Are you gearing up for a career in BSA/AML Compliance Officer? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for BSA/AML Compliance Officer and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

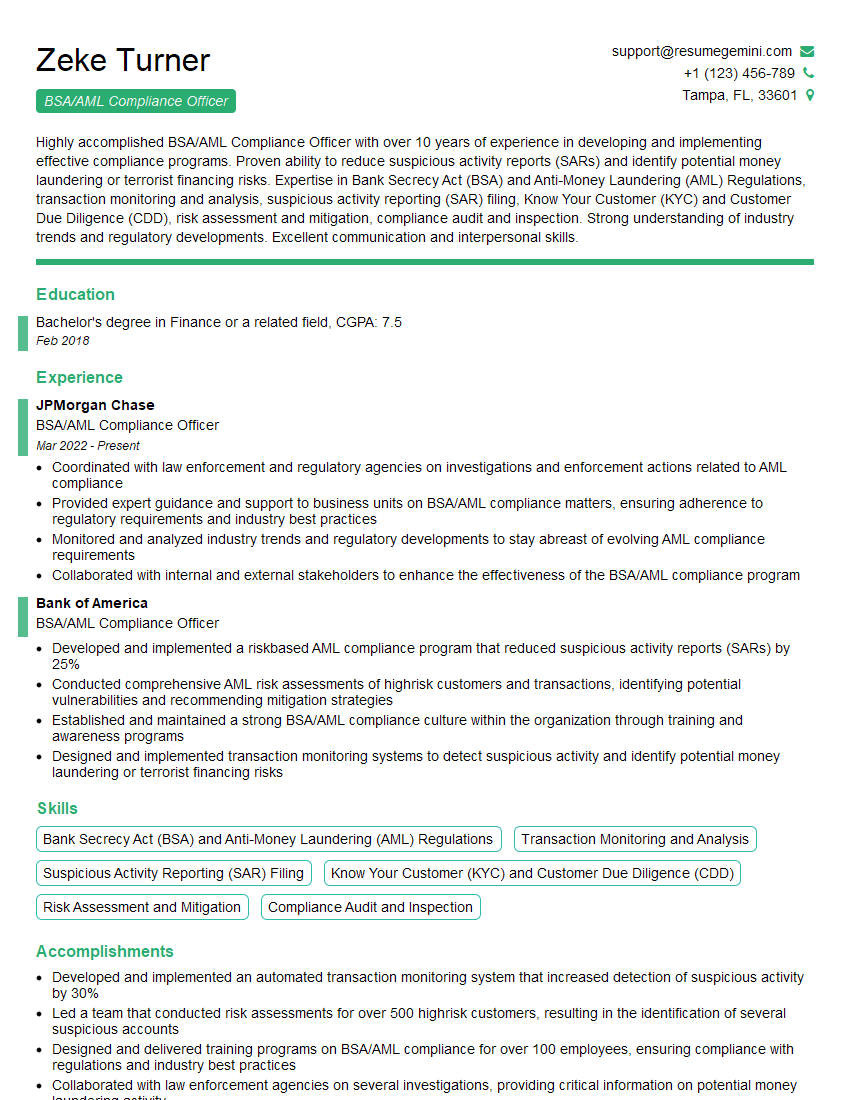

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For BSA/AML Compliance Officer

1. Explain the concept of “Suspicious Activity Report” (SAR) and its role in BSA/AML compliance?

- A SAR is a report filed with the Financial Crimes Enforcement Network (FinCEN) when a financial institution suspects that a transaction or activity may involve money laundering, terrorist financing, or other financial crimes.

- SARs play a vital role in BSA/AML compliance by helping to detect and investigate financial crimes and to prevent them from occurring in the future.

2. Describe the “Know Your Customer” (KYC) process and its importance in preventing financial crime?

- KYC is a process that financial institutions use to identify and verify the identity of their customers.

- It is important in preventing financial crime because it helps financial institutions to identify and mitigate risks associated with their customers, such as the risk of money laundering or terrorist financing.

3. What are the different types of financial crime and how can BSA/AML compliance programs help detect and prevent them?

- Money laundering: The process of disguising the proceeds of crime to make them appear legitimate.

- Terrorist financing: The provision of funds or financial services to terrorists or terrorist organizations.

- Fraud: The use of deception to obtain money or property.

- BSA/AML compliance programs can help detect and prevent financial crime by identifying suspicious transactions and activities, and by reporting them to law enforcement.

4. Explain the role of technology in BSA/AML compliance?

- Technology can play a vital role in BSA/AML compliance by automating tasks, such as transaction monitoring and customer screening.

- This can help financial institutions to improve the efficiency and effectiveness of their compliance programs.

5. What are the key challenges facing BSA/AML compliance officers in today’s environment?

- The increasing complexity of financial transactions

- The growing use of technology by criminals

- The globalization of financial markets

- BSA/AML compliance officers need to be aware of these challenges and adapt their compliance programs accordingly.

6. How do you stay up-to-date on the latest BSA/AML regulations and guidance?

- Reading industry publications

- Attending conferences and webinars

- Taking online courses

- Networking with other compliance professionals

7. What are the qualities and skills that make a successful BSA/AML compliance officer?

- Strong understanding of BSA/AML regulations and guidance

- Excellent analytical and problem-solving skills

- Strong communication and interpersonal skills

- Ability to work independently and as part of a team

8. What are your career goals?

- To become a leader in the field of BSA/AML compliance

- To help financial institutions to prevent financial crime

- To make a positive impact on the world

9. Why are you interested in this position?

- I am passionate about BSA/AML compliance and I believe that I have the skills and experience necessary to be successful in this role.

- I am eager to learn more about the company and the challenges that you face.

- I am confident that I can make a significant contribution to your team.

10. What are your salary expectations?

- My salary expectations are commensurate with my experience and qualifications.

- I am open to negotiating a salary that is fair and competitive.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for BSA/AML Compliance Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the BSA/AML Compliance Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A BSA/AML Compliance Officer is responsible for ensuring that their organization complies with the Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) regulations. Their key responsibilities include:

1. Developing and Implementing Compliance Programs

This involves creating and maintaining policies and procedures to prevent and detect money laundering, terrorist financing, and other financial crimes.

- Conducting risk assessments to identify areas where the organization is vulnerable to financial crime.

- Developing and implementing internal controls to mitigate these risks.

2. Monitoring Transactions and Identifying Suspicious Activity

This involves reviewing financial transactions to identify any that may be suspicious or indicative of money laundering or terrorist financing.

- Developing and implementing a transaction monitoring system.

- Investigating suspicious transactions and reporting them to the appropriate authorities.

3. Training and Education

This involves providing training to employees on BSA/AML compliance requirements and best practices.

- Developing and delivering training materials.

- Conducting training sessions for employees at all levels.

4. Internal Auditing

This involves conducting internal audits to assess the effectiveness of the organization’s BSA/AML compliance program.

- Developing and implementing an internal audit plan.

- Conducting internal audits and reporting the results to senior management.

Interview Tips

To ace an interview for a BSA/AML Compliance Officer position, it is important to be well-prepared and to have a strong understanding of the key job responsibilities. Here are some interview tips:

1. Research the Company and the Role

Before the interview, take the time to research the company and the specific role you are applying for. This will help you to understand the company’s culture and values, as well as the specific requirements of the position.

- Visit the company’s website.

- Read the job description carefully.

- Talk to people in your network who work at the company.

2. Practice Your Answers to Common Interview Questions

There are a number of common interview questions that you may be asked in a BSA/AML Compliance Officer interview. It is important to practice your answers to these questions in advance so that you can deliver them confidently and concisely.

- Tell me about your experience with BSA/AML compliance.

- What are your strengths and weaknesses as a BSA/AML Compliance Officer?

- Why are you interested in this position?

3. Be Prepared to Discuss Your Experience

In addition to practicing your answers to common interview questions, you should also be prepared to discuss your experience in detail. This includes your experience with BSA/AML compliance, as well as your experience in other relevant areas such as risk management, internal auditing, and training.

- Quantify your accomplishments whenever possible.

- Use specific examples to illustrate your skills and abilities.

- Be prepared to discuss your experience in detail.

4. Be Enthusiastic and Professional

First impressions matter, so it is important to be enthusiastic and professional throughout the interview process. Dress appropriately, arrive on time, and be polite and respectful to everyone you meet.

- Dress professionally.

- Arrive on time for your interview.

- Be polite and respectful to everyone you meet.

Next Step:

Now that you’re armed with the knowledge of BSA/AML Compliance Officer interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for BSA/AML Compliance Officer positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini