Are you gearing up for an interview for a Certified Public Accountant (CPA) position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Certified Public Accountant (CPA) and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

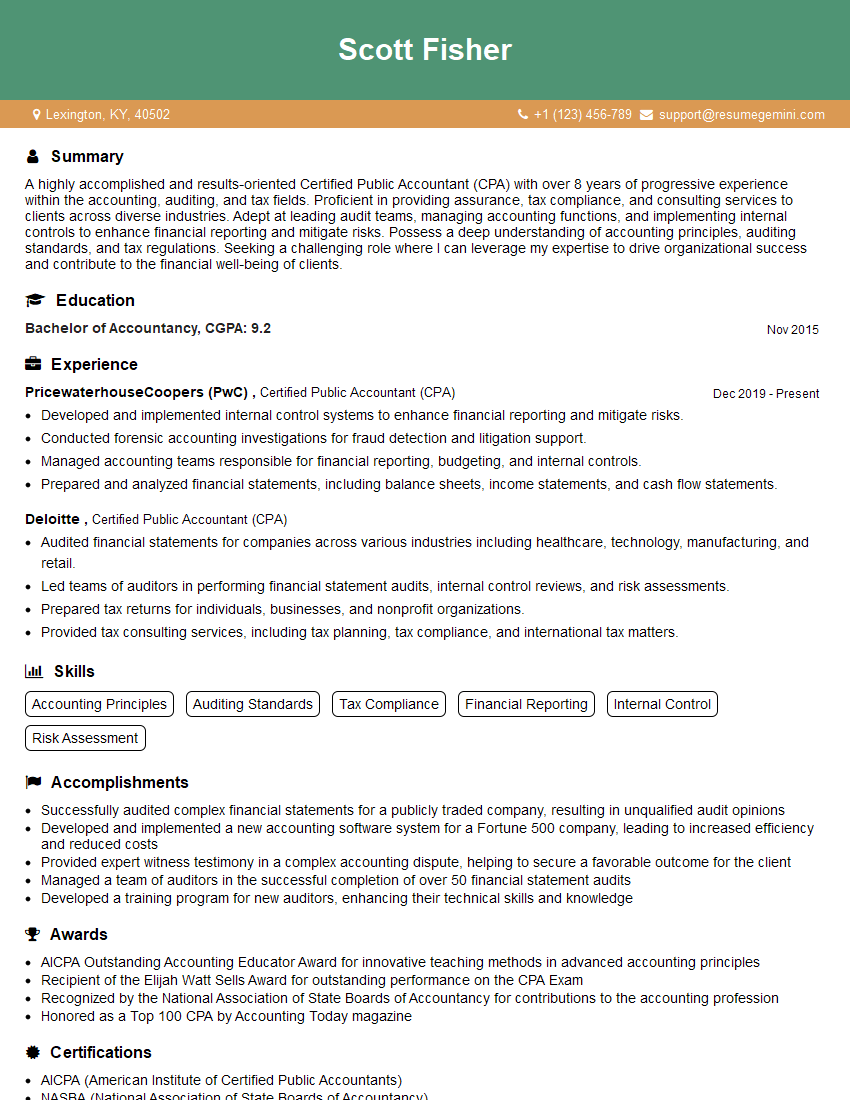

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Certified Public Accountant (CPA)

1. How would you approach an audit of a company with a complex inventory system that uses multiple warehouses?

– I would begin by gaining an understanding of the company’s business and its inventory system. – I would then develop an audit plan that would include the following steps: – Assessing the risk of inventory misstatement – Designing and performing analytical procedures – Testing the accuracy of the inventory records – Observing the physical inventory count – Evaluating the company’s inventory control procedures

2. What are some of the key differences between a financial audit and an operational audit?

Financial Audit

- Focuses on the accuracy and reliability of financial information.

- Concerns the financial statements.

- Often performed by external auditors.

- May be required by law or regulation.

Operational Audit

- Focuses on the efficiency and effectiveness of operations.

- Concerns the processes and procedures of an organization.

- Often performed by internal auditors.

- Not required by law or regulation.

3. Walk me through the steps involved in preparing a consolidated financial statement.

– Combine the financial statements of two or more entities. – Requires the elimination of inter-entity transactions and balances. – Eliminations ensure that the consolidated financial statements do not contain double counting. – The resulting consolidated financial statements provide a view of the combined entity as a single economic unit.

4. What are some of the ethical considerations that a CPA must be aware of when conducting an audit?

– Confidentiality: Accountants must keep client information confidential. – Integrity: Accountants must act with integrity and objectivity. – Independence: Accountants must be independent of their clients. – Professionalism: Accountants must adhere to the AICPA’s Code of Professional Conduct. – Objectivity: Accountants must avoid conflicts of interest and personal bias.

5. How would you audit a company’s internal control system?

– Understand the company’s business and its internal control system. – Assess the risk of material misstatement. – Design and perform audit procedures to test the effectiveness of the internal control system. – Evaluate the results of the audit procedures and issue an opinion on the effectiveness of the internal control system.

6. What are some of the common fraud schemes that you have encountered in your experience?

– Financial statement fraud – Asset misappropriation – Corruption – Identity theft – Cybercrime

7. How would you investigate a suspected case of fraud?

– Gather evidence to support the suspicion of fraud. – Interview witnesses and collect documents. – Analyze financial data and other information. – Determine the extent of the fraud and its impact on the company. – Report the findings of the investigation to management and the appropriate authorities.

8. What are some of the recent developments in accounting that you are aware of?

– The adoption of new accounting standards, such as IFRS 16 Leases. – The increasing use of data analytics in auditing. – The rise of blockchain technology.

9. How do you stay up-to-date on the latest accounting developments?

– I read accounting journals and articles. – I attend conferences and webinars. – I take continuing education courses.

10. Why are you interested in this position?

– I am confident that my skills and experience would be a valuable asset to your team. – I am eager to learn more about your company and the challenges that you are facing. – I am confident that I can make a significant contribution to your organization.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Certified Public Accountant (CPA).

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Certified Public Accountant (CPA)‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Certified Public Accountants (CPAs) are financial professionals that provide various accounting, auditing, and tax-related services. They are highly trained professionals with a deep understanding of accounting principles, financial reporting standards, and auditing procedures.

1. Financial Statement Audits

CPAs are responsible for conducting financial statement audits to assess the accuracy and fairness of a company’s financial statements. They review the company’s accounting records, systems, and controls and provide an opinion on the reliability of the statements.

- Review financial records and perform analytical procedures to assess the accuracy and completeness of financial information

- Evaluate internal controls to ensure reliability of financial reporting

2. Tax Preparation and Planning

CPAs provide tax preparation and planning services to individuals and businesses. They prepare tax returns, advise on tax laws and regulations, and develop strategies to minimize tax liabilities.

- Prepare individual and business tax returns

- Advise on tax laws and regulations

- Develop tax planning strategies to minimize liabilities

3. Accounting and Financial Reporting

CPAs provide accounting and financial reporting services to businesses. They help businesses maintain their accounting records, prepare financial statements, and comply with applicable financial reporting standards.

- Maintain accounting records and prepare financial statements

- Comply with financial reporting standards (e.g., GAAP, IFRS)

- Provide management with financial analysis and reporting

4. Consulting and Advisory Services

CPAs also provide consulting and advisory services to businesses. They help businesses improve their accounting and financial management practices, develop and implement internal controls, and make informed business decisions.

- Provide consulting on accounting and financial management practices

- Develop and implement internal controls

- Advise on business decisions and strategies

Interview Tips

To prepare effectively for a CPA interview, there are several tips and tricks that candidates can follow to increase their chances of success.

1. Research the Company

Before the interview, it is crucial for candidates to thoroughly research the company they are applying to. This includes understanding the company’s size, industry, financial performance, and recent news or developments. It is also helpful to review the company’s website and social media pages to gather additional information about their culture and values.

- Visit the company’s website and social media pages

- Read news articles and press releases about the company

- Check industry reports and financial statements

2. Practice Answering Common Questions

There are several common questions that are frequently asked in CPA interviews. Candidates should anticipate these questions and prepare thoughtful responses that highlight their skills, experience, and qualifications.

- Tell me about your experience with financial statement audits

- What is your understanding of Generally Accepted Accounting Principles (GAAP)?

- How do you stay up-to-date on tax laws and regulations?

3. Highlight Your Technical Skills

Interviewers will be eager to assess candidates’ technical skills and knowledge. Candidates should be prepared to discuss their proficiency in accounting software, auditing procedures, and tax preparation. They should also be able to demonstrate their understanding of financial reporting standards and industry best practices.

- List relevant skills on your resume and be able to elaborate on them

- Provide examples of projects or assignments that showcase your technical abilities

- Consider obtaining certifications or licenses that demonstrate your expertise

4. Showcase Your Communication Abilities

In addition to technical skills, strong communication abilities are essential for CPAs. Interviewers will be looking for candidates who can clearly and effectively communicate complex financial information to clients, colleagues, and management. Candidates should be prepared to participate in group discussions or deliver presentations during the interview process.

- Practice active listening and nonverbal communication skills

- Prepare examples of challenging conversations or presentations you have handled successfully

- Use clear and concise language when answering questions

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Certified Public Accountant (CPA) role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.