Are you gearing up for an interview for a City Tax Auditor position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for City Tax Auditor and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

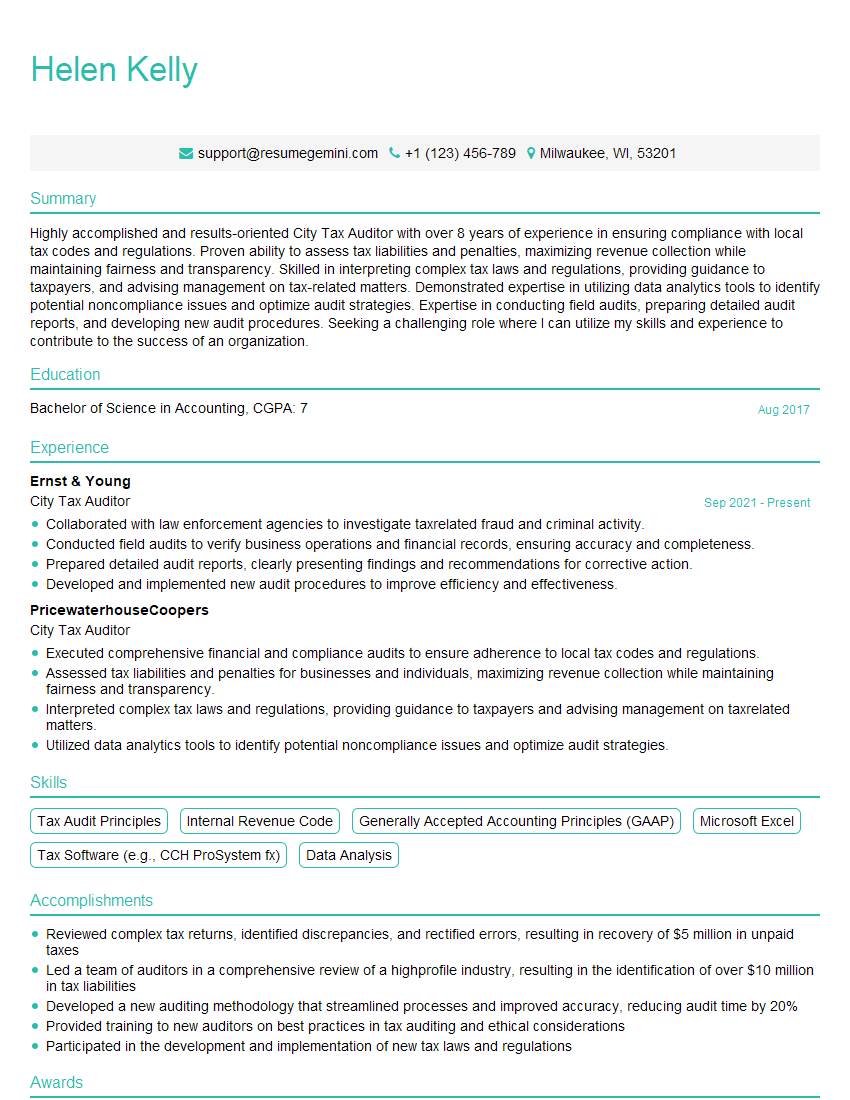

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For City Tax Auditor

1. Describe the process you would follow when conducting a field audit of a taxpayer’s business?

- Review the taxpayer’s financial statements and supporting documentation.

- Interview the taxpayer and their representatives.

- Examine the taxpayer’s business operations.

- Test the taxpayer’s accounting system.

- Prepare an audit report.

2. What are the most common errors you encounter during tax audits?

Errors in reporting income

- Omission of income

- Understatement of income

- Overstatement of deductions

Errors in claiming deductions

- Claiming deductions for personal expenses

- Claiming deductions for expenses that are not ordinary and necessary

- Claiming deductions for expenses that are not properly substantiated

3. How do you stay up-to-date on the latest tax laws and regulations?

- Attend continuing education courses.

- Read professional journals and articles.

- Participating in online forums and discussion groups.

4. What are the ethical considerations that you must be aware of when conducting tax audits?

- Confidentiality

- Objectivity

- Independence

- Professionalism

5. How do you handle disagreements with taxpayers during audits?

- Listen to the taxpayer’s concerns.

- Review the taxpayer’s evidence.

- Explain the tax law and regulations to the taxpayer.

- Be willing to compromise when appropriate.

6. What are the most challenging aspects of being a City Tax Auditor?

- The complexity of the tax laws and regulations.

- The need to be objective and impartial.

- The potential for conflict with taxpayers.

- The deadlines that must be met.

7. What are the most rewarding aspects of being a City Tax Auditor?

- The opportunity to make a difference in the community.

- The challenge of solving complex problems.

- The opportunity to learn new things.

- The feeling of satisfaction when you complete a successful audit.

8. What are your strengths as a City Tax Auditor?

- Strong technical skills

- Excellent communication skills

- Ability to work independently and as part of a team

- Strong work ethic

9. What are your weaknesses as a City Tax Auditor?

- Sometimes I can be too detail-oriented.

- I am not always the most patient person.

- I can be a bit of a perfectionist.

10. Why are you interested in this position with our city?

- I am looking for a challenging and rewarding career.

- I am passionate about public service.

- I believe that my skills and experience would be a valuable asset to your team.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for City Tax Auditor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the City Tax Auditor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Audits are an important part of the financial management of any city. City tax auditors play a vital role in ensuring that the city’s tax revenues are collected fairly and accurately.

1. Conduct Audits

Tax auditors examine financial records to ensure that taxpayers are complying with tax laws and regulations.

- Review financial statements and other records

- Interview taxpayers and third parties

- Analyze data and prepare audit reports

2. Investigate Tax Fraud

Tax auditors investigate suspected cases of tax fraud.

- Gather evidence of fraud

- Interview witnesses

- Prepare reports and present findings to law enforcement

3. Provide Taxpayer Assistance

Tax auditors provide assistance to taxpayers who have questions about their tax obligations.

- Answer questions about tax laws and regulations

- Help taxpayers prepare their tax returns

- Resolve tax disputes

- Educate taxpayers about their tax obligations

4. Stay Up-to-Date on Tax Laws and Regulations

Tax laws and regulations are constantly changing. Tax auditors must stay up-to-date on these changes in order to effectively perform their job.

- Attend training seminars

- Read professional journals

- Participate in continuing education courses

Interview Tips

Preparing for an interview for a city tax auditor position can be daunting, but with the right preparation, you can increase your chances of success.

1. Research the City and the Position

Before you go on an interview, it is important to research the city and the position you are applying for. This will help you understand the city’s tax laws and regulations, as well as the specific responsibilities of the position.

- Visit the city’s website

- Read the job description carefully

- Talk to people who work in the city’s finance department

2. Practice Answering Interview Questions

One of the best ways to prepare for an interview is to practice answering interview questions. This will help you feel more confident and prepared during the interview.

- Use the STAR method to answer interview questions

- Prepare answers to common interview questions

- Ask a friend or family member to practice interviewing you

3. Dress Professionally

First impressions matter, so it is important to dress professionally for your interview.

- Wear a suit or business casual attire

- Make sure your clothes are clean and pressed

- Accessorize with a briefcase or portfolio

4. Be on Time

Punctuality is important for any job interview, but it is especially important for a city tax auditor position. This shows that you are reliable and respectful of other people’s time.

- Give yourself plenty of time to get to the interview

- If you are running late, call the interviewer and let them know

- Arrive at the interview on time, or even a few minutes early

5. Be Yourself

It is important to be yourself during your interview. The interviewer wants to get to know the real you, so don’t try to be someone you’re not.

- Be honest and authentic

- Show your personality

- Be confident in your abilities

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the City Tax Auditor interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.