Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Bursar interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Bursar so you can tailor your answers to impress potential employers.

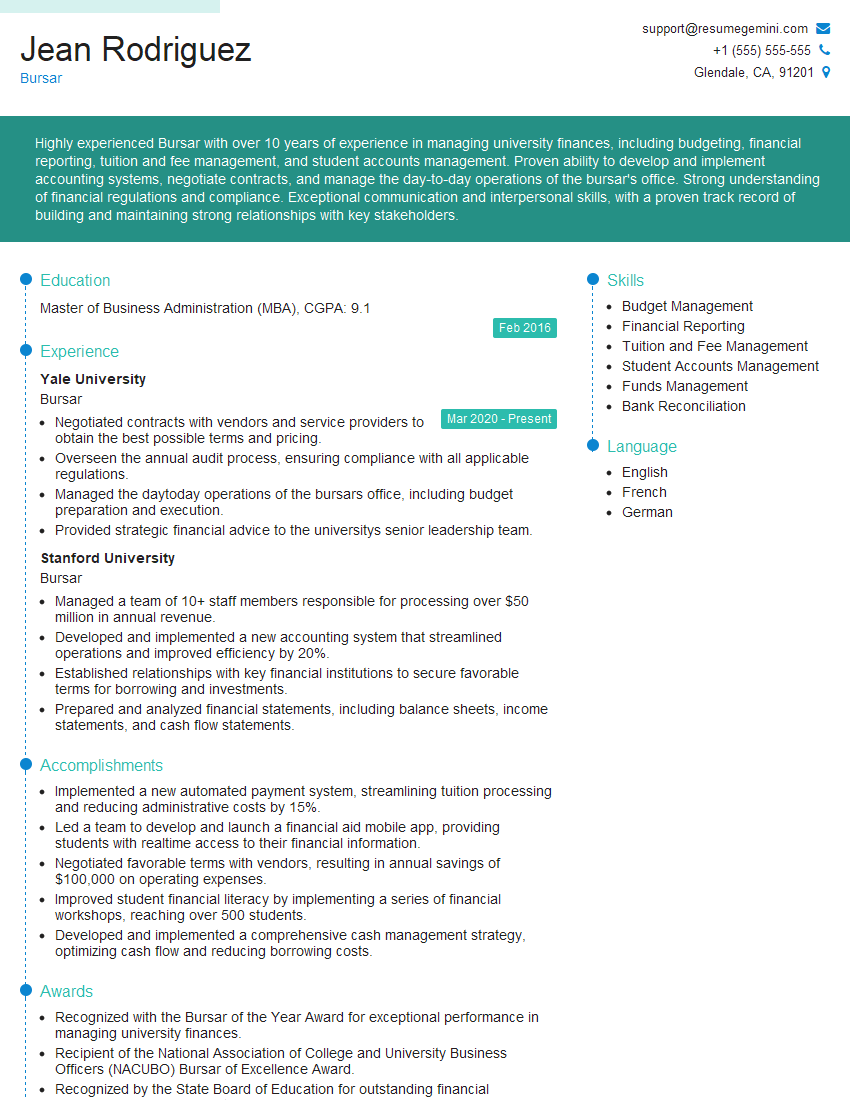

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bursar

1. What are the key responsibilities of a Bursar?

As a Bursar, my primary responsibilities include:

- Managing the institution’s financial resources

- Overseeing financial operations, including budgeting, accounting, and payroll

- Developing and implementing financial policies and procedures

- Providing financial advice to the institution’s leadership team

- Ensuring compliance with all applicable financial regulations

2. How do you ensure the accuracy and integrity of financial data?

Internal Controls

- Establish a robust system of internal controls to prevent and detect errors or fraud

- Regularly review and update internal controls based on best practices and regulatory requirements

Reconciliation

- Implement a thorough reconciliation process to ensure that all financial data matches across all systems

- Review reconciliations regularly to identify any discrepancies and take corrective action promptly

Third-Party Audits

- Engage independent third-party auditors to conduct regular financial audits

- Review audit reports thoroughly and implement any recommended improvements to strengthen financial data integrity

3. How do you stay informed about changes in accounting and financial reporting regulations?

- Attend industry conferences and webinars on financial reporting and regulatory updates

- Subscribe to professional journals and publications that cover accounting and finance

- Network with other Bursars and financial professionals to exchange knowledge and best practices

- Actively monitor regulatory websites and government announcements for changes in reporting requirements

- Seek professional development opportunities, such as continuing education courses and certifications, to enhance my knowledge and skills in accounting and finance

4. How do you prioritize and manage multiple financial projects and initiatives?

- Develop a clear understanding of the goals and objectives of each project

- Create a detailed project plan that outlines timelines, responsibilities, and resource requirements

- Communicate project plans and timelines to stakeholders to ensure alignment and support

- Establish regular project review meetings to monitor progress, identify risks, and make necessary adjustments

- Delegate tasks to team members based on their skills and expertise, empowering them to contribute effectively

5. How do you collaborate with other departments within the institution to ensure financial alignment?

- Establish and maintain strong working relationships with department heads and key staff

- Attend regular meetings to discuss financial matters and provide guidance on budgeting, forecasting, and financial analysis

- Provide financial training and support to other departments to enhance their understanding of financial principles

- Develop and implement cross-departmental initiatives to streamline financial processes and improve efficiency

- Foster a culture of open communication and transparency to encourage collaboration and avoid financial silos

6. How do you manage risk in the context of financial operations?

- Identify and assess potential financial risks, including market volatility, fraud, operational inefficiencies, and regulatory changes

- Develop and implement risk mitigation strategies to reduce the likelihood and impact of potential risks

- Monitor financial performance and risk indicators to identify any emerging issues or trends

- Communicate risks and mitigation strategies to stakeholders to ensure transparency and informed decision-making

- Regularly review and update risk management policies and procedures to ensure they remain effective and aligned with the institution’s strategic objectives

7. How do you stay updated on best practices in financial management for higher education institutions?

- Attend industry conferences and workshops specifically designed for Bursars and financial professionals in higher education

- Read industry publications and research papers that focus on best practices in financial management for higher education institutions

- Network with other Bursars and financial professionals in the higher education sector to exchange ideas and learn from their experiences

- Seek professional development opportunities, such as continuing education courses and certifications, that are tailored to the financial management needs of higher education institutions

- Monitor industry reports and publications that provide insights into emerging trends and challenges in financial management for higher education

8. How do you support the institution’s strategic goals through financial management?

- Align financial planning and budgeting with the institution’s strategic objectives

- Provide financial data and analysis to inform decision-making and support strategic initiatives

- Identify and secure funding sources to support strategic goals, such as grants, donations, and capital financing

- Develop and implement financial policies that support the institution’s mission and strategic direction

- Communicate financial information to stakeholders in a clear and concise manner to ensure understanding and support

9. How do you balance the need for financial responsibility with the institution’s commitment to academic excellence?

- Develop a financial plan that supports the institution’s academic priorities while ensuring financial sustainability

- Identify cost-effective ways to deliver high-quality academic programs and services

- Explore innovative funding models and revenue streams to supplement traditional sources of income

- Collaborate with academic leaders to understand their needs and identify areas for financial support

- Communicate the financial implications of academic decisions to ensure informed decision-making

10. What financial management software and tools are you proficient in?

- Enterprise Resource Planning (ERP) systems, such as SAP or Oracle

- Financial accounting and reporting software, such as QuickBooks or NetSuite

- Budgeting and forecasting tools

- Investment management software

- Data analysis and visualization tools

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bursar.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bursar‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Bursars play a pivotal role in managing the financial operations of educational institutions. Their responsibilities encompass a wide range of tasks, including:

1. Financial Planning and Budgeting

– Developing and implementing financial plans and budgets – Monitoring and controlling expenditures – Ensuring compliance with financial regulations

2. Accounting and Reporting

– Maintaining accurate financial records – Preparing financial statements – Reporting on financial performance

3. Cash Management

– Managing cash flow – Investing surplus funds – Facilitating payments

4. Student Accounts and Billing

– Processing student tuition and fees – Managing student loans and financial aid – Providing financial counseling to students

5. Staff Management

– Supervising and managing staff – Training and developing employees – Maintaining a positive and productive work environment

6. Relationship Management

– Building and maintaining relationships with faculty, staff, students, and external stakeholders – Representing the institution at financial meetings and events

Interview Tips

Preparing for a Bursar interview requires thorough research and a strategic approach. Here are some key tips to help candidates ace the interview:

1. Research the Institution

– Learn about the institution’s history, mission, and financial situation. – Review their website and financial statements. – Identify any recent financial challenges or opportunities.

2. Practice Common Interview Questions

– Prepare answers to questions about your financial management experience, leadership skills, and ability to work in a university setting. – Consider questions about budgeting, cash flow management, and student accounts.

3. Highlight Your Financial Expertise

– Quantify your accomplishments and provide specific examples of your success in financial management. – Use data and metrics to demonstrate your ability to improve financial performance.

4. Showcase Your Communication Skills

– Bursars must be able to communicate effectively with a diverse range of stakeholders. – Practice your communication skills in a mock interview or with a friend. – Emphasize your ability to clearly explain financial concepts and build relationships.

5. Prepare Questions for the Interviewer

– Asking thoughtful questions shows that you are engaged and interested in the position. – Prepare questions about the institution’s financial challenges, growth plans, and employee development opportunities.

6. Dress Professionally and Arrive on Time

– First impressions matter. Dress professionally and arrive on time for your interview. – Maintain a professional demeanor and be respectful of the interviewer’s time.

7. Follow Up

– After the interview, send a thank-you note to the interviewer. – Reiterate your interest in the position and highlight your key qualifications. – Inquire about the next steps in the hiring process.

Next Step:

Now that you’re armed with the knowledge of Bursar interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Bursar positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini