Are you gearing up for a career in Chief Payroll Clerk? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Chief Payroll Clerk and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

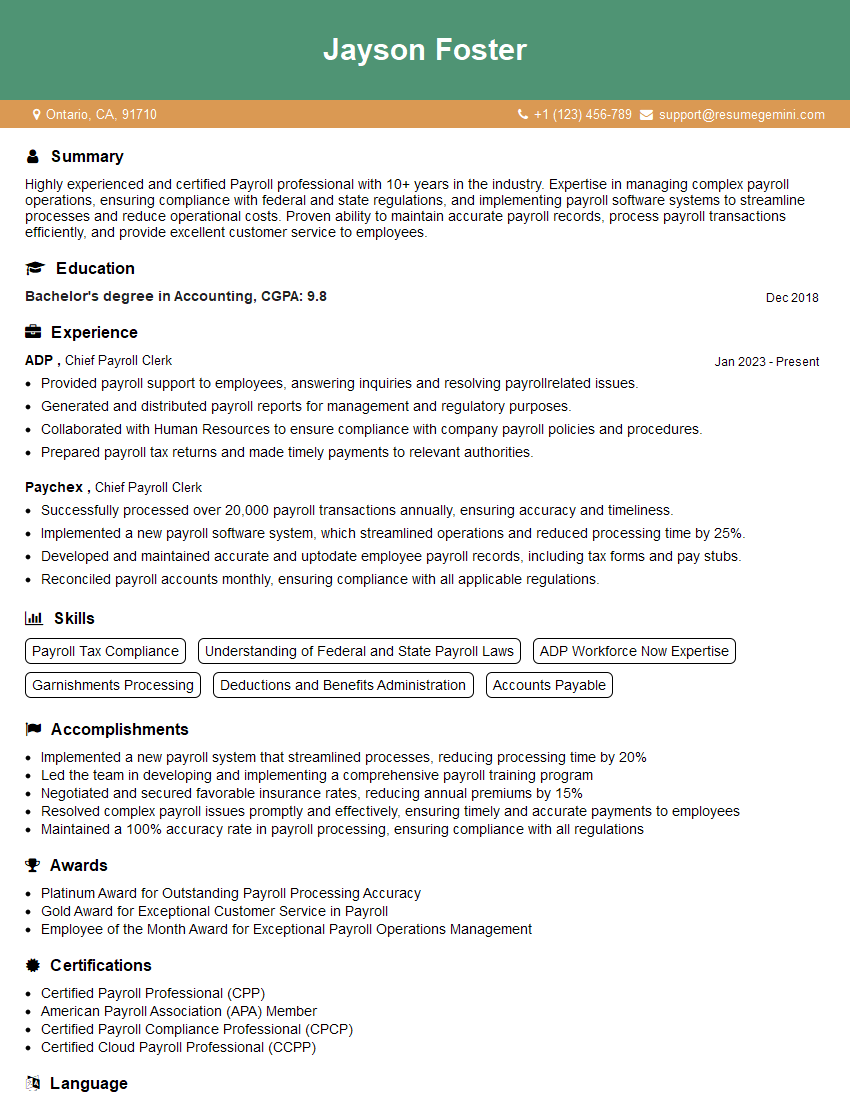

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Chief Payroll Clerk

1. Walk me through the step-by-step process you follow to calculate payroll and prepare paychecks?

- Collect timecards and other payroll-related documents from employees and managers.

- Verify hours worked, overtime, and other payroll data.

- Calculate gross pay based on hourly rates or salaries and applicable deductions.

- Apply payroll taxes (federal, state, local) and other deductions (health insurance, 401(k), etc.).

- Calculate net pay and issue paychecks or direct deposits.

- Prepare and file payroll reports and tax returns.

2. What are the key payroll laws and regulations that you must comply with?

Federal Laws

- Fair Labor Standards Act (FLSA)

- Social Security Act

- Medicare Act

- Unemployment Insurance Act

- Family and Medical Leave Act (FMLA)

State Laws

- State income tax laws

- State unemployment insurance laws

- State disability insurance laws

- State wage and hour laws

3. How do you handle payroll errors or discrepancies?

- Verify the error and determine its root cause.

- Contact the affected employee and explain the error.

- Make the necessary corrections to the payroll and issue a corrected paycheck or direct deposit.

- Document the error and corrective actions taken.

4. What are the most common types of payroll fraud, and how do you prevent them?

- Timecard fraud: Employees falsifying hours worked or punching in/out for others.

- Payroll theft: Unauthorized access or manipulation of payroll records to steal funds.

- Expense fraud: Employees submitting false or inflated expense claims.

- Preventative measures: Implement strong payroll controls, conduct regular audits, and train employees on payroll fraud awareness.

5. How do you stay up-to-date on changes to payroll laws and regulations?

- Attend industry conferences and webinars.

- Subscribe to payroll newsletters and publications.

- Review government websites and authoritative sources for the latest updates.

- Consult with legal counsel or payroll software providers for expert guidance.

6. Describe your experience with payroll software and how you leverage it to improve payroll efficiency.

- Proficiency in using payroll software to automate calculations and processes.

- Experience in customizing payroll software to meet specific organizational needs.

- Use of payroll software features to enhance accuracy, streamline reporting, and comply with regulations.

7. How do you ensure the confidentiality of employee payroll information?

- Maintain physical security of payroll records and computer systems.

- Limit access to payroll data only to authorized personnel.

- Educate employees on the importance of payroll confidentiality.

- Encrypt sensitive payroll information and use secure communication channels.

8. How do you handle employee inquiries or disputes related to payroll?

- Listen attentively to the employee’s concerns and gather all relevant information.

- Review payroll records and relevant documents to verify the accuracy of the payroll.

- Explain the payroll process and calculations to the employee.

- Address any errors or discrepancies promptly and fairly.

9. What are your strategies for improving payroll accuracy and efficiency?

- Implement automated payroll processes using software.

- Establish clear payroll procedures and train staff on them.

- Conduct regular payroll audits and reviews.

- Foster a culture of accuracy and accountability among payroll staff.

10. Describe your experience with payroll budgeting and planning.

- Prepare payroll budgets based on historical data, employee projections, and compensation plans.

- Monitor payroll expenses and identify areas for cost optimization.

- Collaborate with management to ensure alignment between payroll costs and organizational goals.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Chief Payroll Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Chief Payroll Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Chief Payroll Clerk is responsible for managing the day-to-day payroll operations of an organization. This typically includes processing payroll; ensuring accurate and timely payments; maintaining payroll records; complying with relevant laws and regulations; and providing support to employees regarding payroll-related matters.

1. Payroll Processing

The Chief Payroll Clerk is responsible for processing payroll accurately and on time. This includes calculating employee pay, withholding taxes and other deductions, and issuing paychecks or direct deposits.

- Calculating employee pay, including wages, overtime, and bonuses.

- Withholding taxes, including federal, state, and local income taxes, and FICA taxes.

- Deducting other amounts, such as health insurance premiums, retirement contributions, and child support.

- Issuing paychecks or direct deposits to employees.

2. Payroll Recordkeeping

The Chief Payroll Clerk is responsible for maintaining accurate and complete payroll records. This includes keeping track of employee hours, earnings, deductions, and taxes.

- Maintaining employee time records.

- Recording employee earnings, deductions, and taxes.

- Preparing and filing payroll tax returns.

3. Compliance with Laws and Regulations

The Chief Payroll Clerk is responsible for ensuring that the organization complies with all relevant laws and regulations. This includes complying with federal, state, and local wage and hour laws, tax laws, and unemployment insurance laws.

- Staying up-to-date on changes to laws and regulations.

- Ensuring that the organization’s payroll practices comply with all applicable laws.

- Responding to inquiries from tax authorities and other government agencies.

4. Employee Support

The Chief Payroll Clerk is responsible for providing support to employees regarding payroll-related matters. This includes answering employee questions, resolving payroll issues, and providing guidance on payroll-related matters.

- Answering employee questions about payroll.

- Resolving payroll issues, such as errors in paychecks or deductions.

- Providing guidance on payroll-related matters, such as how to change withholding allowances or how to contribute to retirement accounts.

Interview Tips

Preparing for an interview for a Chief Payroll Clerk position can be daunting, but there are a few things you can do to increase your chances of success.

1. Research the Organization

Before you go to an interview, it’s important to do some research on the organization. This will help you understand the organization’s culture, values, and needs. You can research the organization’s website, LinkedIn page, and other sources.

2. Practice Your Answers to Common Interview Questions

There are a few common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” It’s important to practice your answers to these questions so that you can deliver them confidently and concisely.

3. Highlight Your Skills and Experience

In your interview, be sure to highlight your skills and experience that are relevant to the Chief Payroll Clerk position. This includes your experience with payroll processing, payroll recordkeeping, compliance with laws and regulations, and employee support.

4. Be Enthusiastic and Professional

It’s important to be enthusiastic and professional during your interview. This will show the interviewer that you are interested in the position and that you are confident in your abilities.

5. Ask Questions

At the end of the interview, be sure to ask the interviewer questions about the position and the organization. This will show the interviewer that you are engaged and that you are interested in learning more about the opportunity.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Chief Payroll Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!