Are you gearing up for an interview for a Check Examiner position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Check Examiner and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

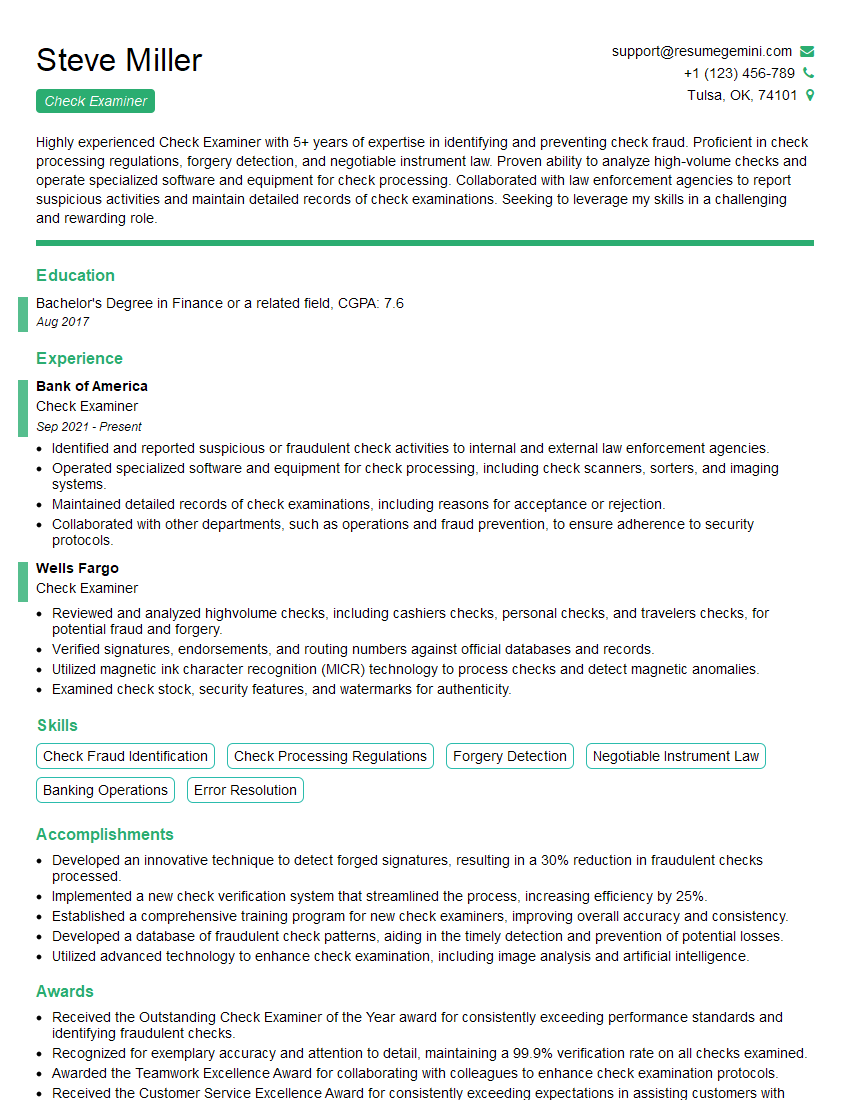

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Check Examiner

1. Which key factors do you consider when determining the validity and reliability of a check?

- The authenticity of the check

- The identity of the check writer

- The presence of proper signatures

- The absence of alterations or erasures

2. How do you handle a situation where a customer disputes the amount on a check?

Investigate the Dispute

- Interview the customer to understand their concerns

- Review the check and supporting documents

- Contact the check writer to obtain their perspective

Determine the Validity of the Dispute

- Analyze the evidence gathered

- Consider applicable laws and regulations

- Weigh the credibility of witnesses

Resolve the Dispute

- Communicate the findings to both parties

- Facilitate a resolution that is fair and equitable

- Document the outcome and any actions taken

3. What are the common types of check fraud?

- Counterfeiting

- Forgery

- Embezzlement

- Identity theft

- Check washing

4. How do you stay up-to-date on the latest trends in check fraud?

- Attending industry conferences and workshops

- Reading industry publications and research reports

- Participating in professional organizations

- Consulting with law enforcement and other experts

5. What is the importance of maintaining confidentiality when handling check fraud cases?

- Protecting the privacy of victims and witnesses

- Preventing the spread of false or misleading information

- Maintaining the integrity of the investigation

6. How do you prioritize check fraud cases?

- Severity of the fraud

- Likelihood of successful prosecution

- Potential for financial loss

- Impact on the community

7. What are the challenges you have faced as a Check Examiner?

- The increasing sophistication of check fraud techniques

- The need to stay up-to-date on the latest trends in check fraud

- The importance of maintaining confidentiality and objectivity

8. How do you ensure accuracy and consistency in your work?

- Following established procedures and protocols

- Utilizing checklists and other tools

- Seeking regular feedback and training

9. What makes you a good fit for this role?

- Proven experience in check examination

- Strong knowledge of check fraud detection techniques

- Exceptional attention to detail and accuracy

- Excellent communication and interpersonal skills

10. What are your career goals and how does this position align with them?

- To become a leading expert in check fraud detection

- To develop innovative techniques to combat check fraud

- To contribute to the safety and security of the financial system

- This position provides me with the opportunity to apply my skills and knowledge to achieve these goals

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Check Examiner.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Check Examiner‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Check Examiners play a crucial role in the banking and financial industry, ensuring the accuracy and validity of financial transactions.

1. Check Processing

Examine and verify checks for authenticity, completeness, and accuracy of information, such as signatures, endorsements, dates, and amounts.

- Compare checks against authorized signatures and endorsemets.

- Check for alterations, erasures, or counterfeits.

2. Compliance and Fraud Detection

Review checks for compliance with banking regulations and internal policies to prevent fraud and errors.

- Identify suspicious transactions and potential fraudulent activities.

- Report any irregularities or suspected illegal activities to supervisors.

3. Customer Service

Respond to customer inquiries and provide information related to check processing and fraud prevention.

- Explain banking procedures and policies to customers.

- Assist in resolving check-related issues and disputes.

4. Record Keeping

Maintain detailed records of checks processed, including images, notes, and any irregularities detected.

- Document all findings and actions taken for audits and compliance purposes.

- Keep records organized and accessible for future reference.

Interview Tips

Preparing thoroughly for a Check Examiner interview can significantly increase your chances of success.

1. Research the Company and Position

Learn about the bank’s reputation, its products and services, and the specific requirements of the Check Examiner role.

- Visit the company’s website and social media pages.

- Read industry news and articles to stay informed about banking trends.

2. Highlight Relevant Skills and Experience

Emphasize your attention to detail, analytical abilities, and problem-solving skills.

- Showcase your experience in check processing, financial analysis, or customer service.

- Quantify your accomplishments using specific metrics and results.

3. Practice Common Interview Questions

Prepare answers to common interview questions, such as:

- Why are you interested in becoming a Check Examiner?

- Describe a time when you detected fraudulent activity.

- How do you stay up-to-date on industry regulations and best practices?

4. Dress Professionally and Be Punctual

First impressions matter, so dress in business attire and arrive for your interview on time.

- Maintain a positive and confident attitude throughout the interview.

- Be respectful of the interviewer’s time and answer questions concisely.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Check Examiner interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!