Feeling lost in a sea of interview questions? Landed that dream interview for Budget Counselor but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Budget Counselor interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

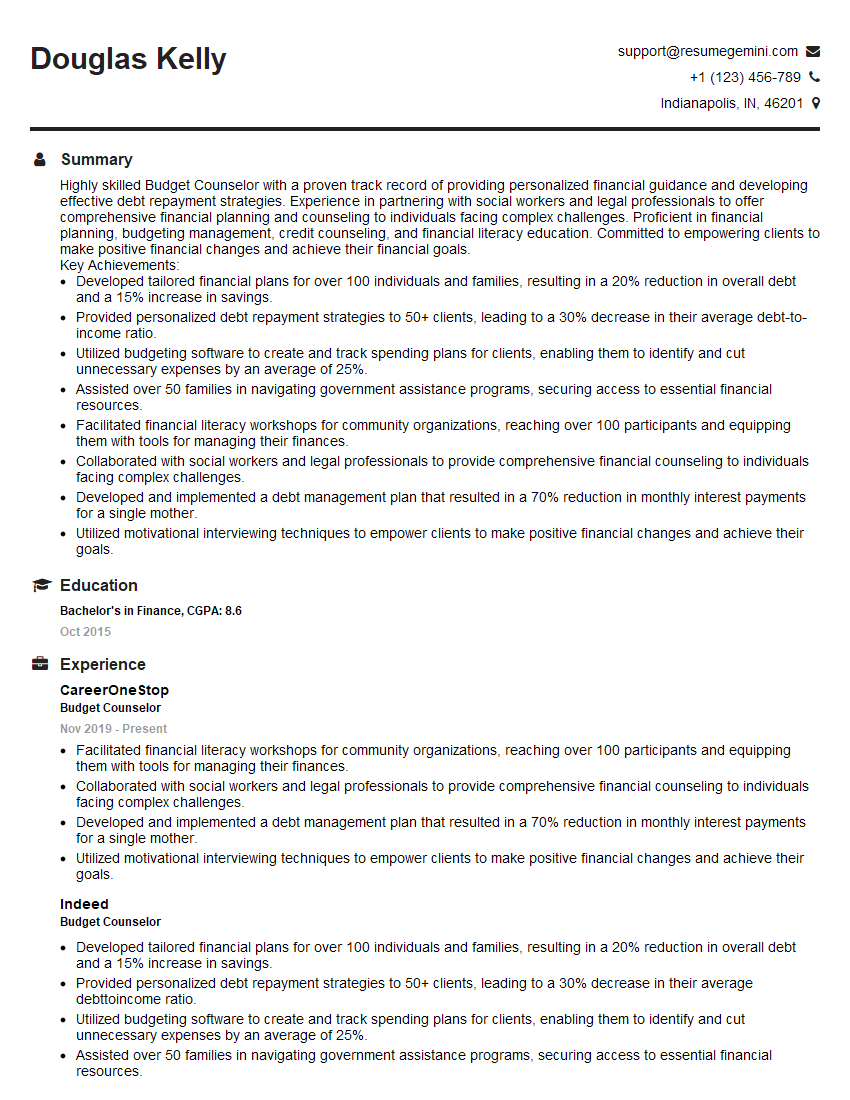

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Budget Counselor

1. How do you assess a client’s financial situation?

- Gather financial information through interviews, questionnaires, and document review.

- Analyze income, expenses, assets, and debts to determine their cash flow and financial stability.

- Identify areas of concern and potential risks.

- Evaluate the client’s financial goals and objectives.

2. What are the different budgeting methods that you recommend to clients?

Explain each method and its advantages.

- Zero-based budgeting: Allocates every dollar of income to a specific expense or savings category.

- Envelope budgeting: Uses physical envelopes or digital apps to assign cash to different categories.

- 50/30/20 rule: Divides income into 50% for needs, 30% for wants, and 20% for savings and debt repayment.

- Reverse budgeting: Starts with savings and debt repayment, then allocates the remaining funds to expenses.

Discuss the factors to consider when choosing a budgeting method for a client.

- Financial situation and goals.

- Spending habits and behaviors.

- Personal preferences and comfort level.

3. How do you assist clients with managing high levels of debt?

- Review the client’s debt situation and prioritize payments.

- Explore debt consolidation options, such as debt management plans or balance transfer cards.

- Negotiate with creditors to reduce interest rates or payment amounts.

- Provide counseling and support to help the client stay motivated and avoid future debt.

4. How do you educate clients on the importance of saving and investing?

- Explain the benefits of saving and investing, including financial security, retirement planning, and wealth accumulation.

- Set realistic savings goals and develop a savings plan.

- Provide guidance on choosing appropriate investment options based on their risk tolerance and financial goals.

- Emphasize the importance of regular contributions and staying invested for the long term.

5. What are some common financial challenges that you have helped clients overcome?

- Overspending and impulsive purchases.

- High levels of debt and credit card balances.

- Lack of emergency savings and financial preparedness.

- Ineffective budgeting and financial planning.

- Financial stress and anxiety.

6. How do you stay up-to-date on the latest financial trends and regulations that impact clients?

- Attend industry conferences, webinars, and workshops.

- Read financial publications and research articles.

- Network with other professionals and experts in the field.

- Obtain continuing education and certifications.

7. What are the ethical guidelines that you follow in your work as a budget counselor?

- Confidentiality and privacy of client information.

- Objectivity and unbiased advice.

- Avoiding conflicts of interest.

- Maintaining a professional and ethical demeanor.

- Adhering to all applicable laws and regulations.

8. What strategies do you use to build rapport with clients and gain their trust?

- Active listening and empathetic communication.

- Building a strong connection and understanding their needs.

- Demonstrating genuine care and support.

- Respecting their privacy and boundaries.

- Following through on commitments and providing timely support.

9. How do you handle situations where clients are resistant to change or refuse to follow your recommendations?

- Acknowledge their concerns and validate their feelings.

- Explore the reasons behind their resistance.

- Provide clear and evidence-based explanations of your recommendations.

- Offer alternatives or modifications that meet their needs while still achieving their financial goals.

- Encourage small, incremental changes and celebrate progress.

10. How do you measure the effectiveness of your work as a budget counselor?

- Client satisfaction and feedback.

- Improvement in client’s financial situation, such as increased savings, debt reduction, or improved cash flow.

- Positive changes in spending habits and financial behaviors.

- Increased financial literacy and confidence.

- Repeat business and referrals from satisfied clients.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Budget Counselor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Budget Counselor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Budget Counselors play a vital role in guiding individuals and families towards financial stability and well-being. Their responsibilities encompass a wide range of tasks aimed at assisting clients in managing their finances effectively.

1. Financial Assessment and Counseling

Conduct thorough financial assessments to understand clients’ income, expenses, assets, and debts.

- Create personalized budgets that align with clients’ financial goals and circumstances.

- Provide guidance on managing debt, reducing expenses, and increasing savings.

2. Education and Empowerment

Educate clients on financial principles, budgeting techniques, and responsible spending habits.

- Empower clients with the knowledge and skills to make informed financial decisions.

- Facilitate workshops and group sessions to enhance financial literacy.

3. Case Management and Referral

Develop and implement case management plans to track clients’ progress and support their goals.

- Refer clients to appropriate resources, such as credit counseling agencies or social service organizations.

- Collaborate with other professionals, including social workers, attorneys, and financial advisors.

4. Reporting and Documentation

Maintain detailed client records and progress reports.

- Prepare reports for funding agencies and other stakeholders.

- Evaluate the effectiveness of counseling programs and make recommendations for improvements.

Interview Tips

To ace your interview for a Budget Counselor position, it’s essential to prepare thoroughly and present yourself as a knowledgeable, compassionate, and skilled professional.

1. Research the Organization and Position

Before the interview, research the organization’s mission, values, and the specific role you’re applying for.

- Show that you’re genuinely interested in the position and the organization’s work.

- Tailor your answers to highlight how your skills and experience align with the job requirements.

2. Highlight Your Financial Expertise

Emphasize your strong understanding of financial principles, budgeting techniques, and debt management strategies.

- Provide examples of successful client interactions where you effectively guided them towards financial stability.

- Discuss your experience in developing and implementing personalized financial plans.

3. Demonstrate Your Educational Approach

Explain your approach to financial education and how you empower clients to make informed decisions.

- Showcase your ability to simplify complex financial concepts and engage clients in a meaningful way.

- Share examples of educational materials or workshops you’ve developed or facilitated.

4. Emphasize Your Compassion and Empathy

Budget Counselors often work with clients facing financial challenges. Highlight your compassion and empathy for individuals in need.

- Describe situations where you’ve demonstrated understanding and support while guiding clients through difficult financial circumstances.

- Explain how you build rapport and create a safe and encouraging environment for clients.

5. Prepare Questions

Asking thoughtful questions at the end of the interview shows your interest and engagement.

- Inquire about the organization’s approach to financial counseling and client support.

- Ask about opportunities for professional development and advancement within the role.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Budget Counselor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!