Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Chief Accountant position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

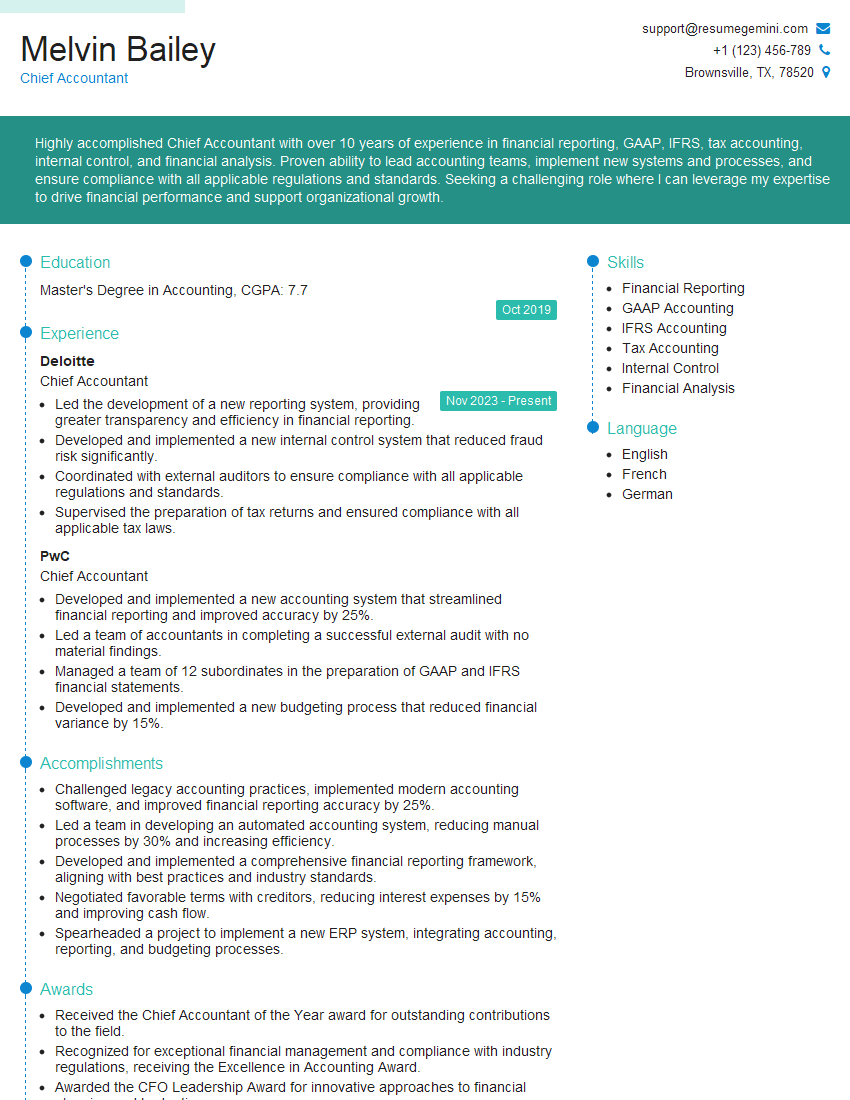

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Chief Accountant

1. How would you implement and maintain a system of internal controls within the accounting department?

- Establish clear policies and procedures for all accounting processes, including authorization, recording, and reconciliation.

- Implement a system of segregation of duties to prevent any single individual from having complete control over financial transactions.

- Require regular reviews of all accounting records and transactions by a qualified independent party, such as an internal auditor.

- Establish a system for reporting and investigating any suspected instances of fraud or financial irregularities.

- Provide ongoing training to all accounting staff on the importance of internal controls and how to maintain them.

2. What are the key financial ratios that you would monitor to assess the financial health of a company?

- Liquidity ratios: Current ratio, quick ratio, cash ratio

- Solvency ratios: Debt-to-equity ratio, times interest earned ratio, debt-to-asset ratio

- Profitability ratios: Gross profit margin, net profit margin, operating profit margin

- Efficiency ratios: Inventory turnover ratio, accounts receivable turnover ratio, accounts payable turnover ratio

- Return on investment ratios: Return on equity, return on assets, return on invested capital

3. How would you prepare a consolidated financial statement for a group of companies?

- Combine the financial statements of all the companies in the group, eliminating intercompany transactions and balances.

- Adjust the financial statements for any differences in accounting policies between the companies.

- Translate the financial statements of any foreign subsidiaries into the reporting currency.

- Prepare consolidated financial statements that present the financial position and results of operations of the group as a whole.

4. What are the key considerations when implementing a new accounting software system?

- Functional requirements: The system must be able to meet the specific accounting needs of the organization.

- Integration with other systems: The system must be able to integrate with other systems, such as ERP systems and CRM systems.

- Security: The system must be secure to protect financial data from unauthorized access.

- Cost: The cost of the system must be within the organization’s budget.

- Scalability: The system must be able to scale to meet the future needs of the organization.

5. How would you manage a team of accounting professionals?

- Set clear goals and expectations for each team member.

- Provide regular feedback and support to team members.

- Empower team members to make decisions and take ownership of their work.

- Foster a collaborative and supportive team environment.

- Recognize and reward team members for their contributions.

6. What are the emerging trends in accounting?

- The use of artificial intelligence and machine learning to automate accounting tasks.

- The adoption of cloud-based accounting systems.

- The increasing importance of data analytics in accounting.

- The growing focus on sustainability and environmental, social, and governance (ESG) reporting.

- The need for accountants to have a strong understanding of technology and business.

7. What are the ethical responsibilities of a Chief Accountant?

- To maintain confidentiality of financial information.

- To act with integrity and objectivity.

- To avoid conflicts of interest.

- To comply with all applicable laws and regulations.

- To report any suspected instances of fraud or financial irregularities.

8. What are your strengths and weaknesses as a Chief Accountant?

- Strengths:

- Strong technical accounting skills

- Experience in managing a team of accounting professionals

- Excellent communication and interpersonal skills

- Ability to work independently and as part of a team

- Strong work ethic

- Weaknesses:

- Lack of experience in a particular industry

- Not yet a CPA

- Can be a bit of a perfectionist

9. Why are you interested in this position?

- I am a highly skilled and experienced Chief Accountant with a proven track record of success.

- I am confident that I have the skills and experience necessary to be successful in this role.

- I am eager to learn more about your company and how I can contribute to your success.

10. Do you have any questions for me?

- What are the biggest challenges facing your company right now?

- What are your expectations for this role?

- What is the company’s culture like?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Chief Accountant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Chief Accountant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Chief Accountant is a senior-level accounting professional responsible for overseeing the accounting and financial reporting functions of an organization. Their key responsibilities include:

1. Financial Reporting and Analysis

Prepare and present financial statements in accordance with GAAP or other applicable standards

- Analyze financial data and trends to identify patterns and opportunities for improvement

2. Management of Accounting Operations

Supervise and manage the accounting team, ensuring accuracy and compliance in all accounting processes

- Review and approve journal entries, trial balances, and other financial documents

3. Internal Control and Compliance

Establish and maintain internal controls to ensure the accuracy and integrity of financial information

- Monitor compliance with all applicable accounting regulations and standards

4. Financial Planning and Forecasting

Develop and maintain financial plans and forecasts

- Participate in budgeting and strategic planning

Interview Tips

To ace the interview for a Chief Accountant position, it’s essential to prepare thoroughly and tailor your responses to the specific requirements of the role. Here are some tips:

1. Research the Organization and Position

Familiarize yourself with the organization’s industry, business model, and recent financial performance.

- Review the company’s website, annual reports, and news articles to gain insights into their operations and financial management practices.

2. Practice Common Interview Questions

Prepare for standard interview questions related to accounting, financial reporting, and management skills. Examples include:

- “Describe your experience in preparing and presenting financial statements.”

- “How do you ensure the accuracy and integrity of financial information?”

3. Highlight Relevant Skills and Experience

Emphasize your expertise in accounting principles, financial analysis, and internal control.

- Quantify your accomplishments and provide specific examples to demonstrate your impact on the organization.

- Explain how your skills and experience align with the key responsibilities of the Chief Accountant role.

4. Be Confident and Enthusiastic

Project a positive and professional demeanor during the interview.

- Be confident in your abilities and articulate your value proposition clearly.

- Express your interest in the role and demonstrate your enthusiasm for the organization and its mission.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Chief Accountant, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Chief Accountant positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.