Are you gearing up for an interview for a Cash Checker position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Cash Checker and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

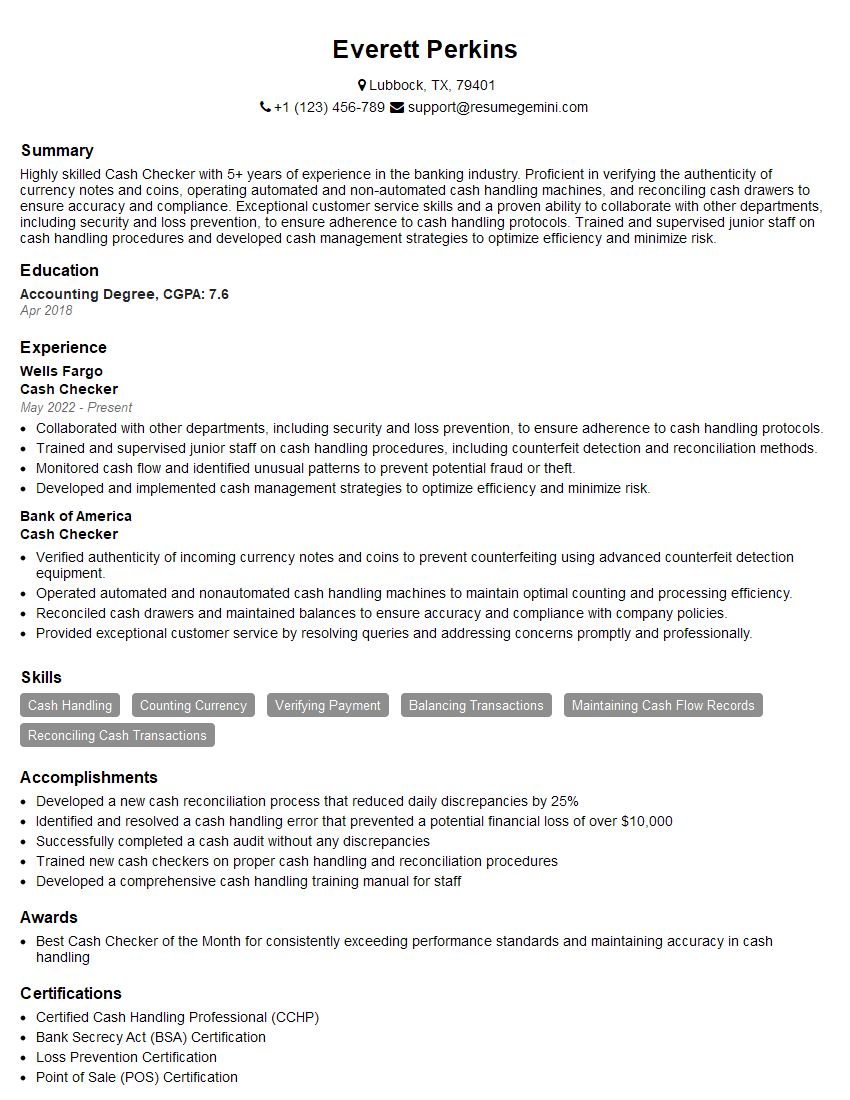

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Cash Checker

1. Explain the process of reconciling cash drawer at the end of shift?

Sample Answer: – Count the cash in the drawer, including bills, coins, checks, and any other forms of payment. – Compare the total amount counted to the amount that should be in the drawer, based on the sales and transactions completed during the shift. – If there is a difference between the two amounts, investigate the cause of the discrepancy and make any necessary adjustments.

2. How do you handle discrepancies in cash drawers?

Sample Answer: – Identify the cause of the discrepancy: Conduct a thorough review of the transactions and sales records to determine the source of the discrepancy. – Document the discrepancy: Create a detailed report that documents the amount of the discrepancy, the date and time it occurred, and any other relevant information. – Investigate the cause: Review security camera footage, interview employees, and examine cash handling procedures to identify the root cause of the discrepancy. – Resolve the discrepancy: Take appropriate action to resolve the discrepancy, such as adjusting the cash drawer, reprimanding employees, or implementing new cash handling procedures.

3. What procedures do you follow to prevent cash-handling errors?

Sample Answer: – Count cash multiple times: Verify the amount of cash in the drawer several times throughout the shift to minimize errors. – Use a cash register system: Utilize a reliable cash register system that tracks transactions and provides accurate totals. – Follow established cash handling procedures: Adhere to clear and concise cash handling guidelines to ensure consistency and reduce mistakes. – Receive training: Regularly participate in training sessions to enhance cash handling skills and stay updated on best practices.

4. How do you calculate change for customers accurately and efficiently?

Sample Answer: – Use mental math: Calculate the change in your head quickly and accurately for small transactions. – Utilize a calculator: Employ a calculator for larger transactions or when dealing with complex calculations. – Double-check calculations: Recalculate the change to ensure accuracy and avoid mistakes.

5. What techniques do you use to identify counterfeit money?

Sample Answer: – Check the security features: Examine the bill for watermarks, security threads, and other anti-counterfeiting measures. – Utilize a counterfeit detection pen: Use a pen that reacts to the paper or ink of counterfeit bills, leaving a mark or changing color. – Verify the serial number: Check the serial numbers on the bill to ensure they are unique and match the series of authentic bills.

6. How do you maintain a professional and courteous demeanor while dealing with customers?

Sample Answer: – Greet customers with a smile: Establish a positive and welcoming atmosphere from the outset. – Listen actively to customer inquiries: Pay attention to what customers are saying, ask clarifying questions, and demonstrate understanding. – Respond with empathy and respect: Show compassion and understanding towards customers, even when they are upset or demanding.

7. How do you handle difficult or demanding customers?

Sample Answer: – Remain calm and professional: Maintain composure and avoid becoming defensive or argumentative. – Listen to the customer’s concerns: Allow the customer to express their concerns fully without interrupting. – Apologize for any inconvenience: Acknowledge the customer’s frustration and apologize for any inconvenience they may have experienced, even if it was not your fault. – Offer solutions or alternatives: Provide options or solutions to address the customer’s concerns and find a mutually acceptable outcome.

8. How do you prioritize and manage multiple tasks efficiently?

Sample Answer: – Create a to-do list: Start by listing all the tasks that need to be completed. – Prioritize tasks: Determine which tasks are most important and urgent, and focus on those first. – Break down large tasks: Divide complex tasks into smaller, more manageable steps. – Delegate tasks: If appropriate, assign tasks to others to share the workload.

9. How do you work effectively as part of a team?

Sample Answer: – Communicate clearly: Share information, updates, and concerns with team members regularly. – Collaborate on projects: Work together to achieve common goals and support each other’s efforts. – Provide constructive feedback: Offer feedback to team members in a positive and supportive manner to help them improve.

10. How do you stay up-to-date on new products, promotions, and company policies?

Sample Answer: – Attend company meetings and training sessions: Regularly participate in company meetings and training programs to stay informed about new developments. – Read company communications: Review company emails, newsletters, and other communications for updates on products, promotions, and policies. – Communicate with colleagues: Engage in conversations with colleagues to share information and knowledge.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Cash Checker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Cash Checker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Cash Checkers play a vital role in ensuring the accuracy and efficiency of financial transactions within an organization. Their primary responsibilities include:

1. Cash Handling

Verify and count cash transactions, including deposits, withdrawals, and exchanges.

- Detect counterfeit currency using various verification methods.

- Maintain a clean and organized cash drawer throughout the shift.

2. Customer Service

Provide excellent customer service by greeting customers, answering questions, and addressing concerns.

- Maintain a professional demeanor and resolve customer issues promptly and efficiently.

- Ensure a positive and welcoming atmosphere for customers.

3. Reconciliation and Reporting

Reconcile cash drawer balances with sales reports and other financial documents.

- Identify and resolve any discrepancies in cash transactions.

- Prepare daily and weekly cash reports for management review.

4. Security

Follow established security protocols to prevent fraud and theft.

- Monitor cash transactions for suspicious activity.

- Report any irregularities or security breaches to supervisors.

Interview Tips

Preparing thoroughly for a Cash Checker interview can significantly increase your chances of success. Here are some tips to help you ace the interview:

1. Research the Company and Position

Demonstrate your interest in the company by researching its history, culture, and the specific role you’re applying for. This will help you understand the organization’s needs and tailor your answers accordingly.

- Visit the company website and social media pages.

- Read industry articles and news to stay up-to-date on recent developments.

2. Highlight Your Experience and Skills

Emphasize your experience in cash handling, customer service, and reconciliation. Quantify your accomplishments to demonstrate your impact.

- Use specific examples to illustrate how you have excelled in these areas.

- Be prepared to discuss your knowledge of cash handling procedures and security measures.

3. Prepare for Common Interview Questions

Prepare answers to common interview questions, such as:

- Tell me about your experience in handling cash transactions.

- How do you ensure the accuracy and security of cash transactions?

- How do you handle discrepancies in cash reconciliations?

- What are your strengths and weaknesses as a Cash Checker?

4. Practice Your Answers

Practice your answers out loud to improve your delivery and confidence. Ask a friend or family member to conduct a mock interview.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Keep your answers concise, specific, and relevant to the job requirements.

5. Dress Professionally and Arrive on Time

Make a good impression by dressing professionally and arriving at the interview on time. Be polite and respectful to everyone you meet, regardless of their position.

- Choose an outfit that is clean, ironed, and appropriate for an office setting.

- Arrive at the interview location a few minutes early to allow for any unforeseen delays.

6. Ask Thoughtful Questions

Asking thoughtful questions at the end of the interview shows your interest in the position and the company. It also gives you an opportunity to learn more about the organization and the role.

- Prepare questions about the company’s growth plans, future projects, or training opportunities.

- Ask about the company’s commitment to customer service or security.

7. Follow Up

Follow up with the interviewer within 24 hours to thank them for their time and reiterate your interest in the position. This shows your appreciation and professionalism.

- Send a brief email or handwritten note expressing your gratitude.

- Reiterate your key strengths and how they align with the job requirements.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Cash Checker interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.