Feeling lost in a sea of interview questions? Landed that dream interview for Budget Officer but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Budget Officer interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

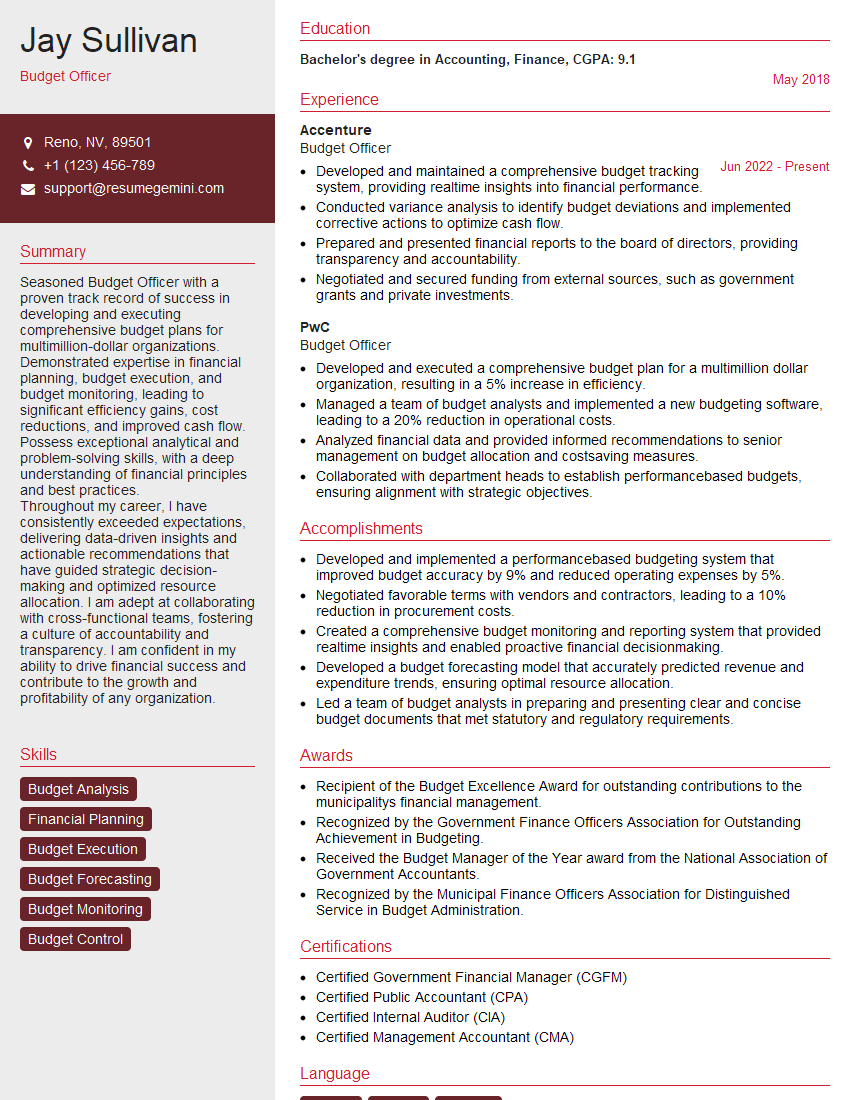

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Budget Officer

1. Explain the key responsibilities of a Budget Officer?

As a Budget Officer, I understand the primary responsibilities encompass:

- Developing, monitoring, and evaluating budgets

- Ensuring compliance with financial laws and regulations

- Forecasting financial needs and developing contingency plans

- Collaborating with stakeholders to prepare budget proposals

- Analyzing financial data and providing recommendations

2. What are the different types of budgets that a Budget Officer may work with?

Operating Budgets

- Cover day-to-day operational expenses

- Include items like salaries, supplies, and utilities

Capital Budgets

- Plan for long-term investments

- Involve assets like equipment, buildings, and infrastructure

Program Budgets

- Allocate funds to specific programs or projects

- Track expenses and measure outcomes

3. What is the role of a Budget Officer in the budgeting process?

Throughout the budgeting process, the Budget Officer plays a multifaceted role:

- Planning: Collaborate with stakeholders to gather data and forecast needs

- Development: Draft budget proposals based on analysis and stakeholder input

- Implementation: Monitor and track budget execution, ensuring compliance

- Control: Analyze financial data, identifying variances and recommending corrective actions

- Reporting: Prepare financial reports and provide insights to management and stakeholders

4. How do you ensure accuracy and reliability in the budgeting process?

Maintaining accuracy and reliability in budgeting is crucial:

- Data Validation: Cross-check data from multiple sources and verify with stakeholders

- Scenario Planning: Develop multiple budget scenarios to account for uncertainties

- Regular Reviews: Conduct periodic reviews with stakeholders to assess progress and make adjustments

- Internal Controls: Implement strong internal controls to prevent errors and fraud

- Audits: Subject budgets to internal and external audits to ensure compliance and accuracy

5. Describe the importance of aligning the budget with organizational goals.

Aligning the budget with organizational goals is essential because:

- Resource Allocation: Ensures resources are allocated effectively towards priority objectives

- Performance Measurement: Provides a framework for measuring progress and assessing goal achievement

- Accountability: Holds departments and individuals accountable for achieving budgeted outcomes

- Strategic Decision-Making: Facilitates informed decision-making by linking financial plans to strategic priorities

- Stakeholder Support: Builds buy-in and support for budget proposals by demonstrating alignment with organizational vision

6. How do you manage budget variances and unforeseen circumstances?

Managing budget variances and unforeseen circumstances requires a proactive approach:

- Monitor Regularly: Track actual spending against the budget on a regular basis

- Analyze Deviations: Identify the causes of variances and assess their potential impact

- Develop Contingency Plans: Create plans to address potential risks and uncertainties

- Revise and Adjust: If necessary, adjust the budget or explore alternative funding sources

- Communicate Effectively: Keep stakeholders informed of budget variances and proposed actions

7. What financial analysis tools and techniques do you use in your role?

To perform financial analysis, I utilize a range of tools and techniques:

- Spreadsheets: Excel and Google Sheets for data manipulation and analysis

- Budgeting Software: Specialized software for developing and tracking budgets

- Financial Modeling: Building financial models to simulate and forecast financial outcomes

- Variance Analysis: Comparing actual results to budgeted amounts

- Trend Analysis: Identifying patterns and trends in financial data

8. How do you stay up-to-date with changes in financial regulations and best practices?

Staying current with financial regulations and best practices is crucial:

- Industry Publications: Regularly read trade journals and industry newsletters

- Professional Development: Attend conferences and webinars

- Continuing Education: Pursue certifications (e.g., Certified Government Financial Manager) or enroll in specialized courses

- Networking: Connect with other professionals in the field through LinkedIn or industry organizations

- Internal Updates: Monitor internal communications and guidance from the finance department

9. Describe your experience in preparing and presenting financial reports.

In my previous role, I was responsible for preparing and presenting financial reports:

- Monthly Financial Statements: Prepared balance sheets, income statements, and cash flow statements

- Budget vs. Actual Reports: Tracked actual expenses against budgeted amounts and highlighted variances

- Performance Dashboards: Developed interactive dashboards to visualize key financial metrics

- Management Presentations: Presented financial information to senior management, explaining trends, risks, and opportunities

- Technical Reports: Conducted in-depth financial analyses and prepared detailed reports for decision-making

10. How do you prioritize budget requests and allocate resources effectively?

Prioritizing budget requests and allocating resources effectively involves a systematic approach:

- Establish Criteria: Define clear criteria for evaluating budget requests (e.g., alignment with strategic goals, return on investment)

- Gather Input: Collect data and input from stakeholders to assess needs

- Rank Requests: Use scoring systems or weighted criteria to prioritize requests

- Consider Constraints: Allocate resources within budgetary constraints and consider potential trade-offs

- Monitor and Evaluate: Track the performance of funded projects and make adjustments as needed

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Budget Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Budget Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Budget Officers play a pivotal role in managing financial resources within an organization. Their primary responsibilities include:

1. Budget Preparation and Management

Developing and maintaining annual operating and capital budgets in alignment with organizational goals and objectives

- Forecasting revenue and expense projections based on historical data and market trends

- Assigning budget allocations to various departments or divisions, ensuring optimal resource allocation

2. Monitoring and Reporting

Tracking and monitoring budget performance throughout the fiscal year, identifying variances and taking corrective actions

- Preparing regular financial reports for management, stakeholders, and external auditors

- Analyzing financial data to identify areas of cost savings and efficiency improvements

3. Variance Analysis and Control

Investigating and analyzing budget variances to determine underlying causes

- Developing corrective action plans to address variances and maintain budget integrity

- Implementing budget controls and procedures to prevent unauthorized expenditures or misuse of funds

4. Policy Development and Compliance

Developing and maintaining financial policies and procedures to ensure compliance with regulatory requirements

- Participating in the development and review of financial policies, such as expense reimbursement, procurement, and travel

- Monitoring compliance with established policies and procedures, ensuring adherence to ethical standards and legal regulations

Interview Tips

To increase your chances of success in a Budget Officer interview, consider the following preparation tips:

1. Research the Organization and Role

Gather information about the specific organization you are applying to and the role you are interviewing for

- Visit the organization’s website and review their financial statements and annual reports

- Identify the key challenges and priorities facing the organization and how your skills and experience can contribute to their goals

2. Highlight Relevant Skills and Experience

In your resume and cover letter, emphasize your technical skills and experience that align with the job description.

- Quantify your accomplishments whenever possible, using specific metrics and examples

- Tailor your resume and cover letter to each individual job application, highlighting how your skills and experience meet the specific requirements of the role.

3. Practice Common Interview Questions

Anticipate and prepare for common interview questions related to budget management, financial analysis, and compliance

- Consider using the STAR method (Situation, Task, Action, Result) to structure your answers and provide detailed examples of your work

- Practice answering questions with confidence and clarity, emphasizing your skills and how they would benefit the organization

4. Prepare Questions for the Interviewer

Asking thoughtful questions during the interview demonstrates your interest in the role and the organization.

- Prepare questions that show you have researched the organization and the position

- Ask questions that help you better understand the organization’s financial goals, challenges, and opportunities

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Budget Officer interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.