Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Chief Risk Officer interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Chief Risk Officer so you can tailor your answers to impress potential employers.

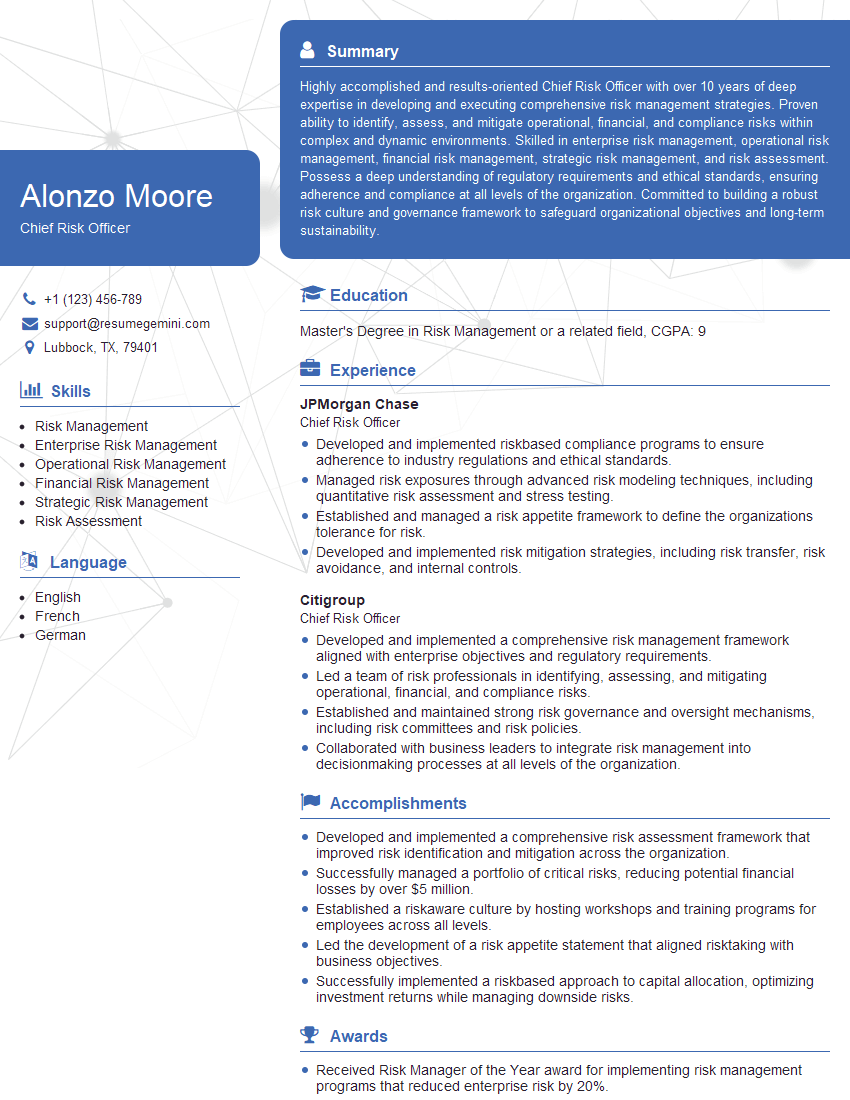

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Chief Risk Officer

1. What are the key risk categories relevant to our business and how do you prioritize them?

- Credit risk: Risk of loss due to failure of borrowers to repay loans or meet other financial obligations.

- Market risk: Risk of loss due to fluctuations in market prices, such as interest rates, foreign exchange rates, or commodity prices.

- Operational risk: Risk of loss due to internal failures, such as fraud, errors, or system failures.

- Liquidity risk: Risk of loss due to inability to meet financial obligations as they become due.

- Reputational risk: Risk of loss due to damage to the organization’s reputation.

- Prioritization based on likelihood and impact, regulatory requirements, business strategy, and risk appetite.

2. How do you assess and measure risk? What tools and methodologies do you use?

Risk Assessment Techniques

- Qualitative analysis: Subjective assessment of risk based on expert judgment and experience.

- Quantitative analysis: Numerical assessment of risk using statistical techniques and historical data.

Risk Measurement Tools

- Value at Risk (VaR): Measures potential loss in a portfolio over a specific period.

- Stress testing: Simulates extreme market conditions to assess portfolio resilience.

- Scenario analysis: Evaluates the impact of specific hypothetical events on the portfolio.

3. How do you develop and implement a risk management framework?

- Establish risk appetite and tolerance.

- Identify and assess risks.

- Develop risk mitigation strategies.

- Implement controls and monitoring systems.

- Continuously monitor and review the framework.

4. How do you ensure that risk management is embedded throughout the organization?

- Establish clear risk ownership and accountability.

- Provide training and awareness programs to employees.

- Incorporate risk management into decision-making processes.

- Communicate risk information to stakeholders effectively.

5. How do you stay up-to-date with emerging risks and regulatory changes?

- Monitor industry publications and research.

- Attend conferences and webinars.

- Engage with peers and regulators.

- Conduct periodic risk reviews to identify new and evolving risks.

6. How do you handle conflicts between risk and return?

- Balance risk and return objectives based on risk appetite.

- Prioritize risk mitigation strategies without sacrificing excessive returns.

- Seek opportunities to enhance returns while managing risk.

- Communicate the trade-offs between risk and return to decision-makers.

7. How do you measure the effectiveness of risk management?

- Monitor key risk indicators (KRIs).

- Assess adherence to risk policies and procedures.

- Analyze loss experience and compare it to industry benchmarks.

- Conduct periodic risk audits and reviews.

8. How do you communicate risk information to stakeholders?

- Develop clear and concise risk reports.

- Present risk information in a manner that is tailored to the audience.

- Use visuals and data to support risk communication.

- Encourage open discussion and feedback on risk-related issues.

9. How do you work with other functions in the organization, such as finance, operations, and compliance, to manage risk?

- Establish cross-functional risk committees.

- Share risk information and insights.

- Collaborate on risk mitigation strategies.

- Align risk management with organizational objectives.

10. How do you stay up-to-date with best practices and emerging trends in risk management?

- Attend industry conferences and webinars.

- Read industry publications and journals.

- Network with other risk professionals.

- Participate in professional development programs.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Chief Risk Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Chief Risk Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Chief Risk Officer (CRO) holds a critical leadership role within an organization, ansvarlig for assessing, managing, and mitigating risks that may impact the company’s financial performance, operational efficiency, and reputation.

1. Risk Assessment and Management

CROs are tasked with developing and implementing a comprehensive risk management framework that identifies, evaluates, and prioritizes potential risks across the organization.

- Conduct thorough risk assessments using appropriate methodologies and tools

- Monitor emerging risks and industry best practices to stay abreast of evolving risk landscape

2. Risk Mitigation and Response Planning

CROs are responsible for creating and executing strategies to mitigate identified risks effectively.

- Develop risk mitigation plans that outline actions to minimize the likelihood and impact of risks

- Oversee the implementation and monitoring of risk mitigation measures

3. Risk Reporting and Communication

CROs regularly report on risk management activities to senior management, the board of directors, and other stakeholders.

- Provide clear and concise risk reports that effectively communicate risk exposure and mitigation strategies

- Communicate risk management updates to stakeholders, ensuring transparency and accountability

4. Regulatory Compliance and Internal Control

CROs play a vital role in ensuring that the organization complies with applicable laws, regulations, and internal control policies.

- Monitor regulatory changes and ensure compliance with industry standards

- Review and assess internal control systems to identify and address weaknesses

Interview Tips

Preparing thoroughly for a Chief Risk Officer interview is crucial to showcasing your qualifications and making a positive impression. Here are some tips to help you ace the interview:

1. Research the Company and Industry

Demonstrate your interest in the organization by researching its industry, business model, and current risk landscape.

- Read industry publications and company financial reports

- Familiarize yourself with the company’s risk management framework and recent risk events

2. Showcase Your Technical Expertise

Highlight your knowledge of risk management principles, methodologies, and tools.

- Discuss your experience in conducting risk assessments, developing mitigation plans, and monitoring risk indicators

- Provide examples of innovative risk management solutions you have implemented in previous roles

3. Emphasize Your Communication and Leadership Skills

Effective communication and leadership are essential for CROs. Highlight your ability to convey complex risk information clearly and persuasively.

- Describe how you have effectively communicated risk management strategies to senior management and stakeholders

- Share examples of how you have led and motivated risk management teams to achieve organizational goals

4. Prepare for Behavioral Questions

Interviewers often ask behavioral questions to assess your problem-solving abilities and work ethic.

- Use the STAR method to structure your answers

- Provide specific examples of situations where you successfully managed risk or resolved risk-related challenges

Next Step:

Now that you’re armed with the knowledge of Chief Risk Officer interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Chief Risk Officer positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini