Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the City Controller interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a City Controller so you can tailor your answers to impress potential employers.

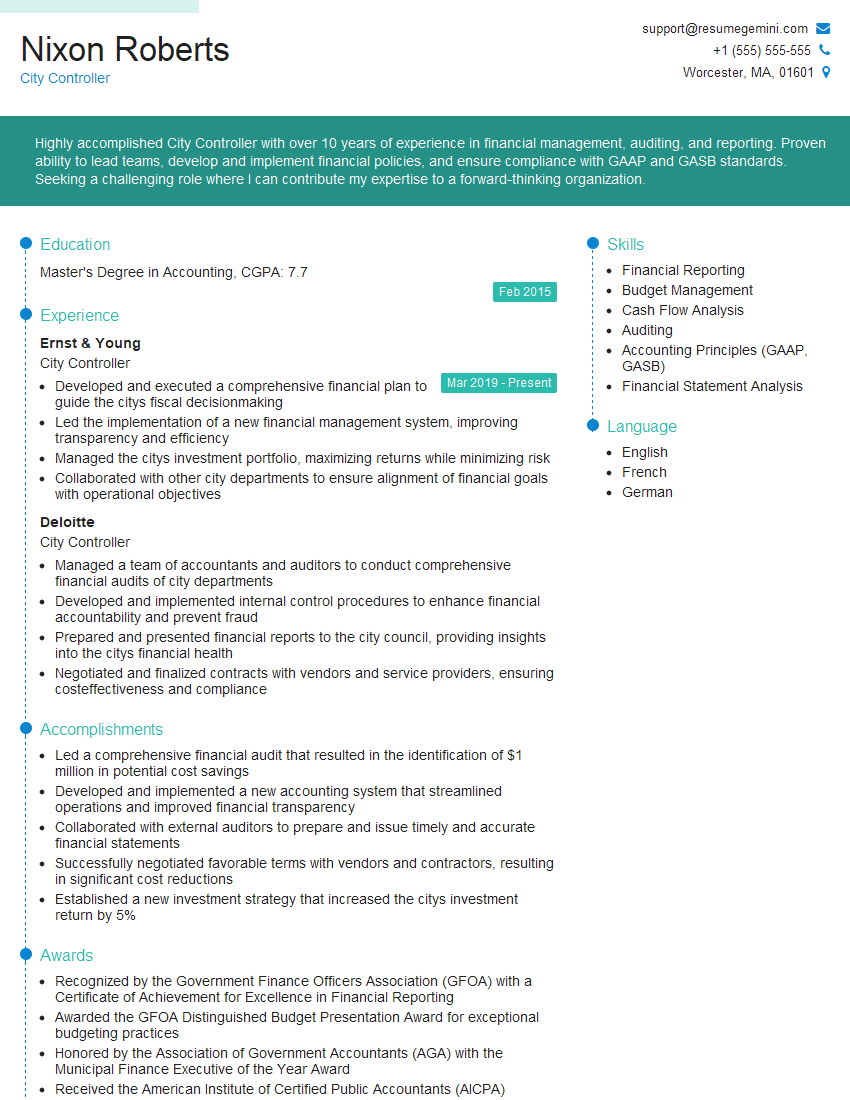

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For City Controller

1. How would you assess the overall financial health of a city?

- Reviewing the city’s financial statements, including the balance sheet, income statement, and cash flow statement.

- Analyzing key financial ratios, such as the debt-to-asset ratio, liquidity ratio, and operating ratio.

- Examining the city’s budget and forecasting future financial performance.

- Assessing the city’s economic development and demographic trends.

- Comparing the city’s financial performance to other similar cities or industry benchmarks.

2. What are the most important accounting principles and standards that a City Controller should follow?

GAAP

- Accrual accounting

- Going concern

- Matching principle

- Materiality

- Consistency

GASB

- Budgetary accounting

- Governmental fund accounting

- Proprietary fund accounting

- Fiduciary fund accounting

- Reporting of infrastructure assets

3. How would you develop and implement a comprehensive internal control system for a city?

- Establish a clear organizational structure with defined roles and responsibilities for financial management.

- Implement strong accounting procedures and controls to ensure the accuracy and reliability of financial information.

- Establish a system of internal audit to provide independent oversight of financial operations.

- Develop policies and procedures for procurement, accounts payable, and payroll.

- Provide ongoing training to city staff on financial management and internal control procedures.

4. What are the key differences between governmental accounting and financial reporting and private sector accounting and financial reporting?

- Governmental accounting focuses on the measurement of financial position and results of operations of governmental entities, while private sector accounting focuses on the measurement of financial position and results of operations of for-profit entities.

- Governmental accounting is based on the accrual basis of accounting, while private sector accounting can be based on either the accrual basis or the cash basis of accounting.

- Governmental accounting reports on a fund basis, while private sector accounting reports on a single entity basis.

- Governmental accounting places a greater emphasis on compliance with legal and regulatory requirements, while private sector accounting places a greater emphasis on providing information to investors and creditors.

5. How would you manage the city’s investments to maximize returns while minimizing risk?

- Develop an investment policy statement that outlines the city’s investment goals, objectives, and risk tolerance.

- Diversify the city’s investments across a range of asset classes, such as stocks, bonds, and real estate.

- Use investment strategies that are appropriate for the city’s risk tolerance and investment goals.

- Monitor the performance of the city’s investments and make adjustments as needed.

- Hire a qualified investment manager to assist with the management of the city’s investments.

6. How would you prepare the city’s annual financial report?

- Gather financial data from all city departments.

- Prepare the city’s financial statements in accordance with GAAP and GASB.

- Write the city’s financial report, which includes the financial statements, management’s discussion and analysis, and other required disclosures.

- Submit the city’s financial report to the city council and other stakeholders.

- Answer questions from the city council and other stakeholders about the city’s financial report.

7. What are the most important qualities of a successful City Controller?

- Strong accounting and financial management skills.

- Excellent communication and interpersonal skills.

- Ability to work independently and as part of a team.

- Strong work ethic and commitment to excellence.

- Understanding of local government accounting and financial reporting requirements.

8. What are the current challenges facing City Controllers?

- Meeting the increasing demand for transparency and accountability from the public.

- Managing the city’s finances in a challenging economic environment.

- Implementing new accounting and financial reporting standards.

- Recruiting and retaining qualified staff.

- Keeping up with the latest technology.

9. What are your goals for the position of City Controller?

- To provide accurate and timely financial information to the city council and other stakeholders.

- To develop and implement sound financial policies and procedures.

- To manage the city’s investments prudently.

- To promote transparency and accountability in the city’s financial management.

- To contribute to the city’s overall success.

10. Why are you the best candidate for the position of City Controller?

- I have over 10 years of experience in municipal accounting and financial management.

- I am a Certified Public Accountant (CPA) and a Certified Government Financial Manager (CGFM).

- I have a strong understanding of GAAP and GASB.

- I am a proven leader with a track record of success.

- I am passionate about public service.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for City Controller.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the City Controller‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As the City Controller, you will play a pivotal role in overseeing the financial well-being of the city. Your responsibilities will encompass a wide range of duties, including:

1. Financial Management and Reporting

Managing the city’s financial operations, including budgeting, accounting, and financial reporting. Ensuring that the city’s financial statements are accurate, transparent, and compliant with all applicable laws and regulations.

- Developing and implementing financial policies and procedures.

- Preparing financial reports and statements for internal and external stakeholders.

2. Auditing and Compliance

Conducting regular audits of city departments and programs to ensure compliance with financial regulations and best practices.

- Investigating allegations of fraud, waste, or abuse.

- Recommending corrective actions to improve financial management and internal controls.

3. Cash Management and Investments

Managing the city’s cash flow and investments to ensure the efficient use of financial resources.

- Developing and implementing investment strategies.

- Negotiating with banks and other financial institutions.

4. Debt Management

Overseeing the city’s debt issuance and management activities to minimize borrowing costs and maintain the city’s credit rating.

- Analyzing debt issuance options and recommending the most cost-effective solutions.

- Managing relationships with rating agencies and bondholders.

Interview Tips

To ace your interview for the City Controller position, consider the following tips:

1. Highlight Your Financial Expertise

Demonstrate your deep understanding of financial management principles, accounting practices, and auditing techniques.

- Quantify your accomplishments in previous roles, using specific metrics to highlight your impact.

- Discuss your experience in developing and implementing financial policies and procedures.

2. Emphasize Your Leadership and Communication Skills

As the City Controller, you will need to effectively lead a team and communicate complex financial information to a wide range of stakeholders.

- Share examples of your ability to motivate and inspire others.

- Describe how you have successfully communicated financial information to non-financial audiences.

3. Showcase Your Analytical and Problem-Solving Abilities

The City Controller role requires strong analytical and problem-solving skills.

- Emphasize your ability to analyze financial data and identify trends and patterns.

- Discuss your experience in developing and implementing solutions to financial challenges.

4. Prepare for Common Interview Questions

Research common interview questions for the City Controller position and prepare thoughtful responses.

- Examples of common interview questions: “Tell me about your experience in managing a large budget.” “How would you approach an audit of a city department?” “What strategies would you recommend to improve the city’s financial performance?”

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the City Controller role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.