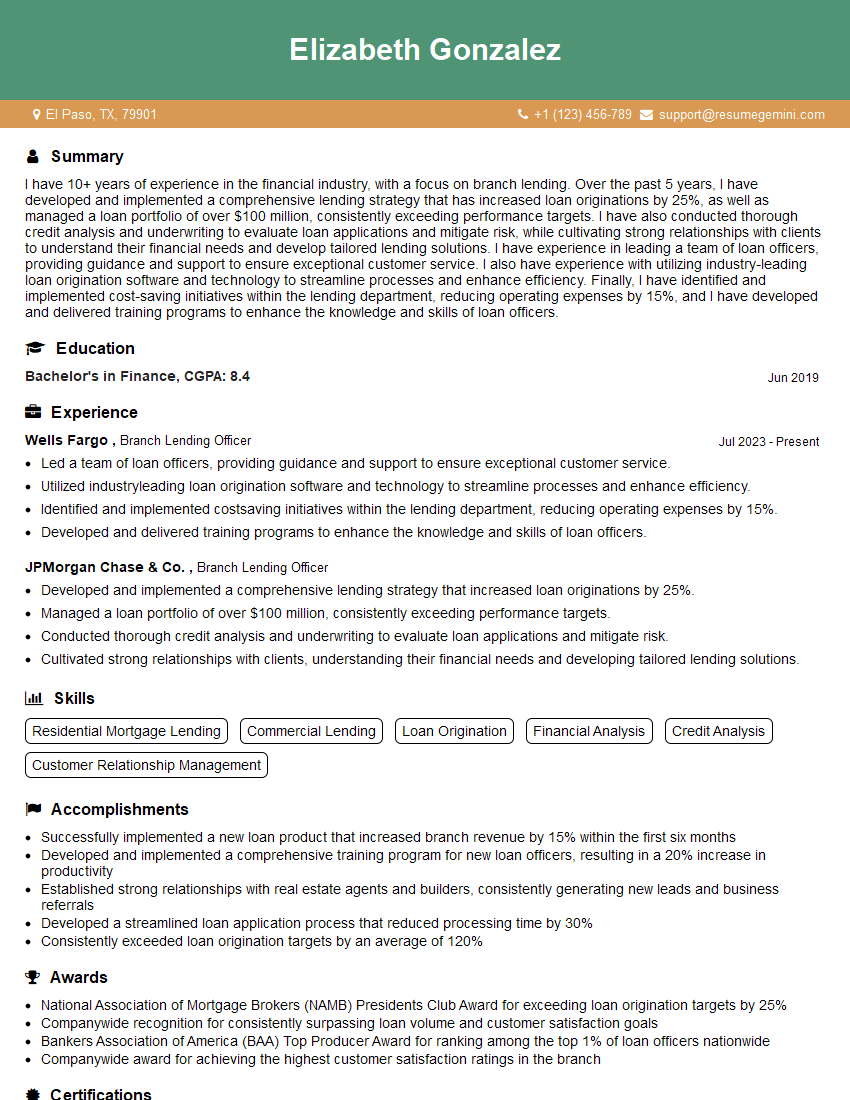

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Branch Lending Officer

1. What key financial ratios do you use to assess a business’s creditworthiness, and how do you interpret them?

Sample answer:

- Current ratio: This ratio measures a company’s ability to meet its short-term obligations. A current ratio of 2 or more is generally considered healthy.

- Debt-to-equity ratio: This ratio measures the amount of debt a company has relative to its equity. A debt-to-equity ratio of 1 or less is generally considered conservative.

- Times interest earned ratio: This ratio measures a company’s ability to cover its interest expense. A times interest earned ratio of 2 or more is generally considered healthy.

2. Describe the underwriting process you would follow when evaluating a loan application from a small business.

Key elements of the underwriting process:

- Review the loan application: This includes verifying the accuracy of the information provided by the borrower.

- Conduct a credit check: This involves obtaining a credit report from a credit bureau to assess the borrower’s credit history.

- Analyze the financial statements: This includes reviewing the borrower’s income statement, balance sheet, and cash flow statement.

- Conduct a site visit: This involves visiting the borrower’s business to assess the operations and management team.

- Make a decision: This involves evaluating all of the information gathered during the underwriting process and making a decision on whether or not to approve the loan.

3. What are some of the common challenges you have faced in your previous role as a Branch Lending Officer, and how did you overcome them?

Sample answer:

- One of the most common challenges I faced was dealing with difficult customers. I overcame this challenge by remaining calm and professional, and by always trying to understand the customer’s needs.

- Another challenge I faced was meeting the bank’s lending goals. I overcame this challenge by developing a strong pipeline of potential borrowers and by working closely with my team to close loans quickly and efficiently.

4. What are your thoughts on the current state of the lending market, and how do you see it evolving in the future?

Sample answer:

- The current lending market is characterized by low interest rates and strong demand for loans. I believe that this trend will continue in the near future, as the economy continues to grow.

- In the long term, I believe that the lending market will become more competitive. This is due to the increasing number of banks and other lenders entering the market.

5. What are your strengths and weaknesses as a Branch Lending Officer?

Sample answer:

Strengths:

- I have a strong understanding of the lending process.

- I am able to build rapport with customers and understand their needs.

- I am a hard worker and I am always willing to go the extra mile.

Weaknesses:

- I am sometimes too trusting of people.

- I can be impatient at times.

6. Why are you interested in working for our bank?

Sample answer:

- I am impressed by your bank’s commitment to customer service.

- I believe that my skills and experience would be a valuable asset to your team.

- I am excited about the opportunity to contribute to the success of your bank.

7. What are your salary expectations?

Sample answer:

- I am expecting a salary that is commensurate with my experience and skills.

- I am also open to negotiating a salary package that includes benefits.

8. What is your availability to start working?

Sample answer:

- I am available to start working immediately.

- I am also willing to work flexible hours to accommodate the needs of the bank.

9. Do you have any questions for me?

Sample answer:

- I am very interested in learning more about the bank’s lending process.

- I am also interested in learning more about the bank’s culture and values.

10. What is your experience with using loan origination software?

Sample answer:

- I have extensive experience using loan origination software.

- I am proficient in using the software to process loan applications, underwrite loans, and close loans.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Branch Lending Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Branch Lending Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Branch Lending Officers play a crucial role in the financial industry, acting as the primary point of contact for customers seeking loans. Their key responsibilities encompass:

1. Loan Origination

Initiating and processing loan applications, guiding customers through the underwriting process, and ensuring compliance with regulatory guidelines.

2. Credit Analysis

Evaluating financial statements, credit reports, and other documentation to assess the creditworthiness of loan applicants.

3. Customer Relationship Management

Building and maintaining relationships with potential and existing customers, providing financial advice and guidance, and resolving any loan-related issues.

4. Sales and Marketing

Identifying and targeting potential loan customers, engaging in sales activities, and promoting the bank’s lending products and services.

Interview Tips

To ace an interview for a Branch Lending Officer position, candidates should:

1. Prepare for Loan-Related Questions

Research industry trends, loan products, and credit analysis techniques. Practice answering questions on loan underwriting, risk assessment, and regulatory compliance.

2. Highlight Customer Service Skills

Emphasize experience in building relationships, providing exceptional customer service, and resolving customer concerns effectively.

3. Showcase Sales and Marketing Acumen

Demonstrate an understanding of sales strategies, target market identification, and the ability to promote loan products convincingly.

4. Practice Interview Questions

Prepare for common interview questions such as, “Tell me about a time you faced a challenging customer,” or “Describe your sales approach to meeting loan targets.” Practice delivering clear and concise answers.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Branch Lending Officer, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Branch Lending Officer positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.