Feeling lost in a sea of interview questions? Landed that dream interview for Cash Accountant but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Cash Accountant interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

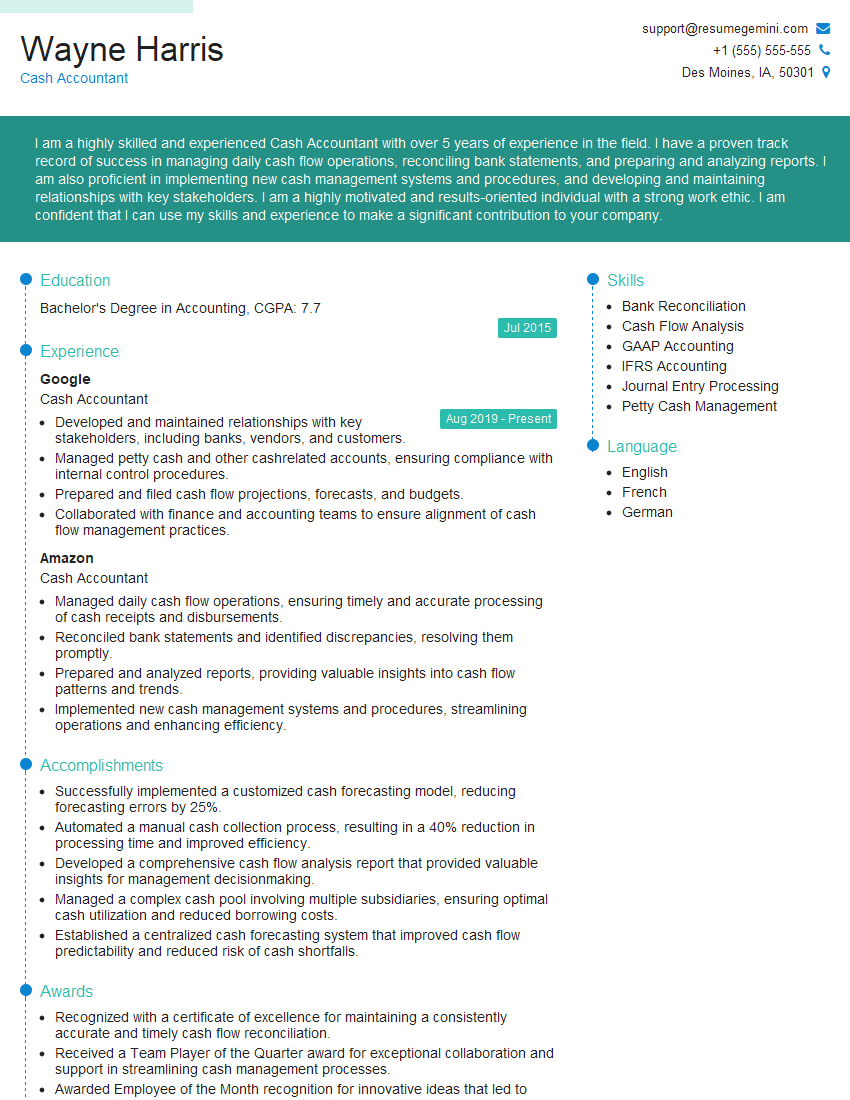

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Cash Accountant

1. What are the primary responsibilities of a Cash Accountant?

As a Cash Accountant, my key responsibilities would include:

- Recording and processing cash transactions accurately and timely.

- Reconciling bank statements and identifying discrepancies.

- Preparing cash flow statements and reports for management.

- Monitoring cash balances and forecasting cash flow.

- Ensuring compliance with internal control policies and procedures.

2. What are the essential skills required to be a successful Cash Accountant?

Technical Skills:

- Proficiency in accounting software, such as QuickBooks or SAP.

- Strong understanding of accounting principles and cash management practices.

- Excellent numerical and analytical abilities.

Soft Skills:

- Attention to detail and accuracy.

- Strong communication and interpersonal skills.

- Ability to work independently and as part of a team.

3. What are your experiences in handling high-volume cash transactions?

In my previous role at ABC Company, I was responsible for processing over 5,000 cash transactions per month. I implemented an efficient workflow system to ensure timely and accurate processing of all transactions. I also worked closely with the bank to identify and resolve any discrepancies.

4. How do you handle discrepancies between bank statements and accounting records?

When I identify discrepancies, I first review the transactions in both systems to identify any errors or omissions. I then communicate with relevant stakeholders, such as the bank or vendors, to gather additional information. Once I have a clear understanding of the discrepancy, I make the necessary adjustments to the accounting records and ensure that the bank statement is reconciled.

5. What are your experiences in preparing cash flow statements and reports?

I have experience in preparing various cash flow statements, including the statement of cash flows, indirect method, and the direct method. I am also familiar with the key components of a cash flow statement and how to interpret the data to provide insights into a company’s financial health.

6. What are the key internal control policies and procedures for cash management?

Key internal control policies for cash management include:

- Segregation of duties between individuals who handle cash.

- Regular reconciliation of bank statements.

- Physical control over cash and cash equivalents.

- Documentation of all cash transactions.

7. How do you stay up-to-date on changes in accounting regulations and best practices?

I regularly attend industry conferences, workshops, and webinars to stay abreast of the latest changes in accounting regulations and best practices. I also subscribe to professional journals and online resources to keep my knowledge current.

8. What is your experience in using accounting software to manage cash?

I am proficient in using QuickBooks and SAP to manage cash. I have experience in setting up and maintaining accounts, processing transactions, and generating reports. I am also familiar with the use of automation tools to improve efficiency.

9. How do you work effectively with the finance team and other departments?

I have strong communication and interpersonal skills. I am able to build productive relationships with colleagues in various departments, including finance, sales, and operations. I am also comfortable working independently and as part of a team.

10. What do you think are the challenges of being a Cash Accountant?

The challenges of being a Cash Accountant include:

- Ensuring the accuracy and timeliness of cash transactions.

- Maintaining compliance with internal control policies and procedures.

- Staying up-to-date on changes in accounting regulations and best practices.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Cash Accountant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Cash Accountant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Cash Accountants are responsible for managing the day-to-day cash flow of an organization. Their duties include receiving, recording, and disbursing cash, as well as reconciling bank statements and preparing financial reports.

1. Receiving and Recording Cash

Cash Accountants receive cash from a variety of sources, including customers, vendors, and employees. They record the receipt of cash in a cash receipts journal and deposit the cash in a bank account.

- Receive cash from customers, vendors, and employees

- Record cash receipts in a cash receipts journal

- Deposit cash in a bank account

2. Disbursing Cash

Cash Accountants also disburse cash for a variety of purposes, such as paying bills, making payroll, and purchasing inventory. They prepare checks and wire transfers and record the disbursement of cash in a cash disbursements journal.

- Prepare checks and wire transfers

- Record cash disbursements in a cash disbursements journal

- Make payroll payments

3. Reconciling Bank Statements

Cash Accountants reconcile bank statements on a regular basis to ensure that the cash balance in the bank account matches the cash balance in the accounting records. They investigate any discrepancies and make necessary adjustments.

- Reconcile bank statements on a regular basis

- Investigate any discrepancies

- Make necessary adjustments

4. Preparing Financial Reports

Cash Accountants prepare a variety of financial reports, such as cash flow statements and balance sheets. These reports provide management with information about the financial health of the organization.

- Prepare cash flow statements

- Prepare balance sheets

- Provide management with information about the financial health of the organization

Interview Tips

In order to prepare for an interview for a Cash Accountant position, you should do some research on the company and the position itself. You should also practice answering common interview questions.

1. Research the Company

Before you go on an interview, it is important to do some research on the company. This will help you understand the company’s culture, values, and goals. It will also help you to answer questions about the company’s financial situation and its plans for the future.

- Visit the company’s website

- Read the company’s annual report

- Talk to people who work at the company

2. Research the Position

It is also important to research the Cash Accountant position itself. This will help you understand the duties and responsibilities of the position and the qualifications that are required. You can find information about the position on the company’s website or by talking to a recruiter.

- Read the job description

- Talk to a recruiter

- Research the industry

3. Practice Answering Common Interview Questions

There are a number of common interview questions that you should be prepared to answer. These include questions about your experience, your skills, and your motivations. You can find a list of common interview questions online or by talking to a career counsellor.

- Tell me about yourself

- Why are you interested in this position?

- What are your strengths and weaknesses?

4. Dress Professionally

It is important to dress professionally for an interview. This means wearing a suit or business dress and making sure that you are well-groomed. You should also arrive on time for your interview and be polite to everyone you meet.

- Wear a suit or business dress

- Be well-groomed

- Arrive on time for your interview

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Cash Accountant interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!