Are you gearing up for an interview for a Claim Service Representative position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Claim Service Representative and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

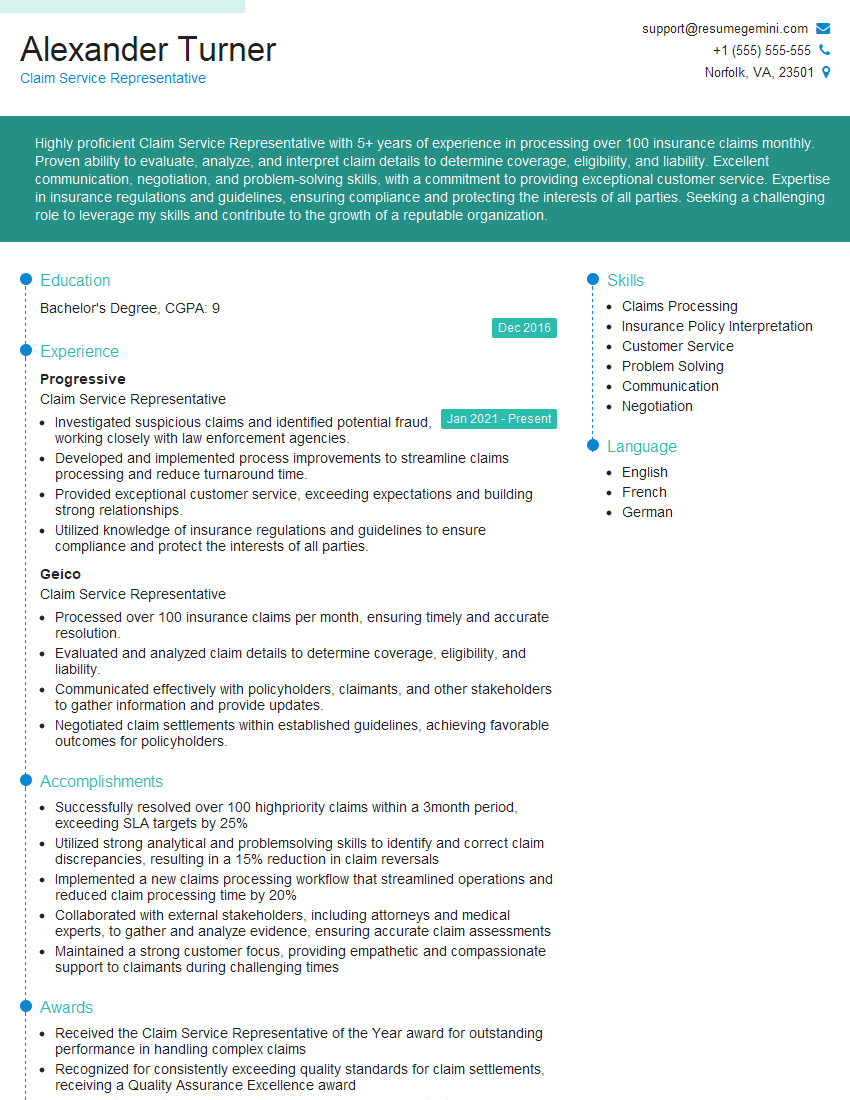

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claim Service Representative

1. Explain the process of handling a claim from the initial report to the final settlement?

- Receive and verify the claim report.

- Investigate the claim to determine coverage and liability.

- Negotiate a settlement with the claimant.

- Issue payment for the claim.

- Document the claim file and close the case.

2. How would you handle a difficult customer who is upset about their claim being denied?

subheading of the answer

- Listen to the customer’s concerns and try to understand their point of view.

- Explain the reason for the denial in a clear and concise way.

- Be empathetic and understanding, even if you cannot change the decision.

- Offer alternative solutions, if possible.

- Document the conversation and any actions taken.

subheading of the answer

- Stay calm and professional.

- Use active listening skills.

- Be empathetic and understanding.

- Avoid using jargon or technical language.

- Offer alternative solutions, if possible.

3. What are the most common types of claims that you have handled?

- Auto claims

- Homeowners claims

- Commercial property claims

- Liability claims

- Workers’ compensation claims

4. What is your experience with using claims software?

- I have experience using a variety of claims software, including Colossus, Guidewire, and PolicyWorks.

- I am proficient in using these software programs to process claims, track progress, and generate reports.

- I am also familiar with the use of electronic claims submission (ECS) and other industry-standard technologies.

5. What are your strengths and weaknesses as a claims service representative?

- Strengths:

- Excellent communication and interpersonal skills

- Strong analytical and problem-solving skills

- Ability to work independently and as part of a team

- Proficient in the use of claims software

- Experience handling a variety of claims types

- Weaknesses:

- I can sometimes be too detail-oriented

- I am not always the most organized person

- I can be a bit of a perfectionist

6. What are your salary expectations?

- My salary expectations are in line with the market rate for claims service representatives with my experience and qualifications.

- I am open to discussing a salary range that is competitive and commensurate with my skills and abilities.

- I am also interested in the opportunity to earn additional compensation through bonuses or incentives.

7. Why are you interested in working for our company?

- I am interested in working for your company because of its reputation as a leader in the insurance industry.

- I am also impressed by your company’s commitment to customer service and employee development.

- I believe that my skills and experience would be a valuable asset to your team, and I am confident that I can make a significant contribution to your company’s success.

8. What are your career goals?

- My career goal is to become a claims manager.

- I believe that my experience and skills would be a valuable asset to a claims management team, and I am confident that I can make a significant contribution to the success of a claims department.

- I am also interested in developing my leadership skills and taking on more responsibility within the insurance industry.

9. What is your availability?

- I am available to work full-time, Monday through Friday, from 8:00 AM to 5:00 PM.

- I am also available to work overtime or on weekends, if necessary.

10. Do you have any questions for me?

- I do have a few questions for you.

- Can you tell me more about the claims process at your company?

- What is the average caseload for a claims service representative?

- What is the company’s policy on overtime?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claim Service Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claim Service Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

1. Handle Inbound Claims

The primary role of a Claim Service Representative is to handle inbound claims. They respond to phone calls, emails, and other forms of communication from policyholders who are reporting a claim. They gather information about the claim, including the date and time of the loss, the type of loss, and the extent of the damage.

2. Investigate and Assess Claims

Once a claim has been reported, the Claim Service Representative is responsible for investigating and assessing the claim. This involves reviewing the policyholder’s coverage, examining the damage, and interviewing witnesses. Based on their investigation, they will determine whether the claim is covered and the amount of the benefit that will be paid.

3. Communicate with Policyholders

Claim Service Representatives are the primary point of contact for policyholders who have filed a claim. They keep policyholders informed about the status of their claim and answer any questions they may have. They also provide guidance and support to policyholders throughout the claims process.

4. Maintain Accurate Records

Claim Service Representatives are responsible for maintaining accurate records of all claims they handle. This includes documenting all communications with policyholders, as well as any other information related to the claim. They also ensure that all claims are processed in a timely and efficient manner.

Interview Tips

1. Research the Company and the Role

Before your interview, take the time to research the insurance company and the specific role you’re applying for. This will help you better understand the company’s culture, values, and goals, as well as the key responsibilities and qualifications for the role.

2. Practice Your Answers to Common Interview Questions

There are a number of common interview questions that you’re likely to be asked, such as “Why are you interested in this role?” and “Tell me about your experience with claims handling.” Take some time to practice your answers to these questions so that you can deliver them confidently and concisely.

3. Highlight Your Skills and Experience

In your interview, be sure to highlight your skills and experience that are relevant to the role of Claim Service Representative. This includes your experience with claims handling, customer service, and communication. You should also emphasize your ability to work independently and as part of a team.

4. Be Enthusiastic and Professional

First impressions matter, so make sure to be enthusiastic and professional throughout your interview. Dress appropriately, arrive on time, and maintain eye contact with the interviewer. Be polite and respectful, even if you’re nervous. And remember to smile!

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Claim Service Representative, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Claim Service Representative positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.