Are you gearing up for an interview for a Branch Manager position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Branch Manager and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

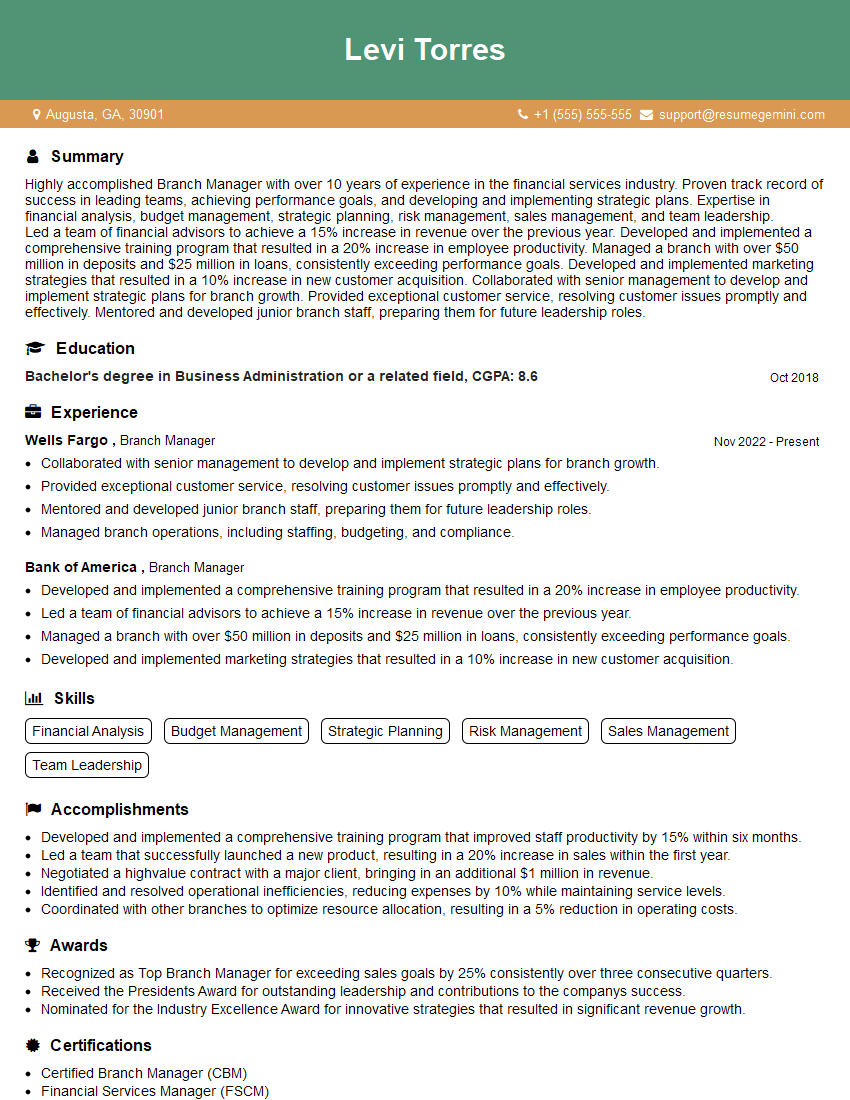

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Branch Manager

1. How would you assess the performance of your branch and measure its effectiveness?

- Utilize key performance indicators (KPIs) such as revenue, customer satisfaction, operational efficiency, and risk management.

- Establish clear and measurable targets for each KPI and track progress regularly.

- Conduct regular performance reviews with team members to identify areas for improvement and provide feedback.

2. What strategies have you employed to increase revenue and customer base?

Customer Acquisition

- Implement targeted marketing campaigns and promotions to attract new customers.

- Leverage digital channels and social media to reach a wider audience.

- Offer exclusive incentives and referral programs to reward customer loyalty.

Customer Retention

- Provide exceptional customer service and build strong relationships with existing customers.

- Analyze customer feedback and address their needs and concerns.

- Implement loyalty programs and offer personalized services to encourage repeat business.

3. How do you manage risk and ensure the security of branch operations?

- Establish clear policies and procedures for risk management and compliance.

- Conduct regular risk assessments and take appropriate measures to mitigate potential threats.

- Implement robust security measures to protect sensitive information and prevent unauthorized access.

- Train staff on risk management best practices and ensure their compliance.

- Stay up-to-date with industry regulations and best practices.

4. How do you lead and motivate your team to achieve high performance?

- Set clear expectations and goals for the team.

- Provide ongoing support and mentorship.

- Foster a positive and collaborative work environment.

- Recognize and reward success.

5. How do you stay informed about industry trends and regulatory changes?

- Attend industry conferences and seminars.

- Read industry publications and research reports.

- Network with other professionals in the field.

- Stay up-to-date on relevant laws and regulations.

6. What is your approach to managing operational costs and maximizing profitability?

- Analyze operating expenses and identify areas for cost optimization.

- Negotiate favorable terms with vendors and suppliers.

- Implement cost-saving initiatives without compromising quality or service.

- Monitor and track expenses to ensure efficient resource allocation.

- Explore revenue-generating opportunities to supplement branch income.

7. How do you ensure that your branch adheres to ethical and compliance standards?

- Establish a code of ethics and ensure that employees are aware of it.

- Conduct regular compliance audits and training sessions.

- Monitor compliance with regulatory requirements and industry best practices.

- Foster a culture of integrity and transparency.

- Handle ethical dilemmas promptly and effectively.

8. How would you manage a challenging customer situation that could potentially damage the branch’s reputation?

- Remain calm and professional.

- Listen attentively to the customer’s concerns.

- Identify the root cause of the issue.

- Explore possible solutions and present them to the customer.

- Work with the customer to find a mutually acceptable resolution.

- Document the incident and take appropriate action to prevent similar issues in the future.

9. How do you use technology to improve branch efficiency and customer satisfaction?

- Implement automated systems to streamline processes.

- Utilize digital tools for customer engagement and communication.

- Provide mobile and online banking services for convenience.

- Use analytics to identify areas for improvement and optimize operations.

- Stay informed about emerging technologies and explore their potential benefits.

10. What is your vision for the future of branch banking?

- Enhanced digital capabilities and customer-focused innovation.

- Integration of technology with personalized in-person services.

- Increased focus on financial literacy and customer education.

- Branches evolving into community hubs and financial advice centers.

- Collaboration with fintech companies to leverage their expertise.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Branch Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Branch Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Branch Managers are pivotal figures in the financial industry, playing a crucial role in ensuring the smooth operation and profitability of their respective branches. Their responsibilities encompass a wide range of tasks, including:

1. Leadership and Management

Branch Managers are responsible for leading and motivating their teams, creating a positive and productive work environment. They set performance goals, provide guidance and support, and manage employee development.

- Motivating and inspiring staff to achieve business objectives

- Creating and implementing branch policies and procedures

2. Customer Service

Branch Managers are the primary point of contact for customers, ensuring their needs are met promptly and efficiently. They build strong relationships with clients, handling inquiries, resolving complaints, and providing financial advice.

- Providing excellent customer service to build long-term relationships

- Identifying and addressing customer needs and concerns

3. Financial Management

Branch Managers are responsible for managing financial operations, including cash flow, lending, and deposits. They ensure compliance with regulations, maximize profitability, and maintain strong relationships with regulators.

- Managing and controlling branch finances, including revenue and expenses

- Developing and implementing financial strategies to optimize branch performance

4. Sales and Marketing

Branch Managers play a crucial role in promoting and selling products and services to customers. They identify sales opportunities, develop marketing strategies, and monitor performance to achieve revenue targets.

- Generating new business and expanding existing client base

- Developing and implementing sales strategies to promote branch offerings

Interview Tips

Ace your job interview for a Branch Manager role by following these tips:

1. Research the Bank and Position

Familiarize yourself with the bank’s mission, values, and products. Study the specific branch where you’re applying, including its location, size, and market share. Research the responsibilities of a Branch Manager and how they align with your skills and experience.

2. Practice Your Answers

Prepare thoughtful responses to common interview questions. Practice answering questions about your leadership style, customer service experience, financial knowledge, and sales skills. Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide concrete examples.

3. Highlight Your Skills and Experience

In your resume and interview, emphasize your relevant skills and experience. Quantify your accomplishments whenever possible to demonstrate the impact of your work. Use specific metrics and success stories to show how you have contributed to the success of previous branches or organizations.

4. Dress Professionally and Be Punctual

First impressions matter, so dress appropriately for a business setting. Arrive on time for your interview and be prepared to start on schedule. Punctuality and professionalism demonstrate respect for the interviewer’s time and the position you’re applying for.

5. Ask Thoughtful Questions

At the end of the interview, ask questions that show you are engaged and interested in the opportunity. This could include questions about the bank’s strategy, the branch’s goals, or the manager’s expectations. Asking thoughtful questions shows you are invested in the position and the organization.

6. Follow Up After the Interview

Send a thank-you note to the interviewer within 24 hours of the meeting. Express your gratitude for their time and restate your interest in the position. You may also briefly highlight one or two of your key qualifications that you believe make you an ideal candidate.

Next Step:

Now that you’re armed with the knowledge of Branch Manager interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Branch Manager positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini