Are you gearing up for a career in Claim Processing Specialist? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Claim Processing Specialist and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

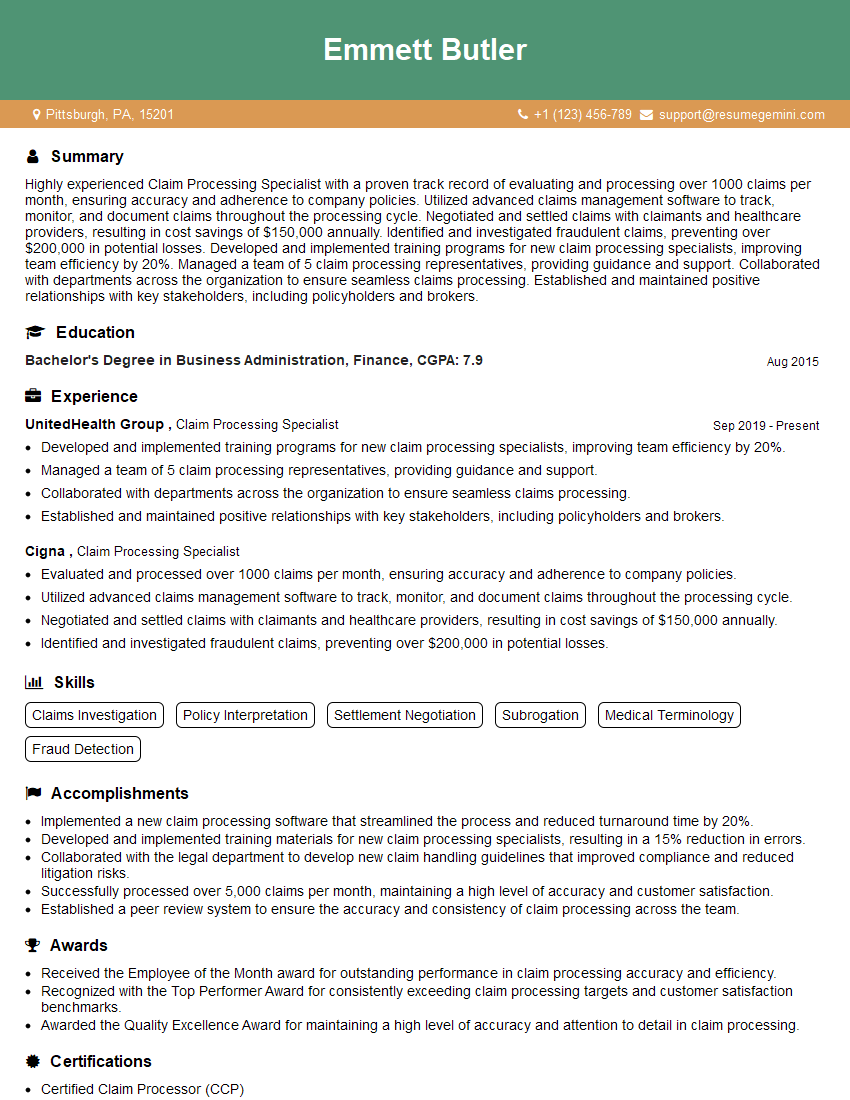

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claim Processing Specialist

1. What are the key steps involved in processing an insurance claim?

- Verification of Coverage

- Investigation of the Incident

- Assessment of Damages

- Calculation of Benefits

- Payment of Benefits

2. What are some of the most common types of insurance claims?

Health Insurance Claims

- Medical Expenses

- Prescription Drug Coverage

- Hospital Stays

- Dental and Vision Care

Property and Casualty Insurance Claims

- Car Accidents

- Home Damage

- Theft

- Natural Disasters

3. What are some of the factors that can affect the processing time of a claim?

- Complexity of the Claim

- Availability of Evidence

- Severity of the Loss

- Insurance Policy Coverage

- Efficiency of the Insurance Company

4. What are some of the best practices for communicating with policyholders throughout the claims process?

- Be empathetic and understanding.

- Communicate clearly and regularly.

- Use multiple communication channels.

- Set realistic expectations.

- Resolve issues promptly.

5. What is your experience with using insurance software and technology?

- I am proficient in using insurance software such as ClaimCenter, Guidewire, and Duck Creek.

- I have experience with using technology to improve the claims process, such as using automation to streamline tasks and using data analytics to identify trends and improve decision-making.

6. What are some of the ethical considerations that you must be aware of when processing claims?

- Confidentiality

- Fairness

- Honesty

- Integrity

- Objectivity

7. What is your experience with handling complex or high-value claims?

- I have experience handling complex and high-value claims in the health insurance industry.

- I have successfully processed claims for medical expenses, lost wages, and pain and suffering.

- I am familiar with the regulations and guidelines that apply to complex and high-value claims.

8. What are some of the challenges that you have faced in your previous claims processing role?

- Dealing with difficult customers

- Processing claims with limited information

- Meeting tight deadlines

- Staying up-to-date on changes in insurance regulations

- Working independently and as part of a team

9. What are your strengths and weaknesses as a claims processing specialist?

- I am highly organized and detail-oriented.

- I am proficient in using insurance software and technology.

- I am able to work independently and as part of a team.

- I am committed to providing excellent customer service.

- I can be impatient at times.

- I am not always good at delegating tasks.

Strengths:

Weaknesses:

10. How do you stay up-to-date on changes in insurance regulations and industry best practices?

- I attend industry conferences and workshops.

- I read insurance publications and articles.

- I network with other claims processing professionals.

- I take continuing education courses.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claim Processing Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claim Processing Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Claim Processing Specialists play a crucial role in the insurance industry, ensuring that claims are processed accurately and efficiently. Here are some key job responsibilities:

1. Claim Assessment and Processing

Analyze and evaluate incoming claims to determine their validity, coverage, and potential liability.

- Gather and review relevant documentation, including medical records, police reports, and witness statements.

- Interview claimants, witnesses, and other parties involved to obtain firsthand information.

2. Investigation and Verification

Investigate claims to ensure they are legitimate and supported by evidence.

- Conduct background checks, review public records, and consult with experts as needed.

- Determine the extent of coverage and calculate the appropriate amount of settlement.

3. Negotiation and Settlement

Negotiate settlements with claimants and their representatives to resolve claims fairly and within the limits of policy coverage.

- Explain the terms and conditions of the settlement to all parties involved.

- Document the settlement agreement in writing and ensure its compliance with legal requirements.

4. Recordkeeping and Reporting

Maintain accurate records of all claims processed, including supporting documentation.

- Generate reports on claims activity, trends, and performance.

- Provide information to management and regulatory agencies as required.

5. Customer Service

Provide excellent customer service to claimants and other stakeholders.

- Respond promptly to inquiries and resolve issues efficiently.

- Maintain a positive and professional demeanor when interacting with clients.

Interview Tips

To ace an interview for a Claim Processing Specialist position, consider the following tips:

1. Research and Preparation

Research the insurance industry, the company you’re applying to, and the specific role.

- Familiarize yourself with common insurance terms and concepts.

- Review the job description thoroughly and identify the key skills and qualifications required.

2. Highlight Relevant Skills and Experience

Emphasize your experience in claims processing, investigation, negotiation, and customer service.

- Quantify your accomplishments and provide specific examples of how you have handled complex claims.

- Discuss your knowledge of relevant software and technologies.

3. Demonstrate Strong Communication and Interpersonal Skills

Effective communication and interpersonal skills are essential in this role.

- Showcase your ability to build rapport with claimants, insurance agents, and other professionals.

- Highlight your proficiency in written and verbal communication, including negotiation and dispute resolution skills.

4. Ask Thoughtful Questions

Asking insightful questions demonstrates your interest and engagement in the role.

- Ask about the company’s claims processing procedures and training opportunities.

- Inquire about the current claims environment and challenges the company is facing.

5. Dress Professionally and Be Punctual

First impressions matter, so dress professionally and arrive on time for your interview.

- Wear business attire and maintain a neat and well-groomed appearance.

- Allow ample time for travel and parking to avoid any last-minute stress.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Claim Processing Specialist, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Claim Processing Specialist positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.