Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Certified Fraud Examiner position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

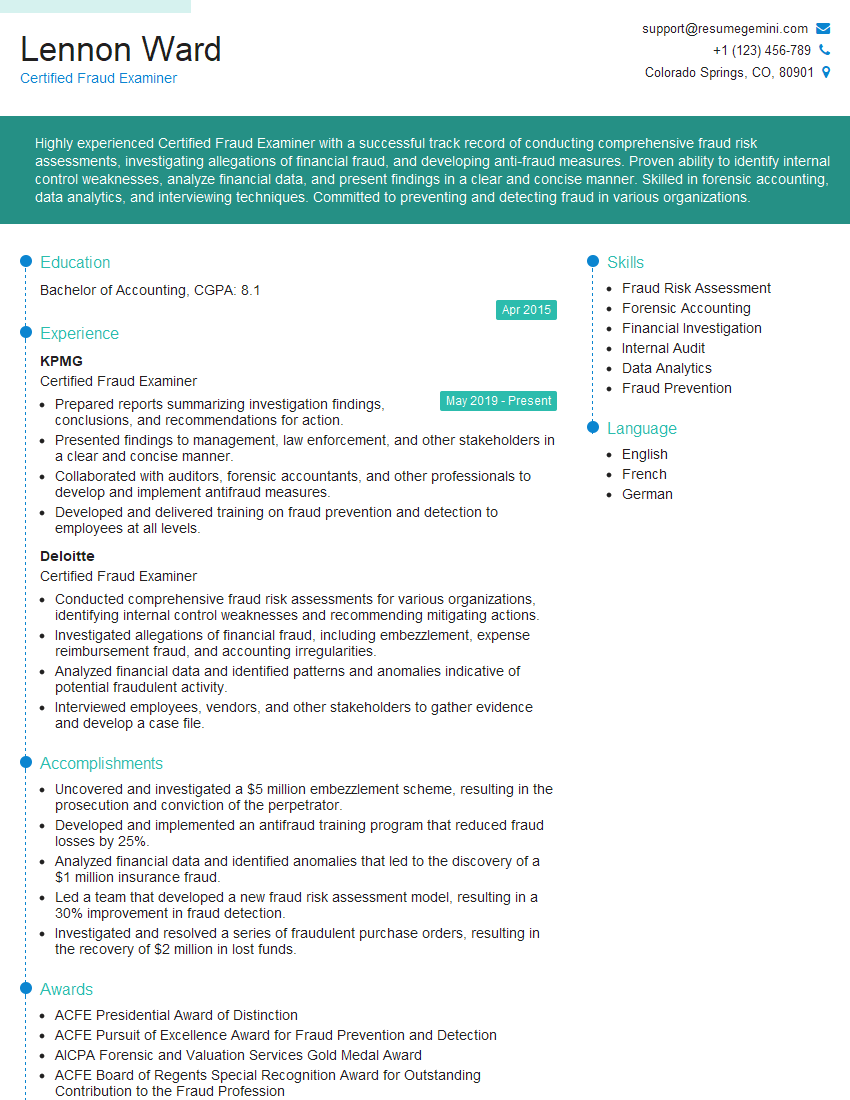

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Certified Fraud Examiner

1. What are the common red flags that indicate potential fraud?

- Unexplained changes in financial statements, such as sudden increases in expenses or decreases in revenue.

- Unusually high or low account balances, especially in cash or inventory.

- Unusually high or low employee turnover rates, especially in key positions.

- Vendors or customers who are related to employees or management.

- Transactions that are not properly documented or authorized.

2. What are the different types of fraud schemes?

Types of Fraud Schemes

- Financial statement fraud

- Asset misappropriation

- Billing fraud

- Corruption

How to Detect Fraud Schemes

- Analyze financial statements for anomalies.

- Review supporting documentation for transactions.

- Interview employees and management.

- Perform risk assessments.

3. What are the steps involved in conducting a fraud investigation?

- Plan the investigation, including determining the scope and objectives.

- Gather evidence, including documents, interviews, and electronic data.

- Analyze the evidence to identify inconsistencies and red flags.

- Draw conclusions about the likelihood and nature of fraud.

- Report the findings of the investigation and make recommendations for corrective action.

4. What are the ethical considerations that must be taken into account when conducting a fraud investigation?

- Confidentiality: The information gathered during the investigation must be kept confidential to protect the privacy of those involved.

- Objectivity: The investigator must remain objective and unbiased throughout the investigation.

- Due process: The investigator must follow due process procedures to ensure that the rights of those involved are protected.

- Independence: The investigator must be independent of the entity being investigated to avoid conflicts of interest.

5. What are the challenges associated with detecting and investigating fraud?

- Fraudsters are often sophisticated and skilled at hiding their activities.

- Fraud investigations can be complex and time-consuming.

- There may be a lack of cooperation from those involved in the fraud.

- The fear of retaliation can prevent victims from reporting fraud.

6. What are the best practices for preventing fraud?

- Implement strong internal controls.

- Conduct regular fraud risk assessments.

- Educate employees about fraud and its consequences.

- Encourage employees to report suspected fraud.

- Create a culture of ethics and integrity.

7. What are the latest trends in fraud?

- The increasing use of technology has led to new opportunities for fraudsters.

- Fraudsters are becoming more sophisticated and targeted in their attacks.

- The global nature of fraud makes it more difficult to detect and investigate.

8. What are the best resources for staying up-to-date on fraud prevention and detection?

- Association of Certified Fraud Examiners (ACFE)

- American Institute of Certified Public Accountants (AICPA)

- Fraud Prevention and Disclosure Act (Sarbanes-Oxley Act)

- Government Accountability Office (GAO)

- Securities and Exchange Commission (SEC)

9. What are the career opportunities for Certified Fraud Examiners?

- Fraud auditor

- Forensic accountant

- Internal auditor

- Risk manager

- Compliance officer

10. Why are you interested in working as a Certified Fraud Examiner?

- I am passionate about fighting fraud and protecting organizations from financial loss.

- I have a strong understanding of fraud prevention and detection techniques.

- I am a highly motivated and results-oriented individual.

- I am confident that I can make a significant contribution to your organization as a Certified Fraud Examiner.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Certified Fraud Examiner.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Certified Fraud Examiner‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Certified Fraud Examiners (CFEs) are responsible for detecting, investigating, and preventing fraud. They work in a variety of settings, including accounting firms, corporations, government agencies, and law enforcement.

1. Detecting and Investigating Fraud

CFEs use their knowledge of accounting, auditing, and investigation to detect and investigate fraud. They may be involved in reviewing financial records, interviewing witnesses, and conducting surveillance.

- Interview witnesses and gather evidence

- Conduct audits and analyze financial records

2. Preventing Fraud

CFEs also work to prevent fraud by developing and implementing fraud prevention measures. They may provide training to employees, conduct risk assessments, and review internal controls.

- Develop and implement fraud prevention measures

- Conduct risk assessments and review internal controls

3. Testifying in Court

CFEs may be called upon to testify in court about their findings. They must be able to clearly and concisely explain their work to a judge and jury.

- Testify in court about their findings

- Explain their work to a judge and jury

4. Continuing Education

CFEs must complete continuing education to maintain their certification. This ensures that they are up-to-date on the latest fraud prevention and detection techniques.

- Complete continuing education to maintain their certification

- Stay up-to-date on the latest fraud prevention and detection techniques

Interview Tips

To ace your interview for a Certified Fraud Examiner position, follow these tips:

1. Research the Organization

Before your interview, take some time to research the organization you are applying to. This will help you understand their culture, values, and the specific challenges they face in terms of fraud.

- Visit the organization’s website

- Read news articles and press releases about the organization

- Talk to people who work or have worked for the organization

2. Prepare Your Answers

Take some time to prepare your answers to common interview questions. This will help you feel confident and prepared during your interview.

- Why are you interested in this position?

- What are your strengths and weaknesses as a CFE?

- What is your experience with fraud detection and investigation?

3. Be Professional

Dress professionally and arrive on time for your interview. Be polite and respectful to the interviewer and other employees you meet.

- Dress professionally

- Arrive on time for your interview

- Be polite and respectful

4. Ask Questions

At the end of your interview, be sure to ask the interviewer questions about the position and the organization. This shows that you are interested in the job and that you are taking the interview seriously.

- What are the biggest challenges facing the organization in terms of fraud?

- What is the organization’s culture like?

- What are the opportunities for advancement?

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Certified Fraud Examiner interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!