Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted City Treasurer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

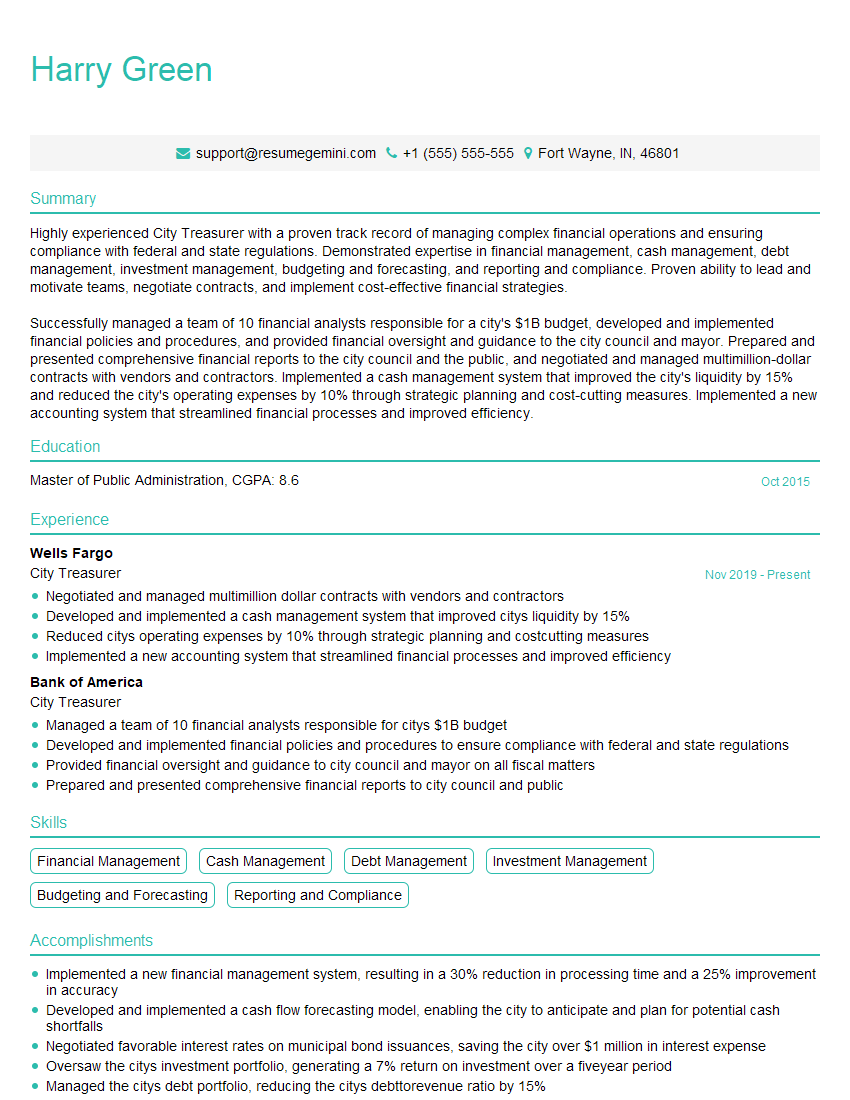

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For City Treasurer

1. How would you develop a strategy to manage the City’s debt portfolio?

In developing a strategy to manage the City’s debt portfolio, I would begin by conducting a thorough assessment of the current debt situation, including a review of the City’s debt obligations, interest rates, and maturity dates. Based on this assessment, I would develop a comprehensive debt management plan that aligns with the City’s financial goals and objectives. This plan would include strategies for optimizing the City’s debt structure, reducing interest costs, and mitigating risks associated with debt.

2. What are the key considerations when investing the City’s idle cash?

Risk Management

- Assess and manage investment risks, including credit risk, market risk, and liquidity risk.

- Diversify investments across asset classes and issuers to mitigate risk.

Return on Investment

- Maximize returns on investments while balancing risk tolerance.

- Monitor market conditions and adjust investment strategies as needed to achieve optimal returns.

Compliance

- Adhere to all applicable laws and regulations governing municipal investments.

- Maintain transparency and accountability in investment decisions.

3. Describe the role of the City Treasurer in ensuring the financial stability of the City.

- Managing the City’s debt portfolio and ensuring compliance with debt covenants.

- Investing the City’s idle cash and generating returns while preserving capital.

- Overseeing the City’s cash flow and ensuring timely payments of obligations.

- Providing financial advice and analysis to the Mayor and City Council.

- Promoting transparency and accountability in financial management.

4. How do you stay abreast of the latest trends and developments in municipal finance?

- Attend industry conferences and workshops.

- Read professional journals and publications.

- Network with other municipal finance professionals.

- Complete continuing education courses and certifications.

5. What are some of the challenges facing City Treasurers in today’s economic environment?

- Managing debt in a low-interest rate environment and preparing for potential interest rate increases.

- Investing idle cash amidst market volatility and inflation.

- Ensuring financial stability in the face of economic downturns and revenue shortfalls.

- Balancing the need for financial prudence with the demand for infrastructure investments and public services.

6. Describe your experience in managing a team of financial professionals.

- Provided leadership and direction to a team of financial analysts and accountants.

- Developed and implemented performance management systems to evaluate and improve team performance.

- Fostered a collaborative and supportive work environment.

- Recognized and rewarded team achievements.

7. What is your understanding of the Government Finance Officers Association (GFOA) and its role in municipal finance?

The Government Finance Officers Association (GFOA) is a professional organization that provides training, resources, and support to government finance professionals. The GFOA’s mission is to advance the practice of government finance by promoting sound financial management and ethical conduct.

8. How would you approach the task of developing a financial plan for the City?

- Analyze the City’s current financial situation and identify areas for improvement.

- Forecast the City’s future financial needs and develop strategies to meet those needs.

- Identify potential risks and develop contingency plans.

- Present the financial plan to the Mayor and City Council for review and approval.

9. How do you ensure transparency and accountability in your financial management practices?

- Publish annual financial reports and make them easily accessible to the public.

- Hold public meetings to discuss the City’s financial performance.

- Respond to public inquiries and provide timely and accurate information.

- Comply with all applicable laws and regulations governing financial transparency.

10. What is your experience with cash flow forecasting?

- Developed and maintained cash flow models for a municipality with over $1 billion in annual revenue.

- Utilized historical data, economic forecasts, and other relevant factors to predict cash flow patterns.

- Provided regular cash flow reports to the City Manager and Finance Director.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for City Treasurer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the City Treasurer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The City Treasurer is responsible for overseeing the financial operations of the city. This includes managing the city’s budget, investing the city’s funds, and collecting taxes. The City Treasurer is also responsible for providing financial advice to the Mayor and City Council.

1. Manage the city’s budget

The City Treasurer is responsible for developing and managing the city’s budget. This involves working with the Mayor and City Council to determine the city’s financial needs and priorities. The City Treasurer must also ensure that the budget is balanced and that the city is able to meet its financial obligations.

2. Invest the city’s funds

The City Treasurer is responsible for investing the city’s funds. This involves working with financial advisors to develop an investment strategy that meets the city’s financial needs and goals. The City Treasurer must also ensure that the city’s investments are safe and profitable.

3. Collect taxes

The City Treasurer is responsible for collecting taxes from city residents and businesses. This involves working with the city’s tax collector to develop and implement a tax collection system. The City Treasurer must also ensure that the city is collecting all of the taxes that it is owed.

4. Provide financial advice to the Mayor and City Council

The City Treasurer is responsible for providing financial advice to the Mayor and City Council. This involves providing information about the city’s financial condition and making recommendations on financial matters. The City Treasurer must also be able to explain complex financial concepts in a clear and concise manner.

Interview Tips

Preparing for an interview for the position of City Treasurer requires meticulous attention to detail, thorough research, and skillful communication. The following tips will help you navigate the interview process seamlessly and showcase your qualifications effectively:

1. Research the city and its financial situation

Before the interview, take the time to research the city you are applying to, including its financial situation. This will give you a clear understanding of the city’s needs and challenges, and you can tailor your answers accordingly. Explore the city’s website, annual reports, and news articles to gain insights into its financial performance and priorities.

2. Review the job description carefully

Ensure you thoroughly understand the key responsibilities and qualifications outlined in the job description. This will help you identify the skills and experiences that the hiring panel is seeking in an ideal candidate. Highlight specific examples from your professional background that align with the requirements of the role.

3. Prepare specific examples of your accomplishments

The STAR method (Situation, Task, Action, Result) is a valuable tool when crafting your responses during the interview. When describing your past experiences and accomplishments, follow this framework to provide structured and impactful answers. Begin by setting the context (Situation), outlining the specific Task you were responsible for, describing the Actions you took, and quantifying the positive Results of your efforts.

4. Be prepared to discuss your financial management strategies

The hiring panel will likely inquire about your approach to financial management. Prepare to discuss your strategies for developing and managing budgets, investing city funds, and ensuring fiscal responsibility. Share examples of successful financial initiatives you have implemented in previous roles and highlight the positive outcomes achieved.

5. Demonstrate your leadership and communication skills

The City Treasurer is a leadership position that requires exceptional communication and interpersonal skills. Prepare to address questions that assess your ability to lead and motivate a team, communicate effectively with stakeholders, and build consensus among diverse groups. Provide specific examples of situations where you successfully navigated challenges and fostered collaboration.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the City Treasurer interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.