Are you gearing up for a career in Claim Auditor? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Claim Auditor and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

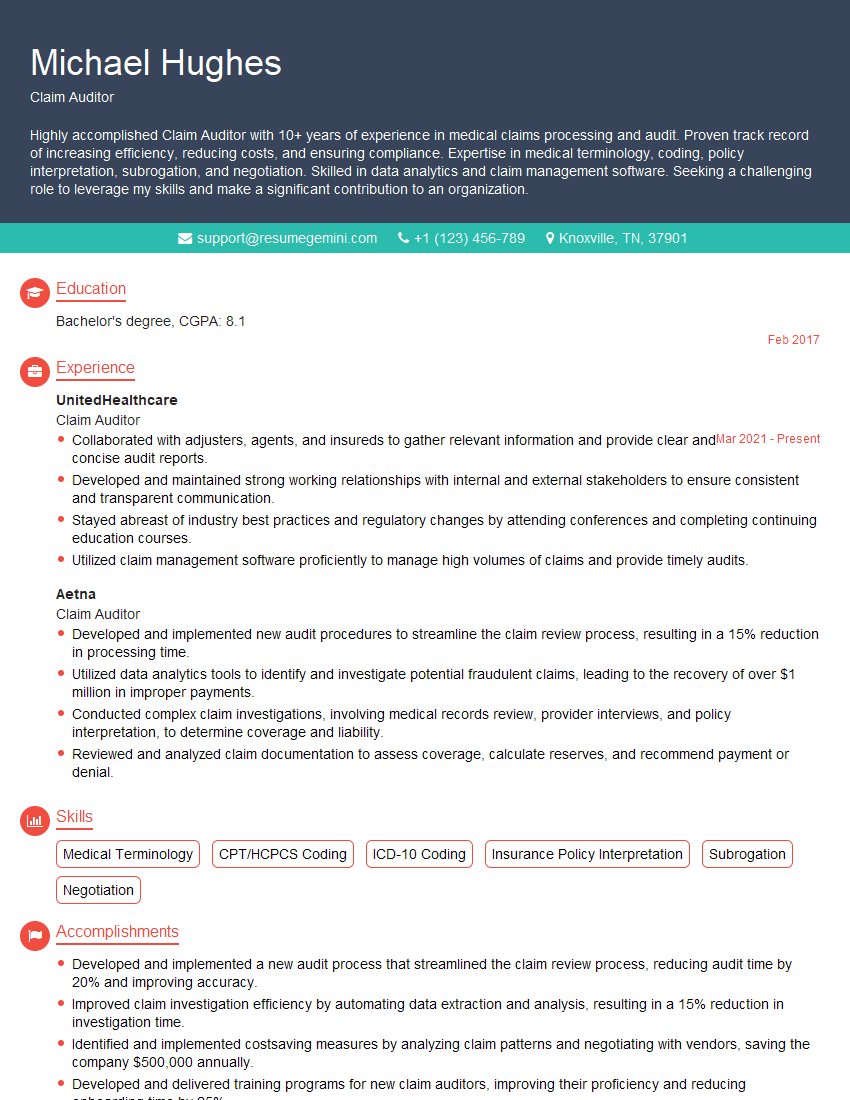

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claim Auditor

1. How do you stay up-to-date on the latest changes in healthcare regulations and guidelines?

To stay up-to-date on the latest changes in healthcare regulations and guidelines, I follow these practices:

- Regularly review industry publications and websites.

- Attend conferences, seminars, and webinars.

- Engage in discussions with colleagues and industry experts.

- Subscribe to email updates and newsletters from regulatory bodies.

- Complete continuing education courses.

2. Describe your process for auditing medical claims.

Initial Review

- Verify patient eligibility and coverage.

- Check for missing or incomplete documentation.

- Identify any potential areas of concern.

Detailed Analysis

- Review medical records to assess the medical necessity of services.

- Verify that the charges are reasonable and customary.

- Check for coding errors or inconsistencies.

Denial or Payment Determination

- If any discrepancies or errors are found, I will issue a denial or request additional information.

- If the claim is valid, I will approve payment.

Communication and Follow-up

- Provide clear and concise explanations for denials or adjustments.

- Follow up with providers or insurance companies if additional information is required.

- Maintain a record of all audit findings and communications.

3. How do you handle complex or disputed claims?

When dealing with complex or disputed claims, I follow a systematic approach:

- Thoroughly review all available documentation.

- Consult with medical experts or other specialists for guidance.

- Research applicable regulations and guidelines.

- Engage in discussions with the provider or insurance company to gather additional information.

- Document my findings and decision-making process clearly.

4. What are some common errors you have encountered during claim audits?

Some common errors I have encountered during claim audits include:

- Coding errors (e.g., incorrect procedure codes, missing modifiers).

- Billing for non-covered services.

- Unreasonable or excessive charges.

- Missing or incomplete documentation.

- Duplicate billing.

5. Describe your experience with using data analytics in claim auditing.

I have experience using data analytics tools to identify patterns and trends in claim data. This has allowed me to:

- Proactively identify potential areas of concern.

- Develop targeted audit strategies.

- Improve the efficiency of the audit process.

- Identify opportunities for cost savings.

6. How do you stay organized and manage multiple claims simultaneously?

To stay organized and manage multiple claims simultaneously, I use a combination of strategies:

- Prioritize claims based on their complexity and urgency.

- Use a case management system to track the progress of each claim.

- Delegate tasks to team members when necessary.

- Set realistic deadlines and stick to them.

- Maintain clear and concise communication with all stakeholders.

7. What are your strengths and weaknesses as a claim auditor?

My strengths as a claim auditor include:

- Excellent attention to detail and analytical skills.

- Strong knowledge of healthcare regulations and guidelines.

- Proven ability to identify and resolve discrepancies.

- Excellent communication and interpersonal skills.

As for my weaknesses, I sometimes tend to be overly cautious in my approach to avoid missing any errors. I am working on improving my efficiency while maintaining accuracy.

8. How do you ensure the confidentiality of patient information during the audit process?

I take the confidentiality of patient information very seriously and adhere to strict privacy protocols:

- Only access patient information that is necessary for the audit.

- Maintain secure storage of all patient data.

- Use encryption and other security measures to protect electronic records.

- Follow all applicable privacy laws and regulations.

9. Describe a time when you had to make a difficult decision regarding a claim.

In a recent audit, I encountered a claim for a complex medical procedure. The documentation was incomplete, and the charges seemed excessive. After careful consideration, I consulted with a medical expert and determined that the procedure was not medically necessary. I denied the claim, providing a detailed explanation to the provider.

10. What are your career goals, and how does this position align with them?

My career goal is to become a lead claim auditor and eventually manage a team of auditors. I am confident that this position will provide me with the necessary experience and skills to achieve my goals. I am eager to contribute to the success of your organization and make a positive impact on the healthcare industry.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claim Auditor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claim Auditor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Claim Auditors scrutinize medical and non-medical claims to ensure they meet specific requirements, regulations, and guidelines, and are submitted appropriately for reimbursement.

1. Claim Processing and Review

Assess and verify claims for accuracy, completeness and compliance with established guidelines and regulations.

- Review medical records, diagnostic codes, and other documentation to determine the necessity and appropriateness of medical services provided.

- Examine claims for fraudulent or abusive billing practices, identifying discrepancies and potential red flags.

2. Claim Adjustments and Denials

Analyze claims to identify overpayments, underpayments, or incorrect coding, and make necessary adjustments.

- Denial of claims with missing or incomplete information, or those not meeting established criteria.

- Request additional documentation from providers to support the validity of the claim.

3. Communication and Reporting

Communicate with providers and policyholders to clarify issues, provide explanations, and resolve disputes.

- Provide detailed reports and summaries of claim audits to management or stakeholders.

- Stay informed of changes in regulations, policies, and industry best practices.

4. Compliance and Fraud Detection

Conduct regular audits to prevent and detect fraudulent or abusive billing practices.

- Review claims history and identify patterns or anomalies that suggest potential fraud.

- Cooperate with law enforcement agencies and regulatory bodies in investigations.

Interview Tips

To prepare for a claim auditor interview, it is crucial to research the company, the industry, and the specific role you are applying for. Highlight your skills and experience that align with the key responsibilities of the position.

1. Demonstrate Your Technical Expertise

Emphasize your understanding of healthcare regulations, medical terminology, and claim processing guidelines. Provide examples of specific audits you have conducted and the outcomes you achieved.

- Quantify your accomplishments using metrics such as the number of claims audited, fraud detected, or cost savings realized.

- Explain how your attention to detail and analytical skills have helped you identify errors and discrepancies.

2. Showcase Your Communication Skills

Claim auditors frequently interact with providers, policyholders, and colleagues. Highlight your ability to communicate clearly and effectively, both verbally and in writing.

- Describe situations where you successfully resolved disputes or provided explanations regarding claim decisions.

- Emphasize your interpersonal skills and ability to build rapport with various stakeholders.

3. Stay Up-to-Date on Industry Trends

Claim auditing is a constantly evolving field. Show that you are aware of current trends and best practices in the industry.

- Mention any professional development courses or certifications you have recently completed.

- Discuss how you stay informed about changes in healthcare regulations and industry standards.

4. Prepare for Common Interview Questions

Anticipate and prepare for common interview questions, such as:

- Tell us about your experience in conducting claim audits.

- How do you stay up-to-date on changes in healthcare regulations?

- Describe a situation where you identified a fraudulent claim.

- How do you handle disagreements with providers or policyholders regarding claim decisions?

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Claim Auditor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!