Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Claim Agent interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Claim Agent so you can tailor your answers to impress potential employers.

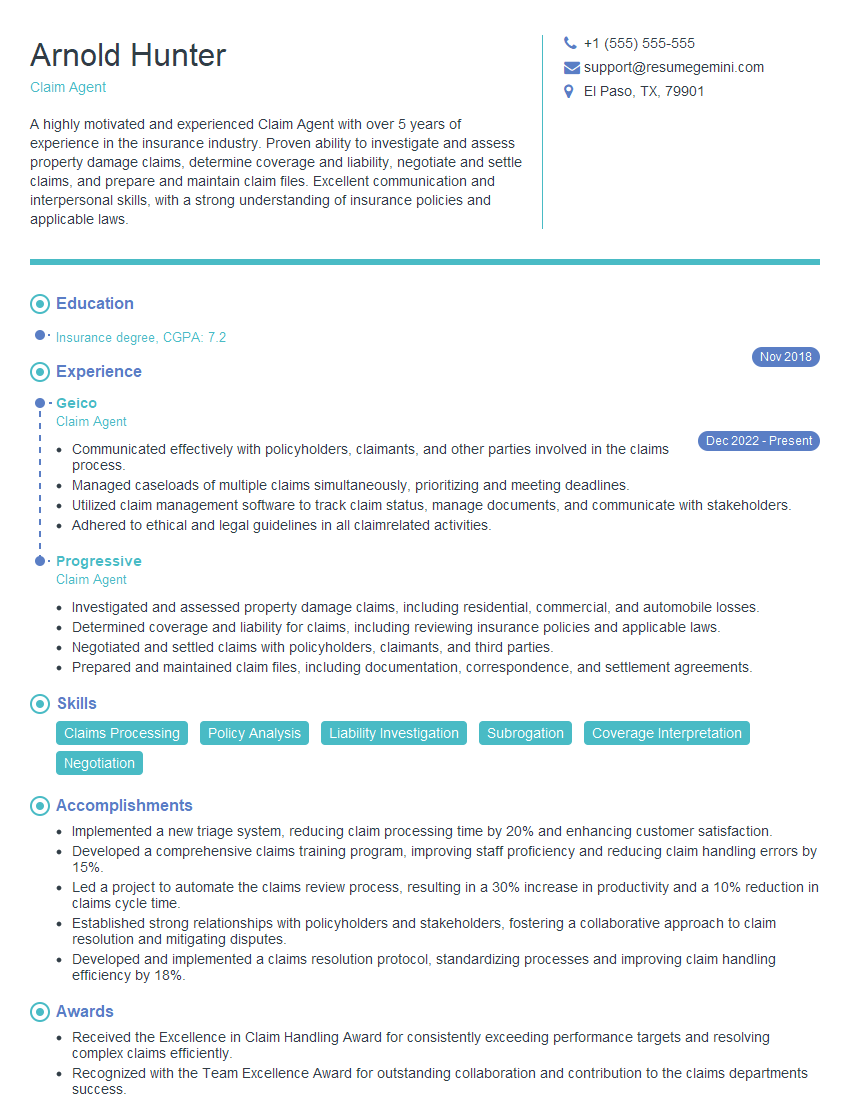

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claim Agent

1. Describe the key steps involved in handling a property damage claim?

- Initiate contact with the claimant and gather initial information.

- Dispatch an adjuster to inspect the damage and assess the loss.

- Review the adjuster’s report and determine coverage and liability.

- Negotiate a settlement with the claimant.

- Process the claim and issue payment.

2. How do you determine the value of a property damage claim?

- Review the adjuster’s report and estimate the cost of repairs.

- Consult with experts, such as contractors or appraisers, if necessary.

- Consider the age, condition, and location of the property.

- Negotiate a settlement with the claimant that is fair and reasonable.

3. How do you handle a disputed claim?

- Review the policy and relevant case law.

- Gather evidence to support the company’s position.

- Negotiate with the claimant or their attorney.

- Prepare for and attend mediation or litigation, if necessary.

4. How do you stay up-to-date on changes in insurance regulations and laws?

- Attend industry conferences and webinars.

- Read insurance publications and legal journals.

- Consult with experts in the field.

5. How do you manage your workload and prioritize your tasks?

- Use a to-do list or project management software.

- Set deadlines for yourself and stick to them.

- Delegate tasks to others when appropriate.

- Take breaks throughout the day to avoid burnout.

6. What is your claims philosophy?

I believe that the customer is always right. I strive to provide excellent customer service and resolve claims fairly and efficiently. I am committed to upholding the highest ethical standards and ensuring that the company’s interests are protected.

7. Why are you interested in working for our company?

I am impressed by your company’s commitment to customer service and ethical business practices. I believe that my skills and experience would be a valuable asset to your team. I am eager to learn from experienced professionals and contribute to the company’s success.

8. What are your strengths and weaknesses as a claims agent?

Strengths

- Excellent communication and interpersonal skills.

- Strong analytical and problem-solving abilities.

- Detailed knowledge of insurance policies and procedures.

- Ability to handle multiple tasks and manage my time effectively.

- Committed to providing excellent customer service.

Weaknesses

- I am relatively new to the insurance industry.

- I can sometimes be too detail-oriented, which can slow me down.

9. What are your salary expectations?

My salary expectations are commensurate with my experience and skills. I am open to negotiation.

10. Do you have any questions for me?

- What is the company’s claims volume and average claim size?

- What are the company’s expectations for claim handling times?

- What opportunities are there for professional development?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claim Agent.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claim Agent‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Claim Agents play a crucial role in the insurance industry. They are responsible for investigating, evaluating, and settling claims filed by policyholders. Their primary goal is to determine the validity of a claim and ensure that the company fulfills its obligations to its customers while minimizing its financial exposure. Key responsibilities of a Claim Agent include:

1. Investigating and Evaluating Claims

Claim Agents thoroughly investigate and evaluate claims to determine their validity and extent. They gather information from various sources, including policyholders, witnesses, medical professionals, and police reports. They analyze the evidence to assess the cause and extent of the loss or damage and determine whether it is covered under the policy.

2. Assessing Liability and Damages

Claim Agents assess liability and damages based on the evidence gathered during the investigation. They determine who is at fault for the incident and calculate the amount of compensation owed to the policyholder. They consider factors such as negligence, breach of contract, and coverage limits.

3. Negotiating Settlements

Claim Agents negotiate settlements with policyholders and their representatives. They work to reach a fair and equitable settlement that satisfies both parties while protecting the company’s interests. They use their knowledge of insurance policies, legal principles, and negotiation techniques to reach mutually acceptable agreements.

4. Managing Claims Files and Documentation

Claim Agents maintain accurate and complete claims files, which include all relevant documentation related to the claim, such as investigation reports, medical records, and correspondence. They organize and manage these files effectively to ensure timely and efficient claim processing.

5. Communicating with Policyholders and Other Stakeholders

Claim Agents communicate with policyholders, claimants, attorneys, and other stakeholders throughout the claims process. They provide updates on the status of claims, answer questions, and address concerns. They are the primary point of contact for claimants, ensuring that they are kept informed and satisfied with the claims handling process.

Interview Tips

To ace the interview for a Claim Agent position, it is essential to prepare thoroughly and showcase your relevant skills and experience. Here are some helpful interview preparation tips:

1. Research the Company and Position

Before the interview, take the time to research the insurance company and the specific Claim Agent position you are applying for. Familiarize yourself with the company’s products, services, and industry reputation. Understand the key responsibilities and qualifications required for the role.

2. Highlight Relevant Skills and Experience

During the interview, emphasize your relevant skills and experience in claims handling. Quantify your accomplishments whenever possible. For example, instead of simply stating that you “investigated claims,” provide specific details about the number of claims you handled, the complexity of the cases, and the outcomes you achieved.

3. Practice Answering Common Interview Questions

Anticipate and prepare for common interview questions related to claim handling. Practice answering questions about your investigative techniques, negotiation skills, and experience with different types of claims. Consider using the STAR method (Situation, Task, Action, Result) to structure your answers and provide concrete examples of your abilities.

4. Demonstrate Your Understanding of Insurance Policies

Interviewers will assess your understanding of insurance policies and legal principles. Be prepared to discuss your knowledge of different types of insurance policies, coverage exclusions, and legal precedents relevant to claim handling. Explain how you interpret and apply these principles in your work.

5. Emphasize Customer Service Skills

Claim Agents interact frequently with policyholders and other stakeholders. Highlight your strong customer service skills and ability to build rapport with clients. Share examples of how you have handled challenging situations with empathy and professionalism.

Next Step:

Now that you’re armed with the knowledge of Claim Agent interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Claim Agent positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini