Are you gearing up for a career in Catastrophe Claims Supervisor? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Catastrophe Claims Supervisor and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

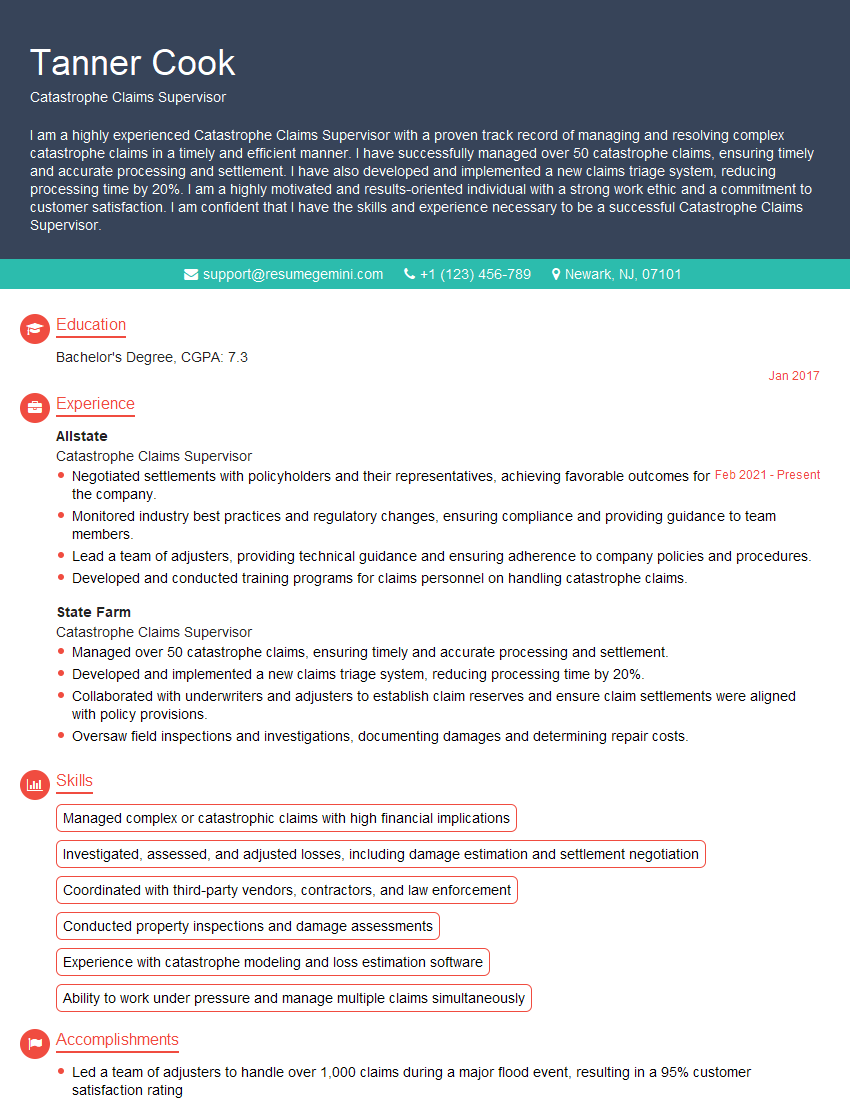

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Catastrophe Claims Supervisor

1. How would you prioritize claims and allocate resources in the event of a major catastrophe?

- Triage claims based on severity and potential impact.

- Establish a command center to coordinate response efforts.

- Mobilize additional staff from other departments or hire temporary employees.

2. Describe your experience in assessing and adjusting complex catastrophe claims.

Negotiation Skills

- Strong negotiation skills to resolve claims fairly and efficiently.

- Ability to build rapport with claimants and establish trust.

Technical Expertise

- Expertise in insurance policies, coverage interpretation, and claims settlement procedures.

- Knowledge of applicable laws and regulations.

3. How do you manage a team of claims adjusters during a catastrophe event?

- Provide clear instructions and expectations.

- Monitor progress and provide support when needed.

- Foster teamwork and collaboration.

4. What software and tools do you use in catastrophe claims management?

- Claims management software

- Property inspection software

- Data analysis tools

5. How do you handle claims involving fraud or misrepresentation?

- Investigate claims thoroughly.

- Identify red flags and inconsistencies.

- Report suspected fraud to the appropriate authorities.

6. What is your experience in working with insurance carriers, brokers, and policyholders?

- Strong communication and interpersonal skills.

- Ability to build relationships and establish trust.

- Knowledge of insurance industry practices and procedures.

7. How do you manage your time and prioritize tasks when working under pressure?

- Prioritize urgent claims.

- Delegate tasks effectively.

- Use time management tools and techniques.

8. What is your approach to claim resolution?

- Investigate claims thoroughly.

- Communicate with claimants throughout the process.

- Resolve claims fairly and efficiently.

9. What is your experience in managing conflicts or disputes?

- Facilitate communication between parties.

- Identify underlying issues.

- Negotiate resolutions that are acceptable to all parties.

10. How do you stay updated on industry trends and best practices?

- Attend industry conferences and webinars.

- Read industry publications.

- Network with other claims professionals.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Catastrophe Claims Supervisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Catastrophe Claims Supervisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Catastrophe Claims Supervisor plays a vital role in managing the aftermath of large-scale events that result in significant property damage or loss. The key responsibilities of this position encompass:

1. Claims Management

Overseeing the efficient handling of catastrophe claims from submission to settlement.

2. Team Leadership

Directing and supervising a team of claims adjusters to ensure timely and accurate claims processing.

3. Quality Control

Establishing and maintaining quality standards for claims handling and ensuring compliance with company policies and procedures.

4. Catastrophe Response Coordination

Coordinating with external stakeholders, including government agencies, emergency responders, and policyholders.

Interview Tips

1. Research the Company and Position

Thoroughly research the insurance company and specific role to understand its culture, products, and industry standing.

- Visit the company’s website, LinkedIn page, and industry publications.

- Identify the company’s mission, values, and competitive advantages.

2. Highlight Relevant Experience and Skills

Emphasize your experience in catastrophe claims management, team leadership, and quality control.

- Quantify your accomplishments using specific metrics and data points.

- Use the STAR method (Situation, Task, Action, Result) to describe your experiences.

3. Demonstrate Understanding of Catastrophe Claims Process

Expound on your knowledge of the end-to-end catastrophe claims process, including triage, investigation, documentation, and settlement.

- Discuss your experience in handling complex or high-value claims.

- Highlight your understanding of claims handling software and technology.

4. Prepare for Common Interview Questions

Anticipate and prepare answers to common interview questions, such as:

- Why are you interested in this role?

- Describe your experience in handling catastrophe claims.

- How do you manage and motivate a team during a crisis?

- How do you ensure the quality and accuracy of claims handling?

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Catastrophe Claims Supervisor, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Catastrophe Claims Supervisor positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.