Feeling lost in a sea of interview questions? Landed that dream interview for Checkman but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Checkman interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

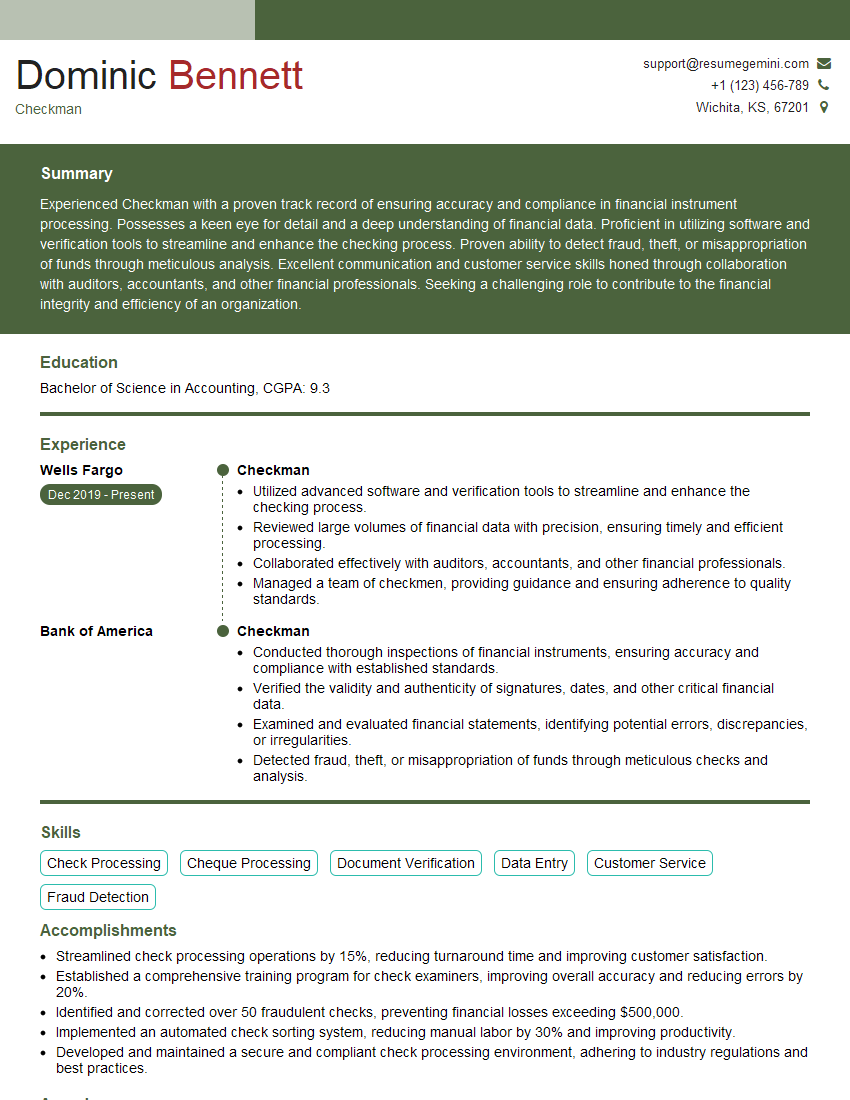

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Checkman

1. What are the different types of checks that a Checkman can perform?

As a Checkman, I am well-versed in performing various types of checks, including:

- Cheque verification: Verifying the authenticity and validity of cheques, including identifying forged or altered cheques.

- Credit checks: Assessing an individual’s or entity’s creditworthiness and financial history.

- Background checks: Conducting thorough investigations into an individual’s past, including criminal history, employment history, and references.

- Identity checks: Verifying an individual’s identity through various means, such as document examination, biometric checks, and facial recognition.

- Asset checks: Determining the ownership and value of assets, including real estate, vehicles, and financial accounts.

2. Can you describe your experience in identifying and preventing fraud?

Fraud Detection

- Utilized advanced fraud detection techniques to identify suspicious transactions and patterns.

- Examined account statements, transaction histories, and other relevant documentation to uncover anomalies.

- Analyzed customer behavior and identified inconsistencies or deviations from established patterns.

Fraud Prevention

- Implemented fraud prevention measures, such as strong authentication protocols and secure data encryption.

- Educated customers on fraud prevention techniques and best practices.

- Collaborated with law enforcement and regulatory authorities to combat fraud and protect clients.

3. What are the ethical and legal considerations you must adhere to as a Checkman?

As a Checkman, I am committed to maintaining the highest ethical and legal standards in my work:

- Confidentiality: Ensuring the privacy of sensitive information and maintaining the confidentiality of client data.

- Accuracy and Objectivity: Conducting thorough and impartial investigations, providing accurate and unbiased reports.

- Compliance with Laws and Regulations: Adhering to all applicable laws and regulations, including data protection and anti-money laundering legislation.

- Professional Conduct: Maintaining a high level of professionalism, integrity, and ethical behavior.

- Conflicts of Interest: Disclosing any potential conflicts of interest and taking appropriate steps to avoid bias.

4. How do you stay updated on the latest trends and developments in the Checkman industry?

- Attending industry conferences and workshops.

- Reading industry publications and research papers.

- Participating in online forums and discussion groups.

- Networking with other professionals in the field.

- Seeking opportunities for professional development and training.

5. Describe a challenging case you encountered as a Checkman and how you resolved it.

In one instance, I was tasked with verifying the authenticity of a large number of cheques presented for payment by a new client. Upon closer examination, I discovered several inconsistencies and suspicious patterns in the cheque design and signatures. Through further investigation, I identified forged signatures and altered cheque numbers. I promptly alerted the relevant authorities and assisted in apprehending the perpetrators. The timely detection of the fraud prevented significant financial losses for the client.

6. How do you handle cases involving sensitive or confidential information?

- Maintaining strict confidentiality protocols and following established security guidelines.

- Accessing and processing sensitive information only on a need-to-know basis.

- Storing and transmitting data securely using encryption and access controls.

- Shredding or securely disposing of confidential documents after use.

- Reporting any unauthorized access or suspected breaches to the appropriate authorities.

7. Can you explain how you use technology to enhance your work as a Checkman?

- Automated cheque verification systems to detect forgeries and fraud.

- Database management systems to organize and analyze large volumes of data.

- Cloud-based platforms for secure storage and sharing of information.

- Artificial intelligence to identify patterns and anomalies in financial transactions.

- Biometric identification technology for secure and efficient identity verification.

8. How do you manage your workload and prioritize your tasks effectively?

- Utilizing project management tools to track progress and meet deadlines.

- Setting priorities based on the importance and urgency of tasks.

- Delegating responsibilities to team members when appropriate.

- Communicating effectively with clients to manage expectations and seek clarification.

- Continuously evaluating and refining workflows to improve efficiency.

9. What are your strengths and weaknesses as a Checkman?

Strengths:

- Exceptional analytical and investigative skills.

- Strong attention to detail and accuracy.

- Ability to work independently and as part of a team.

- Excellent communication and interpersonal skills.

- Proficient in using industry-specific technology and software.

Weaknesses:

- Can be overly meticulous at times, requiring conscious effort to maintain a balance between thoroughness and efficiency.

- While I am comfortable working under pressure, managing multiple high-priority tasks simultaneously can occasionally be challenging.

10. Why are you interested in working as a Checkman for our company?

I am eager to join your esteemed company as a Checkman due to its reputation for integrity, ethical conduct, and commitment to excellence in the industry. Your company’s focus on delivering high-quality services aligns perfectly with my values and aspirations. I believe that my skills and experience would be a valuable asset to your team, and I am confident that I can contribute significantly to your success.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Checkman.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Checkman‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Checkman is responsible for verifying the accuracy and completeness of financial transactions, documents, or other records. They ensure that all data is correct and that all necessary information is present. Common responsibilities include:

1. Verifying Data

Checks numerical data for accuracy, such as invoices, purchase orders, and other financial documents.

- Compares data against source documents to ensure accuracy.

- Verifies that all required information is present and complete.

2. Reviewing Documents

Reviews documents for completeness, accuracy, and compliance with company policies and procedures.

- Checks for missing or incomplete information.

- Ensures that all necessary signatures and approvals are obtained.

3. Investigating Discrepancies

Investigates any discrepancies or errors in data or documents and takes corrective action.

- Identifies and corrects errors in calculations.

- Resolves discrepancies between different sources of data.

4. Maintaining Records

Maintains accurate and complete records of all checks and verifications performed.

- Documents any errors or discrepancies found.

- Keeps records of all corrective actions taken.

Interview Tips

To prepare for an interview for a Checkman position, consider the following tips:

1. Research the Company and Position

Learn about the company’s industry, culture, and specific job requirements. This will help you tailor your answers to the interviewer’s questions.

- Visit the company’s website and social media pages.

- Read industry news and articles to stay up-to-date on trends.

2. Highlight Relevant Skills and Experience

Emphasize your skills in data verification, document review, and problem-solving. Provide specific examples of your work experience that demonstrate these abilities.

- Quantify your accomplishments whenever possible, using specific numbers and metrics.

- Use keywords from the job description in your resume and interview answers.

3. Practice Common Interview Questions

Prepare for common interview questions, such as “Tell me about your experience in data verification” and “How do you handle discrepancies in data?” Practice answering these questions concisely and effectively.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Focus on showcasing your skills and how they align with the company’s needs.

4. Dress Professionally and Be Punctual

First impressions matter, so dress professionally for your interview and arrive on time. Show the interviewer that you respect their time and that you are eager for the opportunity to work for their company.

- Choose clothing that is appropriate for the office environment.

- Make sure your clothes are clean, pressed, and fit well.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Checkman, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Checkman positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.