Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Check Clerk interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Check Clerk so you can tailor your answers to impress potential employers.

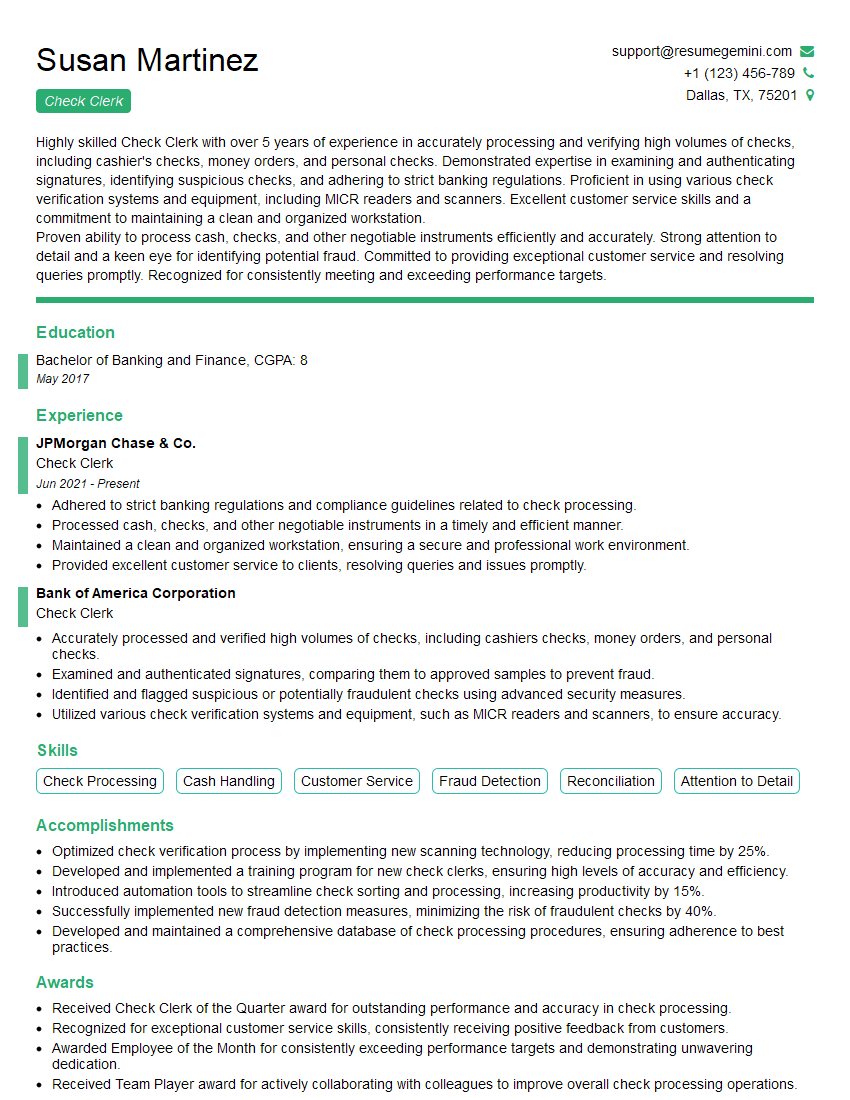

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Check Clerk

1. Describe the process of reconciling bank statements?

The process of reconciling bank statements involves comparing the bank’s records with the company’s records to ensure that both sets of records match.

- The first step is to gather all necessary documents, including the bank statement, the company’s check register, and any other relevant documents.

- Next, the bank statement is reviewed to identify any discrepancies between the bank’s records and the company’s records.

- Any discrepancies are then investigated to determine the cause of the discrepancy.

- Once the cause of the discrepancy has been determined, the necessary adjustments are made to the company’s records.

- Finally, the bank statement is reconciled with the company’s records to ensure that both sets of records match.

2. What are the different types of checks that you have processed?

Certified checks

- A certified check is a check that has been guaranteed by the bank. This means that the bank has verified that the check writer has sufficient funds in their account to cover the amount of the check.

Cashier’s checks

- A cashier’s check is a check that is drawn on the bank’s own account. This means that the check is guaranteed by the bank and is not subject to being returned for insufficient funds.

Personal checks

- A personal check is a check that is drawn on the check writer’s own account. Personal checks are not guaranteed by the bank and are subject to being returned for insufficient funds.

Traveler’s checks

- Traveler’s checks are checks that are designed for use by people who are traveling. Traveler’s checks are typically issued in denominations of $100, $500, and $1,000 and can be used to make purchases or to withdraw cash from banks and other financial institutions.

3. What are the different methods of depositing checks?

There are several different methods of depositing checks, including:

- In person at a bank branch

- Using a mobile banking app

- Using an ATM

- By mail

4. What are the different types of holds that can be placed on a check?

There are several different types of holds that can be placed on a check, including:

- A hold for insufficient funds

- A hold for fraud prevention

- A hold for verification of the check writer’s identity

5. What are the different types of fees that can be charged for check processing?

There are several different types of fees that can be charged for check processing, including:

- A check cashing fee

- A stop payment fee

- A returned check fee

6. What are the different types of reports that you have generated as a Check Clerk?

As a Check Clerk, I have generated a variety of reports, including:

- Daily check processing reports

- Monthly check processing reports

- Reports on check holds

- Reports on check returns

7. What are the different types of software that you have used as a Check Clerk?

As a Check Clerk, I have used a variety of software, including:

- Check processing software

- Imaging software

- Reporting software

8. What are the different types of security measures that you have implemented as a Check Clerk?

As a Check Clerk, I have implemented a variety of security measures to protect against fraud and other security risks, including:

- Verifying the identity of check writers

- Checking for forged or altered checks

- Storing checks in a secure location

9. What are the different types of customer service skills that you have used as a Check Clerk?

As a Check Clerk, I have used a variety of customer service skills to assist customers, including:

- Answering questions about check processing

- Resolving customer complaints

- Providing information about bank products and services

10. What are the different types of problem-solving skills that you have used as a Check Clerk?

As a Check Clerk, I have used a variety of problem-solving skills to resolve issues, including:

- Investigating and resolving check holds

- Resolving customer disputes

- Identifying and correcting errors in check processing

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Check Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Check Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Check Clerks are essential for ensuring the smooth flow of financial transactions. Their primary duties involve verifying, recording, handling and safeguarding checks.

1. Check Verification

Check Clerks meticulously examine checks to authenticate their validity. They verify signatures, amounts, dates, and other crucial information against records, ensuring the checks are legitimate and complete.

- Cross-checking check details against account records

- Identifying potential fraud or errors

2. Record Keeping

Meticulous record-keeping is another key responsibility. Check Clerks capture essential details from each check, including check numbers, amounts, dates, account information, and any relevant notes.

- Maintaining accurate logs and registers

- Documenting all check-related transactions

3. Cash Handling

Depending on the organization, Check Clerks may handle cash transactions. They prepare and process cash payments, ensuring accurate accounting and proper handling of funds.

- Counting, sorting, and distributing cash

- Maintaining cash drawers and reconciling amounts

4. Customer Service

Check Clerks occasionally interact with customers, answering inquiries, providing information, and assisting with check-related issues. They strive to deliver courteous and efficient customer service.

- Responding to customer queries and resolving concerns

- Maintaining confidentiality and professionalism

Interview Tips

Preparing for a Check Clerk interview requires thorough research and thoughtful consideration of your skills and experiences. Here are some tips to help you ace the interview:

1. Research the Company and Position

Take the time to learn about the company’s industry, services, and culture. Understanding the specific responsibilities of the Check Clerk role will help you tailor your answers and demonstrate your suitability.

- Visit the company website and social media

- Read industry news and articles

2. Highlight Relevant Skills and Experience

Emphasize your meticulous attention to detail, accuracy, and ability to handle sensitive financial information. Showcase any previous experience in cash handling, record-keeping, or customer service.

- Quantify your accomplishments with specific examples

- Prepare examples that demonstrate your integrity and trustworthiness

3. Practice Answering Common Questions

Anticipate questions about your work habits, accuracy, and ability to handle pressure. Prepare thoughtful responses that highlight your strengths and enthusiasm for the role.

- Research common interview questions

- Rehearse your answers out loud

4. Dress Professionally and Arrive Punctually

Present yourself in a professional manner, as this reflects your attention to detail and respect for the interviewer. Punctuality demonstrates your reliability and eagerness.

- Choose appropriate business attire

- Arrive for your interview on time

5. Ask Insightful Questions

At the end of the interview, take the opportunity to ask thoughtful questions. This shows your interest in the role and the company, and it provides you with an opportunity to clarify any uncertainties.

- Prepare questions about the company’s culture, growth opportunities, or specific responsibilities

- Avoid asking questions that are easily answered through research

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Check Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!