Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Claim Representative position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

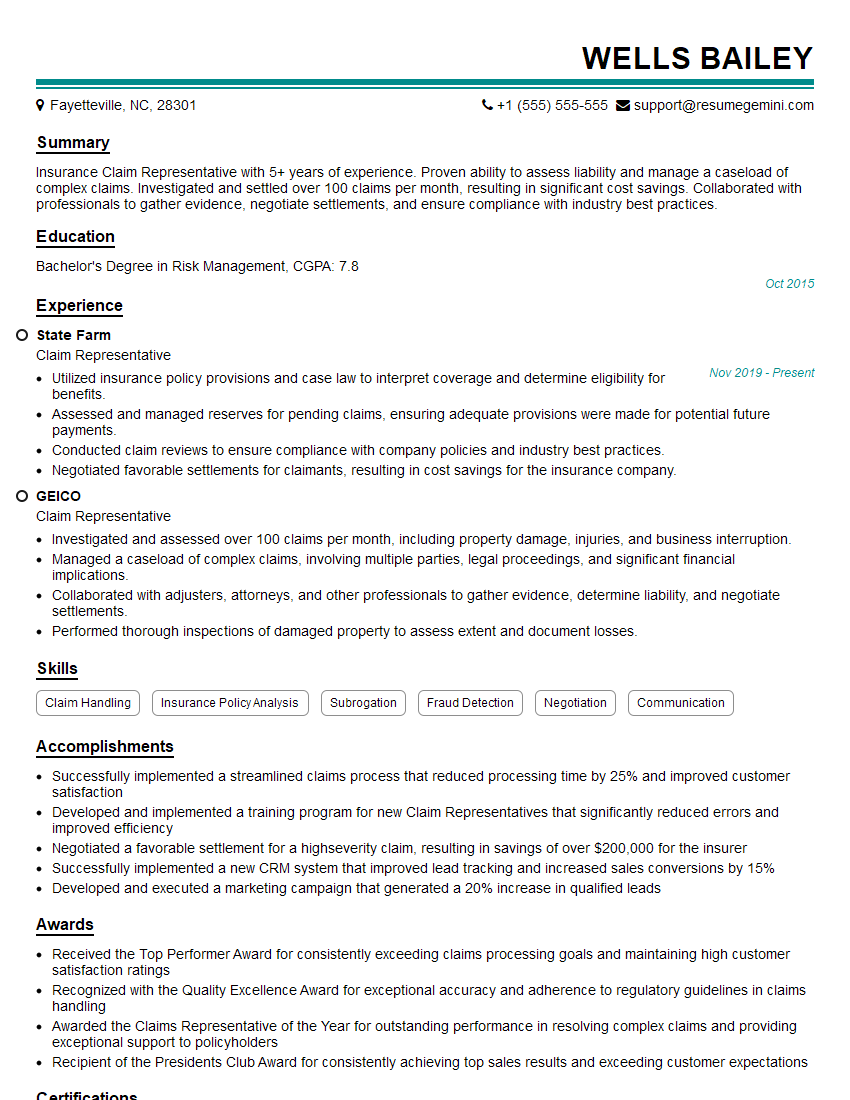

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claim Representative

1. Describe the key steps involved in processing an insurance claim.

The key steps in processing an insurance claim include:

- Receiving and logging the claim

- Investigating the claim

- Assessing the damage

- Negotiating the settlement

- Issuing the payment

2. What are the different types of insurance claims?

Property claims

- Homeowners insurance claims

- Commercial property insurance claims

- Auto insurance claims

Liability claims

- General liability insurance claims

- Professional liability insurance claims

- Product liability insurance claims

Health insurance claims

- Medical insurance claims

- Dental insurance claims

- Vision insurance claims

3. What are the most common reasons for insurance claims being denied?

- The claim is not covered by the policy

- The claim is not filed within the time limit

- The claim is fraudulent

- The damage is not severe enough

- The insured has not paid the premium

4. What are your key responsibilities as a Claim Representative?

- Investigating and assessing claims

- Negotiating settlements

- Issuing payments

- Providing customer service

- Maintaining accurate records

5. What are your strengths and weaknesses as a Claim Representative?

Strengths

- Strong analytical skills

- Excellent communication skills

- Ability to work independently and as part of a team

- Attention to detail

- Customer-focused

Weaknesses

- Can be slow to make decisions

- Sometimes have difficulty dealing with difficult customers

- Not always able to meet deadlines

6. What are your salary expectations?

My salary expectations are $50,000 to $60,000 per year.

7. What are your career goals?

My career goals are to become a Senior Claim Representative and eventually a Claim Manager.

8. Why are you interested in this position?

I am interested in this position because I am passionate about helping people. I have always been drawn to the insurance industry because it gives me the opportunity to make a difference in the lives of others. I am also interested in the challenges and rewards of working in a fast-paced environment.

9. What is your experience with insurance claims?

I have been working as a Claim Representative for the past 5 years. In that time, I have handled a wide variety of claims, including property claims, liability claims, and health insurance claims. I have a strong understanding of the claims process and am able to investigate and assess claims quickly and efficiently.

10. What is your favorite color?

That’s an interesting question. I don’t have a favorite color per se, but I do have a few that I like. I like the color blue because it’s calming and serene. I also like the color green because it’s the color of nature. And I like the color purple because it’s the color of royalty.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claim Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claim Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Claim Representatives are responsible for a wide range of duties related to processing and managing insurance claims. They must possess a deep understanding of insurance policies and procedures, as well as excellent communication and interpersonal skills. Key job responsibilities typically include:1. Claims Processing

* Reviewing and evaluating insurance claims to determine coverage and liability * Investigating claims to gather evidence and determine the cause and extent of loss * Calculating claim settlements and recommending appropriate payment amounts * Negotiating with policyholders, claimants, and other parties involved in the claim process * Preparing and issuing claim payments2. Customer Service

* Answering policyholder inquiries and providing guidance on claims procedures * Resolving complaints and grievances related to claims handling * Communicating claim status updates to policyholders and other stakeholders * Maintaining positive relationships with customers and fostering trust3. Compliance and Regulatory Reporting

* Ensuring adherence to all relevant insurance regulations and laws * Completing and submitting required reports to regulatory agencies * Maintaining accurate and up-to-date records related to claims processing * Staying abreast of industry best practices and regulatory changes4. Fraud Detection and Prevention

* Identifying and investigating potential fraudulent claims * Collaborating with law enforcement and other agencies to combat insurance fraud * Implementing anti-fraud measures and educating policyholders on fraud preventionInterview Tips

To prepare for a Claim Representative interview, candidates should focus on the following tips:1. Research the Industry and Company

Thoroughly research the insurance industry, including the specific area of claims you are interested in. Learn about the company’s products, services, and reputation. This knowledge will help you demonstrate your understanding of the field and your interest in the role.2. Highlight Relevant Skills and Experience

Emphasize your experience in claims processing, customer service, or other related fields. If you have any experience with insurance regulations or fraud prevention, be sure to mention it. Quantify your accomplishments with specific examples of claims you have handled and resolved successfully.3. Practice Communication Skills

Claim Representatives must be able to communicate effectively with a wide range of individuals. Prepare for the interview by practicing your communication skills. This includes being able to clearly articulate your thoughts, asking clarifying questions, and actively listening to others.4. Be Prepared to Discuss Your Ethics

Insurance companies place a high value on integrity and ethical behavior. During the interview, be prepared to discuss your understanding of ethical guidelines and how you would handle situations that involve potential conflicts of interest.5. Ask Informed Questions

At the end of the interview, take the opportunity to ask informed questions about the role and the company. This shows your interest in the position and your desire to learn more about the organization. Asking thoughtful questions can also help you gauge whether the company is a good fit for your values and career aspirations.Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Claim Representative interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.