Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Claim Adjuster position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

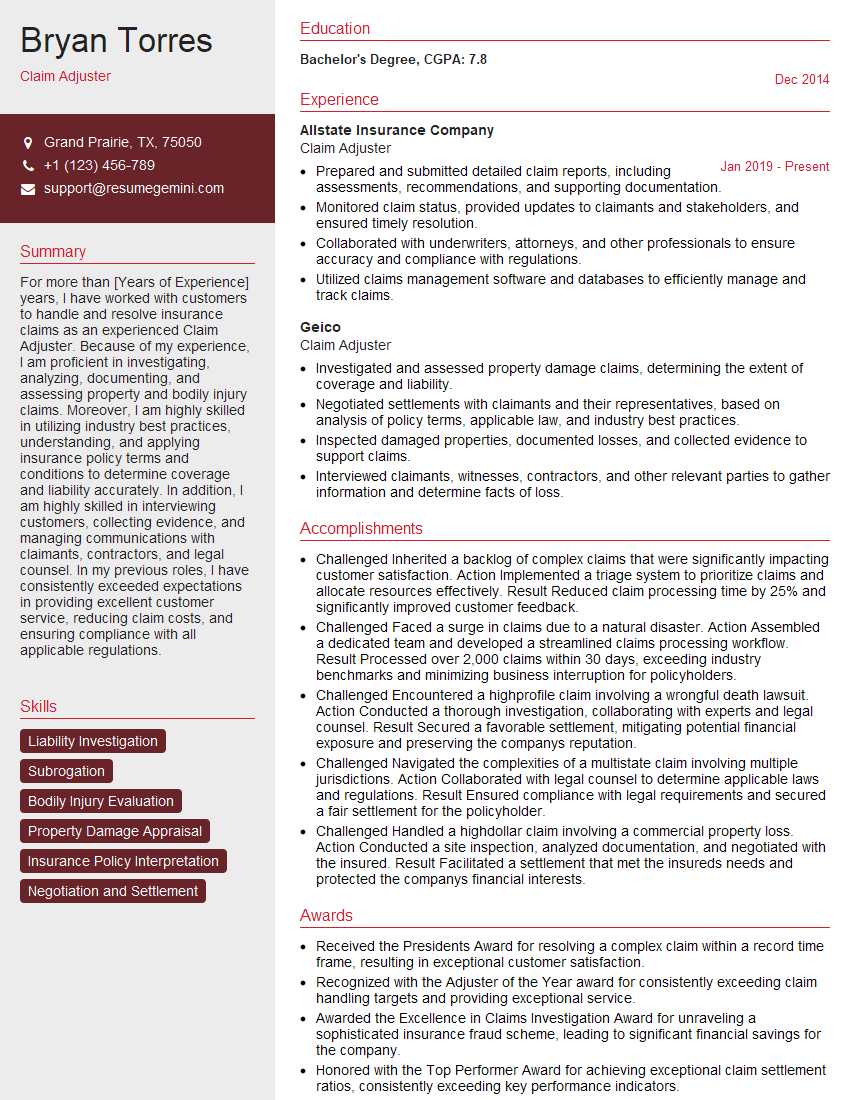

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claim Adjuster

1. Tell me about a complex claim you handled, and how you resolved it?

In my previous role, I handled a complex claim involving a major property loss. The property was a 5-story apartment building that had been severely damaged by a fire. The claim involved multiple units, and there were several different parties involved, including the building owner, the tenants, and the insurance companies for both the building and the tenants. I worked closely with all of the parties involved to assess the damage, determine the cause of the fire, and negotiate a settlement. The settlement was fair to all of the parties involved, and it was reached in a timely manner.

2. What is your process for investigating a claim?

Gathering Information

- Review the claim file

- Contact the claimant

- Inspect the damaged property

- Interview witnesses

Assessing Damages

- Determine the extent of the damage

- Estimate the cost of repairs

- Determine the loss of value

Negotiating a Settlement

- Discuss the claim with the claimant

- Negotiate a settlement that is fair to both parties

- Finalize the settlement agreement

3. What are some of the challenges you have faced as a claim adjuster?

Some of the challenges I have faced as a claim adjuster include:

- Dealing with difficult claimants

- Investigating complex claims

- Negotiating settlements

- Managing multiple claims

- Keeping up with changes in the insurance industry

4. What are your strengths as a claim adjuster?

- Excellent communication and interpersonal skills

- Strong investigative and analytical skills

- Experience in negotiating settlements

- Ability to manage multiple claims

- Knowledge of the insurance industry

5. What are your weaknesses as a claim adjuster?

- I can be somewhat impatient at times

- I am not always the best at delegating tasks

- I can be a bit of a perfectionist

6. What are your career goals?

My career goal is to become a senior claim adjuster. I would like to continue to develop my skills and knowledge in the insurance industry. I am also interested in taking on more leadership responsibilities.

7. What do you know about our company?

I have done some research on your company and I am impressed by your commitment to customer service. I am also impressed by your company’s reputation for being a leader in the insurance industry.

8. Why do you want to work for our company?

I want to work for your company because I believe that my skills and experience would be a valuable asset to your team. I am also looking for a company that is committed to customer service and innovation.

9. What are your salary expectations?

My salary expectations are in line with the industry average for a claim adjuster with my experience and qualifications.

10. Are you willing to relocate?

I am willing to relocate for the right opportunity.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claim Adjuster.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claim Adjuster‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Claim Adjusters are the backbone of the insurance industry, responsible for investigating and evaluating claims to determine the extent of the insurer’s liability and the appropriate settlement amount.

1. Investigate Claims

Claim Adjusters thoroughly investigate claims by gathering information from policyholders, witnesses, and relevant third parties. They review police reports, medical records, property damage assessments, and other documentation to assess the validity and extent of the claim.

- Conduct interviews with claimants, witnesses, and other parties involved in the claim.

- Inspect damaged property and assess the extent of damage.

- Review medical records and other relevant documentation to determine the nature and severity of injuries.

2. Evaluate Claims

Based on their investigation, Claim Adjusters evaluate claims to determine the amount of coverage available under the policy and the appropriate settlement amount. They consider factors such as policy limits, deductibles, and applicable coverages.

- Analyze policy provisions and coverage limits to determine the insurer’s liability.

- Calculate the amount of loss or damage based on the information gathered during the investigation.

- Determine appropriate settlement amounts within the limits of the policy and applicable laws.

3. Negotiate Settlements

Claim Adjusters negotiate settlements with claimants to resolve claims fairly and amicably. They present settlement offers, discuss the basis for their evaluation, and negotiate terms to reach mutually acceptable agreements.

- Negotiate with policyholders and third parties to reach fair and reasonable settlements.

- Explain the basis for settlement offers and work to resolve any disputes.

- Document settlement agreements and ensure they are executed correctly.

4. Manage Claims

Claim Adjusters manage claims throughout their lifecycle, from initial investigation to final settlement. They track the progress of claims, communicate with claimants and other parties, and ensure compliance with company policies and procedures.

- Maintain accurate records and documentation throughout the claims process.

- Communicate with claimants, policyholders, and other stakeholders to provide updates and answer questions.

- Monitor claims to ensure timely resolution and adherence to deadlines.

Interview Tips

To ace your Claim Adjuster interview, it’s essential to prepare thoroughly. Here are some tips to help you stand out:

1. Research the Company and Industry

Thoroughly research the insurance company and the industry as a whole. Understand their products, services, and market reputation. This knowledge will demonstrate your interest and enthusiasm for the role.

2. Practice Answering Common Interview Questions

Prepare for common interview questions related to your claims handling experience, problem-solving abilities, and customer service skills. Use the STAR method (Situation, Task, Action, Result) to craft concise and impactful answers that highlight your competencies.

3. Quantify Your Experience

When describing your claims handling experience, use specific numbers and metrics to quantify your accomplishments. This will help to illustrate your impact on the company and demonstrate your ability to produce results.

4. Showcase Your Communication Skills

Claim Adjusters need excellent communication skills to effectively interact with claimants, policyholders, and other stakeholders. Highlight your ability to communicate clearly, build rapport, and resolve conflicts professionally.

5. Prepare Industry-Related Questions

Prepare a few industry-related questions to ask the interviewer. This demonstrates your engagement and interest in the field, and allows you to gather additional insights into the company’s operations and culture.

6. Dress Professionally and Arrive on Time

Dress professionally and arrive on time for your interview. First impressions matter, and a professional demeanor will reflect your respect for the company and the position.

7. Follow Up After the Interview

Within 24 hours of the interview, send a brief thank-you note to the interviewer. Reiterate your interest in the position and any specific aspects of the job or company that particularly appeal to you.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Claim Adjuster interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!