Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Business Taxes Specialist position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

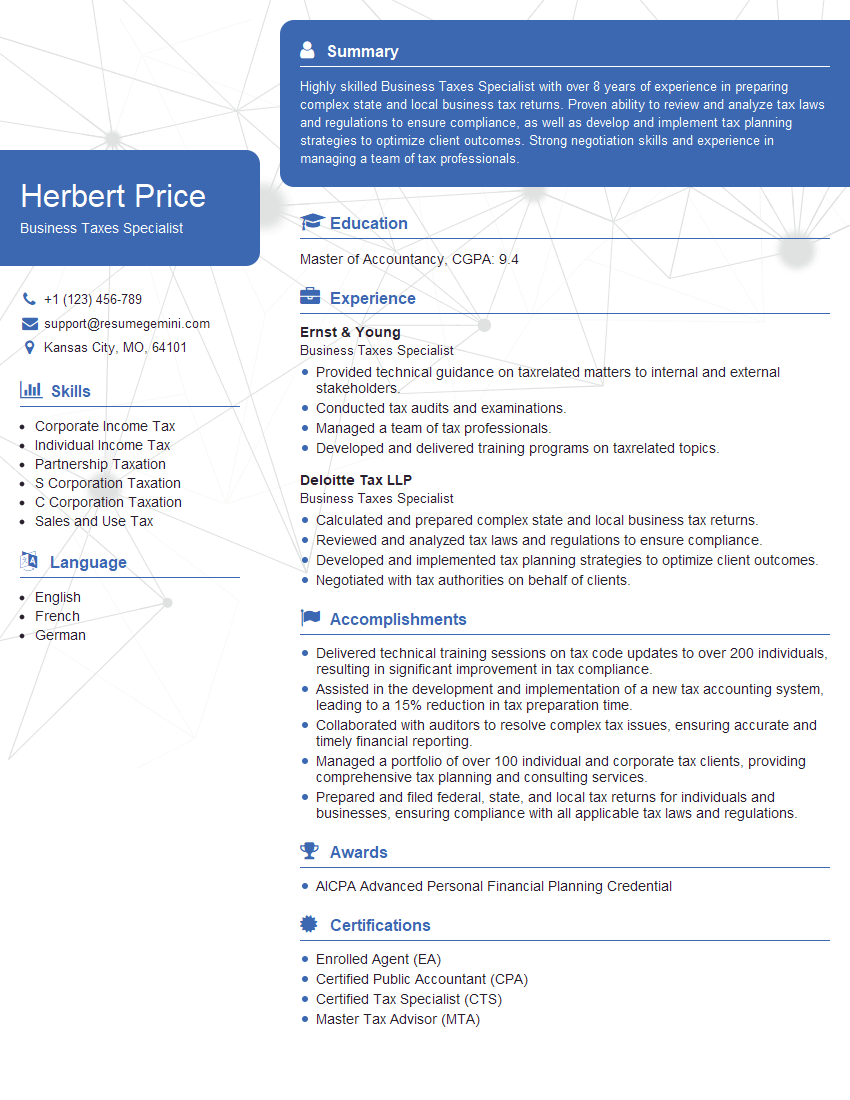

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Business Taxes Specialist

1. What are the key responsibilities of a Business Taxes Specialist?

As a Business Taxes Specialist, my key responsibilities include:

- Preparing and filing business tax returns, including federal, state, and local taxes.

- Providing tax advice and guidance to clients on a variety of topics, including business deductions, credits, and tax planning strategies.

- Researching and staying up-to-date on tax laws and regulations to ensure that clients are in compliance.

- Representing clients before tax authorities in audits and appeals.

- Developing and implementing tax planning strategies for clients to minimize their tax liability and maximize their after-tax income.

2. What are some of the challenges you have faced in your previous role as a Business Taxes Specialist?

One of the challenges I faced in my previous role was staying up-to-date on the constantly changing tax laws and regulations. The tax code is complex and ever-changing, so it is essential to stay informed to provide accurate and timely advice to clients.

Another challenge was representing clients in audits and appeals. Dealing with tax authorities can be complex, so it is important to be prepared and knowledgeable about the tax laws and procedures. I found that by thoroughly preparing for these situations, I was able to successfully represent my clients and achieve favorable outcomes.

3. What are some of the tax planning strategies that you have implemented for your clients?

Some of the tax planning strategies that I have implemented for my clients include:

- Advising clients on the choice of business entity to minimize their tax liability.

- Developing tax-saving strategies for retirement planning, such as setting up IRAs and 401(k) plans.

- Helping clients to take advantage of tax deductions and credits to reduce their tax liability.

- Assisting clients with tax audits and appeals to ensure that they are paying the correct amount of taxes.

- Advising clients on tax-efficient ways to invest their money.

4. What are some of the accounting software that you are familiar with?

I am familiar with a variety of accounting software, including QuickBooks, NetSuite, and Sage Intacct. I have used these software programs to prepare financial statements, manage accounts receivable and payable, and track inventory.

In addition to these software programs, I am also proficient in Microsoft Office Suite and have experience using data analysis tools such as Excel and Power BI.

5. What are some of the methods and techniques that you use to research tax laws and regulations?

I use a variety of methods and techniques to research tax laws and regulations. These include:

- Reading tax publications and articles.

- Attending tax seminars and webinars.

- Consulting with other tax professionals.

- Using online tax research databases.

- Reading the Internal Revenue Code and Treasury Regulations.

I find that by using a variety of resources and techniques, I am able to stay up-to-date on the latest tax laws and regulations and provide accurate and timely advice to my clients.

6. What are some of the ethical considerations that you must be aware of as a Business Taxes Specialist?

As a Business Taxes Specialist, I am bound by a number of ethical considerations, including:

- Confidentiality: I must keep all client information confidential.

- Objectivity: I must provide objective and unbiased advice to my clients.

- Integrity: I must maintain a high level of integrity in all my dealings with clients and tax authorities.

- Professionalism: I must conduct myself in a professional manner at all times.

- Competence: I must maintain my professional competence by staying up-to-date on the latest tax laws and regulations.

I take these ethical considerations very seriously and believe that they are essential to providing high-quality tax services to my clients.

7. What are some of the key trends that you see in the tax landscape?

I see a number of key trends in the tax landscape, including:

- The increasing complexity of the tax code.

- The globalization of businesses.

- The rise of the digital economy.

- The increasing focus on tax compliance.

- The use of technology to improve tax administration and compliance.

I believe that these trends will continue to shape the tax landscape in the years to come, and I am committed to staying up-to-date on these trends so that I can provide my clients with the best possible tax advice and services.

8. What are some of the skills and qualities that you possess that make you a successful Business Taxes Specialist?

I possess a number of skills and qualities that make me a successful Business Taxes Specialist, including:

- A deep understanding of the tax code and tax regulations.

- Excellent research and analytical skills.

- Strong communication and interpersonal skills.

- The ability to work independently and as part of a team.

- A commitment to continuing education and professional development.

I am confident that I have the skills and qualities necessary to be successful in this role and to provide high-quality tax services to your clients.

9. Why are you interested in working for our company?

I am interested in working for your company because I am impressed by your commitment to providing high-quality tax services to your clients. I am also impressed by your company’s reputation for being a leader in the tax industry.

I believe that my skills and experience would be a valuable asset to your team, and I am confident that I can make a significant contribution to your company’s success.

10. What are your salary expectations?

My salary expectations are in line with the market rate for Business Taxes Specialists with my experience and qualifications. I am open to discussing my salary expectations further during the negotiation process.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Business Taxes Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Business Taxes Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Business Taxes Specialist, you will be the tax advisor for a portfolio of clients and contribute to the overall success of the company. Your key responsibilities will include:

1. Tax Planning and Compliance

You will assist clients in tax planning to minimize their tax liability. You will also prepare and file various tax returns, such as income tax returns, sales tax returns, and property tax returns.

- Develop and implement tax strategies to minimize clients’ tax liabilities.

- Prepare and file tax returns, including income tax returns, sales tax returns, and property tax returns.

- Represent clients before tax authorities, such as the IRS and state tax agencies.

2. Tax Research and Analysis

You will perform tax research and analysis to keep up-to-date on the latest tax laws and regulations. You will also use your research and analysis skills to help clients solve complex tax problems.

- Research and analyze tax laws and regulations to keep up-to-date on the latest tax changes.

- Use research and analysis skills to help clients solve complex tax problems.

- Write technical memos and articles on tax-related topics.

3. Client Service

You will provide excellent customer service to clients. You will be responsive to their needs and answer their questions in a timely and professional manner.

- Provide excellent customer service to clients.

- Be responsive to clients’ needs and answer their questions in a timely and professional manner.

- Build and maintain strong relationships with clients.

4. Other Duties

You may also be responsible for performing other duties, such as training new staff, writing articles on tax-related topics, and presenting at conferences.

- Train new staff on tax-related topics.

- Write articles on tax-related topics.

- Present at conferences on tax-related topics.

Interview Tips

There are various ways to help you prepare for your interview for the position, Business Taxes Specialist. Below are some tips that you can use below:

1. Research the Company

Before your interview, take some time to research the company. This will help you learn more about the company’s culture, values, and goals. You can also use this information to tailor your answers to the interviewer’s questions.

- Visit the company’s website.

- Read the company’s annual report.

- Talk to people who work at the company.

2. Practice Your Answers

Once you have researched the company, take some time to practice your answers to common interview questions. This will help you feel more confident and prepared during your interview.

- Write down your answers to common interview questions.

- Practice saying your answers out loud.

- Get feedback from a friend or family member.

3. Dress Professionally

First impressions matter, so it is important to dress professionally for your interview. This means wearing a suit or business casual attire.

- Wear a suit or business casual attire.

- Make sure your clothes are clean and pressed.

- Avoid wearing strong perfumes or colognes.

4. Be on Time

Punctuality is important, so be sure to arrive for your interview on time. This shows the interviewer that you are respectful of their time.

- Plan your route to the interview in advance.

- Leave early to give yourself plenty of time.

- If you are running late, call the interviewer to let them know.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Business Taxes Specialist, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Business Taxes Specialist positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.