Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Claim Approver position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

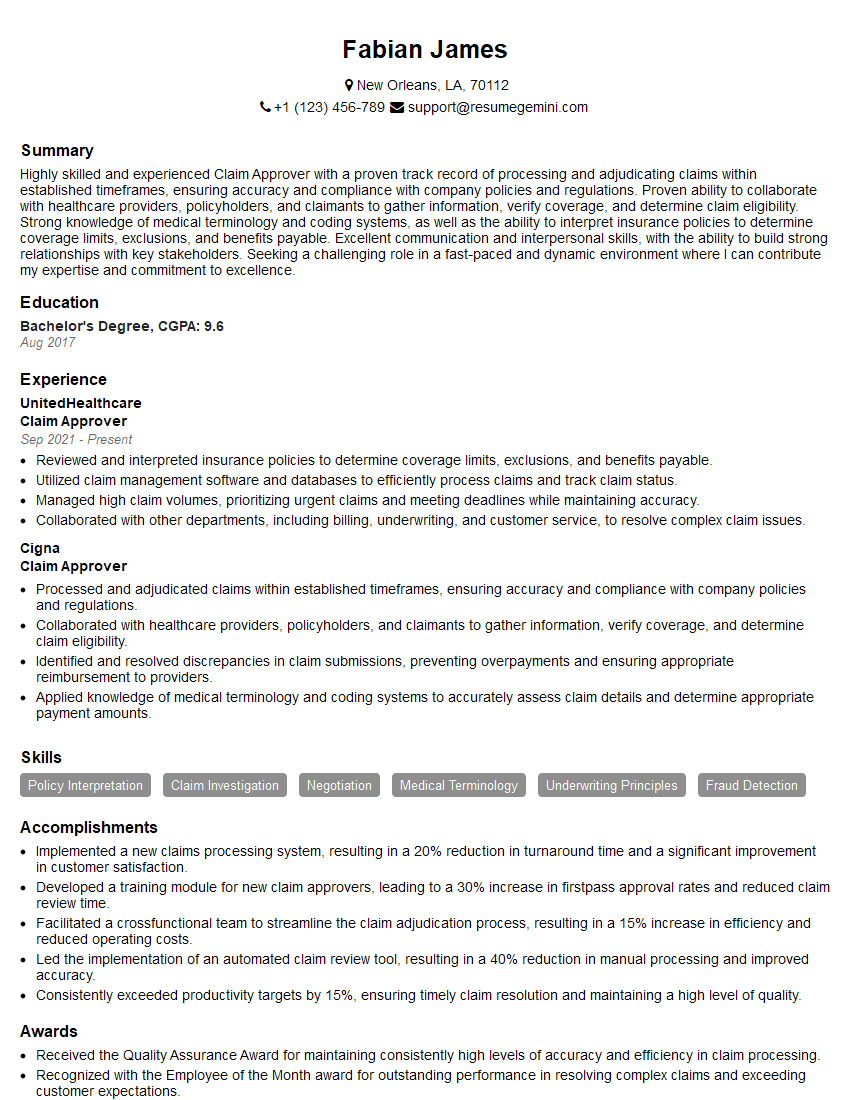

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claim Approver

1. What are the key responsibilities of a Claim Approver?

- Reviewing claims for accuracy, completeness, and compliance with policies

- Assessing claim severity and making decisions on coverage and payment

- Negotiating with providers and beneficiaries to resolve disputes

- Adhering to regulatory guidelines and internal procedures

- Communicating with claimants, providers, and stakeholders to provide updates and resolve issues

2. How do you ensure that claims are processed accurately and efficiently?

Understanding Policy Guidelines

- Thoroughly understanding insurance policies and coverage limitations

- Staying up-to-date with regulatory changes and industry best practices

Reviewing and Verifying Documentation

- Carefully examining medical records, bills, and other supporting documentation

- Verifying the accuracy and completeness of the information provided

Communicating with Claimants and Providers

- Establishing clear communication channels with claimants and providers

- Requesting additional information or clarification as needed

Using Technology Effectively

- Utilizing claims processing software and databases to streamline operations

- Automating certain tasks to improve efficiency

3. What are the most common reasons for claim denials?

- Lack of coverage

- Incomplete or inaccurate documentation

- Exceeding policy limits

- Fraud or misrepresentation

- Procedural errors

4. How do you handle disputes or disagreements with providers or beneficiaries?

- Maintaining a professional and empathetic demeanor

- Objectively reviewing all relevant information

- Negotiating with providers to reach a fair and reasonable resolution

- Explaining the claim decision clearly and providing supporting documentation

- Escalating the issue to supervisors or external authorities if necessary

5. What are your strategies for preventing and detecting insurance fraud?

- Understanding common fraud schemes and red flags

- Reviewing claims for irregularities or inconsistencies

- Collaborating with investigators to identify and prosecute fraudulent claims

- Educating claimants and providers about fraud prevention

- Maintaining a high level of ethical conduct and integrity

6. How do you stay updated on changes in insurance regulations and industry best practices?

- Attending industry conferences and workshops

- Reading trade publications and online resources

- Participating in professional organizations

- Seeking guidance from supervisors and legal counsel

- Maintaining a commitment to continuous learning

7. How do you manage multiple claims and prioritize your workload?

- Assessing the urgency and severity of each claim

- Setting clear priorities and managing deadlines

- Delegating tasks to team members when appropriate

- Utilizing technology to streamline processes and improve efficiency

- Maintaining open communication with supervisors and colleagues

8. What is your approach to customer service?

- Treating claimants and providers with respect and empathy

- Responding promptly to inquiries and concerns

- Providing clear and concise explanations

- Going the extra mile to resolve issues and build strong relationships

- Maintaining a positive and professional demeanor

9. What software or systems are you familiar with that are used in claims processing?

- Claim processing platforms (e.g., Guidewire, Duck Creek)

- Medical billing and coding software (e.g., McKesson, Cerner)

- Fraud detection tools

- Communication and collaboration tools (e.g., email, instant messaging)

- Data analysis and reporting tools

10. What career goals do you have and how does this role fit into them?

- Express interest in the position and the company

- Discuss how the role aligns with your skills and experience

- Explain how you plan to contribute to the team and organization

- Articulate your long-term career aspirations and how this opportunity supports them

- Demonstrate enthusiasm and commitment to the profession

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claim Approver.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claim Approver‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Claim Approvers are responsible for reviewing and approving insurance claims. They ensure that claims are accurate, complete, and meet all policy requirements. Key job responsibilities include:

1. Review and approve insurance claims

Claim Approvers review and approve insurance claims for a variety of products, including health, auto, property, and liability.

- Examine claim forms and supporting documentation to determine if the claim is valid and meets policy requirements.

- Investigate claims and gather additional information as needed to make a decision.

- Approve or deny claims based on the policy terms and applicable laws and regulations.

2. Communicate with claimants and other parties

Claim Approvers communicate with claimants, policyholders, and other parties involved in the claims process.

- Explain coverage and policy requirements to claimants.

- Negotiate settlements with claimants.

- Provide status updates on claims to claimants and other parties.

3. Maintain accurate records

Claim Approvers maintain accurate records of all claims processed.

- Document all decisions made on claims.

- Maintain records of all communications with claimants and other parties.

- Track claim status and progress.

4. Stay up-to-date on industry regulations

Claim Approvers stay up-to-date on industry regulations and best practices.

- Attend training and continuing education courses.

- Read industry publications and articles.

- Participate in professional organizations.

Interview Tips

To ace the interview for a Claim Approver position, it is important to prepare thoroughly and highlight your relevant skills and experience.

1. Research the company and the position

Before the interview, take the time to research the company and the specific position you are applying for. This will help you understand the company’s culture, values, and goals, and tailor your answers to the interviewer’s questions accordingly.

- Visit the company’s website to learn about their history, mission, and products or services.

- Read industry news and articles to stay up-to-date on the latest trends and developments.

- Prepare questions to ask the interviewer about the company and the position.

2. Practice your answers to common interview questions

There are several common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” It is important to practice your answers to these questions so that you can deliver them confidently and clearly.

- Use the STAR method to answer behavioral questions (Situation, Task, Action, Result).

- Highlight your relevant skills and experience, and how they apply to the position you are applying for.

- Quantify your accomplishments with specific metrics whenever possible.

3. Dress professionally and arrive on time

First impressions matter, so it is important to dress professionally and arrive on time for your interview. This shows the interviewer that you are respectful of their time and that you take the interview seriously.

- Choose clothing that is clean, pressed, and appropriate for a business setting.

- Arrive at the interview location at least 10 minutes early.

- Bring a copy of your resume and any other relevant materials.

4. Be yourself and be confident

The most important thing is to be yourself and be confident in your abilities. The interviewer wants to get to know the real you, so don’t try to be someone you’re not. If you are prepared and have practiced your answers, you should be able to relax and let your personality shine through.

- Make eye contact with the interviewer and speak clearly and confidently.

- Smile and be friendly, but also maintain a professional demeanor.

- Be enthusiastic and passionate about the position you are applying for.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Claim Approver, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Claim Approver positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.