Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Certified Professional Controller (CPC) position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

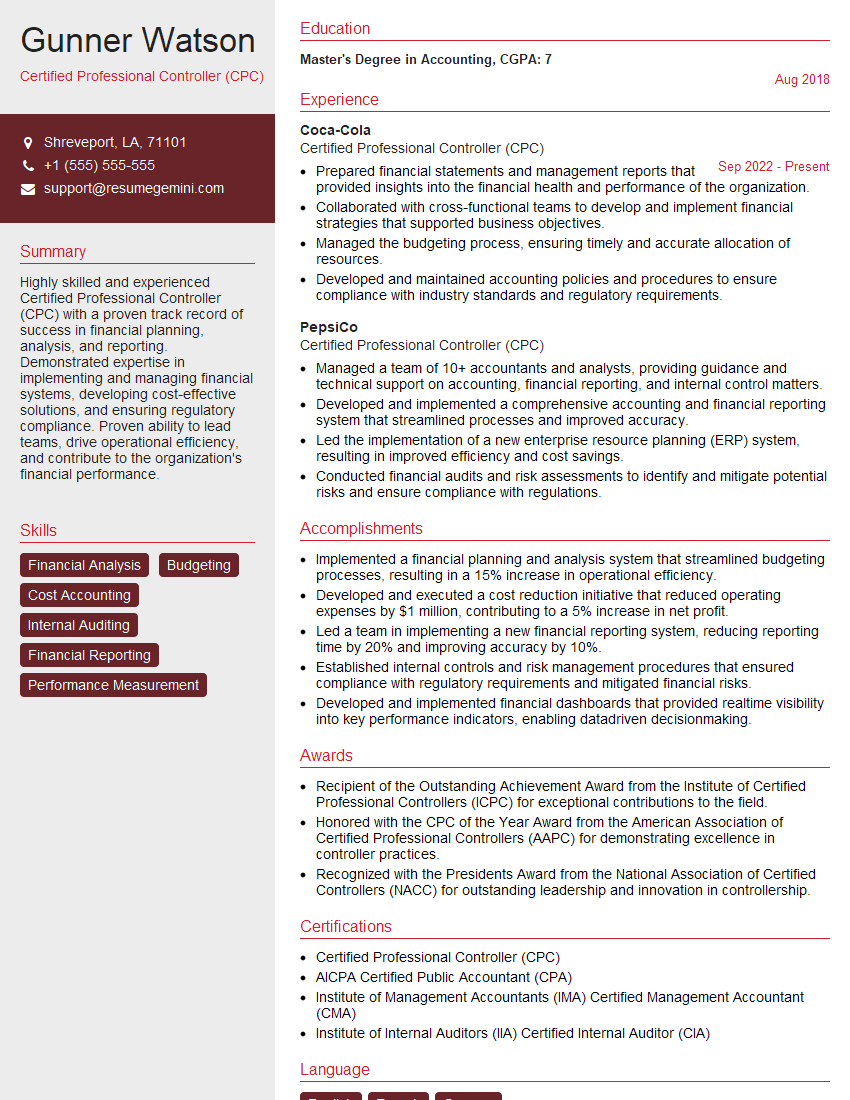

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Certified Professional Controller (CPC)

1. What are the key responsibilities of a Certified Professional Controller (CPC)?

As a CPC, my responsibilities would include:

- Preparing, analyzing, and interpreting financial statements and reports

- Developing and implementing internal controls and accounting systems

- Performing cost accounting and budgeting

- Complying with all applicable laws, regulations, and standards

- Managing financial risks

2. What are the core principles of internal control over financial reporting?

- Control environment: The tone at the top, integrity and ethical values, and commitment to competence

- Risk assessment: Identifying, assessing, and responding to risks of material misstatement

- Control activities: Policies and procedures to prevent or detect fraud and errors

- Information and communication: Relevant information and communication among those involved in internal control

- Monitoring: Ongoing monitoring of internal control systems

3. What are the different types of financial statements?

- Balance sheet

- Income statement

- Statement of cash flows

- Statement of changes in equity

- Notes to financial statements

4. What are the different types of internal controls?

- Preventive controls: Prevent errors or fraud from occurring

- Detective controls: Detect errors or fraud after they have occurred

- Manual controls: Performed by humans

- Automated controls: Performed by computer systems

5. What are the different methods of cost accounting?

- Job costing

- Process costing

- Activity-based costing (ABC)

- Standard costing

- Lean accounting

6. What are the different types of financial risks?

- Credit risk

- Market risk

- Liquidity risk

- Operational risk

7. What are the different types of financial ratios?

- Liquidity ratios

- Solvency ratios

- Profitability ratios

- Activity ratios

8. What are the different types of accounting software?

- Enterprise resource planning (ERP) systems

- Small business accounting software

- Cloud accounting software

- Open-source accounting software

9. What are the different types of accounting certifications?

- Certified Public Accountant (CPA)

- Certified Management Accountant (CMA)

- Certified Internal Auditor (CIA)

- Certified Professional Controller (CPC)

- Certified Fraud Examiner (CFE)

10. What are the different types of accounting careers?

- Public accounting

- Private accounting

- Government accounting

- Not-for-profit accounting

- Forensic accounting

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Certified Professional Controller (CPC).

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Certified Professional Controller (CPC)‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Certified Professional Controller (CPC) plays a pivotal role within an organization, overseeing crucial financial and operational duties. This role requires expertise in numerous aspects, including:1. Financial Reporting and Disclosure

The CPC is entrusted with the preparation, analysis, and presentation of accurate and timely financial statements. This involves ensuring compliance with relevant accounting standards, such as GAAP or IFRS, and providing clear and concise information to stakeholders.

- Develop and implement financial reporting strategies.

- Oversee the preparation of financial statements, including balance sheets, income statements, and cash flow statements.

2. Internal Controls and Compliance

The CPC is responsible for establishing and maintaining a robust system of internal controls. They ensure that proper policies and procedures are in place to prevent fraud, errors, and unauthorized access to financial information.

- Develop and implement internal control policies and procedures.

- Monitor and evaluate the effectiveness of internal controls.

3. Budgeting and Forecasting

The CPC plays a key role in developing and managing budgets and forecasts. They analyze financial data to identify trends, make projections, and assist in strategic planning.

- Develop and implement budgeting and forecasting processes.

- Monitor and evaluate budget performance.

4. Cost and Performance Analysis

The CPC analyzes financial and operational data to assess cost efficiency and overall performance. They identify areas for improvement and recommend strategies to optimize operations.

- Conduct cost and performance analysis.

- Identify opportunities for cost reduction and process improvement.

5. Compliance and Regulatory Oversight

The CPC ensures that the organization complies with all applicable laws, regulations, and industry standards. They stay up-to-date on changes in the regulatory landscape and advise the organization accordingly.

- Monitor and ensure compliance with applicable laws and regulations.

- Provide guidance and training on compliance matters.

Interview Preparation Tips

To ace an interview for a CPC position, candidates should follow these preparation tips:1. Research the Organization and Position

Thoroughly research the organization’s background, industry, and financial performance. Understand the specific responsibilities of the CPC role and how it aligns with the organization’s overall goals.

- Visit the organization’s website and social media profiles.

- Read industry news and articles to gain insights into the organization’s operations.

2. Practice Your Communication Skills

Effective communication is crucial for CPCs. Practice articulating your thoughts clearly and concisely, both verbally and in writing. Prepare examples of your communication skills from previous work experiences.

- Role-play interview questions with a friend or colleague.

- Prepare a brief presentation on a topic related to financial reporting or internal controls.

3. Highlight Your Technical Skills and Experience

Emphasize your technical skills in financial reporting, internal controls, budgeting, and cost analysis. Quantify your accomplishments using specific metrics and examples to demonstrate your impact on the organization.

- Prepare a portfolio of your work samples, such as financial statements or internal control reports.

- Be prepared to discuss your experience in implementing new accounting standards or improving internal control systems.

4. Demonstrate Your Industry Knowledge

Stay up-to-date on the latest trends in financial reporting and regulation. Be prepared to discuss how these trends may impact the organization and the role of the CPC.

- Attend industry conferences and webinars.

- Read industry publications and articles.

5. Prepare Questions for the Interviewer

Asking thoughtful questions at the end of the interview demonstrates your interest in the position and the organization. Prepare questions that focus on the company’s financial reporting practices, industry challenges, and growth opportunities.

- Research the interviewer’s background and ask specific questions related to their experience.

- Inquire about the organization’s plans for future growth and how the CPC role will contribute to those plans.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Certified Professional Controller (CPC) role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.