Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Business Banker position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

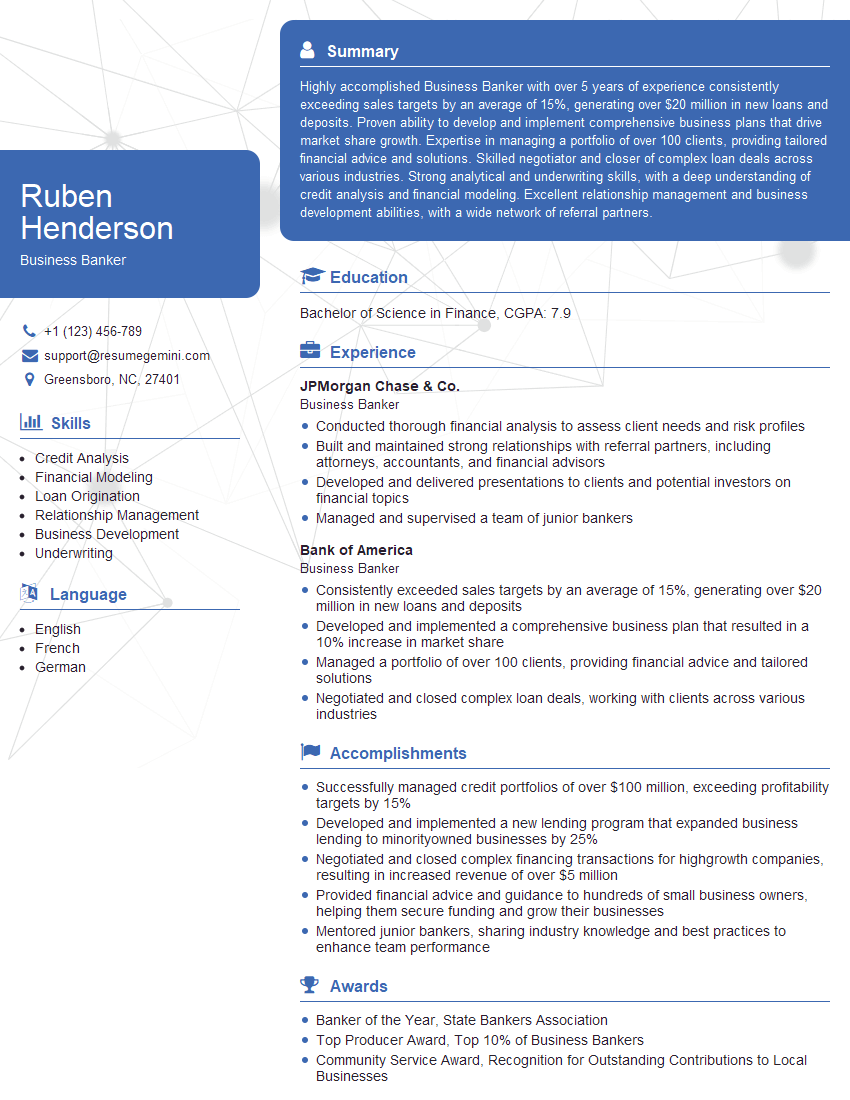

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Business Banker

1. What are the key financial ratios that you analyze when assessing a business loan application?

- Current ratio: This ratio measures a company’s ability to meet its short-term obligations.

- Debt-to-equity ratio: This ratio measures the amount of debt a company has relative to its equity.

- Interest coverage ratio: This ratio measures a company’s ability to meet its interest payments.

- EBITDA margin: This ratio measures a company’s profitability before interest, taxes, depreciation, and amortization.

- Return on equity (ROE): This ratio measures a company’s return on its equity investment.

2. How do you structure a loan for a business that is experiencing rapid growth?

Lending on a case-by-case basis

- Consider the company’s financial projections and cash flow.

- Structure the loan with a flexible repayment schedule that can accommodate the company’s growth.

- Provide the company with access to additional capital if needed.

Security and Guarantees

- Request additional security or guarantees from the business owners.

- This can help to mitigate the risk of the loan.

3. What are some of the challenges that you have faced in your previous role as a Business Banker?

- Analyzing complex financial statements.

- Structuring loans for businesses with unique needs.

- Managing a large portfolio of loans.

- Building and maintaining relationships with clients.

- Staying up-to-date on the latest industry trends.

4. What are your thoughts on the current state of the banking industry?

- The banking industry is undergoing a period of significant change.

- Technology is playing an increasingly important role in the way banks operate.

- Banks are facing increased competition from non-traditional lenders.

- Banks need to adapt to these changes in order to remain competitive.

5. What are your goals for your career?

- I want to continue to develop my skills and knowledge in the banking industry.

- I want to take on more responsibility and leadership roles.

- I want to make a positive impact on the clients and businesses that I work with.

6. Why are you interested in working for our bank?

- I am impressed by your bank’s commitment to customer service.

- I believe that my skills and experience would be a valuable asset to your team.

- I am excited about the opportunity to work with businesses and help them achieve their financial goals.

7. What is your understanding of the role of a Business Banker?

- A Business Banker is responsible for developing and maintaining relationships with business clients.

- They provide financial advice and lending solutions to help businesses grow and succeed.

- They also work to identify and mitigate risks associated with business lending.

8. What are some of the key challenges facing businesses today?

- Access to capital

- Competition

- Technology

- Regulation

- Economic uncertainty

9. How do you stay up-to-date on the latest industry trends?

- Read industry publications and attend conferences.

- Network with other professionals in the banking industry.

- Take continuing education courses.

10. What are your strengths and weaknesses?

Strengths

- Strong analytical and problem-solving skills.

- Excellent communication and interpersonal skills.

- Proven ability to build and maintain relationships.

- Deep understanding of the banking industry.

- Commitment to providing exceptional customer service.

Weaknesses

- I can be too detail-oriented at times.

- I am still developing my leadership skills.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Business Banker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Business Banker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

1. Developing and Managing Client Relationships

As a business banker, you’ll be responsible for building and maintaining relationships with business clients. This includes meeting with clients regularly to discuss their financial needs and goals, and developing customized financial solutions that meet their specific requirements.

2. Financial Analysis and Due Diligence

You’ll need to have strong financial analysis skills to evaluate the financial health of potential and existing clients. This includes assessing their financial statements, performing credit checks, and evaluating their business plans.

- Evaluate financial statements to assess a company’s financial health.

- Analyze market trends and industry data to identify potential clients.

3. Loan Origination and Structuring

You’ll be responsible for originating and structuring loans for business clients. This includes assessing their creditworthiness, determining loan terms, and preparing loan documentation.

- Develop and present loan proposals to clients.

- Negotiate loan terms and conditions with clients.

4. Portfolio Management

You’ll be responsible for managing a portfolio of business loans. This includes monitoring loan performance, identifying and mitigating risks, and working with clients to resolve any issues.

Interview Tips

Preparing for a job interview can be nerve-wracking, but there are a few things you can do to increase your chances of success. Here are a few tips to help you ace your interview for a business banker position:

1. Research the Company and Position

Before you go to your interview, it’s important to do your research on the company and the position you’re applying for. This will help you understand the company’s culture, goals, and values, and it will also help you tailor your answers to the interviewer’s questions.

2. Practice Answering Common Interview Questions

There are a few common interview questions that you’re likely to be asked, so it’s a good idea to practice answering them before you go to your interview. Some common interview questions include:

- “Tell me about yourself.”

- “Why are you interested in this position?”

- “What are your strengths and weaknesses?”

- “What are your salary expectations?”

3. Dress Professionally and Arrive on Time

First impressions matter, so it’s important to dress professionally and arrive on time for your interview. This shows the interviewer that you respect their time and that you’re taking the interview seriously.

4. Be Confident and Enthusiastic

It’s important to be confident and enthusiastic during your interview. This will show the interviewer that you’re passionate about the position and that you’re confident in your abilities.

5. Follow Up After the Interview”

After your interview, it’s important to follow up with the interviewer. This shows the interviewer that you’re interested in the position and that you’re serious about your candidacy.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Business Banker, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Business Banker positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.