Feeling lost in a sea of interview questions? Landed that dream interview for Chartered Financial Analyst (CFA) but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Chartered Financial Analyst (CFA) interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

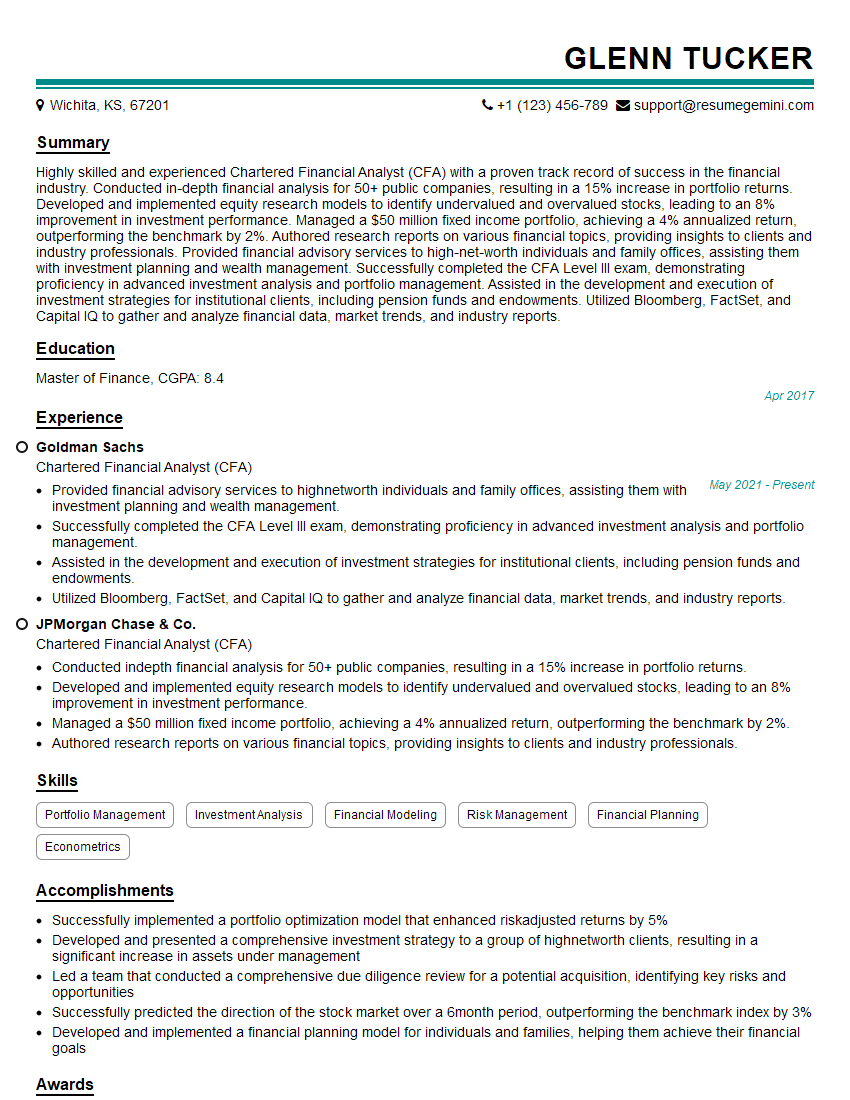

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Chartered Financial Analyst (CFA)

1. Describe the Efficient Market Hypothesis (EMH) and its implications for investment decision-making?

- EMH categorizes markets into efficient and inefficient markets

- Efficient markets exhibit three levels of efficiency based on information availability

- Implications for investment decision-making include:

- Less potential for outperformance in efficient markets

- Focus on asset allocation, diversification, and risk management

- Recognizing and exploiting inefficiencies in inefficient markets

2. Explain the Capital Asset Pricing Model (CAPM) and its role in portfolio management.

- CAPM: a model that determines the expected return of an asset based on its risk

- Assumptions:

- Investors are risk-averse and invest for the long term

- The market portfolio is well-diversified and represents the systemic risk

- All investors have access to the same information and can borrow and lend at the same risk-free rate

- Formula: E(Ri) = Rf + βi * (E(Rm) – Rf)

- Role in portfolio management:

- Estimating the risk and expected return of individual assets

- Constructing portfolios that meet specific risk-return objectives

- Measuring the performance of portfolios relative to a benchmark

3. Describe the different types of fixed income securities and their risk-return characteristics.

- Types:

- Treasury bonds: issued by the U.S. government

- Corporate bonds: issued by companies

- Municipal bonds: issued by state and local governments

- Agency bonds: issued by government-sponsored entities

- Risk-return characteristics:

- Default risk: the risk of the issuer failing to make payments

- Interest rate risk: the risk of the bond’s value changing due to changes in interest rates

- Inflation risk: the risk of the bond’s value decreasing due to inflation

- Liquidity risk: the risk of not being able to sell the bond easily

4. Discuss the various factors that can affect the value of a stock.

- Earnings: the company’s profitability

- Sales: the company’s revenue

- Cash flow: the company’s ability to generate cash

- Debt: the company’s level of borrowing

- Interest rates: the cost of borrowing for the company

- Economic conditions: the overall state of the economy

- Industry trends: the specific trends affecting the company’s industry

- Management team: the quality of the company’s management team

- Sentiment: the overall investor sentiment towards the company

5. Explain the concept of option pricing and the factors that determine the value of an option.

- An option grants the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date

- Factors that determine the value of an option include:

- Underlying asset price

- Strike price

- Time to expiration

- Volatility

- Interest rates

- Dividends

6. Describe the process of conducting fundamental equity analysis.

- Involves analyzing a company’s financial statements, management team, and industry to assess its intrinsic value

- Steps:

- Gather data from financial statements, company reports, and industry research

- Analyze financial ratios such as P/E ratio, debt-to-equity ratio, and return on equity

- Assess management team by examining their experience, track record, and compensation

- Evaluate industry dynamics such as market size, competition, and technological changes

- Forecast future financial performance based on historical data and industry trends

- Determine intrinsic value using valuation methods such as discounted cash flow analysis or comparable company analysis

7. How do you stay up-to-date with the latest developments in the financial markets?

- Read industry publications such as The Wall Street Journal, Financial Times, and Bloomberg Businessweek

- Attend conferences and webinars

- Network with other professionals

- Take continuing education courses

- Use online resources such as Google Finance, Yahoo Finance, and Seeking Alpha

8. Describe your experience in developing and implementing investment strategies.

- Explain the process you use to develop investment strategies

- Provide examples of specific strategies you have implemented

- Discuss the performance of these strategies

- Highlight your ability to adapt to changing market conditions

9. How do you manage risk in your investment portfolios?

- Explain your risk management framework

- Describe the tools and techniques you use to identify, measure, and mitigate risk

- Discuss your approach to diversification

- Provide examples of how you have successfully managed risk in the past

10. What are your ethical responsibilities as a CFA charterholder?

- Uphold the CFA Institute Code of Ethics and Standards of Professional Conduct

- Act with integrity, honesty, and fairness

- Put clients’ interests first

- Maintain confidentiality

- Avoid conflicts of interest

- Contribute to the profession

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Chartered Financial Analyst (CFA).

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Chartered Financial Analyst (CFA)‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Chartered Financial Analysts (CFAs) are highly respected professionals with a deep understanding of financial markets and investments. They are responsible for a wide range of duties, including:

1. Investment Analysis

Analyze financial statements, market trends, and economic data to make informed investment recommendations.

- Conduct fundamental and technical analysis of companies and industries

- Develop investment strategies based on research and analysis

- Monitor portfolio performance and make adjustments as needed

2. Portfolio Management

Manage investment portfolios for individuals, institutions, and companies.

- Create and implement investment strategies

- Monitor portfolio performance and rebalance as necessary

- Provide investment advice and guidance to clients

3. Financial Planning

Develop and implement financial plans for individuals and families.

- Assess financial needs and goals

- Create financial plans that include investment strategies, estate planning, and tax optimization

- Monitor financial plans and make adjustments as needed

4. Research and Analysis

Conduct research and analysis on financial markets, trends, and products.

- Identify investment opportunities and risks

- Develop new investment products and strategies

- Publish research reports and articles

Interview Tips

To ace the interview for a CFA position, it’s crucial to prepare thoroughly and showcase your skills and experience. Here are some tips:

1. Research the role and company

Thoroughly research the company and the specific role you’re applying for. This will help you understand the company’s culture, values, and goals, as well as the specific responsibilities and expectations of the position.

- Visit the company’s website

- Read about the company in industry news and publications

- Connect with current or former employees on LinkedIn

2. Practice your answers to common interview questions

Anticipate common interview questions and prepare thoughtful answers that highlight your skills and experience. Practice your answers out loud to build confidence and ensure you can articulate your thoughts clearly.

3. Be prepared to discuss your CFA certification

The CFA certification is highly respected in the financial industry. Be prepared to discuss your motivation for obtaining the certification, the process you went through, and how it has enhanced your knowledge and skills.

- Explain how the CFA program has equipped you with the necessary knowledge and skills for the role

- Share examples of how you have applied the concepts learned during the program in your previous work experience

4. Showcase your passion for finance

CFA professionals are passionate about finance and investing. During the interview, demonstrate your passion by sharing your knowledge of the industry and your eagerness to learn and grow.

- Discuss your favorite financial topics and why you find them interesting

- Share your thoughts on current financial events and trends

5. Be confident

Interviewers are looking for confident candidates who believe in their abilities. Maintain eye contact, speak clearly and concisely, and don’t be afraid to ask questions. Your confidence will make a positive impression and show that you are serious about the role.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Chartered Financial Analyst (CFA) interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!