Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Check Writer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

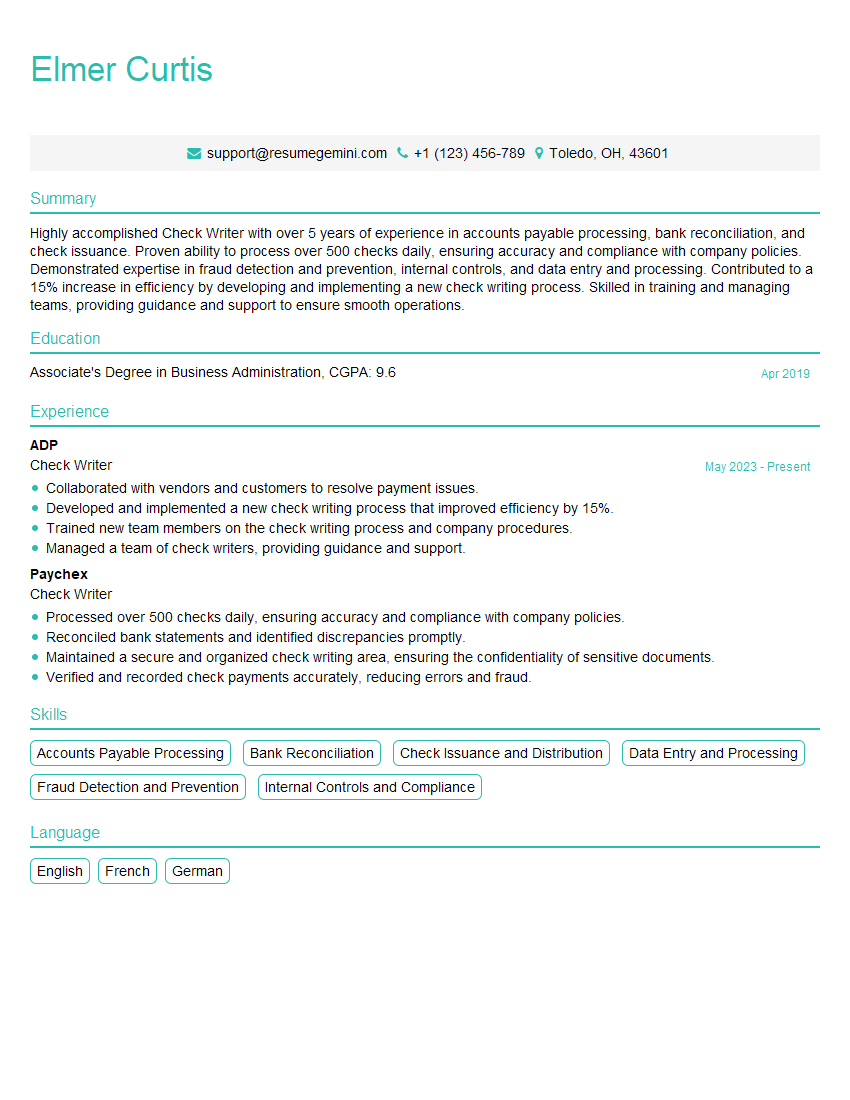

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Check Writer

1. What is the difference between a cashier’s check and a personal check?

- A cashier’s check is a check drawn by a bank on its own funds, while a personal check is drawn by an individual on their own account.

- Cashier’s checks are considered to be more secure than personal checks because they are guaranteed by the bank, while personal checks are only guaranteed by the individual’s account balance.

- Cashier’s checks are typically used for larger purchases or transactions where security is important, while personal checks are more commonly used for everyday purchases.

2. What are the different types of endorsements?

Blank Endorsement

- Simply signing your name on the back of the check.

- Makes the check payable to anyone, bearer.

Restrictive Endorsement

- Specify who the check is payable to.

- For example, “Pay to the order of [name of person or business].”

3. What are the steps involved in processing a check?

- Verify the check is signed and dated.

- Check the amount of the check.

- Check the payee.

- Check the endorsement.

- Process the check through the bank.

4. What are the most common types of check fraud?

- Counterfeit checks: These checks are created to look like real checks, but they are actually fake.

- Forged checks: These checks are altered to change the amount or the payee.

- Stolen checks: These checks are stolen from individuals or businesses and then used to make fraudulent purchases.

5. What are the best practices for preventing check fraud?

- Use security features on checks, such as watermarks and holograms.

- Be careful about who you give checks to.

- Keep your checks in a safe place.

- Report any lost or stolen checks to your bank immediately.

6. What are the most common types of check errors?

- Incorrect amount

- Incorrect date

- Incorrect payee

- Missing signature

- Missing endorsement

7. What are the best practices for correcting check errors?

- Contact the person or business who issued the check.

- Explain the error and provide a copy of the check.

- Request a new check or ask them to correct the error on the original check.

8. What are the different types of check clearing?

Standard Check Clearing

- Takes several days for the check to be processed and the funds to be available.

- Most common type of check clearing.

Next-Day Check Clearing

- Funds are available the next business day after the check is deposited.

- Available for a fee.

Same-Day Check Clearing

- Funds are available the same day the check is deposited.

- Available for a fee.

9. What are the benefits of using a check writer?

- Saves time

- Improves accuracy

- Helps prevent fraud

- Provides a record of all checks written

10. How do you choose the right check writer for your business?

- Consider the volume of checks you write each month.

- Consider the features you need, such as MICR printing.

- Compare the prices of different check writers.

- Read reviews of different check writers.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Check Writer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Check Writer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

1. Issue and Record Financial Documents

– Prepare and issue checks, ACH, or wire transfers for payments to vendors, employees, and other entities – Record and track all financial transactions in a timely and accurate manner – Reconcile bank statements and identify any discrepancies

2. Maintain Financial Records

– File and maintain physical and electronic financial records, including invoices, receipts, and bank statements – Archive financial documents in compliance with company policies – Prepare reports on financial activities as requested

3. Manage Accounts Payable

– Process and approve invoices for payment – Communicate with vendors and resolve any payment issues – Monitor accounts payable aging reports and ensure timely payments

4. Ensure Compliance with Financial Regulations

– Adhere to all applicable laws and regulations governing financial transactions – Maintain strong internal controls over financial processes – Report any suspected fraud or financial irregularities immediately

Interview Tips

1. Research the Company and Position

– Thoroughly research the company’s industry, products or services, and company culture. – Carefully review the job description and identify the key skills and responsibilities. – Prepare specific questions about the role and company to ask during the interview.

2. Highlight Relevant Skills and Experience

– Emphasize your skills in financial management, accounts payable, and check writing. – Provide specific examples of your accomplishments in these areas. – Quantify your results whenever possible, using metrics to demonstrate your impact.

3. Practice Common Interview Questions

– Prepare for common interview questions, such as: – Tell me about yourself and your experience. – Why are you interested in this position? – What are your strengths and weaknesses?

4. Be Enthusiastic and Professional

– Demonstrate enthusiasm for the role and the company. – Dress professionally and arrive on time for your interview. – Maintain eye contact and engage actively in the conversation. – Thank the interviewer for their time and express your interest in the position.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Check Writer interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!